Shooting Star Pattern Candlestick

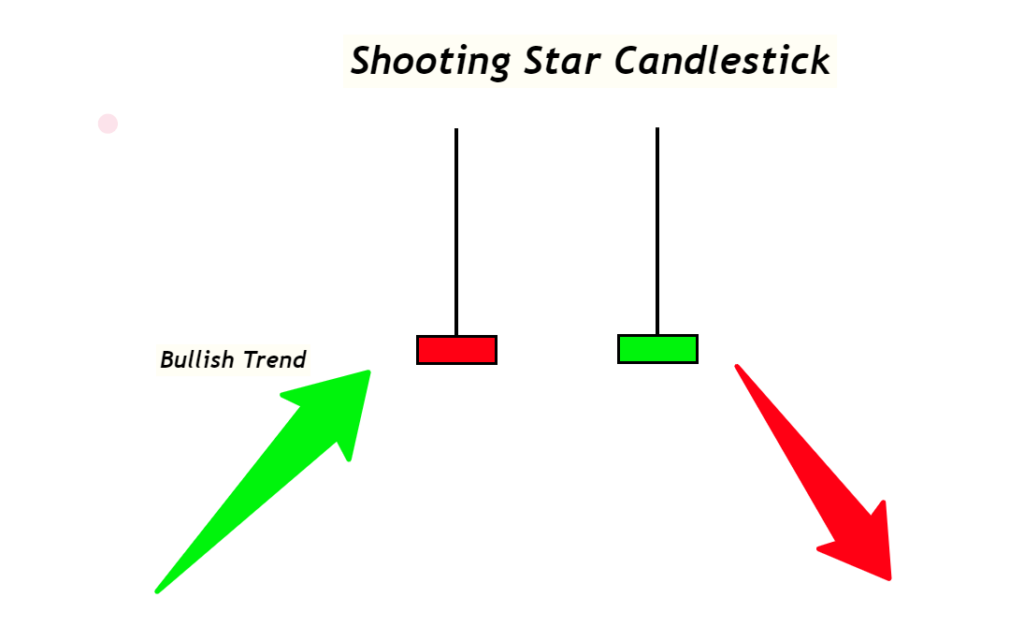

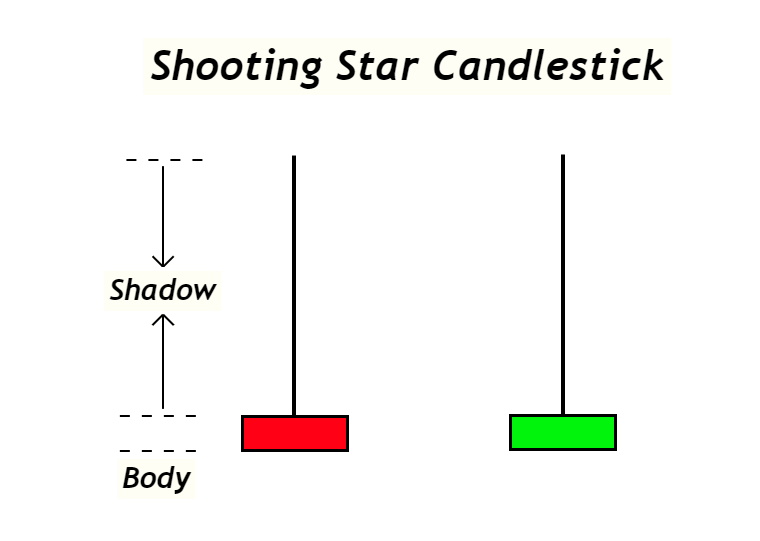

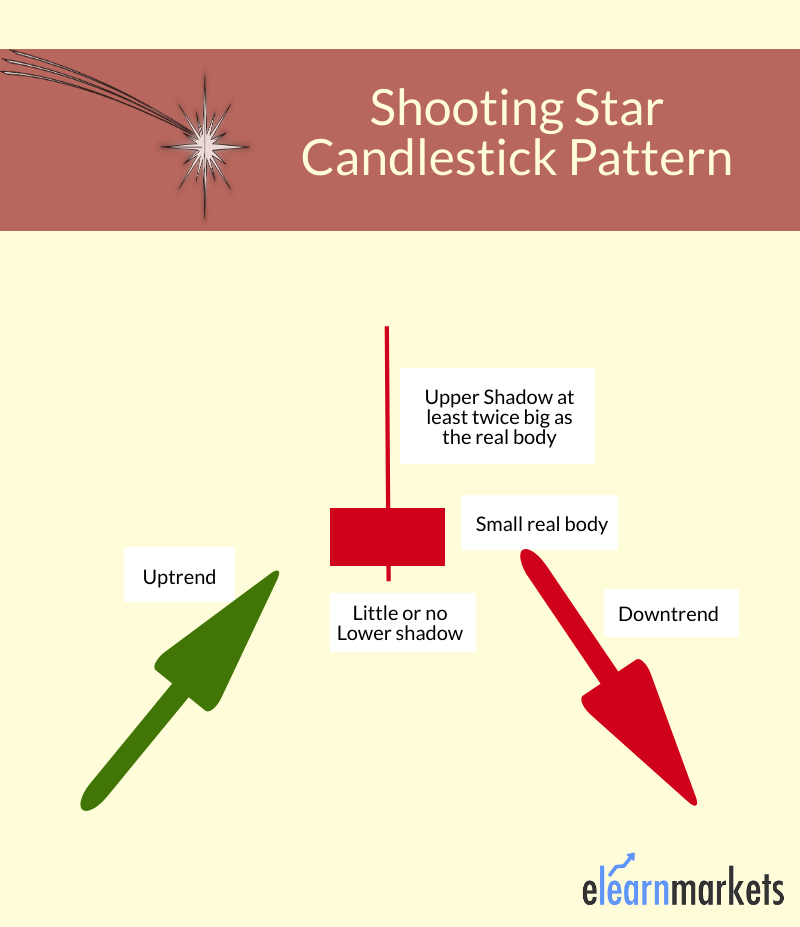

Shooting Star Pattern Candlestick - As to the pattern itself, a shooting star has a small body that’s located in the bottom half of the candle’s range, and has a long upper wick, with a low or absent lower wick. Here are some identification guidelines: Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. It’s composed of a small real body at the lower end of the trading range with a long upper shadow and little to no lower shadow. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. Shooting stars can be propagated by division in the fall when dormant. Web the shooting star pattern is a bearish reversal pattern that typically occurs at the top of an uptrend. Candlesticks fibonacci and chart pattern trading tools. It has no lower wick or sometimes has a smaller wick. Web also, shooting star seedlings may take three or four years before flowers appear. Web what is candlestick charting? Here are some identification guidelines: As to the pattern itself, a shooting star has a small body that’s located in the bottom half of the candle’s range, and has a long upper wick, with a low or absent lower wick. How to use the shooting star? Web the shooting star is a candlestick pattern to. Shooting stars can be propagated by division in the fall when dormant. How to use the shooting star? Web the shooting star is a candlestick pattern to help traders visually see where the resistance and supply is located. Native geographic location and habitat: Here are some identification guidelines: What is a shooting star pattern? The bearish shooting star candlestick pattern appears towards the end of an uptrend to indicate a forthcoming trend reversal. It’s a bearish reversal pattern. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. It presents the open, high, low, and close of a particular period in the form of candlesticks, which. Native geographic location and habitat: It appears after an uptrend. When this pattern appears. What is a shooting star pattern? Web the shooting star candlestick pattern is a bearish reversal pattern. Native geographic location and habitat: How to use the shooting star? When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Web for this reason, a shooting star candlestick pattern is a very powerful formation. After the uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completed exited. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the. The pattern is bearish because we expect to have a bear move after a shooting star appears at the right location. It has no lower wick or sometimes has a smaller wick. Web what is a shooting star candlestick pattern? It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices,. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. Web what is the shooting star candlestick pattern. Shooting stars can be propagated by division in the fall when dormant. Web the morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. The bearish shooting star candlestick pattern appears towards the. Native geographic location and habitat: After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may. Web in technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. Web the shooting star is a candlestick pattern to help traders visually see where the resistance and supply is located. It has no lower wick or sometimes has a smaller wick. Web the shooting star pattern is a bearish reversal pattern that. This is just an inverted hammer candle called a shooting star. The pattern is bearish because we expect to have a bear move after a shooting star appears at the right location. Web in technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline. It has no lower wick or sometimes has a smaller wick. It is characterized by a long upper shadow, a small or no lower shadow, as well as a reduced real body near the day’s low. After the uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completed exited. Download free pdf view pdf. Web what is a shooting star candlestick pattern? Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an uptrend and warns of a possible trend reversal. It appears after an uptrend. Web the shooting star pattern is a bearish reversal pattern that typically occurs at the top of an uptrend. Web the shooting star candlestick pattern, a crucial tool in a trader’s arsenal, is a significant reversal indicator predominantly found at the end of an uptrend. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Web a shooting star candlestick is a japanese candlestick pattern that appears when the security price rises significantly, but the closing price falls and lands close to the opening price. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening price.

Candlestick shooting star pattern strategy ( A to Z ) YouTube

Shooting Star Candlestick Pattern PDF Guide Trading PDF

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Candlestick Pattern How to Identify and Trade

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Shooting Star Candlestick Pattern How to Identify and Trade

Shooting Star Candlestick Pattern (How to Trade & Examples)

Candlestick Patterns The Definitive Guide (2021)

What Is Shooting Star Candlestick With Examples ELM

Candlestick Charting Is A Type Of Financial Chart Used To Analyze Price Movements In Financial Markets.

Web Japanese Candlestick Charting Techniques A Contemporary Guide To The Ancient Investment Techniques Of The Far East.

Web A Shooting Star Is A Bearish Candlestick With A Long Upper Shadow, Little Or No Lower Shadow, And A Small Real Body Near The Low Of The Day.

Web For This Reason, A Shooting Star Candlestick Pattern Is A Very Powerful Formation.

Related Post: