Vcp Pattern

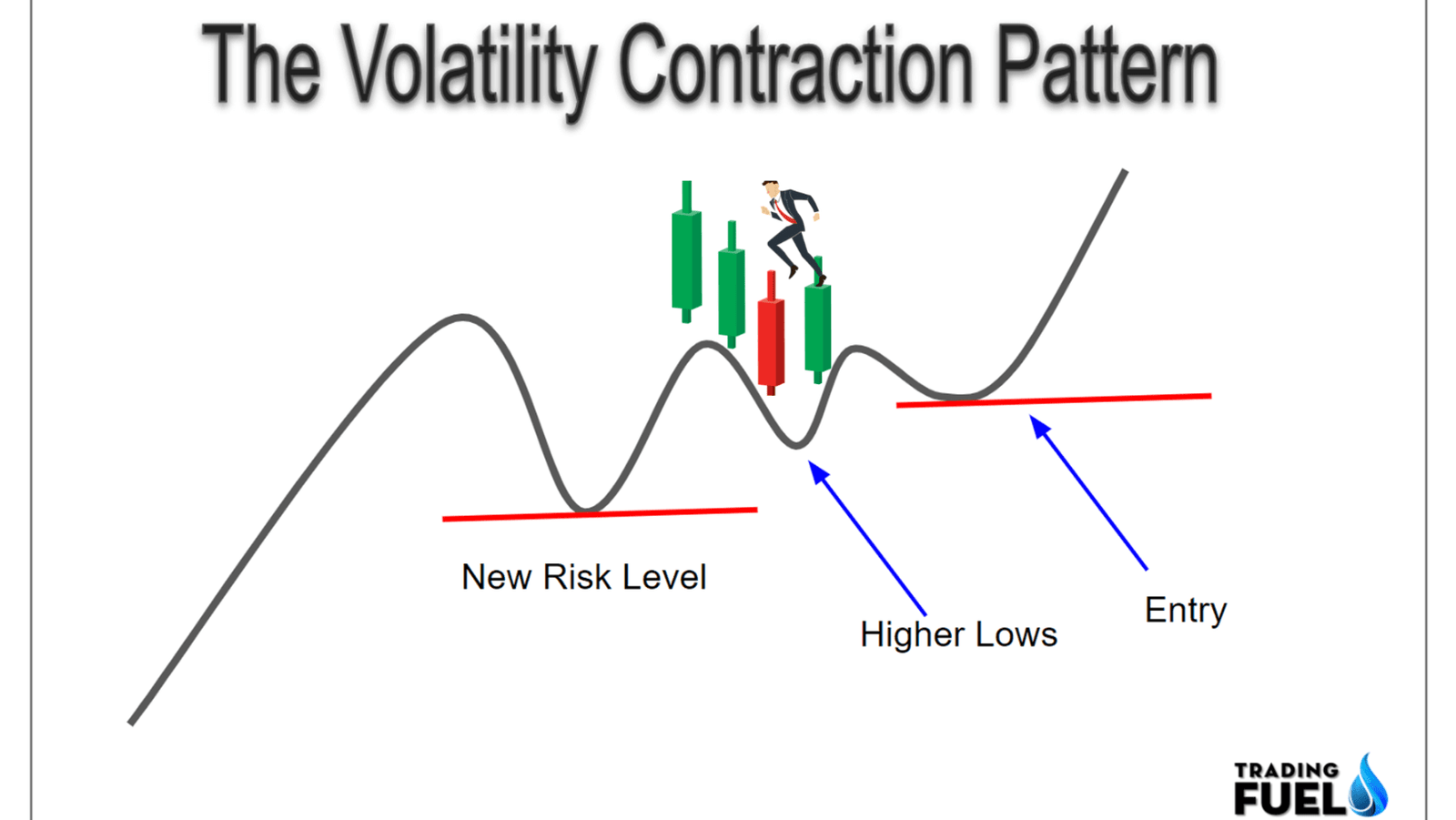

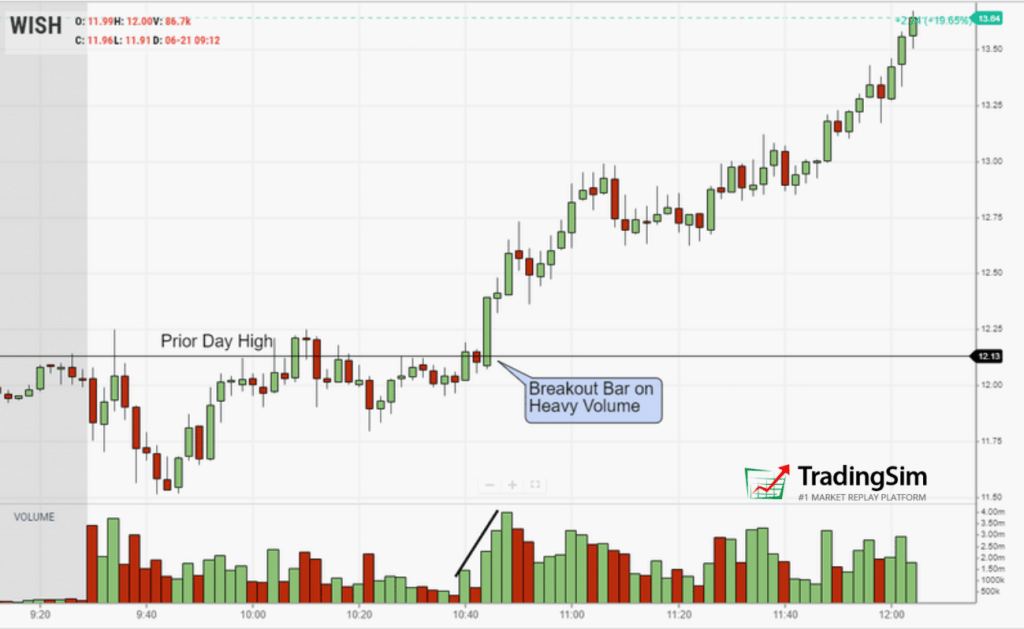

Vcp Pattern - The vcp is based on strong underlying demand, recent overbought/supply pressure, diminishing supply/decreasing volatility, and a breakout on higher time. The premise of the pattern is. Web learn how to identify and profit from the volatility contraction pattern, a chart pattern that occurs during market consolidations. Web learn how to trade the volatility contraction pattern (vcp) in stocks, a market cycle that moves from low to high volatility and vice versa. See examples, indicators, and entry. The pattern occurs when a stock goes through a series of. Web this scan identifies stocks that are in a stage 2 uptrend followed by a consolidation phase, and enter on a higher volume breakout. Web download the free ultimate screening guide here: Web vcp is a scan tool that filters stocks based on various technical indicators and market cap. Find out the key elements, how to catch a vcp. Find out the key elements, how to catch a vcp. See examples, indicators, and entry. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. The premise of the pattern is. Web learn how to identify and profit from the volatility contraction pattern, a chart pattern that occurs during market consolidations. Web learn how to identify and trade the vcp, a powerful pattern that captures explosive price movements. Web the volatility contraction pattern, (vcp) is a famous trading pattern identified and dissected by market wizard, mark minervini. Discover mark minervini's strategy, his books, and. Web vcp is a scan tool that filters stocks based on various technical indicators and market cap.. Find out the key elements, how to catch a vcp. Web what is the volatility contraction pattern (vcp)? The vcp is based on strong underlying demand, recent overbought/supply pressure, diminishing supply/decreasing volatility, and a breakout on higher time. Web learn how to identify and profit from the volatility contraction pattern, a chart pattern that occurs during market consolidations. Discover mark. Discover mark minervini's strategy, his books, and. See backtest results, create alerts, monitor on dashboard and open charts for more. Web what is the volatility contraction pattern (vcp pattern)? The premise of the pattern is. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web vcp is a scan tool that filters stocks based on various technical indicators and market cap. Web what is the volatility contraction pattern (vcp)? See backtest results, create alerts, monitor on dashboard and open charts for more. Web scan stocks based on possible breakout, low free float, no derivatives and other criteria. Web learn how to identify and profit. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web learn how to identify and trade the vcp, a powerful pattern that captures explosive price movements. Discover mark minervini's strategy, his books, and. Web scan stocks based on possible breakout, low free float, no derivatives and other criteria. Web what is the volatility. The vcp involves a decrease in volume. Discover mark minervini's strategy, his books, and. Web the vcp is an essential pattern for swing traders, as it signals the potential for a significant price move. Web scan stocks based on possible breakout, low free float, no derivatives and other criteria. Web learn how to identify and profit from the volatility contraction. Web download the free ultimate screening guide here: The premise of the pattern is. Web the vcp is an essential pattern for swing traders, as it signals the potential for a significant price move. Web learn how to identify and profit from the volatility contraction pattern, a chart pattern that occurs during market consolidations. The vcp pattern is one of. Web learn how to identify and trade the vcp, a powerful pattern that captures explosive price movements. Web volatility contraction patterns (vcps) are a technical setup in stock trading that indicate potential bursts in price movement after a period of consolidation. Web vcp is a scan tool that filters stocks based on various technical indicators and market cap. Web learn. The vcp pattern is based on supply and demand. Web learn how to identify and profit from the volatility contraction pattern, a chart pattern that occurs during market consolidations. The pattern occurs when a stock goes through a series of. Discover mark minervini's strategy, his books, and. Web download the free ultimate screening guide here: See examples, indicators, and entry. Web this scan identifies stocks that are in a stage 2 uptrend followed by a consolidation phase, and enter on a higher volume breakout. Discover mark minervini's strategy, his books, and. Web learn how to use the volatility contraction pattern (vcp) to identify and trade breakouts in indian stocks. Find out the key elements, how to catch a vcp. The premise of the pattern is. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web learn how to trade the volatility contraction pattern (vcp) in stocks, a market cycle that moves from low to high volatility and vice versa. Web vcp is a scan tool that filters stocks based on various technical indicators and market cap. Web what is the volatility contraction pattern (vcp pattern)? The pattern occurs when a stock goes through a series of. The vcp pattern is based on supply and demand. Web scan stocks based on possible breakout, low free float, no derivatives and other criteria. Web learn how to identify and trade the vcp, a powerful pattern that captures explosive price movements. Web volatility contraction patterns (vcps) are a technical setup in stock trading that indicate potential bursts in price movement after a period of consolidation. Web learn how to identify and use the vcp, a chart pattern that occurs in long term up trends and signals a powerful break out.

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP Pattern) Mark Minervini Trading

Volatility Contraction Pattern (VCP Pattern) Mark Minervini trading

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Stock Examples Volatility

Volatility Contraction Pattern (VCP) for MYXPRLEXUS by yccho22

The Volatility Contraction Pattern (VCP) How To Day Trade It TradingSim

Find Out The Criteria, Types, And.

Web Volatility Contraction Patterns Are Often Found In Stocks Before An Explosive Share Price Gain.

Web Learn How To Identify And Trade The Vcp, A Chart Pattern That Tightens From Left To Right Within A Price Base.

Web Download The Free Ultimate Screening Guide Here:

Related Post: