Inverted Head And Shoulder Pattern

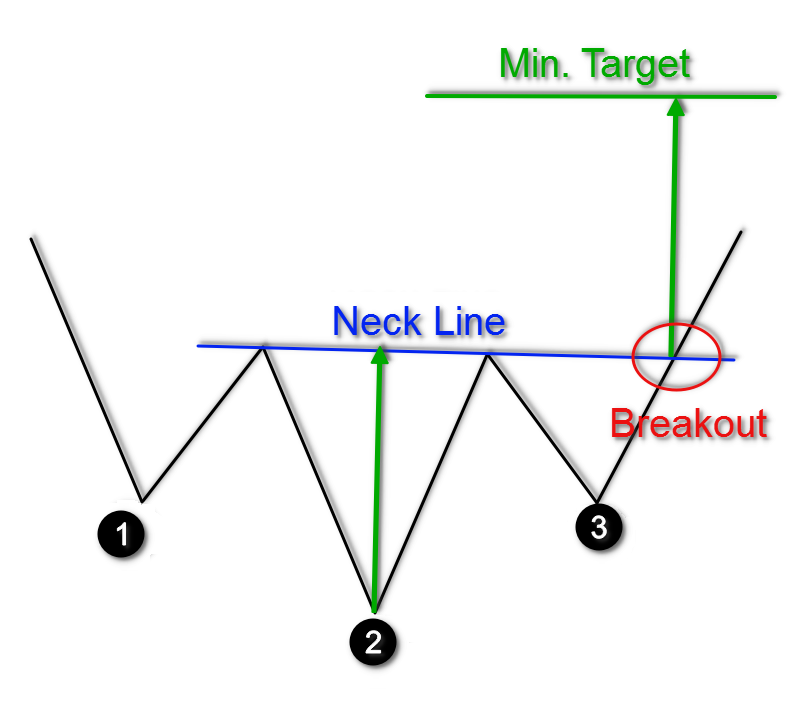

Inverted Head And Shoulder Pattern - Erin mcdowell , samantha grindell , anneta konstantinides, and amanda krause. Add the height to the breakout price to attain a profit. Web head and shoulders pattern: On the other hand, the standard head and. The best scenarios to trade the inverse head and shoulders: Web inverse head and shoulders: The neckline of the pattern stands at the psychological mark of $150. Web pay attention to the size of the inver head and shoulders relative to the downtrend. Traders and investors widely recognize this pattern as it often signals a shift from a downtrend to an uptrend. Web in recent trading sessions, solana’s price trend has teased an inverted head and shoulder pattern, a bullish signal that could lead to a significant price surge. It is also the same as a head and shoulders pattern that flipped on its horizontal axis. Since an inverted head and shoulders chart pattern can be spotted after the reversal from point (5), you can save yourself precious time by doing the following set of calculations before the breakout. Web for head and shoulder pattern to effectively work, we. The neckline of the pattern stands at the psychological mark of $150. Web the inverted head and shoulders pattern is confirmed when the price breaks above resistance created by the neckline. This article will explore the characteristics, identification, and trading strategies. Currently, sol trades at $145 with an intraday move. The pattern is significant because it suggests that the selling. Volume play a major role in both. Titan has formed a reverse head and shoulders pattern on the weekly charts and will have to decisively break out from the current resistance channel and close at a price above 2810 to further validate the bullish pattern. An inverse head and shoulders pattern is the inverted version of a standard head and.. ⭐️the pattern has a very peculiar price action structure: The price falls to a trough and then rises; An inverse head and shoulders pattern is the inverted version of a standard head and. The price falls below the previous trough and then rises again; Web a recent upward movement from this support has led to a 3.8% increase in trx’s. Web the inverted head and shoulders pattern stands as a cornerstone in the realm of technical analysis, offering predictive prowess that has stood the test of time. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). The most common way. The pattern is significant because it suggests that the selling pressure. Since an inverted head and shoulders chart pattern can be spotted after the reversal from point (5), you can save yourself precious time by doing the following set of calculations before the breakout. Typically, when the slope is down, it. Web titan, reverse head and shoulders. Stock passes all. Web you can subtract the low price of the head from the high price of the retracements. May 6, 2024, 8:23 pm pdt. Signals the traders to enter into long position above the neckline. Cardi b attends the 2024 met gala. Web for head and shoulder pattern to effectively work, we need the left shoulder and the head to complete. A “ neckline ” is drawn by connecting the lowest points of the two troughs. An inverse head and shoulders pattern is the inverted version of a standard head and. The best scenarios to trade the inverse head and shoulders: Web a head and shoulders pattern is also a trend reversal formation. It signifies the weakness of buyers in a. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Downward leading to pattern price: Hence, a breakout above this crucial resistance will boost the uptrend momentum in solana. Trading in a bearish trend the price sets a lower low and. 1) in an uptrend 2) when it leans against higher timeframe structure 3) it takes more than 100 bars to form. Less than 2 months ago. The slope of this line can either be up or down. Volume play a major role in both. Web a head and shoulders pattern is also a trend reversal formation. Since an inverted head and shoulders chart pattern can be spotted after the reversal from point (5), you can save yourself precious time by doing the following set of calculations before the breakout. The neckline of the pattern stands at the psychological mark of $150. The most common way to trade the inverse head and shoulders pattern is to immediately enter a position when the price breaks above the resistance neckline. Add the height to the breakout price to attain a profit. The hem of the dress was lined with. Understanding the inverted head and. Web inverted head and shoulders. Scanner guide scan examples feedback. It is formed by a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). Titan has formed a reverse head and shoulders pattern on the weekly charts and will have to decisively break out from the current resistance channel and close at a price above 2810 to further validate the bullish pattern. This pattern, recognized for indicating potential upward momentum, suggests a positive shift in market dynamics. Following this formation is a bullish. Web head and shoulders pattern: The price falls below the previous trough and then rises again; Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. It signifies the weakness of buyers in a bearish trend and a bullish accumulation.

The Head and Shoulders Pattern A Trader’s Guide

What is Inverse Head and Shoulders Pattern & How To Trade It

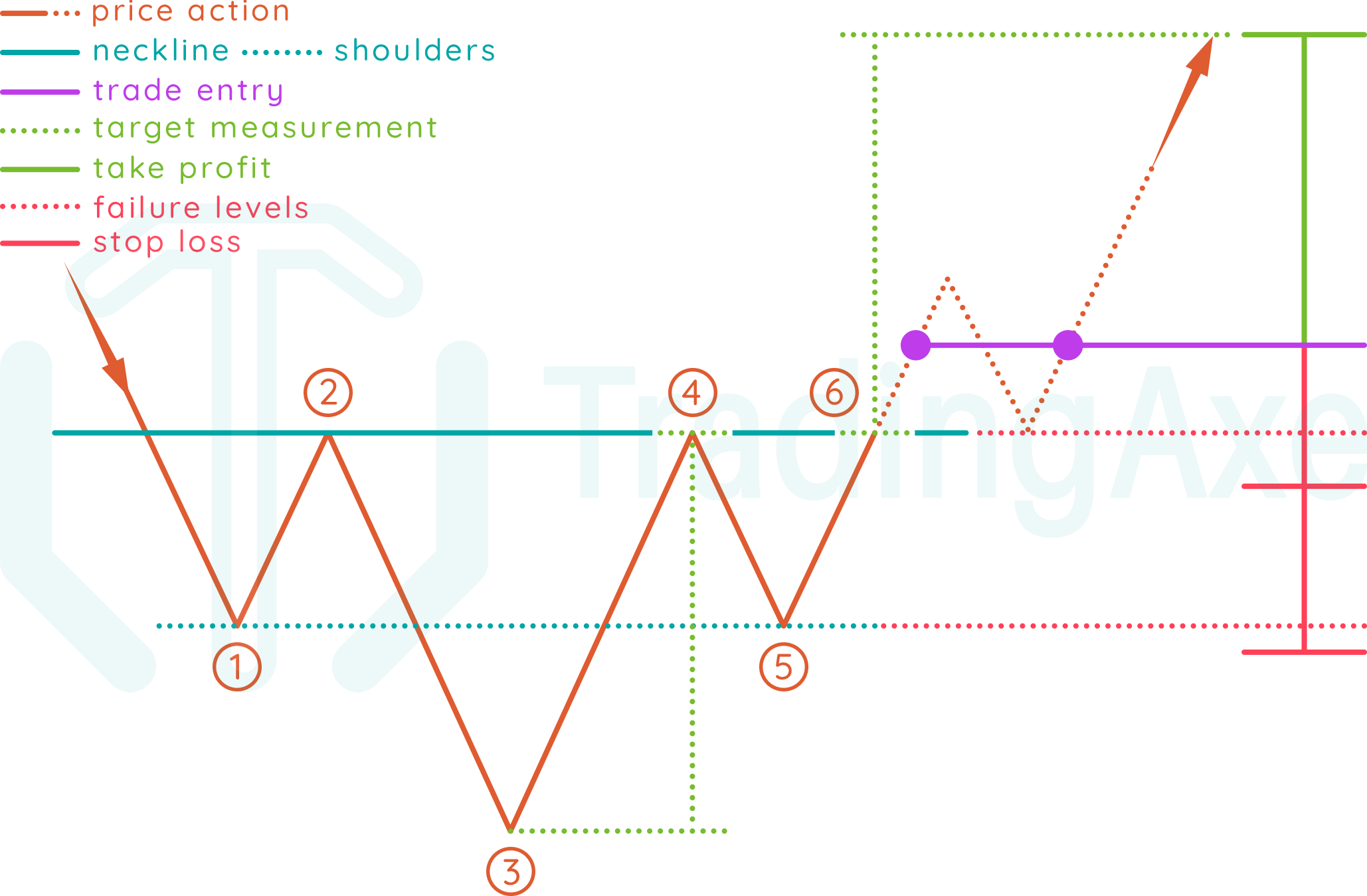

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

What is Inverse Head and Shoulders Pattern & How To Trade It

Inverse Head and Shoulders Pattern How To Spot It

Head and Shoulders Trading Patterns ThinkMarkets EN

Inverse or Inverted Head and Shoulders Pattern Chart Patterns

invertedheadandshoulderspattern Forex Training Group

Inverse Head and Shoulders Pattern Trading Strategy Guide

What is Inverse Head and Shoulders Pattern & How To Trade It

Currently, Sol Trades At $145 With An Intraday Move.

Web An Inverted Head And Shoulder Pattern Is A Significant Technical Analysis Pattern Commonly Used In Financial Markets To Identify Potential Trend Reversals.

Web Titan, Reverse Head And Shoulders.

Web Inverse Head And Shoulders:

Related Post: