Trading Wedge Patterns

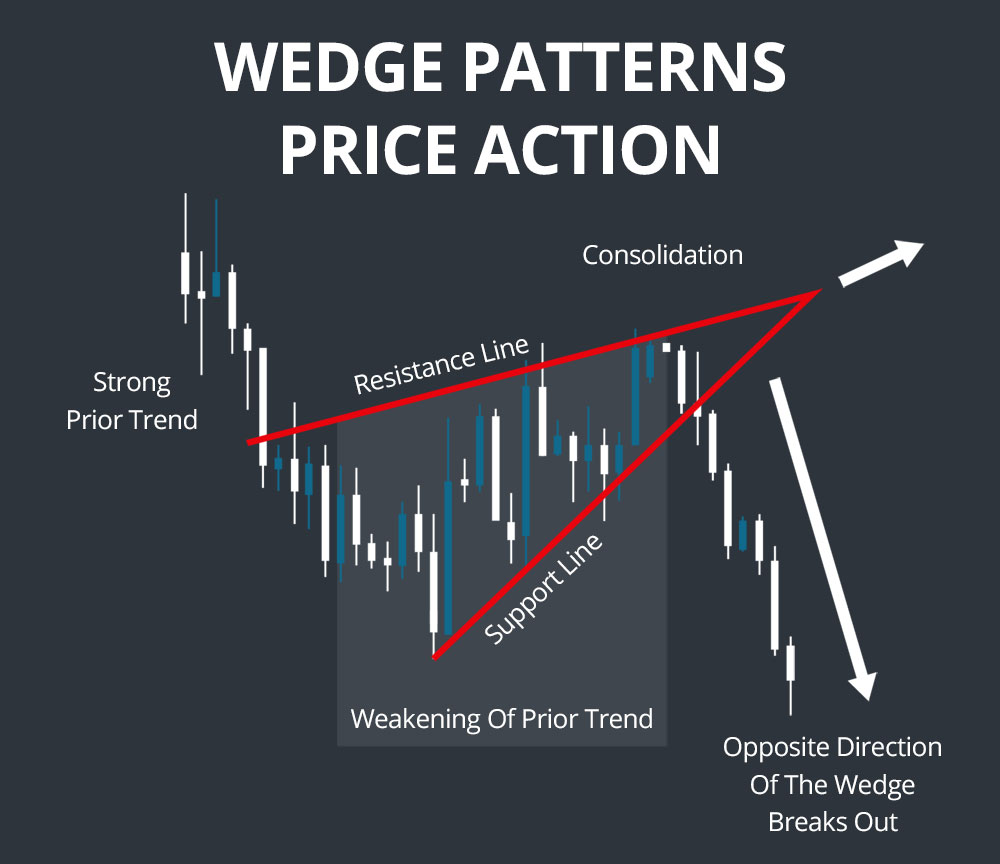

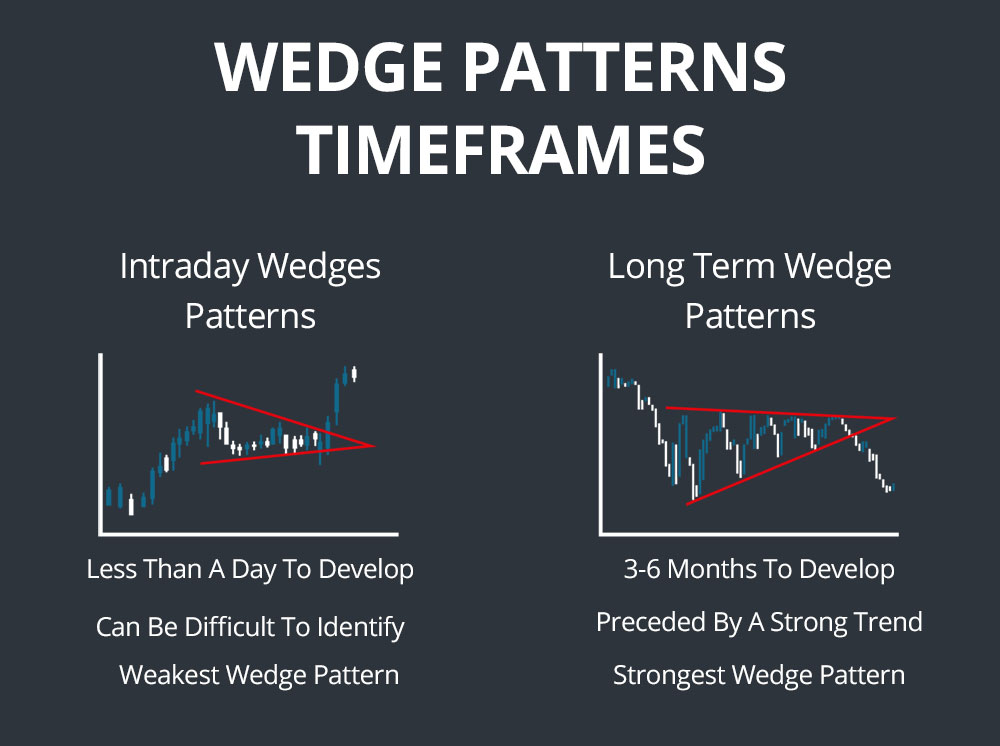

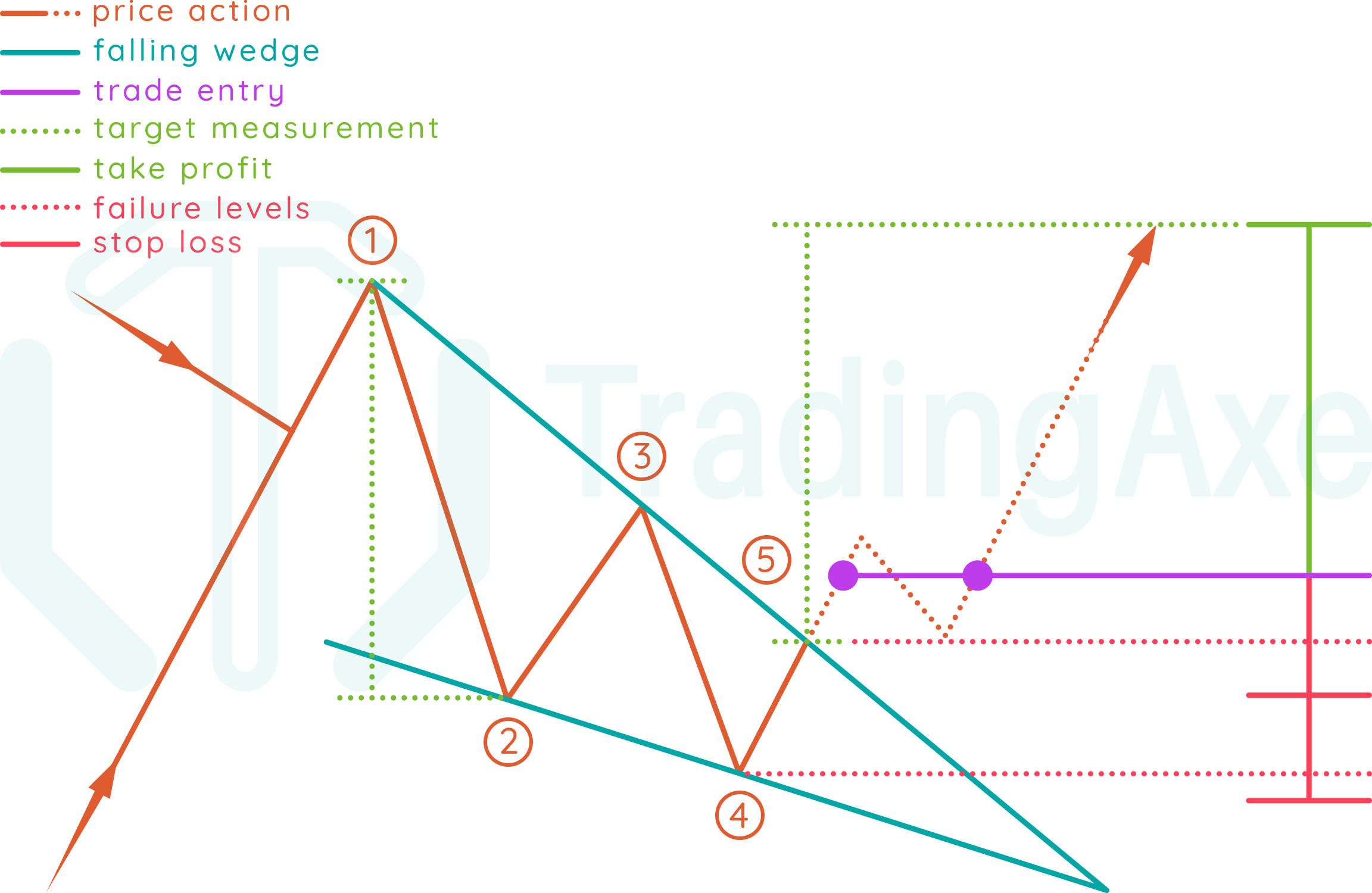

Trading Wedge Patterns - Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. There are 6 broadening wedge patterns that we can separately identify on our charts and each. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Web a wedge pattern is a triangular continuation pattern that forms in all assets such as currencies, commodities, and stocks. Web broadening wedges are one of a series of chart patterns in trading: Web learn how to identify and trade wedge chart patterns in forex, which are formed by two trend lines converging at a point. Trading ideas 1000+ educational ideas 190. This article provides a technical approach to trading. The duration (short/medium/long term) of the top depends upon the timeframe on which it appears. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Web trading wedge patterns involves understanding the breakout direction, setting entry and exit points, and managing risk. Web the falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. The duration (short/medium/long term) of the top depends upon the timeframe on which it appears. There are 6 broadening wedge patterns that we. Identifying and understanding wedge patterns is essential for effective. Bitcoin has been pulling back this week following. They can offer massive profits along. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for a potential breakout. Web a wedge pattern is a signal formed on a price chart when two distinct. If you’re seeking alternatives to wedge patterns for. Whether the price reverses the prior trend or. It signifies that a potential top might be in the offing. Traders rely on these patterns to. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. By stelian olar, updated on: A rising wedge is a bearish pattern. There are 2 types of wedges. Bitcoin has been pulling back this week following. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. The patterns may be considered rising or falling wedges depending on their. Web the arm share price has traded within a narrow rising wedge since mid april—a chart pattern technical. The patterns may be considered rising or falling wedges depending on their. Web the arm share price has traded within a narrow rising wedge since mid april—a chart pattern technical analysts typically interpret as having a bearish. Web a wedge pattern is a triangular continuation pattern that forms in all assets such as currencies, commodities, and stocks. Of all the. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. There are 2 types of wedges indicating price. It is considered a bullish chart formation. Trading ideas 1000+ educational ideas 190. Whether the price reverses the prior trend or. Web the rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Web the falling wedge chart pattern is a recognisable price. There are 2 types of wedges. Identifying and understanding wedge patterns is essential for effective. Of all the reversal patterns we can use in the forex market, the rising and falling wedge patterns are two of my favorite. Web rising wedges typically signal a bearish reversal, while falling wedges suggest a bullish continuation. It signifies that a potential top might. A stock that was trading at $310.40 in 2021 has crashed by about 80% to the current $64.45. Unlike other candlestick patterns, the wedge forms. It is considered a bullish chart formation. Web trading wedge patterns involves understanding the breakout direction, setting entry and exit points, and managing risk. Web the wedge pattern can either be a continuation pattern or. Trading ideas 1000+ educational ideas 190. Web a wedge is a common type of trading chart pattern that helps to alert traders to a potential reversal or continuation of price direction. The duration (short/medium/long term) of the top depends upon the timeframe on which it appears. It signifies that a potential top might be in the offing. Web the rising wedge pattern is one of the numerous tools in technical analysis, often signaling a potential move in the asset or broader market. Whether the price reverses the prior trend or. There are 2 types of wedges indicating price. Web a wedge pattern is a triangular continuation pattern that forms in all assets such as currencies, commodities, and stocks. Web a wedge pattern is a signal formed on a price chart when two distinct trend lines appear to converge with each successive trading session. By stelian olar, updated on: Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Web the wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. If you’re seeking alternatives to wedge patterns for. Unlike other candlestick patterns, the wedge forms. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines.

How to Trade the Rising Wedge Pattern Warrior Trading

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Patterns How Stock Traders Can Find and Trade These Setups

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Simple Wedge Trading Strategy For Big Profits

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Rising And Falling Wedge Patterns The Complete Guide

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

How To Trade Falling Wedge Chart Pattern TradingAxe

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

The Patterns May Be Considered Rising Or Falling Wedges Depending On Their.

Rising And Falling Wedges Are A Technical Chart Pattern Used To Predict Trend Continuations And Trend Reversals.

The Wedge Pattern Can Either Be A Continuation Pattern Or A Reversal Pattern, Depending On The Type Of Wedge And The Preceding Trend.

There Are 6 Broadening Wedge Patterns That We Can Separately Identify On Our Charts And Each.

Related Post: