Candlestick Patterns Hanging Man

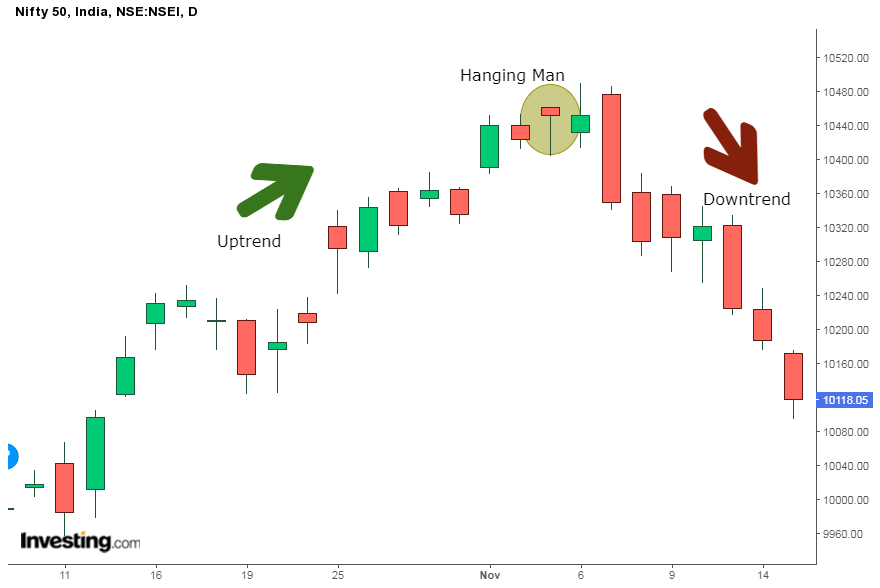

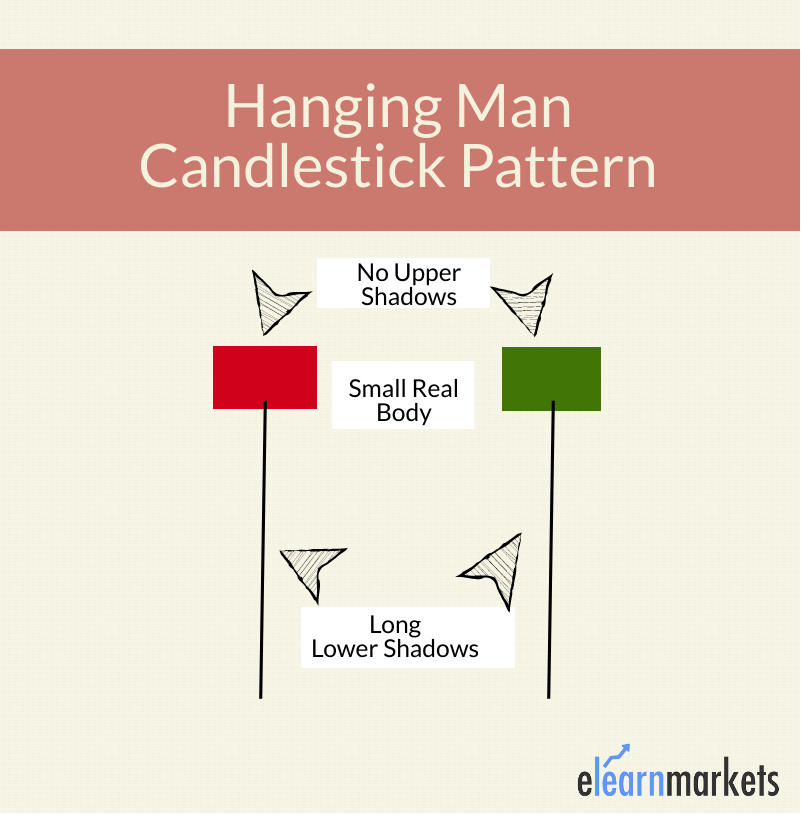

Candlestick Patterns Hanging Man - Web the hanging man candlestick pattern emerges as a pivotal signal in technical analysis, offering a glimpse into possible trend changes in an uptrend. Hence, finding the patterns within the patterns is so important. Web the hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. Which candlestick pattern is most reliable? Web hanging man candlestick pattern example. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. Web the hanging man formation. The evening star is a bearish. Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. Look no further than the hanging man candlestick pattern! The lower wick of a forex hanging man pattern, however, is very long and needs to be at least two times greater in size than the body of the. Web hanging man candlestick pattern example. Web a hanging man is a single candlestick pattern that forms after an uptrend. Perhaps this is a consequence of the impressive name referring to. One simple pattern can speak volumes about where the market may. A hanging man is a bearish candlestick pattern that forms at the end of an uptrend. Yet, the real strength of this pattern lies in its. As long as it’s small you’re good to go. Afterward, the emergence of a hanging man candlestick signals a potential shift in momentum. One simple pattern can speak volumes about where the market may. A small real body (the difference between the open and close prices) at the upper end of the. The lower wick of a forex hanging man pattern, however, is very long and needs to be at least two times greater in size than the body of the. Web the. Web hanging man candlestick pattern example. A hanging man is a bearish candlestick pattern that forms at the end of an uptrend. Web a hanging man candlestick pattern forms during an uptrend at the far end of the phenomenon where security’s opening, high, and closing prices are equal. An umbrella line is a long candlestick with a short real body. Perhaps this is a consequence of the impressive name referring to the shape of the candle resembling a hanged man. Each individual candlestick is constructed from four data points. The lower shadow must be at least twice. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to. The evening star is a bearish. Hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. Web hanging man candlestick pattern example. Web variants of the hanging man candlestick pattern. The candle is formed by a long lower shadow coupled with a small real body. Web the hanging man candlestick pattern is a bearish reversal that forms in an upward price swing. Yet, the real strength of this pattern lies in its. One simple pattern can speak volumes about where the market may. It’s a reversal pattern, which means that it’s believed to precede a market downturn. Hanging man candlestick pattern is a single candlestick. Which candlestick pattern is most reliable? Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. The open, close, high, and low are them. All one needs to. The open, close, high, and low are them. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. It’s a reversal pattern, which means that it’s believed to precede a market downturn. This also indicates that the bulls have lost their strength in moving the prices up, and bears are. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. Yet, the real strength of this pattern lies in its. Web what hanging man pattern candlestick indicates about market sentiment, and how to leverage the hanging dead man candlestick in your own trading strategy. Understanding candlestick patterns like the hanging. An umbrella line is a long candlestick with a short real body located at the top end of the trading range, a long lower shadow, and very little or no upper shadow. It should be used in conjunction with other technical analysis tools and. Web the hanging man candlestick pattern is a bearish reversal that forms in an upward price swing. Traditionally considered a bearish candle, it can also provide continuation. Web the hanging man formation. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. A long lower shadow or ‘wick’, at least two or three times the length of the real body. Web a hanging man is a single candlestick pattern that forms after an uptrend. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Afterward, the emergence of a hanging man candlestick signals a potential shift in momentum as the emerging bullish momentum starts to fade. Web the hanging man candlestick pattern is used when the market is bullish to identify signs of the market turning bearish.the hanging man is a bearish candlestick pattern that indicates a trend reversal. This also indicates that the bulls have lost their strength in moving the prices up, and bears are back in the market. According to the book encyclopedia of candlestick charts by thomas bulkowski, the evening star candlestick has a 72% chance of accurately predicting a downtrend. Hence, finding the patterns within the patterns is so important. Web the bottom line. These patterns have a small body that can be green or red with little to no upper wick.How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

What Is Hanging Man Candlestick Pattern With Examples ELM

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

What Is Hanging Man Candlestick Pattern With Examples ELM

Hanging Man Candlestick Pattern Trading Strategy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging man candlestick chart pattern. Trading signal Japanese

Hanging Man Candle Pattern

Web Popular Bearish Candlestick Chart Patterns.

Perhaps This Is A Consequence Of The Impressive Name Referring To The Shape Of The Candle Resembling A Hanged Man.

Web With The Hanging Man Candlestick Chart Pattern, You Need Confirmation That The Reversal Is Happening.

Web Hanging Man Candlestick Pattern Stock Market Trading|| #Stockmarket #Optionstrading #Shorts#Shortsfeed #Optionstrading #Stockmarket #Sharemarket #Chartpatter.

Related Post: