Stocks Megaphone Pattern

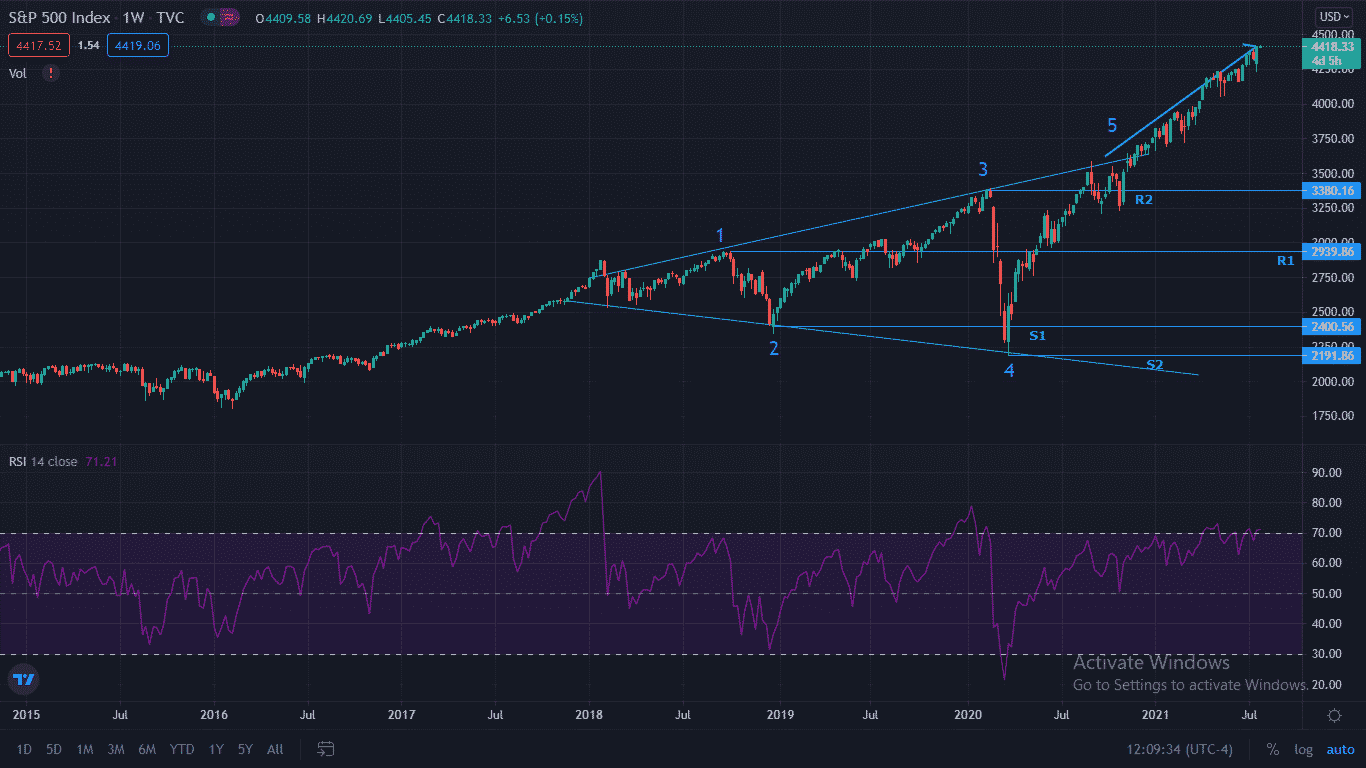

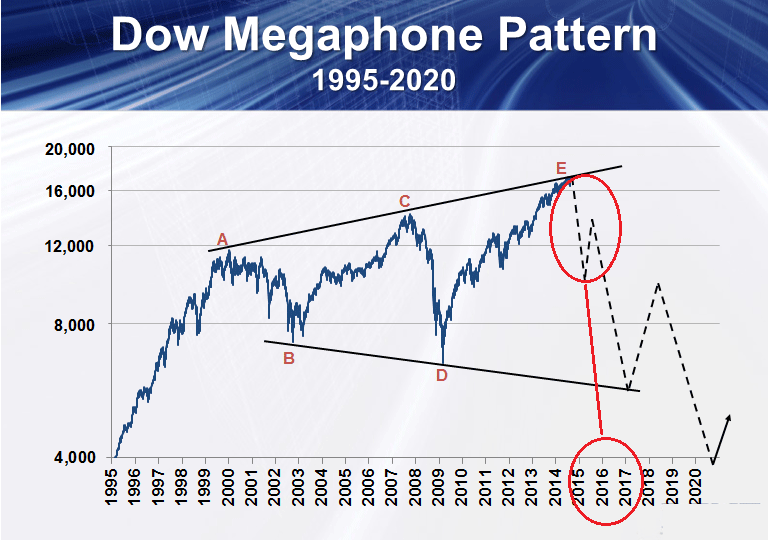

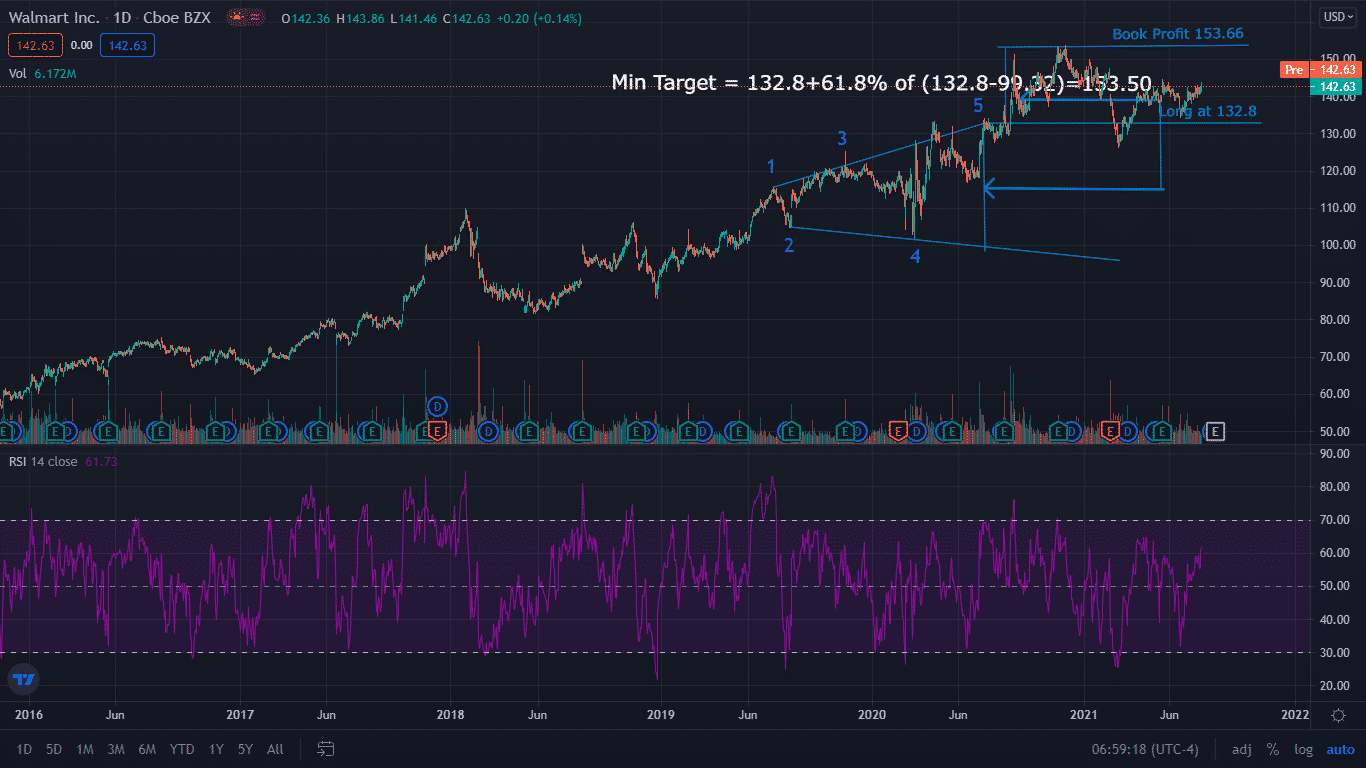

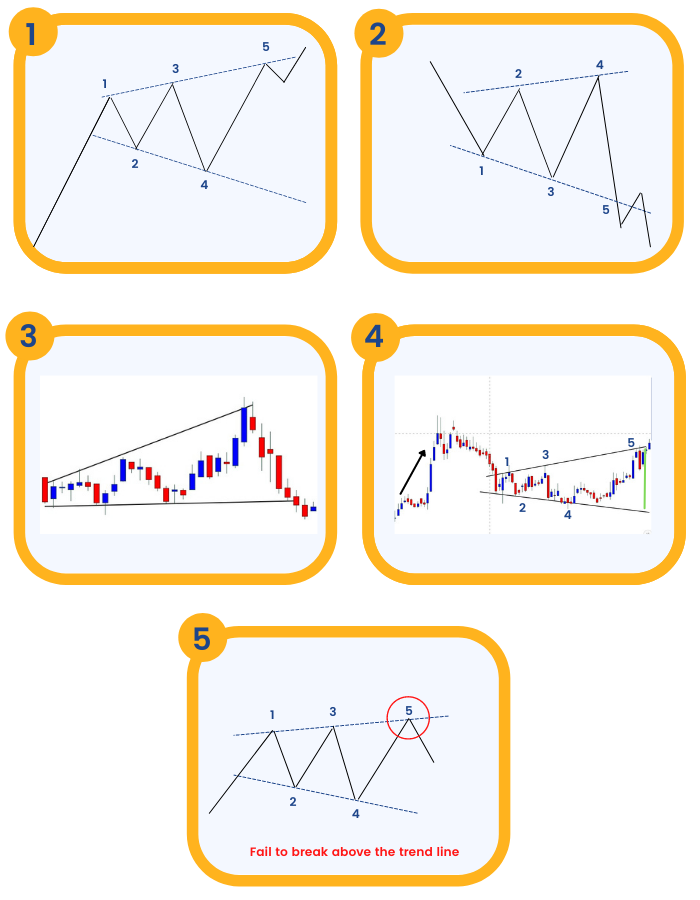

Stocks Megaphone Pattern - Web the megaphone trading pattern, also known as a broadening wedge, inverted symmetrical triangle, or broadening formation, is a chart pattern. It consists of two trend lines diverging from each. It is characterized by increasing price volatility and diagrammed as two. Web traders use the megaphone stock pattern to generate signals to buy or sell a stock based on the direction of the market when it’s reaching either end of its range. Web the megaphone pattern is a price action trading pattern that gets formed due to increasing volatility in prices. Web the rare megaphone bottom—a.k.a. Web a megaphone pattern is when price action makes a series of higher highs and lower lows over a period of time. Compare ira optionslow cost providers$0 acct minimum providers Web the megaphone pattern, also known as the broadening formation, is a distinctive chart pattern that signals increasing market volatility and potential trend. Web a broadening formation is a price chart pattern identified by technical analysts. Broadening pattern—can be recognized by its successively higher highs and lower lows, which form after a downward move. Web traders use the megaphone stock pattern to generate signals to buy or sell a stock based on the direction of the market when it’s reaching either end of its range. Web a broadening top is a unique chart pattern resembling a. Web in this article you’ll learn about the ways to identify a megaphone pattern, whether a megaphone pattern is bullish or bearish, the main characteristics of this. Web the megaphone pattern, also known as the broadening formation, is a distinctive chart pattern that signals increasing market volatility and potential trend. It consists of two trend lines diverging from each. Web. Web when a megaphone pattern emerges in a stock’s price chart, it indicates that there is uncertainty among market participants, causing fluctuations without a clear. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Web the megaphone pattern is a price action trading. Compare ira optionslow cost providers$0 acct minimum providers Web the megaphone pattern is a price action trading pattern that gets formed due to increasing volatility in prices. Web megaphone patterns are most successful for day and swing traders. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: Web a broadening. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. It consists of two trend lines diverging from each. Web the. Web the megaphone trading pattern, also known as a broadening wedge, inverted symmetrical triangle, or broadening formation, is a chart pattern. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: Web traders use the megaphone stock pattern to generate signals to buy or sell a stock based on the direction. It is characterized by increasing price volatility and diagrammed as two. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors.. Web the megaphone pattern is a relatively unique chart formation characterized by higher highs and lower lows, forming a broadening wedge shape. Web traders use the megaphone stock pattern to generate signals to buy or sell a stock based on the direction of the market when it’s reaching either end of its range. Web a broadening formation is a price. Web the megaphone pattern is a relatively unique chart formation characterized by higher highs and lower lows, forming a broadening wedge shape. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: Web the rare megaphone bottom—a.k.a. It consists of two trend lines diverging from each. Thus forming a megaphone like. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web traders use the megaphone stock pattern to generate signals to buy or sell a stock based on the direction of the market when it’s reaching either end of its range. Web the rare megaphone bottom—a.k.a. Web the. Web a broadening formation is a price chart pattern identified by technical analysts. It is characterized by increasing price volatility and diagrammed as two. Thus forming a megaphone like trend line shape. Web the megaphone pattern is a relatively unique chart formation characterized by higher highs and lower lows, forming a broadening wedge shape. Web the megaphone pattern is characterized by a series of higher highs and lower lows, which is a marked expansion in volatility: Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: Web in this article you’ll learn about the ways to identify a megaphone pattern, whether a megaphone pattern is bullish or bearish, the main characteristics of this. It consists of two trend lines diverging from each. Web the rare megaphone bottom—a.k.a. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Web the megaphone pattern, also known as the broadening formation, is a distinctive chart pattern that signals increasing market volatility and potential trend. Web the megaphone trading pattern, also known as a broadening wedge, inverted symmetrical triangle, or broadening formation, is a chart pattern. Compare ira optionslow cost providers$0 acct minimum providers Web traders use the megaphone stock pattern to generate signals to buy or sell a stock based on the direction of the market when it’s reaching either end of its range. Broadening pattern—can be recognized by its successively higher highs and lower lows, which form after a downward move. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors.

What is the Megaphone Pattern? How To Trade It.

Megaphone Chart Pattern Explained! (Technical Analysis Trading Stocks

What is the Megaphone Pattern? How To Trade It.

Megaphone Pattern For Trading YouTube

DOW MEGAPHONE PATTERN Stock Courses MOJO Day Trading

Megaphone Pattern The Art of Trading like a Professional

MICK bullish megaphone pattern? for NYSEMCK by Peet_Serfontein

What is the Megaphone Pattern? How To Trade It.

Megaphone Pattern The Art of Trading like a Professional

What Is A Megaphone Pattern?

Web Megaphone Patterns Are Most Successful For Day And Swing Traders.

Web When A Megaphone Pattern Emerges In A Stock’s Price Chart, It Indicates That There Is Uncertainty Among Market Participants, Causing Fluctuations Without A Clear.

Web A Megaphone Pattern Is When Price Action Makes A Series Of Higher Highs And Lower Lows Over A Period Of Time.

Web The Megaphone Pattern Is A Price Action Trading Pattern That Gets Formed Due To Increasing Volatility In Prices.

Related Post: