Candle Reversal Patterns

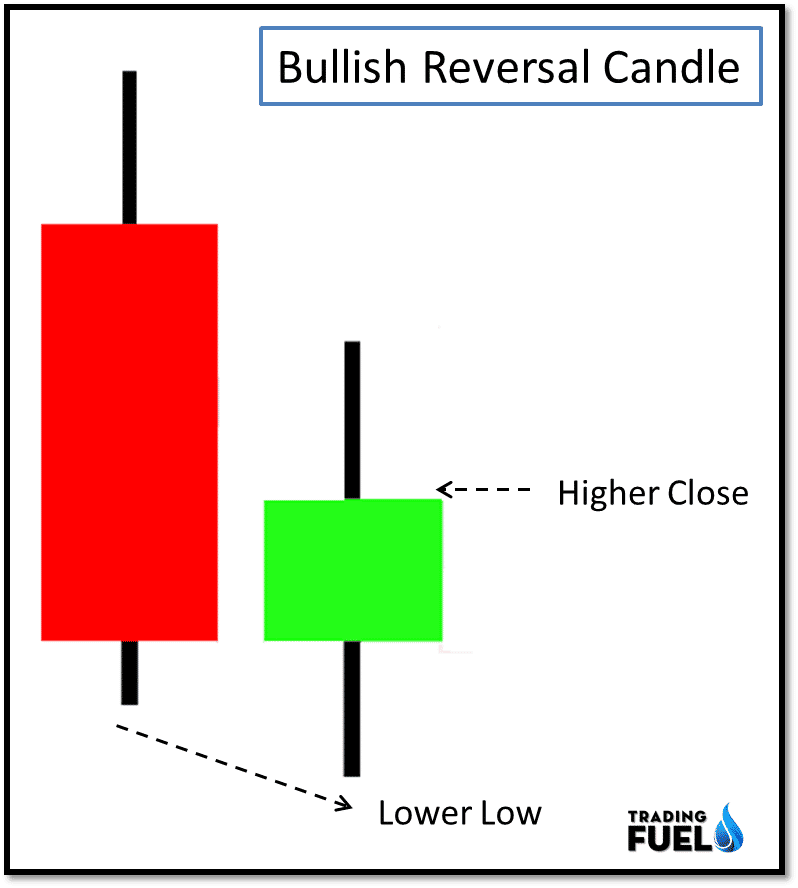

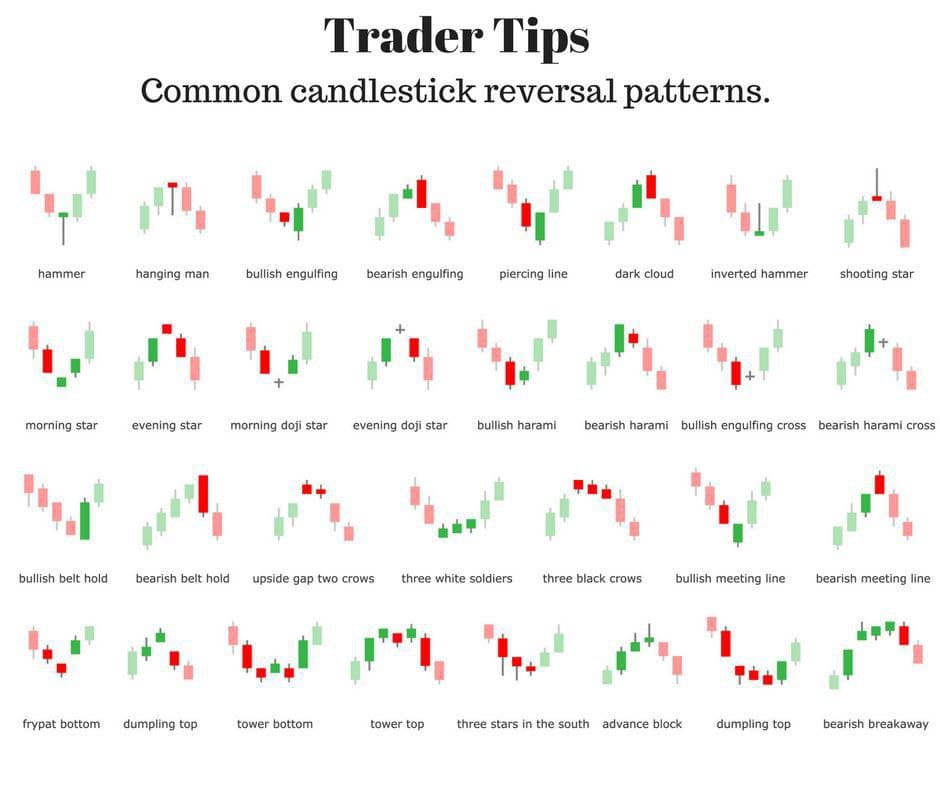

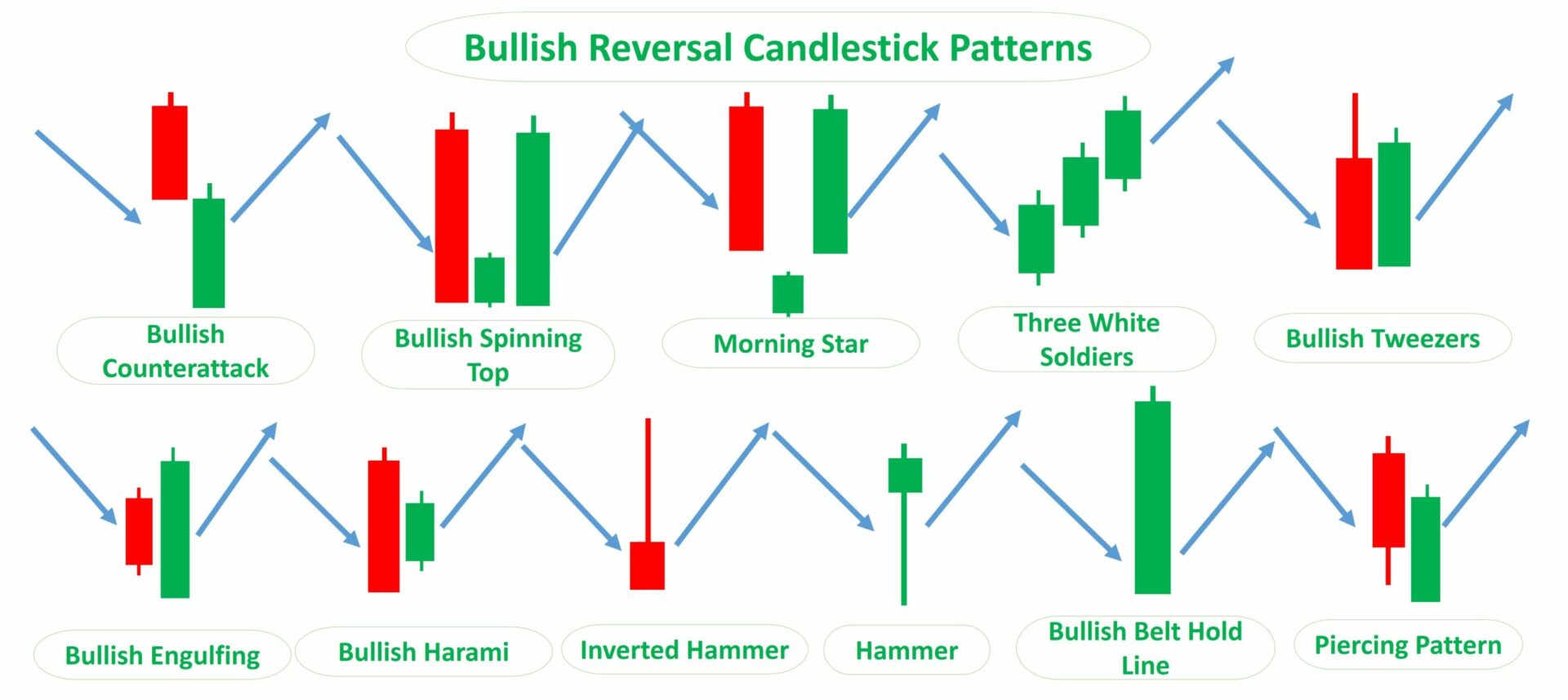

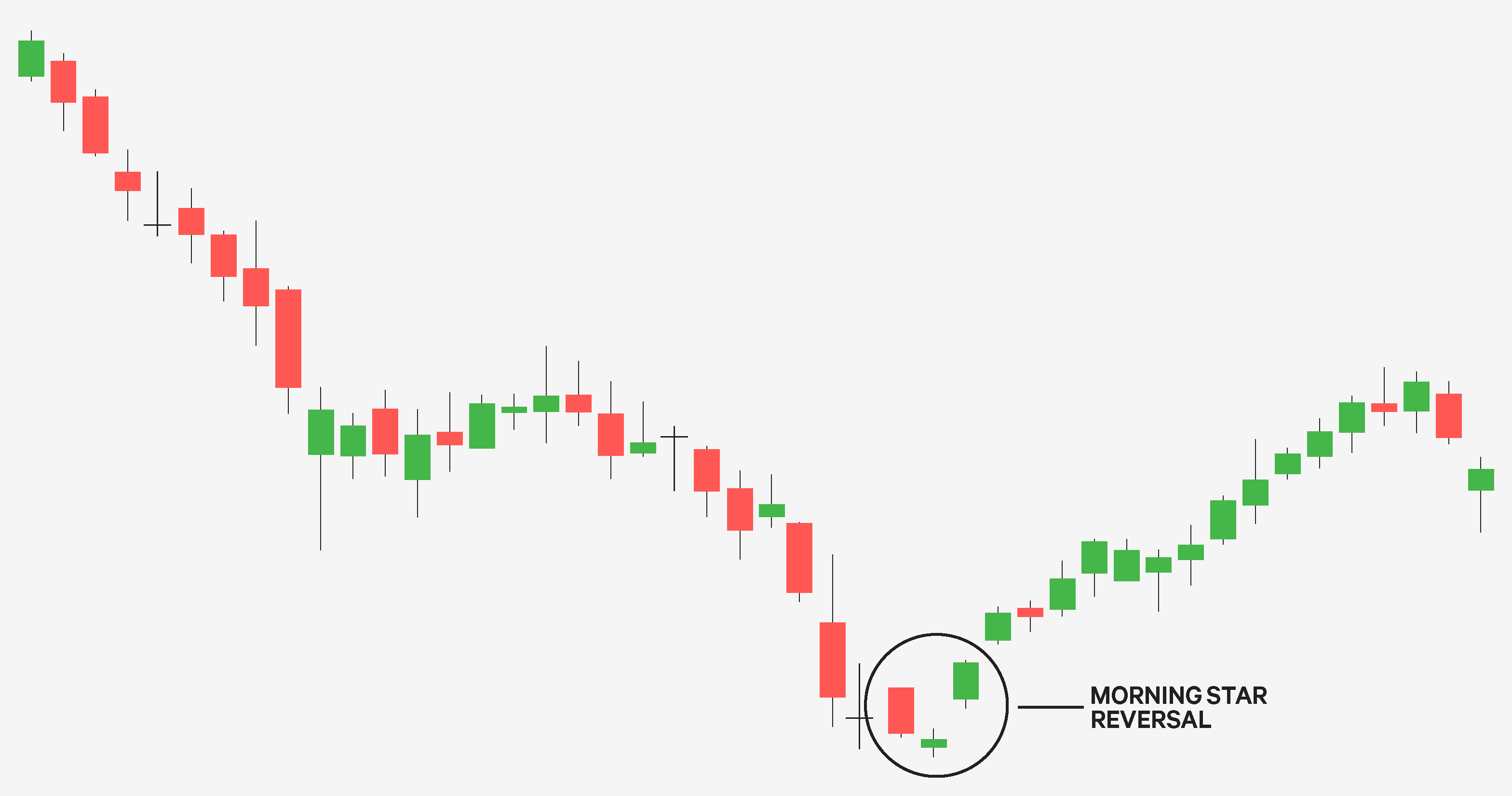

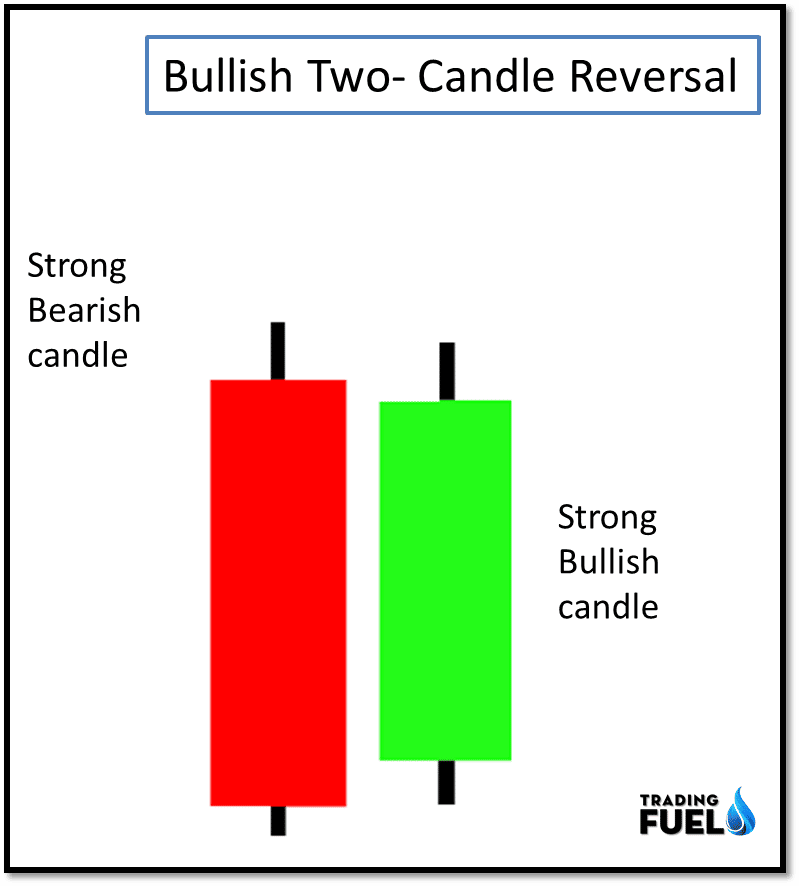

Candle Reversal Patterns - And when you learn to spot them on charts, they can signal a potential change in trend direction. Understanding the importance of reversal patterns in trading. Web 📍 bullish reversal candlestick patterns : Web a downtrend has been apparent in definitive healthcare corp. To that end, we’ll be covering the fundamentals of. Candlestick patterns are a visual aid, helping traders see what the market sentiment is — and when that sentiment may be shifting. A reversal candle pattern is no different from a standard structure. Web below you can find the schemes and explanations of the most common reversal candlestick patterns. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and abandoned baby, to name just a few. The shift can be either bullish or bearish. Web below you can find the schemes and explanations of the most common reversal candlestick patterns. Web here’s a complete list of reversal candlestick patterns, including both bullish and bearish reversals: To that end, we’ll be covering the fundamentals of. Web a reversal candle pattern is a formation of japanese candlesticks arranged in such a way as to indicate the. Web a reversal candlestick pattern is a formation on a candlestick chart that signals a potential change in the direction of a trend. Instead, these candlesticks can be used to identify trending periods, potential reversal points and classic technical analysis patterns. Web common trading reversal patterns include one or multiple candlestick pattern forms like hammers, engulfing bars, morning and evening. Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. It’s the candle grouping and pattern formation that’s different. Web 📍 bullish reversal candlestick patterns : Instead, these candlesticks can be used to identify trending periods, potential. They are identified by a higher low and a lower high compared with the previous day. It can signal an end of the bearish trend, a bottom or a support level. Web the candlestick patterns that turn the trend from bearish to bullish or bullish to bearish price trend are called trend reversal candlestick patterns in technical analysis. Web a. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart pattern was formed. Web a reversal candle pattern is a formation of japanese candlesticks arranged in such a way as to indicate the end of an existing trend in favor of an opposing one. It’s the candle grouping and pattern. Understanding the importance of reversal patterns in trading. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and abandoned baby, to name just a few. While the latter signal that the prevailing trend is likely to continue after a temporary pause is finished and the breakout. They are identified by a higher low and a lower high compared with the previous day. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart pattern was formed. Each pattern has unique characteristics. Several patterns forecast trend reversal. Web a reversal candle pattern is a candlestick chart pattern that. Web the candlestick patterns that turn the trend from bearish to bullish or bullish to bearish price trend are called trend reversal candlestick patterns in technical analysis. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and abandoned baby, to name just a few. Each pattern. Candlestick patterns are a visual aid, helping traders see what the market sentiment is — and when that sentiment may be shifting. The collective story they tell reflects shifting bearish candles to bullish candles (or vice versa). The shift can be either bullish or bearish. However, traders wait for the confirmation of the. This is when momentum begins to shift. Several patterns forecast trend reversal. Certain candlestick patterns tell a story of strong bullish pressure, with little resistance from the selling side. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern. Understanding the importance of reversal patterns in trading. A candlestick pattern is a movement in prices shown graphically. Web reversal patterns are the opposite of continuation candlestick patterns. This is when momentum begins to shift. Web island reversal in both stock trading and financial technical analysis, an island reversal is a candlestick pattern with compact trading activity within a range of prices, separated from the move preceding it. Introduction to candlestick and chart reversal patterns. Several patterns forecast trend reversal. A reversal candle pattern is no different from a standard structure. Sure, it is doable, but it requires special training and expertise. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. While the stock has lost 24.3% over the past week, it could witness a trend reversal as a hammer chart pattern was formed. Instead, these candlesticks can be used to identify trending periods, potential reversal points and classic technical analysis patterns. There are dozens of different candlestick patterns with intuitive, descriptive. Trading without candlestick patterns is a lot like flying in the night with no visibility. Candlestick chart types have become popular among traders because they tell smaller stories within the larger market story. Each pattern has unique characteristics. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and abandoned baby, to name just a few. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern.

25 Bullish reversal candlestick pattern every trader must know and how

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Trader Tips Common candlestick reversal patterns Profit Myntra

Trading Forex With Reversal Candlestick Patterns » Best Forex Brokers

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

Cheat Sheet Candlestick Patterns PDF Free

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

Top Reversal Candlestick Patterns

How To Draw A Candlestick Chart Reversal Candle Pattern Indicator

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Unlike Candlesticks That Continue The Current Trend, Reversals Imply That Buyers Or Sellers Are Losing Control And The Price May Start Moving The Opposite Way.

They Are Identified By A Higher Low And A Lower High Compared With The Previous Day.

Web Some Of The Key Bearish Reversal Patterns Include:

Web Common Trading Reversal Patterns Include One Or Multiple Candlestick Pattern Forms Like Hammers, Engulfing Bars, Morning And Evening Star Candlestick Patterns.

Related Post: