Hammer Candlestick Pattern

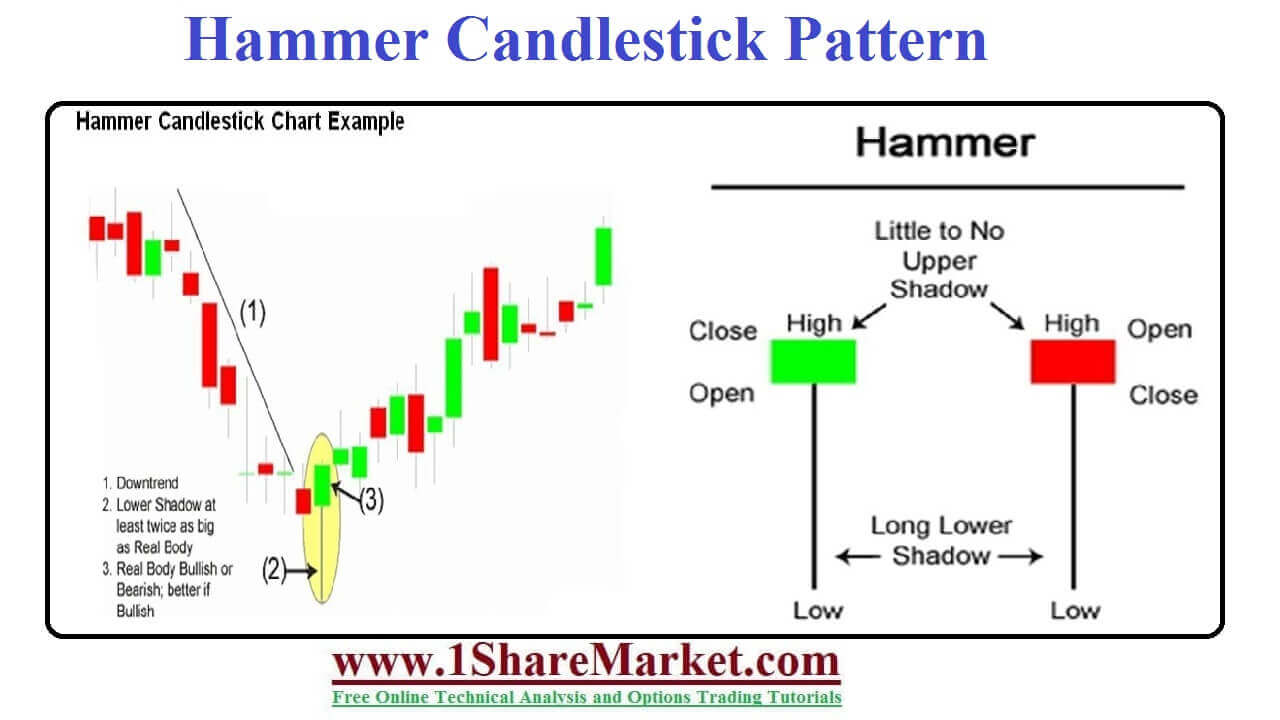

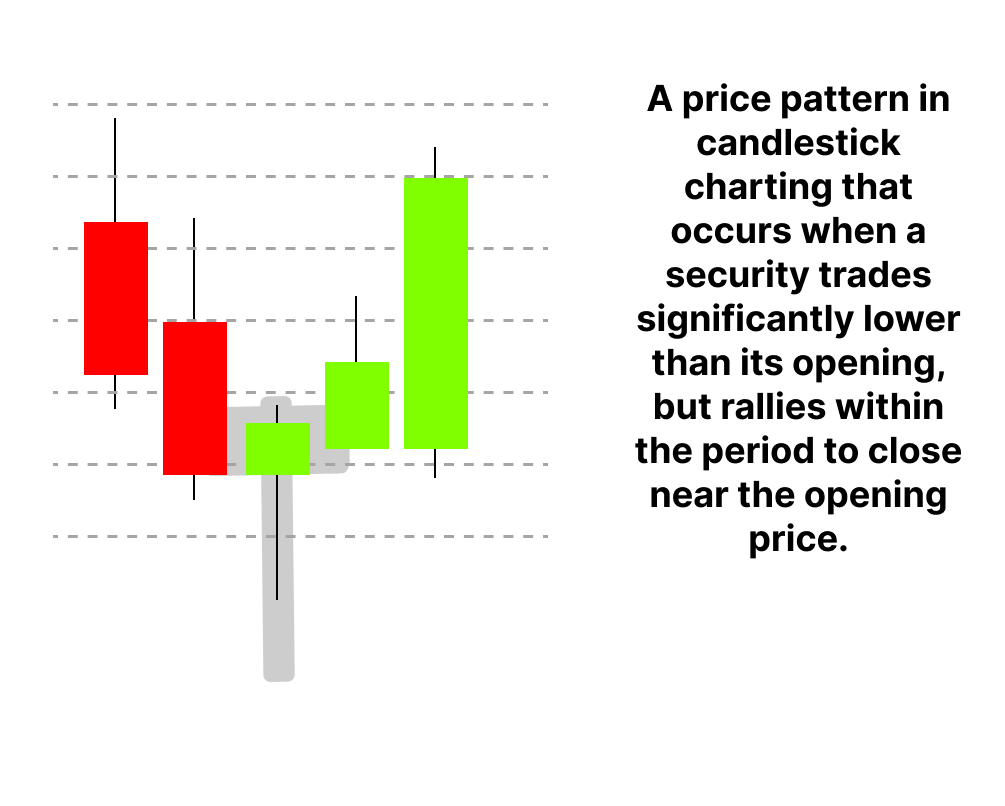

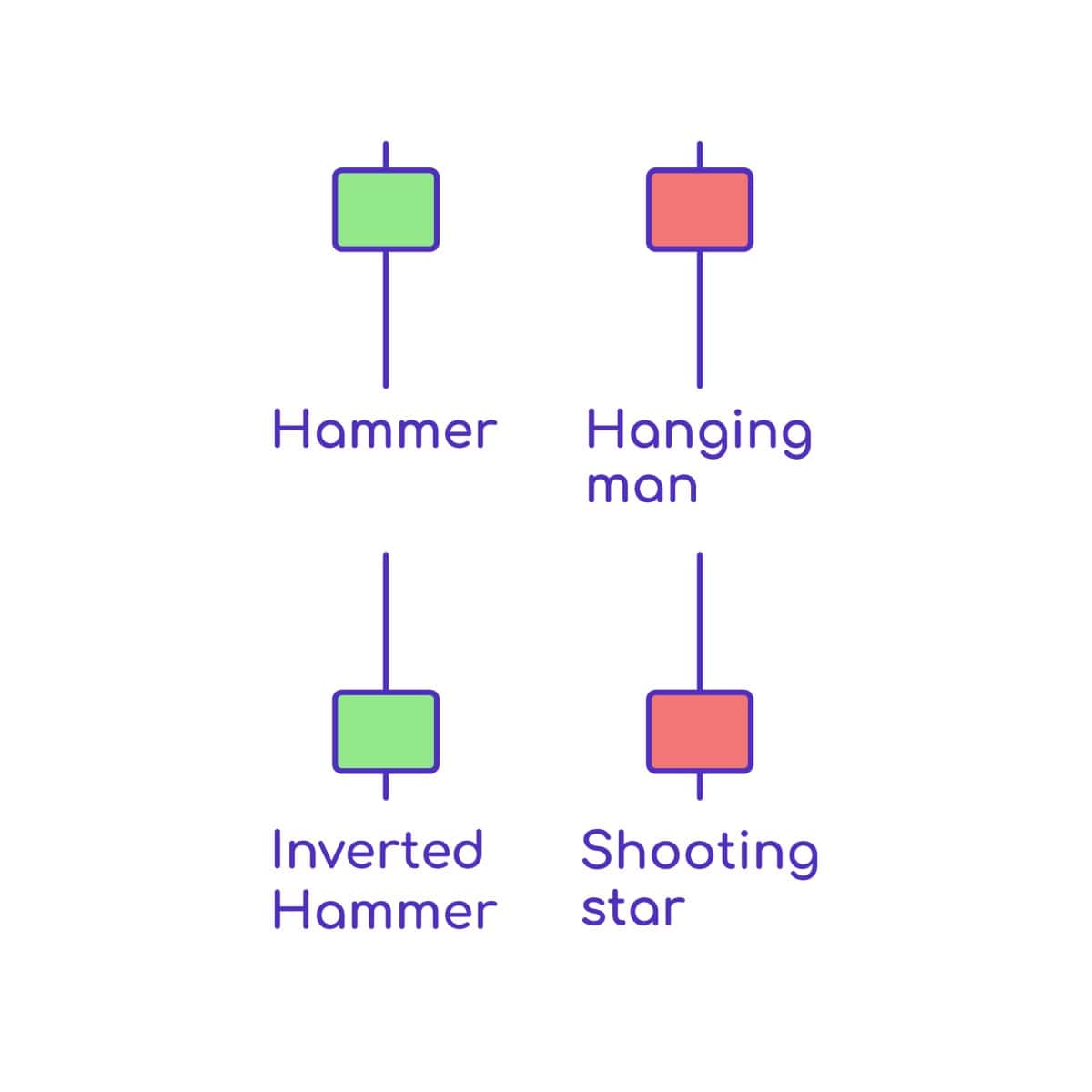

Hammer Candlestick Pattern - The hammer candlestick is a bullish reversal pattern that signals a potential price bottom and ensuing upward move. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. It appears during the downtrend and signals that the bottom is near. Hammer candlestick has a unique shape. The long lower shadow is a strong indication that buying pressure has significantly rejected and countered selling pressure, suggesting the strong likelihood of a bullish reversal. There are two types of hammers: Our guide includes expert trading tips and examples. A minor difference between the opening and closing prices forms a small candle body. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. They consist of small to medium size lower shadows, a real body, and little to no upper wick. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Web what is a hammer chart and how to trade it? The lower shadow is about 2 or 3 times the length of the body. One may find it at the end of a downtrend. The hammer candlestick is. What the pattern means in stock trading. This article illustrates these patterns in this order: Aug 9, 2022 • 2 min read. How to trade a hammer? The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. The lower shadow is about 2 or 3 times the length of the body. This is one of the popular price patterns in candlestick charting. Economists and traders analyze hammer candlestick patterns to understand price action and selling pressure in stock trading, forex. This article illustrates these patterns in this order: Web by leo smigel. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. These candles are typically green or white on stock charts. Web hammer candlestick pattern refers to a candlestick pattern with the appearance of a hammer or the english alphabet’s ‘t.’. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Lower shadow more. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. This shows a hammering out of a base and reversal setup. And. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web what is a hammer candlestick pattern? The following characteristics can identify it: The lower shadow. Derived from japanese candlestick chart analysis methods, this single candle pattern exhibits a distinct. The long lower shadow is a strong indication that buying pressure has significantly rejected and countered selling pressure, suggesting the strong likelihood of a bullish reversal. The lower wick or shadow of the candle is at least twice the size of a very short body with. The lower wick or shadow of the candle is at least twice the size of a very short body with little or no upper shadow. The hammer candlestick is a popular chart pattern that suggests bullish sentiment after a day of trading volatility. After the appearance of the hammer, the prices start moving up. It signals that the market is. This article illustrates these patterns in this order: Derived from japanese candlestick chart analysis methods, this single candle pattern exhibits a distinct. The price closes at the top ¼ of the range. Web what is a hammer candlestick pattern? Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. The long lower shadow is a strong indication that buying pressure has significantly rejected and countered selling pressure, suggesting the strong likelihood of a bullish reversal. There are two types of hammers: Web what is the hammer candlestick pattern? The price closes at the top ¼ of the range. A minor difference between the opening and closing prices forms a small candle body. Occurrence after bearish price movement. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Web the hammer candlestick pattern is a technical analysis tool used by traders to identify potential reversals in price trends. The hammer candlestick is a popular chart pattern that suggests bullish sentiment after a day of trading volatility. This shows a hammering out of a base and reversal setup. The lower shadow is about 2 or 3 times the length of the body. Web the hammer candlestick pattern is used by seasoned professionals and novice traders. It’s a bullish reversal candlestick pattern, which indicates the end. Little to no upper shadow. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher.

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick Pattern Strategy Guide for Day Traders DTTW™

How to Trade the Hammer Candlestick Pattern Pro Trading School

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Pattern Trading Guide

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer Candlestick Patterns (Types, Strategies & Examples)

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Pattern The Complete Guide 2022 (2022)

The Hammer Candlestick Pattern Identifying Price Reversals

Web By Leo Smigel.

Web Hammer Candlestick Pattern Refers To A Candlestick Pattern With The Appearance Of A Hammer Or The English Alphabet’s ‘T.’.

The Hammer Helps Traders Visualize Where Support And Demand Are Located.

It Helps Traders Identify Potential Bullish Trend Reversals.

Related Post: