Three Candle Pattern

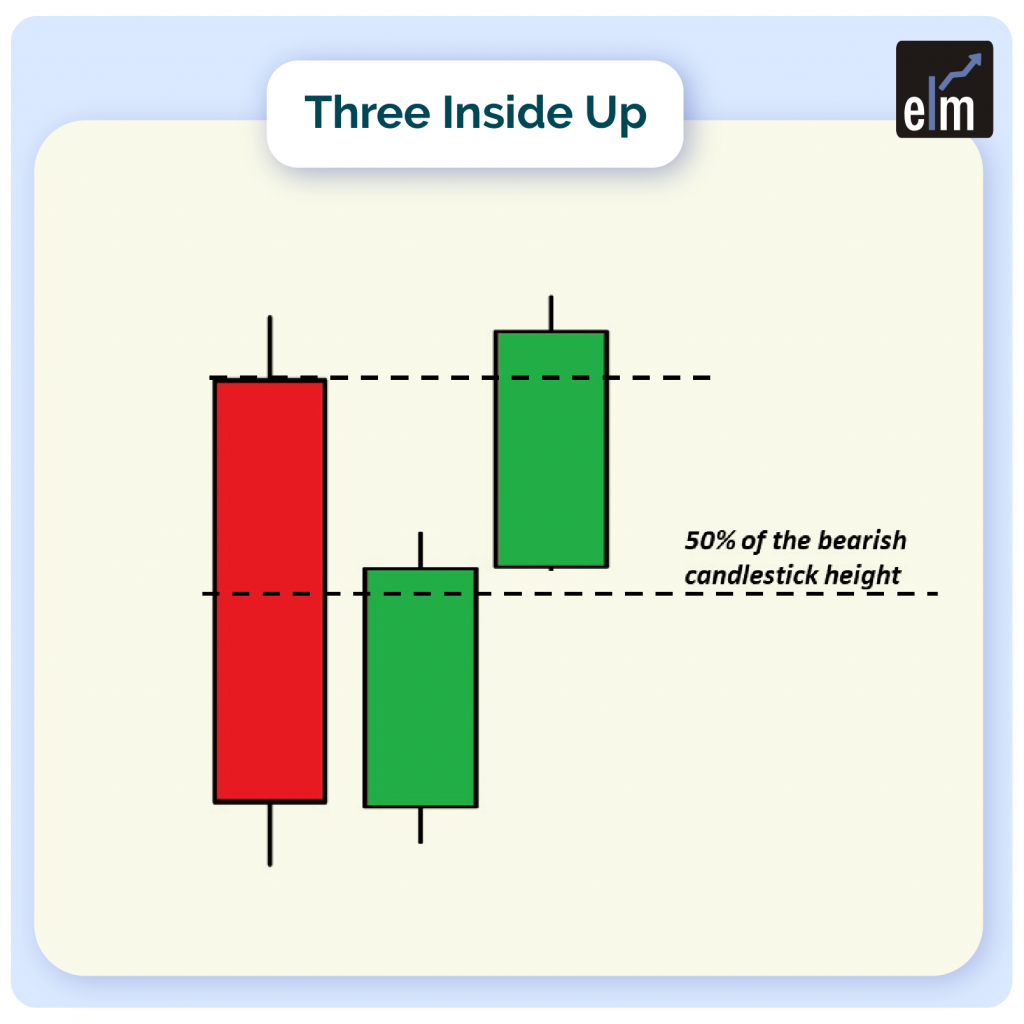

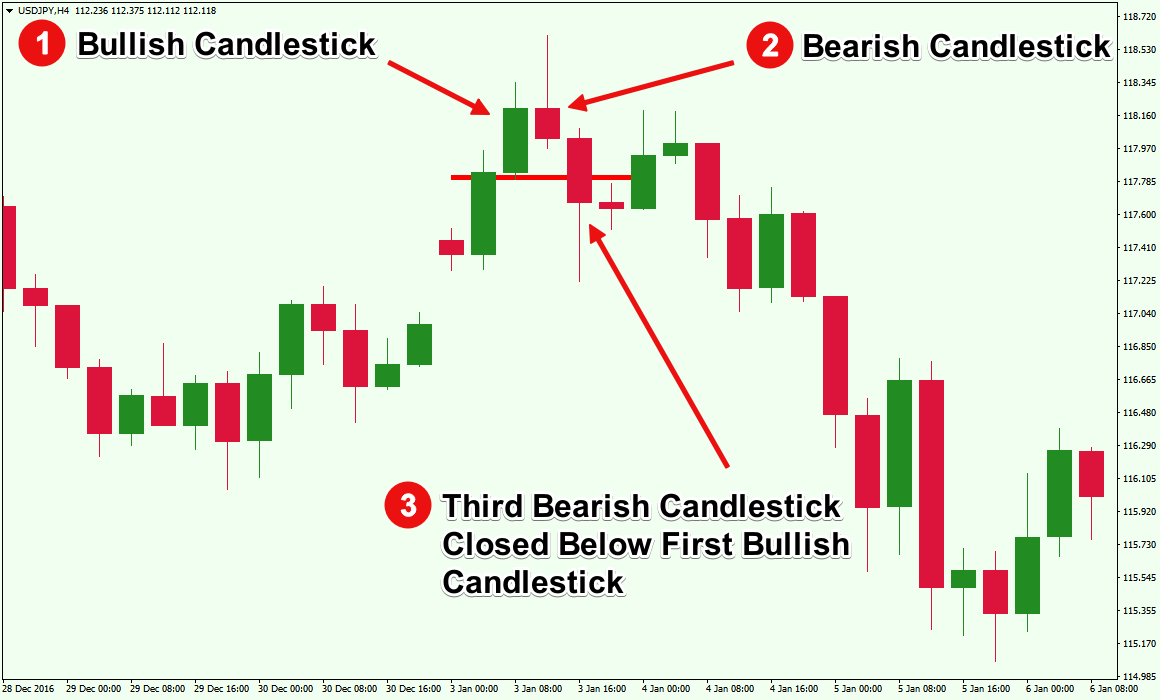

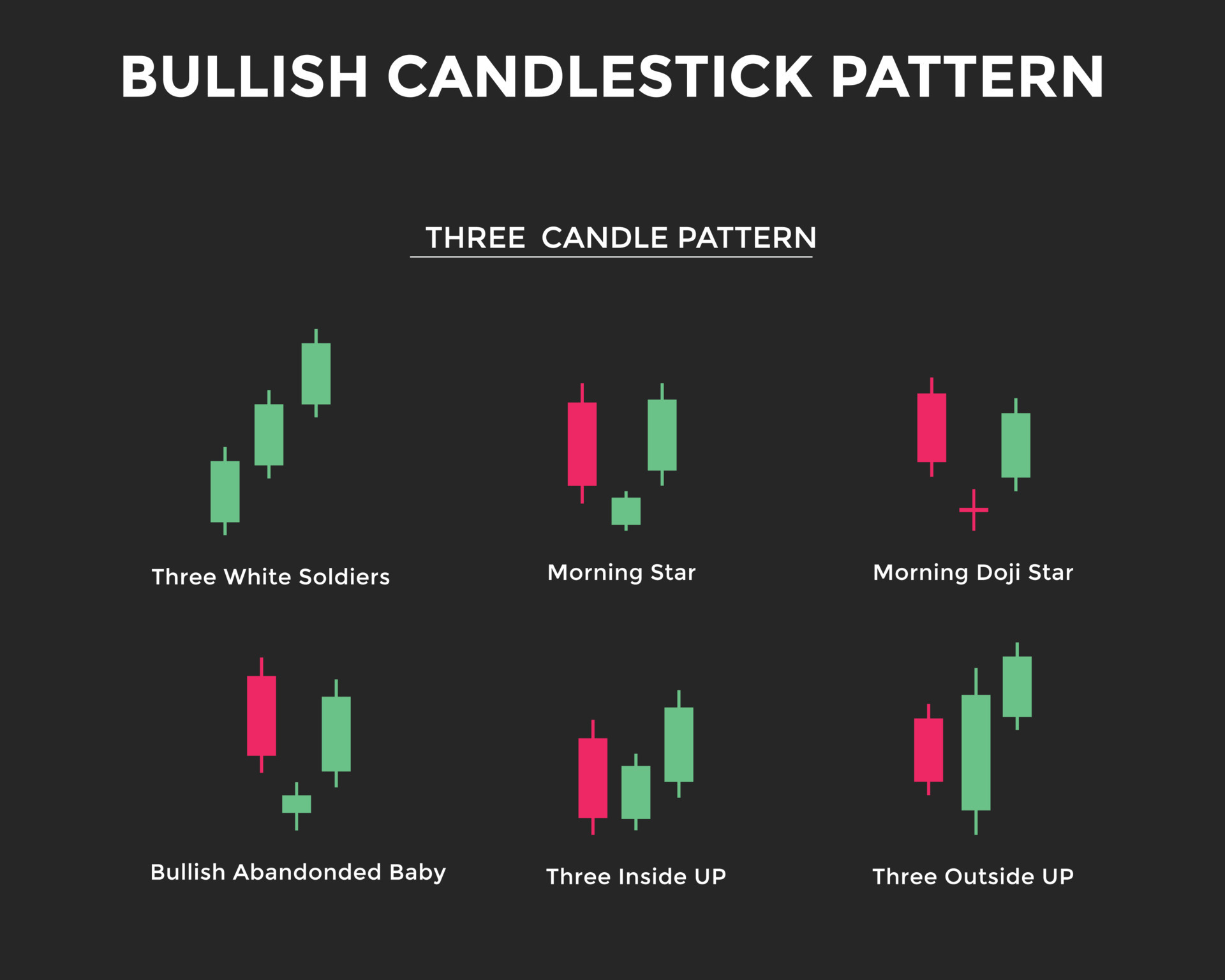

Three Candle Pattern - Definition, structure, types, and trading 66. This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started. Web rising three methods: Web one of the most powerful and easy to recognize continuation patterns for beginners is the three line strike candlestick pattern. Web nifty on wednesday ended flat to form a high wave type candle pattern, which indicates chances of an upside bounce.the positive chart pattern like higher tops and bottoms is intact as per daily timeframe chart and presently the market is in an attempt of new higher bottom formation. The first candle must be bearish; Web three inside up/down: The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. This pattern is formed when the candlesticks meet the following. Cardi b attends the 2024 met gala. Erin mcdowell , samantha grindell , anneta konstantinides, and amanda krause. A type of candlestick pattern that signals a reversal in the current trend. This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started. A bullish candlestick pattern that is used to predict the continuation of the current uptrend. Web nifty on. Web three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend. The bearish formation is composed of a big red candle, 3 down candles, and one up candle erasing the decrease made by the prior 3. This pattern is formed when the candlesticks meet the following. The doji and spinning top. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Web three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend. Secondly, you need to identify the two candle formations of a first long bearish candlestick and a second. Web the final candlestick in a rising three pattern is important as it stands for confirmation that the bullish trend is to continue. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Web the three black crows candlestick pattern, or simply the black crows pattern, signals a likely shift from a. Web three outside up/down: Its first candle is a bearish (matching the recent price movement) spinning top, while the second candle is large and. Secondly, you need to identify the two candle formations of a first long bearish candlestick and a second shorter bullish candlestick (at least 50% the size of the first candle). This pattern is formed when the. A type of candlestick pattern that signals a reversal in the current trend. It typically represents a shift in momentum, with the price moving in the opposite direction after a sustained trend. Falling three bearish bar play pattern. The first candle should be found at the. The bullish formation is composed of a big green candle, 3 up candles, and. The second candle must be bullish; The first candlestick of the chart pattern that needs to appear is a bullish candlestick with. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. Web falling three methods: It indicates the reversal of an uptrend, and is particularly. This pattern is formed when three consecutive doji candlesticks appear at the end of a prolonged trend. Cardi b attends the 2024 met gala. The following candlestick closes below the opening of the first candlestick. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. This pattern is formed when the candlesticks. The third candle should close above the. Web three new lawsuits have been filed alleging a pattern of sexual hazing on the northwestern football team, a scandal that has ballooned in scope since it first surfaced last summer. The setup candle, confirmation candle, and trigger candle. Nifty, after falling for three consecutive trading. Erin mcdowell , samantha grindell , anneta. Falling three bearish bar play pattern. Trading the falling three bar play pattern works the same as trading the rising three bullish pattern, but the structure is obviously different. The following candlestick closes below the opening of the first candlestick. Web in the example above, the proper entry would be below the body of the shooting star, with a stop. Its first candle is a bearish (matching the recent price movement) spinning top, while the second candle is large and. Finally, after identifying the two candlestick. Web the three white soldiers pattern can appear after an extended downtrend and a period of consolidation. The setup candle is the first candle in the pattern and sets the stage for a potential reversal. Web one of the most powerful and easy to recognize continuation patterns for beginners is the three line strike candlestick pattern. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. This pattern is formed when the candlesticks meet the following characteristics. Secondly, you need to identify the two candle formations of a first long bearish candlestick and a second shorter bullish candlestick (at least 50% the size of the first candle). The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. Cardi b attends the 2024 met gala. The three outside up pattern occurs at market bottoms. The first candlestick of the chart pattern that needs to appear is a bullish candlestick with. Definition, structure, types, and trading 66. The following candlestick closes below the opening of the first candlestick. The bearish formation is composed of a big red candle, 3 down candles, and one up candle erasing the decrease made by the prior 3.

What Is Three Inside Up Candlestick Pattern? How To Trade Blog

Three Candle Patterns Explained Part 1 YouTube

An Overview of Triple Candlestick Patterns Forex Training Group

Candlestick Patterns The Definitive Guide (2021)

Understand Three Inside Up And Three Inside Down

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

An Overview of Triple Candlestick Patterns Forex Training Group

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

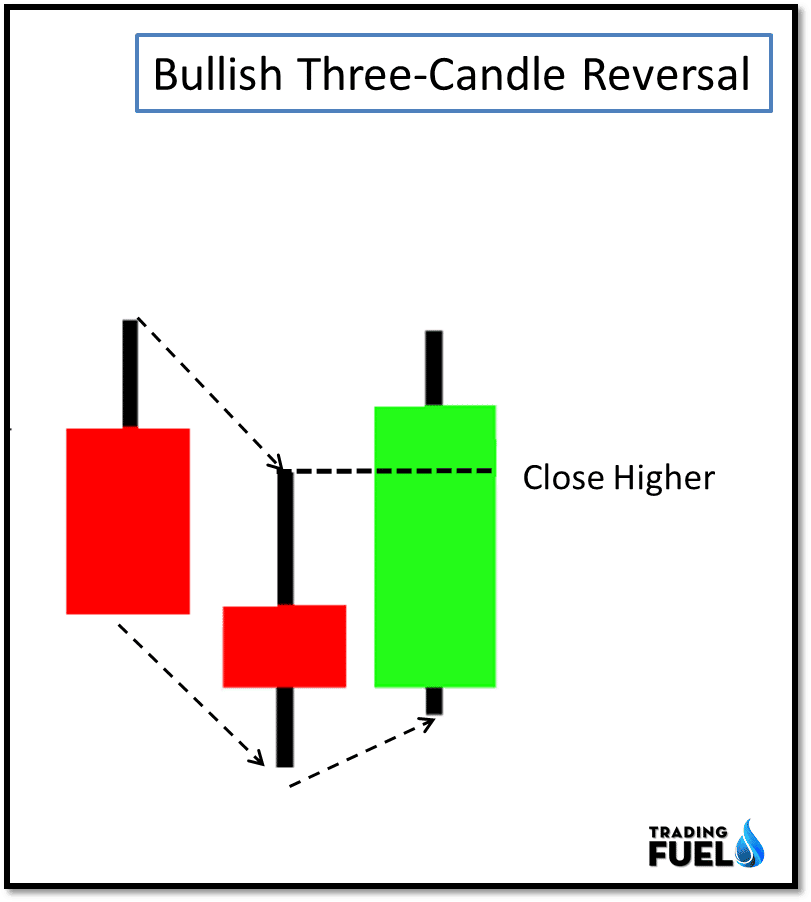

Bullish candlestick chart pattern. Three Candle Patterns. Candlestick

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Web Nifty On Wednesday Ended Flat To Form A High Wave Type Candle Pattern, Which Indicates Chances Of An Upside Bounce.the Positive Chart Pattern Like Higher Tops And Bottoms Is Intact As Per Daily Timeframe Chart And Presently The Market Is In An Attempt Of New Higher Bottom Formation.

It Is Formed Of A Short Candle Sandwiched Between A Long Green Candle And A Large Red Candlestick.

This Pattern Is Formed When Three Consecutive Doji Candlesticks Appear At The End Of A Prolonged Trend.

The Characteristics Of This Pattern Are Defined By:

Related Post: