Chart Cup And Handle Pattern

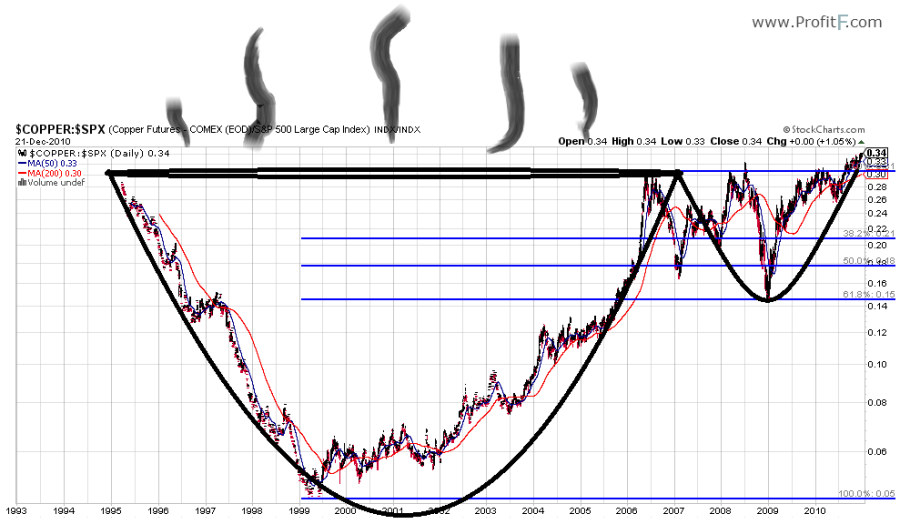

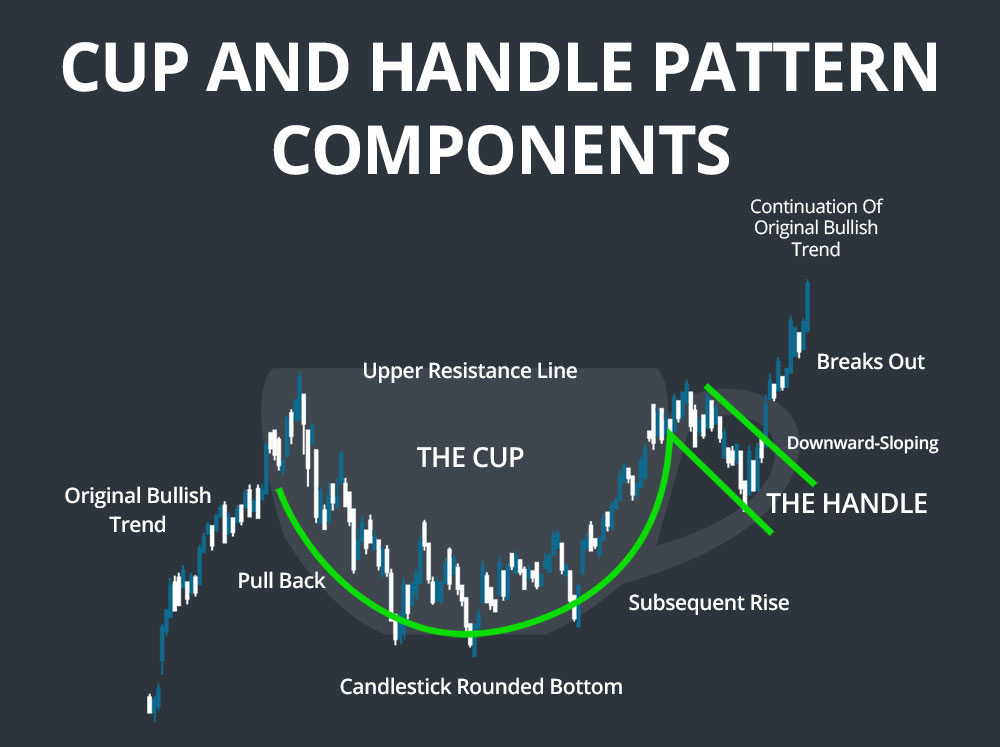

Chart Cup And Handle Pattern - According to research, the cup and handle is a bullish continuation chart pattern, with an impressive 95% success rate.the pattern consists of two distinct parts: Web how to success in swing trading?cup and handle chart pattern is one of the best price action patterns for swing trading forex.learn how to identify bullish a. Secondly, you need to learn to identify the length and depth of a true cup and handle, as there can be false signals. It is a bullish continuation pattern that marks a consolidation period followed by a breakout. The first cup and handle pattern trading step is to identify the pattern on a market chart by manually browsing finance charts or by using a pattern scanner. It starts when a stock’s price runs up at least 30%. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. How to become a professional trader : Technical traders often buy right when the stock climbs back to the pivot price. It´s one of the easiest patterns to identify. As its name implies, there are two parts to the pattern—the cup and the handle. Technical traders often buy right when the stock climbs back to the pivot price. This uptrend must happen before the cup base’s construction. The cup and handle pattern, also sometimes known as the cup with handle pattern was first identified by stockbroker william o'neil in. The first phase of the pattern is the formation of a “cup” shape. The cup is shaped as a u and the handle has a slight downward drift. Eventually, the stock finds a floor of support for weeks or longer before climbing again. As its name implies, the pattern consists of two parts — the cup and the handle. The. Web the cup without handle is a similar bullish stock chart base. However, the pattern can also form a bullish reversal pattern at the end of a downtrend. Web cup and handle: It starts when a stock’s price runs up at least 30%. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. Cup and handle pattern rules: It consists of two distinct parts: The cup and the handle. The “cup” portion of the pattern forms with a downward move in price, followed by an upward rally that. Identify the cup and handle on a price chart. Web cup and handle. Secondly, you need to learn to identify the length and depth of a true cup and handle, as there can be false signals. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. The first phase of the pattern is the formation of a “cup”. Keep reading to see what i mean.) Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Sometimes it forms within a few days, but it can take up to a year for the pattern to fully form. The cup and handle pattern. The cup pattern happens first and then a handle happens next. The pattern happens when bulls are overpowered by bears in. Cup with handle from ibm ( ibm ) in 1926 and walmart ( wmt ) in 1980 to nvidia in 2016 and again in 2020, countless big winners have made large gains from a cup with handle in. The. Web what is a cup and handle chart pattern? Web the cup and handle chart pattern does have a few limitations. This pattern can be an indication of an. The pattern signals technical traders about a potential breakout. Web the cup with handle signal is another way of saying the pattern is a bullish chart pattern. Eventually, the stock finds a floor of support for weeks or longer before climbing again. Keep reading to see what i mean.) The cup is shaped as a u and the handle has a slight downward drift. The first phase of the pattern is the formation of a “cup” shape. It is a bullish continuation pattern that marks a consolidation. The cup pattern happens first and then a handle happens next. Technical/fundamental analysis charts & tools provided for research purpose. There are two parts to the pattern: (the pivot is the top of the handle. Firstly, it does not occur within a specific timeframe. The cup forms after an advance and looks like a bowl or rounding bottom. Web the cup and handle pattern is a widely used chart pattern used in technical analysis because of its advantages as compared to any other indicator. As its name implies, there are two parts to the pattern—the cup and the handle. However, the pattern can also form a bullish reversal pattern at the end of a downtrend. Cup with handle from ibm ( ibm ) in 1926 and walmart ( wmt ) in 1980 to nvidia in 2016 and again in 2020, countless big winners have made large gains from a cup with handle in. But merely identifying the cup and handle chart pattern is not enough to profit. The cup and the handle. Firstly, it does not occur within a specific timeframe. Web elitetradingsignals nov 28, 2022. The cup and handle pattern is easily identified by the traders irrespective of their past trading experiences. The first cup and handle pattern trading step is to identify the pattern on a market chart by manually browsing finance charts or by using a pattern scanner. The first phase of the pattern is the formation of a “cup” shape. The pattern signals technical traders about a potential breakout. Please be aware of the risk. Web the cup and handle pattern strategy is a formation on the price chart of an asset that resembles a cup with a handle. (the pivot is the top of the handle.

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and handle chart pattern How to trade the cup and handle IG UK

Trading the Cup and Handle Chart pattern

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)

Cup and Handle Definition

Cup And Handle Pattern How To Verify And Use Efficiently How To

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

After Forming The Cup, Price Pulls Back To About ⅓ Of The Cups Advance, Forming The.

Chart Patterns Form When The Price Of An Asset Moves In A Way That Resembles A Common Shape, Like A Rectangle, Flag, Pennant, Head And Shoulders, Or, Like In This Example, A Cup And Handle.

The Pattern Happens When Bulls Are Overpowered By Bears In.

11 Chart Patterns For Trading Symmetrical Triangle.

Related Post: