Three Red Crows Candlestick Pattern

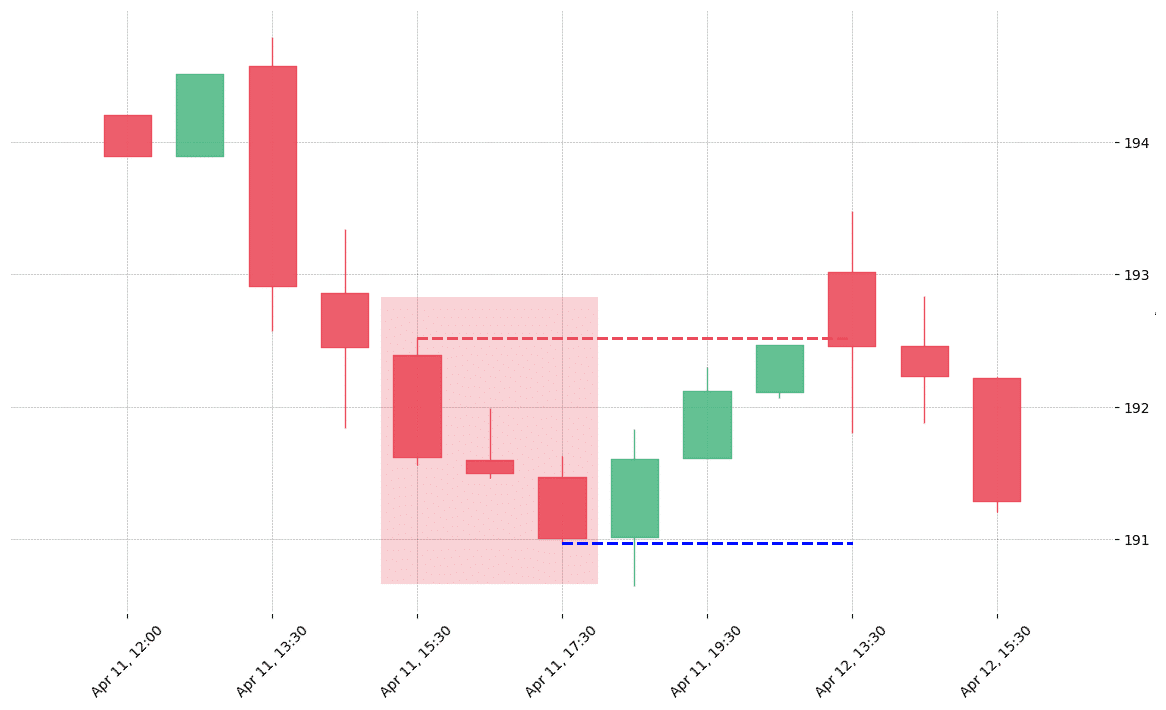

Three Red Crows Candlestick Pattern - Web the three black crows candlestick pattern is a. In this guide, we will look closer at the three black crows pattern. This bearish reversal pattern near a chart pattern top with an overbought technical reading will have more room to go lower than if this candle. Web the gbp/usd chart below gives us a great look at the 3 black crows candlestick pattern. Web september 7, 2022 zafari. The three crows help to confirm that a bull market has ended and market sentiment has turned negative. To predict the reversal of the uptrend. Web the three crows pattern, also referred to as the “three black crows”, is a reversal pattern found at the end of an uptrend. It happens when bearish forces become greater than the bullish forces on three consecutive days i.e. The candlestick pattern that requires that each of the three candlesticks should be relatively long bearish candlesticks with each candlestick opening lower than the previous. Web check out the examples below to test your knowledge of the three black crows candlestick pattern. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web three black crows is a pattern used in technical analysis of stocks, currencies, indices etc. Web three black crows is the. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Each session opens at a similar price to the previous day, but selling pressures push the. The trader observes three successive long red candles, each closing around the day’s bottom, producing the three black crows pattern. It consists of. Web the bottom line. The second candle is longer than the first, and the third candle is longer than the second. Recognize an uptrend in price. The three crows pattern forms as follows: The trader observes three successive long red candles, each closing around the day’s bottom, producing the three black crows pattern. In many ways, they are seen as kill candles, effectively killing the prior uptrend of a move in stocks, crypto, forex, or other asset. Web september 7, 2022 zafari. Follow these steps to identify and trade three black crows: In our first example, the three black crows appear after a brief uptrend. The candlestick pattern that requires that each of. Web the three black crows pattern, a bearish reversal pattern, is identified by three consecutive red candles. Candlestick charts indicate the opening, high, low, and the closing price on a security. These candles must open within the previous body or near the closing price. The three crows pattern forms as follows: The three crows help to confirm that a bull. Web the three crows pattern, also referred to as the “three black crows”, is a reversal pattern found at the end of an uptrend. Web the three black crows pattern is a bearish reversal pattern consisting of three consecutive bearish long candlesticks that trend downward. Web check out the examples below to test your knowledge of the three black crows. Follow these steps to identify and trade three black crows: These candles must open within the previous body or near the closing price. This bearish reversal pattern near a chart pattern top with an overbought technical reading will have more room to go lower than if this candle. Because the context of the market is more important than any. Recognize. In many ways, they are seen as kill candles, effectively killing the prior uptrend of a move in stocks, crypto, forex, or other asset. Web the three black crows candlestick pattern is a. The second candle is longer than the first, and the third candle is longer than the second. The candlestick pattern that requires that each of the three. After this bearish pattern is identified in technical charts, an opportunity to. Web the three crows pattern can be black, red, or whatever color your candle charting uses. The trader observes three successive long red candles, each closing around the day’s bottom, producing the three black crows pattern. Web three black crows is a bearish candlestick pattern that is used. Web check out the examples below to test your knowledge of the three black crows candlestick pattern. These candles must open within the previous body or near the closing price. Each session opens at a similar price to the previous day, but selling pressures push the. After this bearish pattern is identified in technical charts, an opportunity to. To predict. Web the three black crows pattern is a bearish reversal pattern that consists of three consecutive bearish long candlesticks that trend downward like a staircase. Web the three black crows candlestick pattern is a bearish price action formation that is commonly used by traders to identify the possible reversal of a prior uptrend. It consists of three consecutive bearish candlesticks. Mk trader | three black crows candlestick pattern 📈📊 #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick. It happens when bearish forces become greater than the bullish forces on three consecutive days i.e. When moving lower, they show a black or red color. This bearish reversal pattern near a chart pattern top with an overbought technical reading will have more room to go lower than if this candle. After this bearish pattern is identified in technical charts, an opportunity to. The three crows help to confirm that a bull market has ended and market sentiment has turned negative. Three inside up and down. The three black crows pattern is identified as a bearish candlestick pattern used to predict a reversal. Three black crows candlestick pattern #trading #stockmarket #sharemarket #mktrader #stock #sensex #banknifty #nifty #candlestick.. Web the three crows pattern can be black, red, or whatever color your candle charting uses. Web candlestick patterns have become one of the most popular analysis methods available today, and there are quite a variety of patterns available, each holding a different meaning. Crypto traders should avoid this pattern due to the lack of data to form any statistically significant conclusions. Web three black crows is a bearish candlestick pattern that is used to predict the reversal of the current uptrend.

IDENTICAL THREE CROWS CANDLESTICK PATTERN PRICE ACTION TECHINAL

Trading Patterns Including Three Candlesticks

How To Trade Blog How To Use Three Black Crows Candlestick Pattern

Powerful Three Crows Pattern Formation, Trading, Limitations & Use2022

How to Read Candlestick Charts for Intraday Trading

Identical Three Crows Candlestick Pattern The Forex Geek

Powerful Three Crows Pattern Formation, Trading, Limitations & Use2022

Triple Candlestick Patterns Bornean Forex Trader

How To Read Candlestick Chart For Statistics Honing Your Trading Strategy

Identical Three Crows Candlestick Pattern PatternsWizard

This Indicates To The Trader That The Upswing Is Losing Steam And That A Reversal Is Approaching.

The Three Black Crows Is A Bearish Reversal Pattern Therefore It Should Be Considered Only When It Appears After An Uptrend.

Web The Pattern Indicates A Strong Price Reversal From A Bull Market To A Bear Market.

In Many Ways, They Are Seen As Kill Candles, Effectively Killing The Prior Uptrend Of A Move In Stocks, Crypto, Forex, Or Other Asset.

Related Post: