Bullish And Bearish Candlestick Patterns

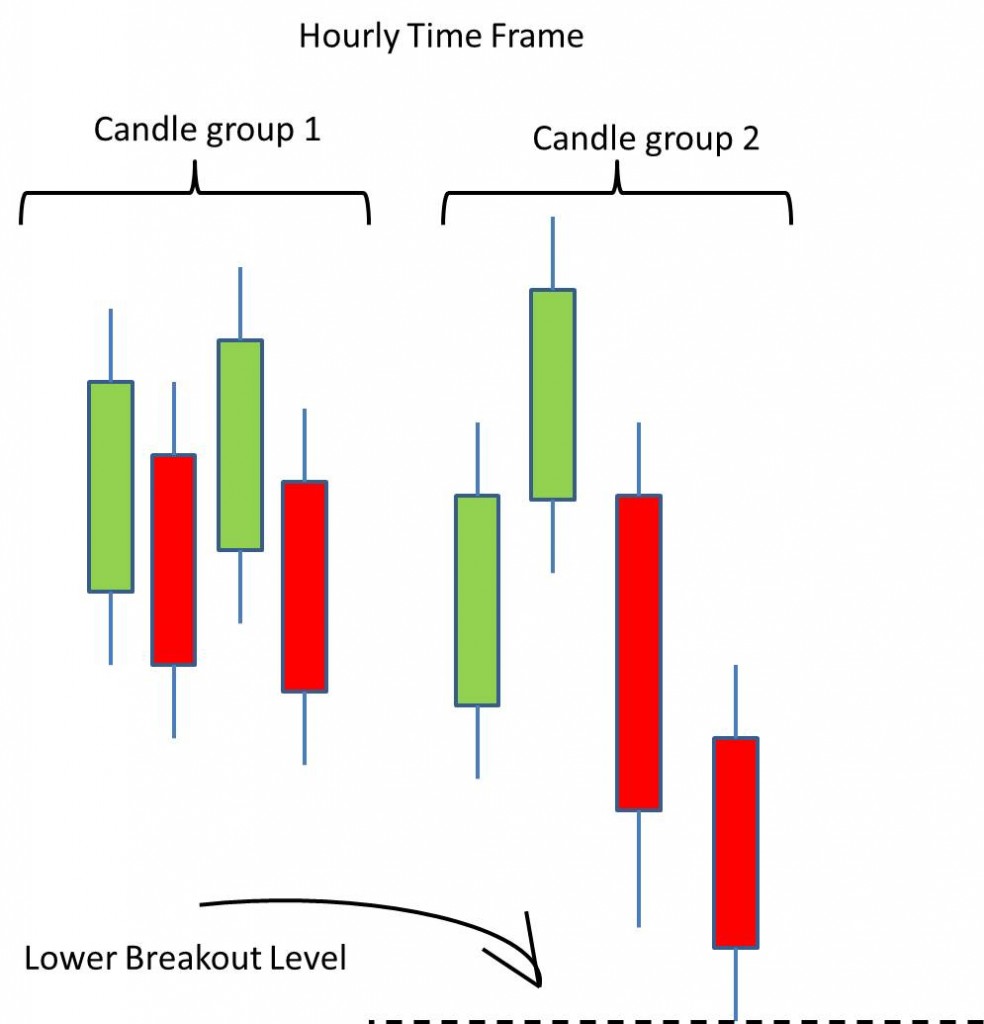

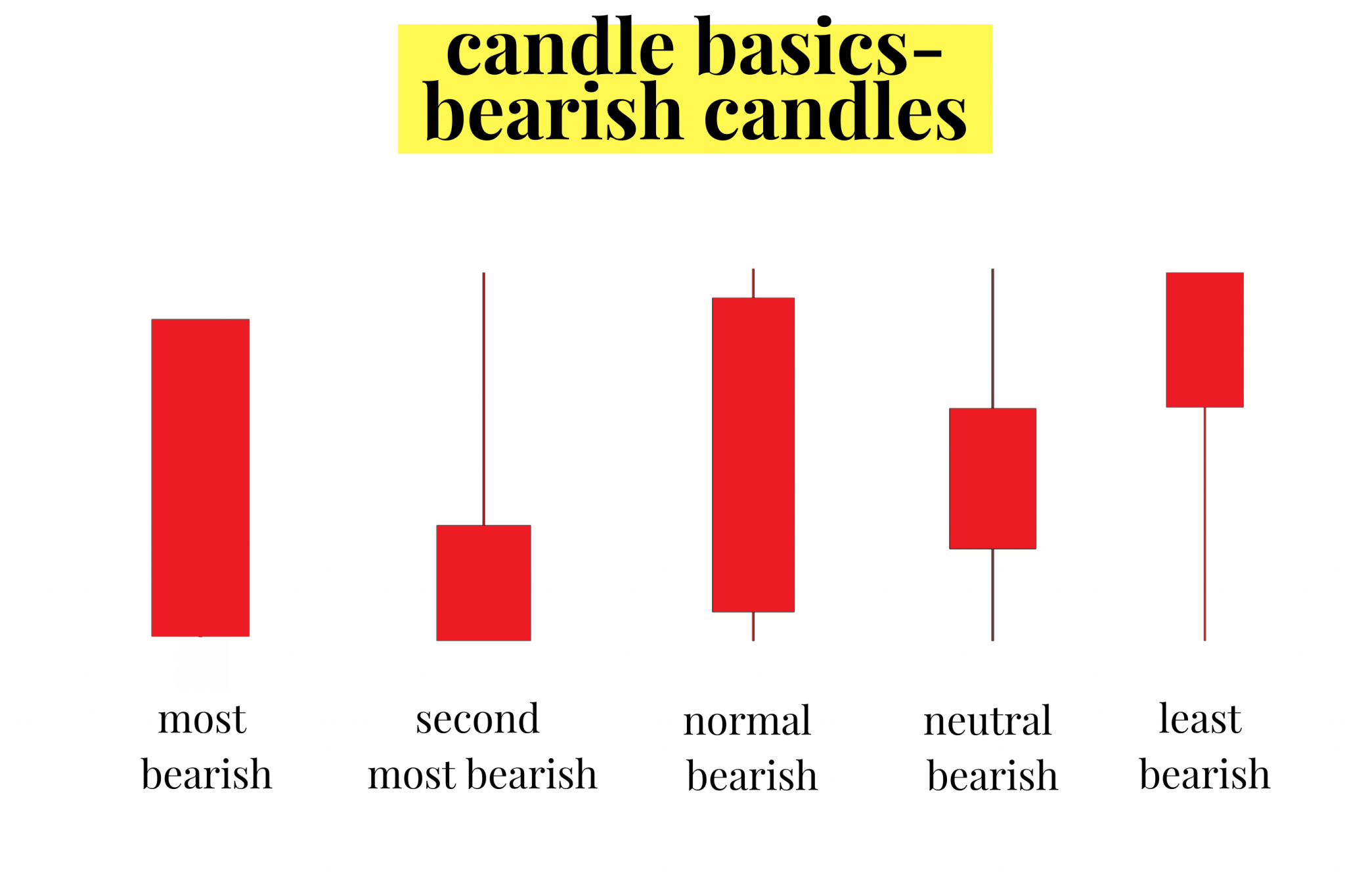

Bullish And Bearish Candlestick Patterns - Web there are dozens of candlestick patterns divided into two groups: They are popular candlestick patterns because they are easy to spot and trade. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential. Web below you can find the schemes and explanations of the most common reversal candlestick patterns. Bullish candlestick patterns and bearish candlestick patterns. What are counterattack candlestick patterns? Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Now that you understand candlestick patterns, here are some things to note before using them. The hammer is a bullish candlestick pattern that indicates when a security is about to reverse upwards. Web a bullish or bearish engulfing candlestick pattern may indicate reversal patterns. Traders expect bullish patterns to move upward and bearish patterns to push prices downward. Now that you understand candlestick patterns, here are some things to note before using them. Web bullish and bearish haramis are among a handful of basic candlestick patterns, including bullish and bearish crosses, evening. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Now let’s cover sideways price action. Web a black or filled candlestick means the closing price for the period was less. Web there are dozens of different bullish candlestick patterns. As the pattern below shows,. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Bar charts and line charts have become antiquated. Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Bar charts and line charts have become antiquated. The bearish engulfing candlestick pattern consists of a bullish (white or green) candlestick followed by a longer bearish (black or red) candlestick that is longer than. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the. Watching a candlestick pattern form can be time consuming and irritating. Per our technical indicators, the current sentiment is bullish while the fear & greed index is showing 66 (greed).friend.tech recorded 30/30 (100%) green days with 0.00% price volatility over. Bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. Web bearish. Now that you understand candlestick patterns, here are some things to note before using them. What you need to know before trading candlestick patterns. Web a black or filled candlestick means the closing price for the period was less than the opening price; But as the saying goes, context is everything. Bar charts and line charts have become antiquated. Much like the hanging man, the hammer is a bullish candlestick reversal candle. Web continuations continue the trend, and reversals reverse it. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. Web there are three types of candlestick interpretations: Meanwhile, a white or hollow. Web what is the candlestick pattern for bullish and bearish? The hammer is a bullish candlestick pattern that indicates when a security is about to reverse upwards. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. What are counterattack candlestick patterns? Depending on their heights and collocation, a bullish or a. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. This is painting a broad stroke, because the context of the candle formation is what really matters. Bullish candlestick patterns and bearish candlestick patterns. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Web as such,. Now let’s cover sideways price action. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Watching a candlestick pattern form can be time consuming and irritating. Per our technical indicators, the current sentiment is bullish while the fear & greed index is showing 66 (greed).friend.tech recorded. Watching a candlestick pattern form can be time consuming and irritating. The context is a steady or oversold downtrend. The bearish three line strike continuation is recognized if: Depending on their heights and collocation, a bullish or a bearish trend continuation can be predicted. Bullish candlestick patterns you need to know. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. But as the saying goes, context is everything. Web six bullish candlestick patterns. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Web there are dozens of candlestick patterns divided into two groups: Patterns are not guaranteed to work. Per our technical indicators, the current sentiment is bullish while the fear & greed index is showing 66 (greed).friend.tech recorded 30/30 (100%) green days with 0.00% price volatility over. Traders expect bullish patterns to move upward and bearish patterns to push prices downward. Web there are dozens of different bullish candlestick patterns. Web what is the candlestick pattern for bullish and bearish? Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded as one of the most bearish signals in the market, indicating a potential.

Candlestick Bullish And Bearish Candle Stick Trading Pattern

Bullish & Bearish Engulfing Bars (Part III) FXMasterCourse

Candlestick Trading Chart Patterns For Traders. One candle pattern

Using 5 Bullish Candlestick Patterns To Buy Stocks

Bullish and Bearish Engulfing Candlesticks ThinkMarkets ZA

How to read candlestick patterns What every investor needs to know

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

Bullish and bearish belt hold candlestick patterns explained on E

Bull and Bear Candlestick Patterns Day Trading Posters Etsy

Candlestick Patterns Explained New Trader U

The Bearish Engulfing Candlestick Pattern Consists Of A Bullish (White Or Green) Candlestick Followed By A Longer Bearish (Black Or Red) Candlestick That Is Longer Than.

What Are Counterattack Candlestick Patterns?

Web Bullish And Bearish Haramis Are Among A Handful Of Basic Candlestick Patterns, Including Bullish And Bearish Crosses, Evening Stars, Rising Threes, And Engulfing Patterns.

They Are An Indicator For Traders To Consider Opening A Long Position To Profit From Any Upward Trajectory.

Related Post: