Pennant Patterns

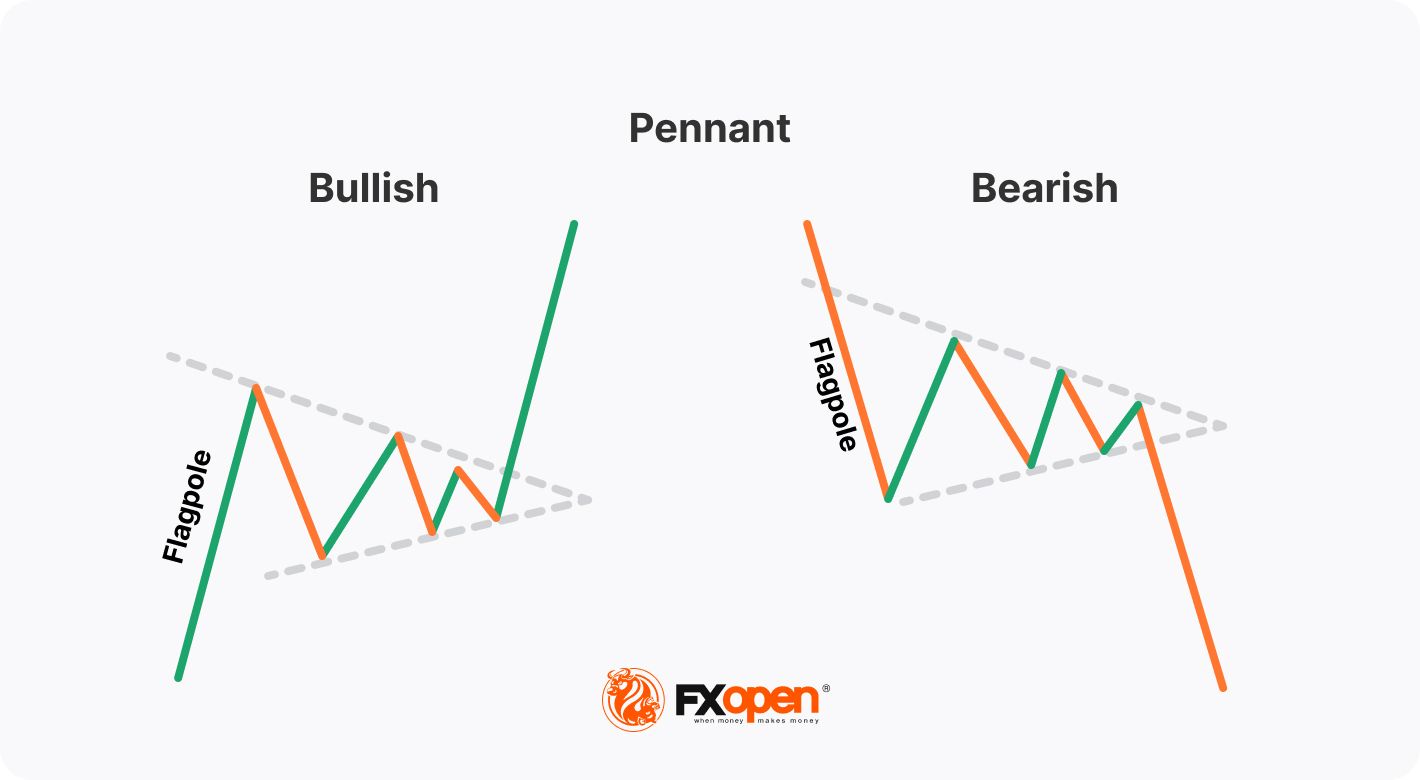

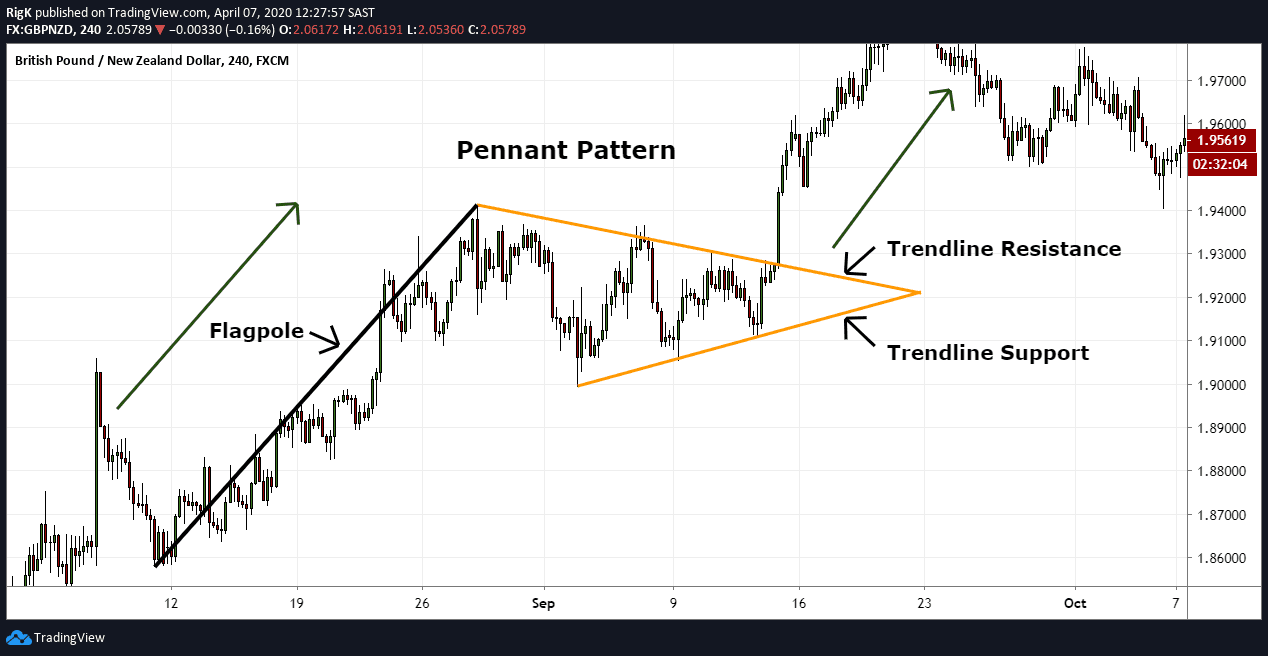

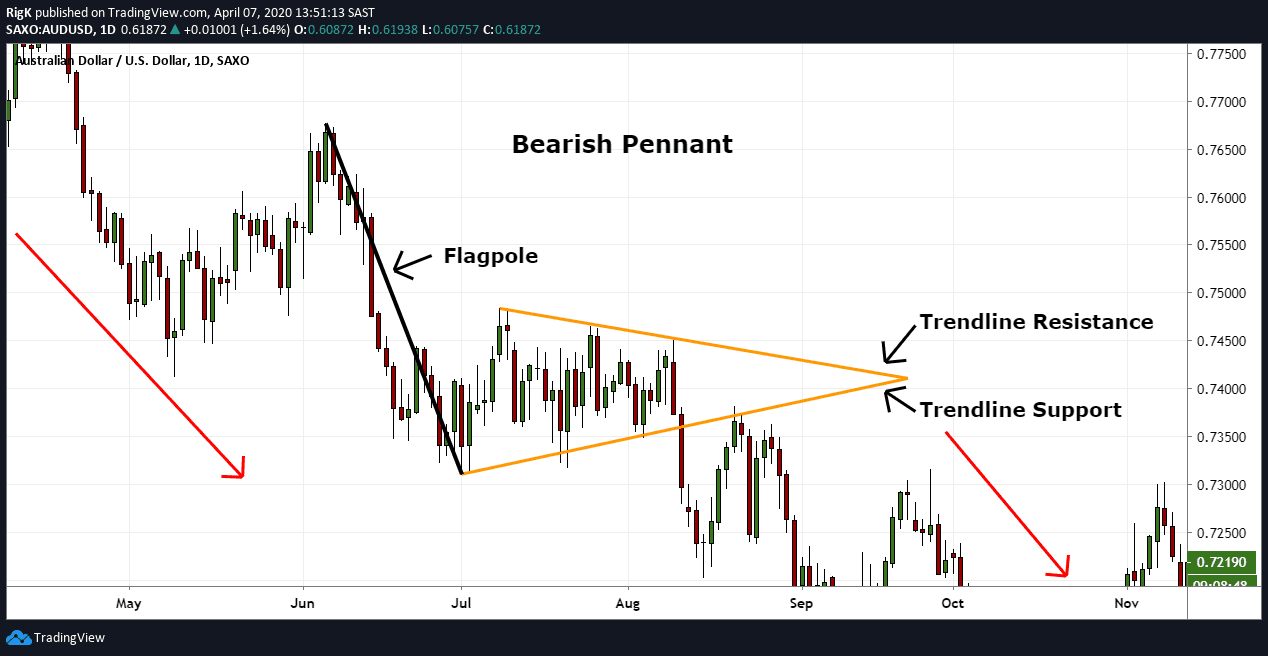

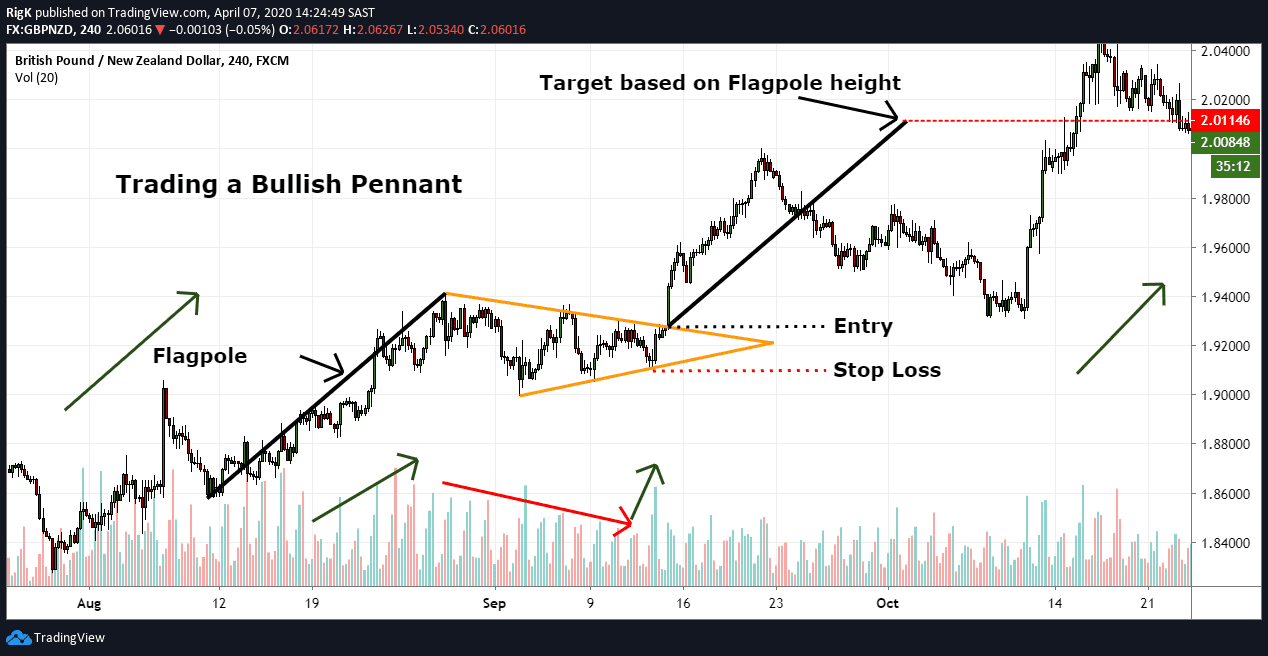

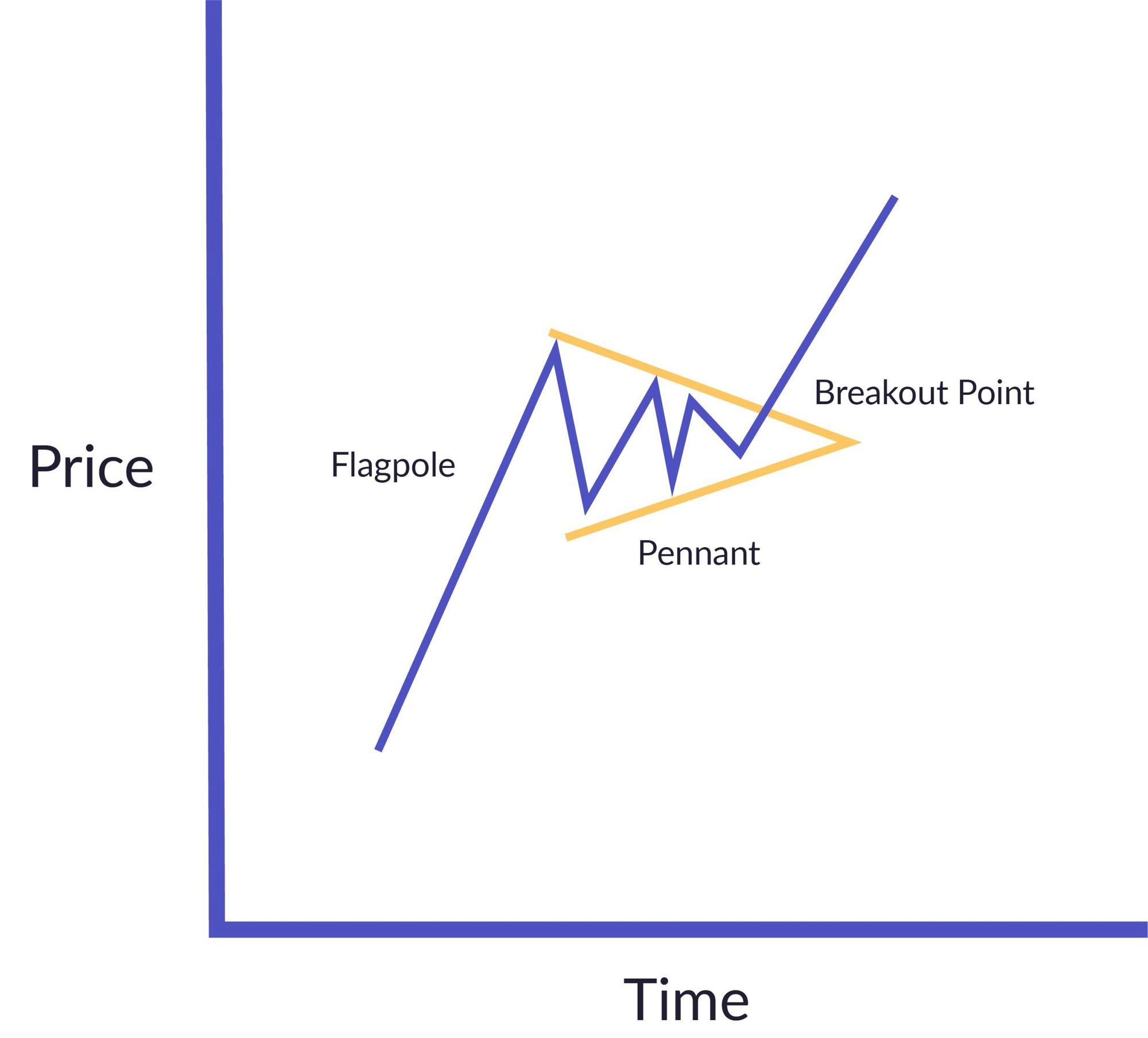

Pennant Patterns - When looking at a pennant pattern, one will identify three distinct phases: Bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. They are traded in the same way, but each has a slightly different shape. Web pennant pattern refers to a chart pattern that traders can witness when a stock or any other security experiences a significant move to the downside or upside after a consolidation period before it subsequently moves in the same direction. In technical analysis, a pennant is a type of continuation pattern. A flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Web what is a pennant pattern? Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a period of consolidation. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Web updated december 10, 2023. Web pennants are continuation patterns where a period of consolidation is followed by a breakout. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Web pennant patterns are technical chart patterns that are used by traders to identify potential entry and exit points in. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Bearish and bullish are two kinds of pennant chart patterns. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend, which is why it is considered to be a continuation pattern. Web a pennant can. Web pennant patterns are technical chart patterns that are used by traders to identify potential entry and exit points in the stock market. Once the price increases, the currency pair starts trading within a range between its support and resistance levels,. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend, which is why it. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. It’s what traders call a continuation pattern, meaning it. There is substantial dependence on the indian banking system, presenting challenges that fintech solutions,. Web pennant pattern refers to a chart pattern that traders can witness when a stock or any other security experiences a significant move to the downside or upside after a consolidation period before it subsequently moves in the same direction. During the consolidation phase price structure. In technical analysis, a pennant is a type of continuation pattern. A flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. There is substantial dependence on the indian. A classic pattern for technical analysts, the pennant pattern is identifiable by a large price move, followed by a consolidation period and a breakout. They are traded in the same way, but each has a slightly different shape. Web a pennant pattern is a type of continuation pattern formed when there is a large movement in a security in technical. In technical analysis, a pennant is a type of continuation pattern. Web flags and pennants are continuation patterns. Web the pennant is a continuation chart pattern that appears in both bullish and bearish markets. During the consolidation phase price structure tends to move sideways within a narrowing range before a breakout occurs. A pennant is a specific chart pattern that. How to identify a pennant chart pattern? Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend. Bearish and bullish are two kinds of pennant chart patterns. A classic pattern for technical analysts, the pennant pattern is identifiable by a large price move, followed by a consolidation period and a breakout. The formation. Web 5 challenges faced by microfinance institutions (mfis) 1.higher interest rates. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Web what are flag and pennant chart patterns? Web a pennant can be used as an entry pattern for the continuation of an established trend. A bullish pennant is. Bearish and bullish are two kinds of pennant chart patterns. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the. A bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. The pattern resembles a flagpole. Web what is a pennant pattern? When looking at a pennant pattern, one will identify three distinct phases: This pattern is formed when a stock experiences a sharp price movement, followed by a consolidation period, resulting in a triangular shape that resembles a pennant. Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend. Web the bear pennant is a bearish chart pattern that aims to extend the downtrend, which is why it is considered to be a continuation pattern. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a period of consolidation. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Web the pennant is a continuation chart pattern that appears in both bullish and bearish markets. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. Web a pennant pattern, referred to technical analysis, is a continuation pattern that is seen when a security experiences a large movement to the upside or downside, followed by a consolidation period, before subsequently moving in the same direction.

Pennant guide How to Trade Bearish and Bullish Pennants?

How To Identify and Trade Pennant Patterns? Phemex Academy

How to Trade a Pennant Pattern Market Pulse

Pennant Chart Patterns Definition & Examples

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

Pennant Chart Patterns and How to Trade them in Forex

Pennant Chart Patterns Definition & Examples

Pennant Patterns Trading Bearish & Bullish Pennants

Blog Your guide to stock trading chart patterns United Fintech

A Pennant Is A Specific Chart Pattern That Indicates A Market Consolidation Followed By A Significant Price Movement.

Unlike The Flag Where The Price Action Consolidates Within The Two Parallel Lines, The Pennant Uses Two Converging Lines For Consolidation Until The Breakout Occurs.

How To Identify A Pennant Chart Pattern?

Web Updated December 10, 2023.

Related Post: