Pattern Wedge

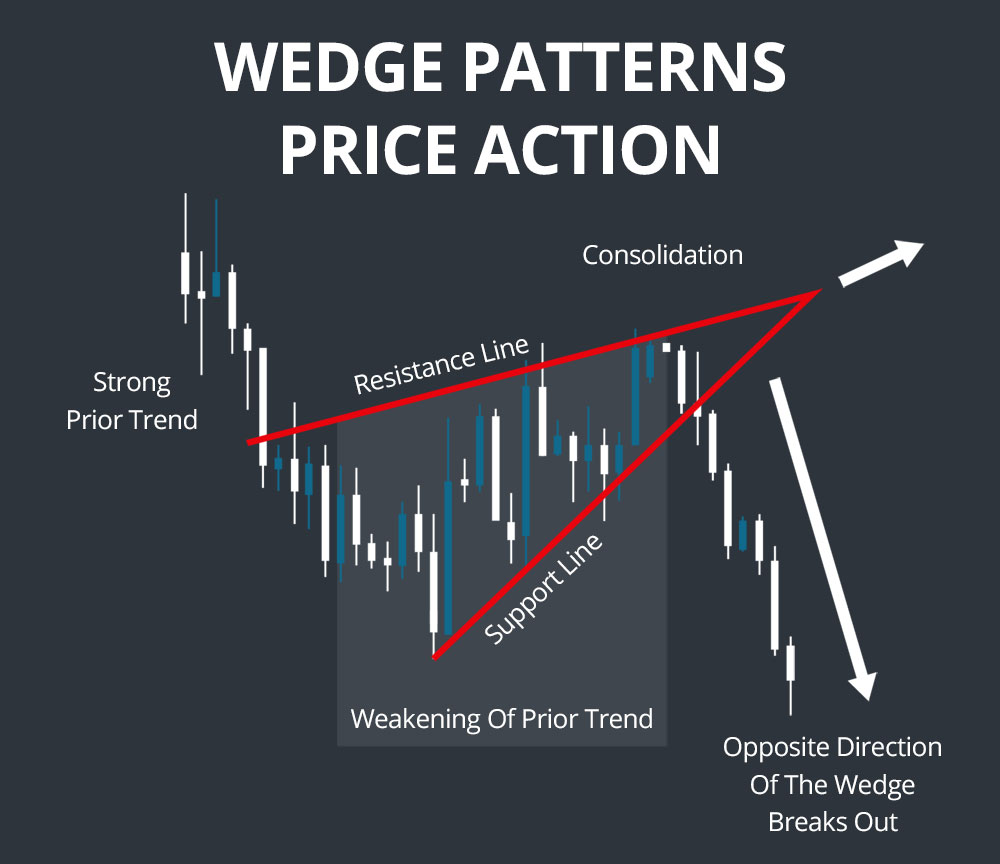

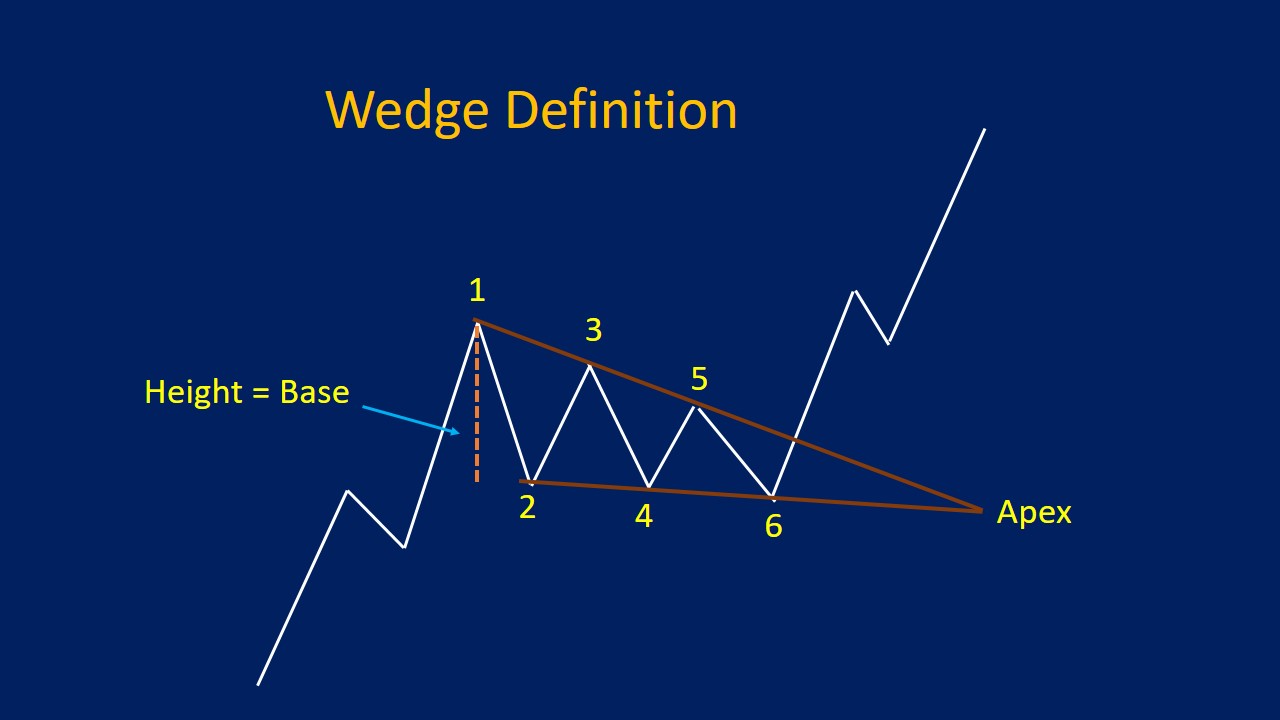

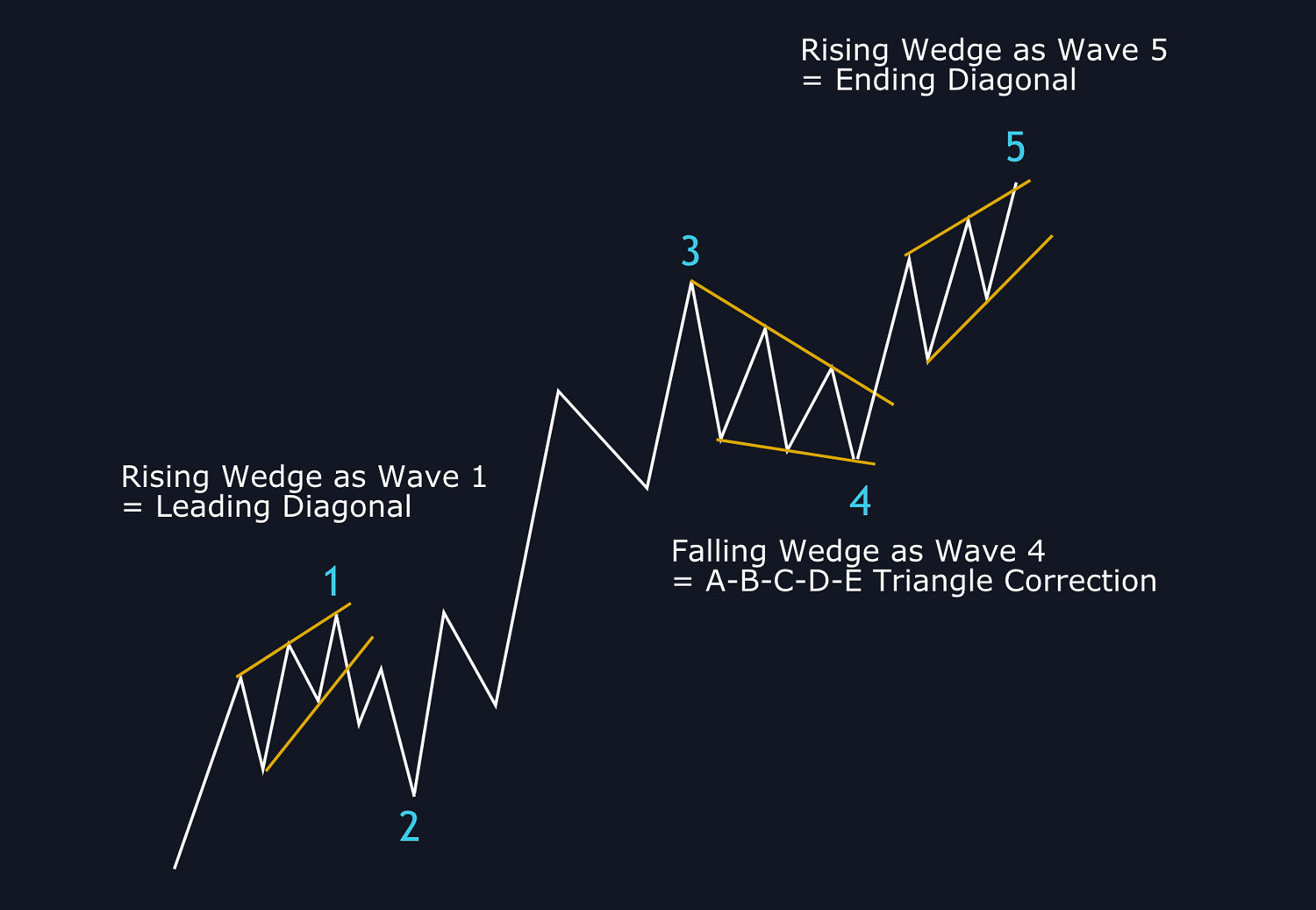

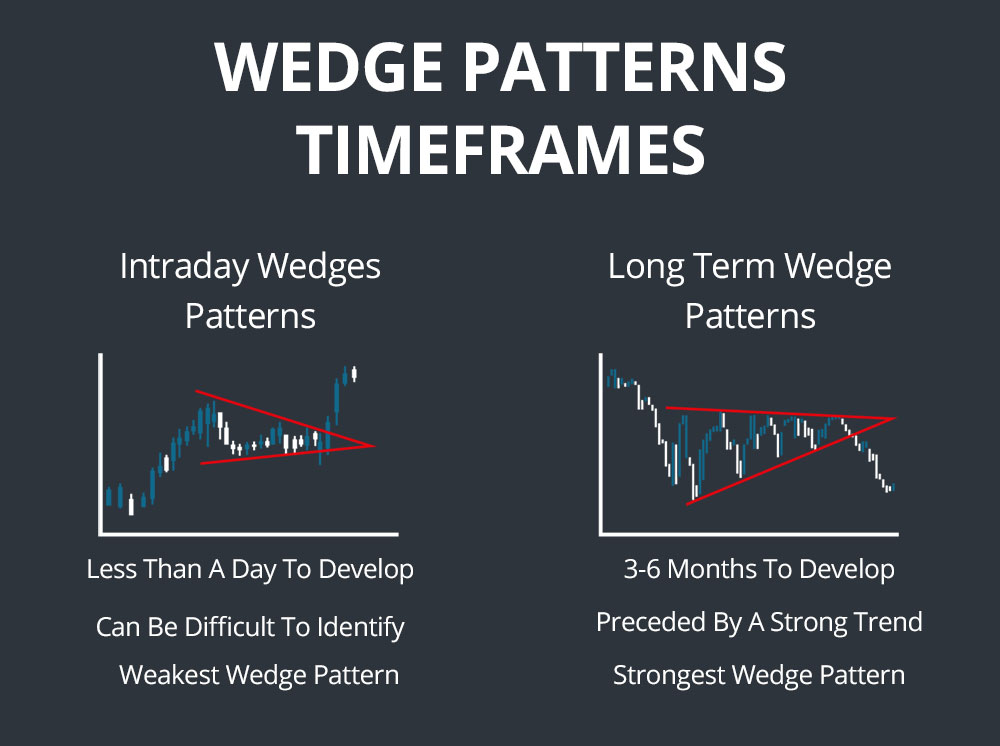

Pattern Wedge - However, all renditions are not created equal. Let's dive in and see how they work. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. There are 2 types of wedges indicating price is in consolidation. In many cases, when the market is trending, a wedge pattern will develop on the chart. These patterns can signal shifts in market trends. Web in a wedge chart pattern, two trend lines converge. Rising wedges typically signal a bearish reversal, while falling wedges suggest a bullish continuation. You can serve wedge salads as a side with just about any meal, like braised short ribs, penne alla vodka, or chicken piccata. This is a form of recovery or accumulation of price after a strong trend. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. However, all renditions are not created equal. A delicious, crisp, iceberg wedge salad recipe topped with bacon crumbles, onion, tomatoes and a creamy homemade blue cheese dressing. Web the falling wedge chart pattern is a recognisable. What is the wedge pattern? Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Characteristics and how to identify. This article explains the structure of a falling wedge formation, its importance as well as technical approach to trading this pattern. This is a form of. There are 2 types of wedges indicating price is in consolidation. In an uptrend, the rising wedge hints at a bearish turn. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. It should take about 3 to 4. Web welcome to the world of. Characteristics and how to identify. Web 4.1 trade forex. Rising wedges typically signal a bearish reversal, while falling wedges suggest a bullish continuation. What is the wedge pattern? However, all renditions are not created equal. A delicious, crisp, iceberg wedge salad recipe topped with bacon crumbles, onion, tomatoes and a creamy homemade blue cheese dressing. This article explains the structure of a falling wedge formation, its importance as well as technical approach to trading this pattern. 4.1.1 for the rising wedge. The first is rising wedges where price is contained by 2 ascending trend lines. Web the rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. 4.2 trade binary options with a wedge pattern. Web a wedge is a technical analysis pattern used in financial markets, illustrating an asset's narrowing price movement over time. Web bitcoin's recent price action. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Wedges signal a pause in the current trend. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. It is identified by connecting a series of highs and lows on. It means that the magnitude of price movement within the wedge pattern is decreasing. It should take about 3 to 4. A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. In an uptrend, the rising wedge hints at a bearish turn. Web wedge patterns are usually characterized by converging trend lines over. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. However, all renditions are not created equal. A delicious, crisp, iceberg wedge salad recipe topped with bacon crumbles, onion, tomatoes and a creamy homemade blue cheese dressing. Wedge is a popular chart pattern in forex. Web wedge patterns are a subset of chart patterns, formed when an asset’s price moves within converging trend lines, resembling a wedge or triangle. Wedge is a popular chart pattern in forex trading. It’s the opposite of the falling (descending) wedge pattern (bullish), as these two constitute a popular wedge pattern. Traders rely on these patterns to make informed decisions. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. It should take about 3 to 4. Web wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for a potential breakout. Web in general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend. However, all renditions are not created equal. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. In many cases, when the market is trending, a wedge pattern will develop on the chart. Characteristics and how to identify. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Bitcoin has been pulling back this week following a test of. What is the wedge pattern? The first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than. In an uptrend, the rising wedge hints at a bearish turn. This wedge could be either a rising wedge pattern or falling wedge pattern. Web 4.1 trade forex.

How to Trade the Rising Wedge Pattern Warrior Trading

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Wedge Pattern Rising & Falling Wedges, Plus Examples

Wedge Pattern Reversal and Continuation Financial Freedom Trading

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Wedge Patterns How Stock Traders Can Find and Trade These Setups

In Contrast To Symmetrical Triangles, Which Have No Definitive Slope And No Bias, Falling Wedges Definitely Slope Down And Have A Bullish Bias.

Wedges Signal A Pause In The Current Trend.

Web A Wedge Is A Common Type Of Trading Chart Pattern That Helps To Alert Traders To A Potential Reversal Or Continuation Of Price Direction.

There Are 2 Types Of Wedges Indicating Price Is In Consolidation.

Related Post: