Stock Wedge Patterns

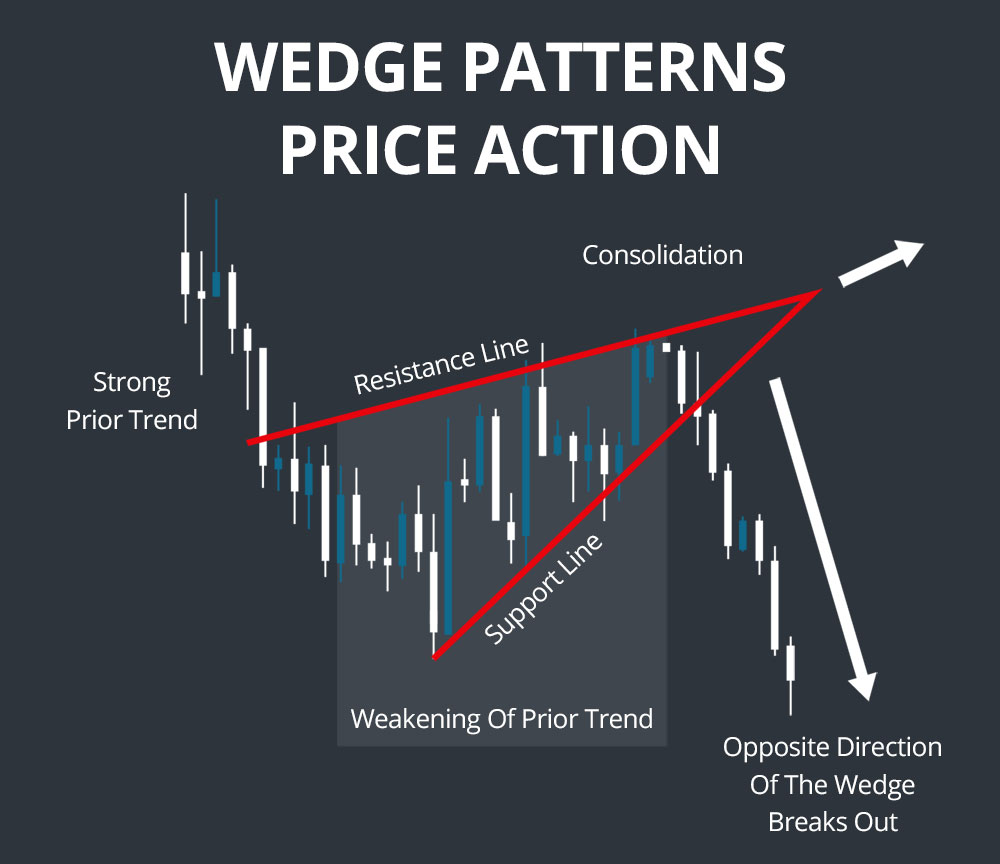

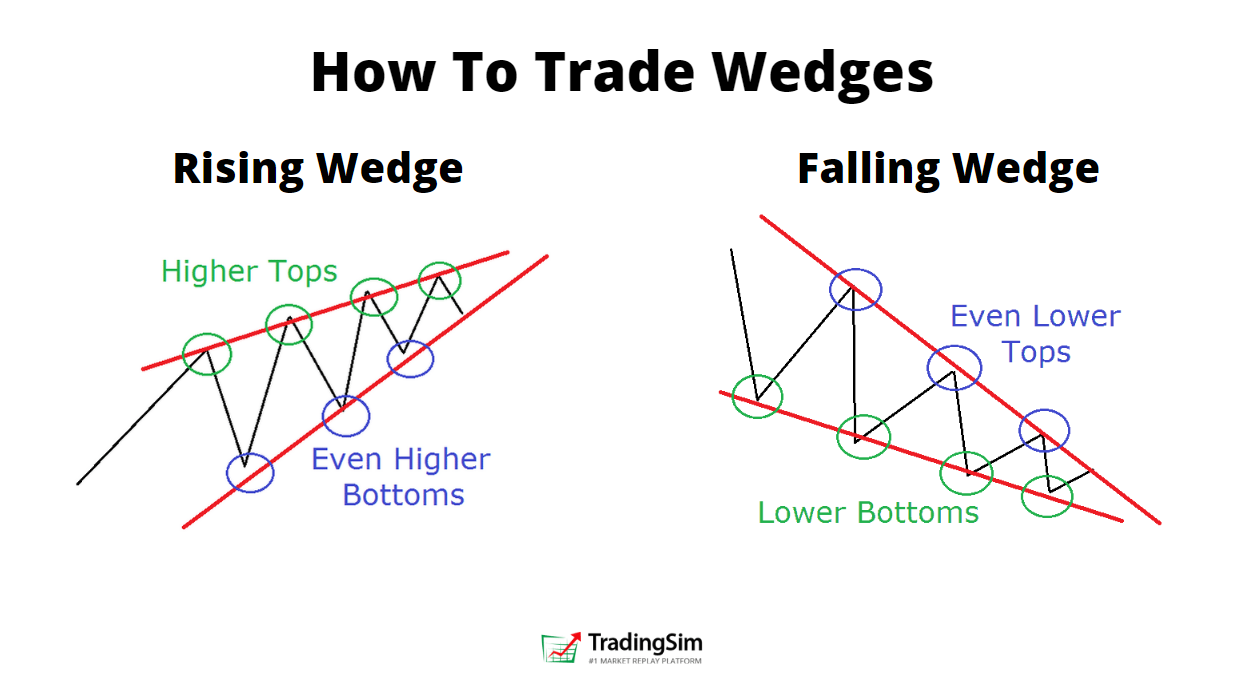

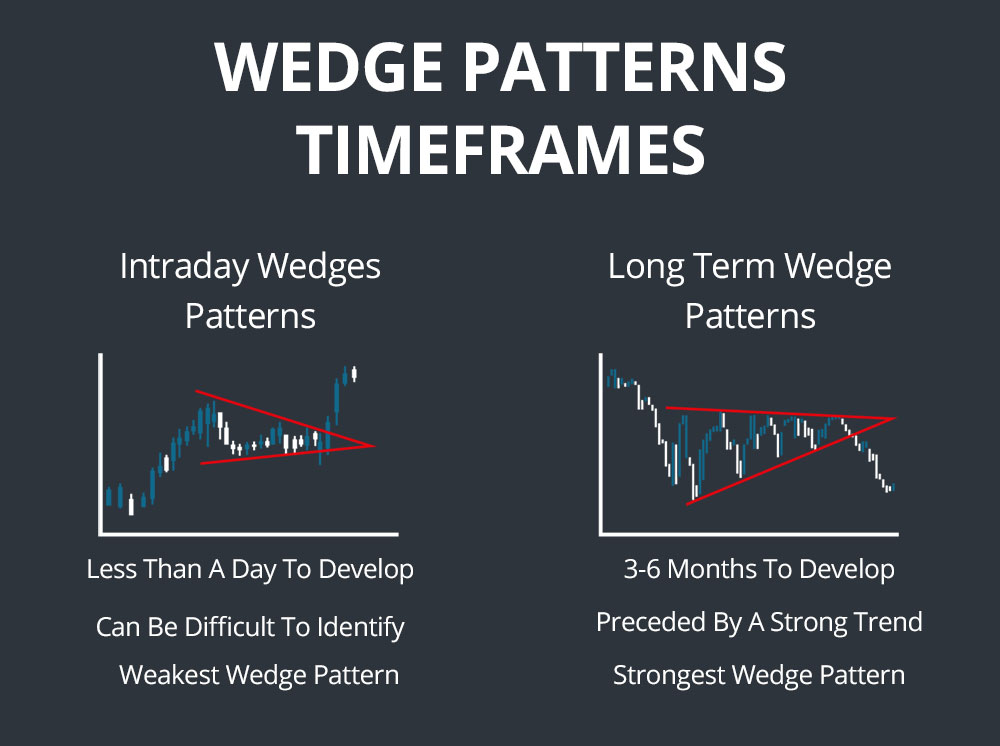

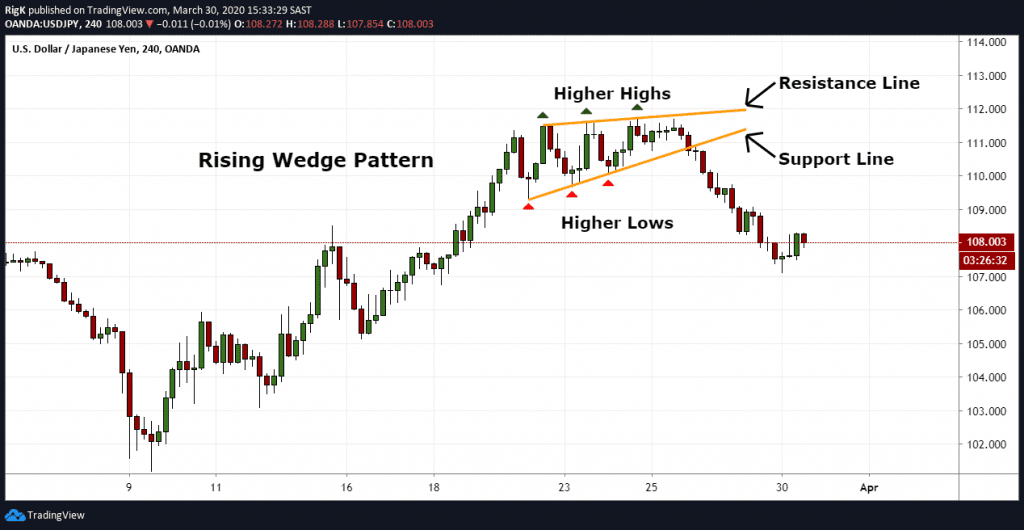

Stock Wedge Patterns - Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. As outlined earlier, falling wedges can be both a. The pattern is characterized by a. There are 2 types of wedges. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. These patterns can be extremely difficult to recognize and. They can be found in uptrends too, but would still generally be regarded as bearish. Web in this article. By stelian olar, updated on: Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets ( stocks, bonds, futures, etc.). These patterns can be extremely difficult to recognize and. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Web 📌 what is the rising wedge pattern? They are composed of the support and resistance trend lines that move in the same direction as the channel gets. Web on the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets ( stocks, bonds, futures, etc.). As outlined earlier, falling wedges can be both a. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. Wedge patterns can. The pattern is characterized by a. Web wedge patterns in stocks are similar to triangle patterns in that they are marked by narrowing price ranges and converging trend lines. It is considered a bullish chart formation. A wedge is a price pattern marked by converging trend lines on a price chart. The rising wedge is a bearish chart pattern found. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. The two trend lines are drawn to connect the respective highs. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. It suggests a potential reversal in the trend. Web in this article. The pattern is characterized by a. The wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge. They can be found in uptrends too, but would still generally be regarded as bearish. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web in this article. The pattern can break out up or down but is primarily considered. Web published research shows the most reliable and profitable stock chart patterns are the inverse. The breakout direction from the wedge determines whether. In many cases, when the market. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a. Web 📌 what is the rising wedge pattern? The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance of a. The pattern is characterized by a. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Web on the technical analysis chart, a. There are 2 types of wedges. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. They can be found in uptrends too, but would still generally be regarded as bearish. By stelian olar, updated on: It is considered a bullish chart formation. Web a rising wedge is a powerful technical analysis pattern with a predictive accuracy of 81%. Web a rising wedge is generally considered bearish and is usually found in downtrends. By stelian olar, updated on: Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Web wedge patterns in stocks are similar to triangle patterns in that they are marked by narrowing price ranges and converging trend lines. They can be found in uptrends too, but would still generally be regarded as bearish. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Web 📌 what is the rising wedge pattern? In many cases, when the market.

Simple Wedge Trading Strategy For Big Profits

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Rising and Falling Wedge Patterns How to Trade Them TradingSim

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How to Trade the Rising Wedge Pattern Warrior Trading

Falling Wedge Pattern Trading 4 Step Wedge Strategy Exposed

The Rising Wedge Pattern Explained With Examples

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

They Are Composed Of The Support And Resistance Trend Lines That Move In The Same Direction As The Channel Gets Narrower, Until.

As Outlined Earlier, Falling Wedges Can Be Both A.

Web In This Article.

Mesmerizing As Modern Art Yet Orderly As Geometry—Wedge Patterns Capture.

Related Post: