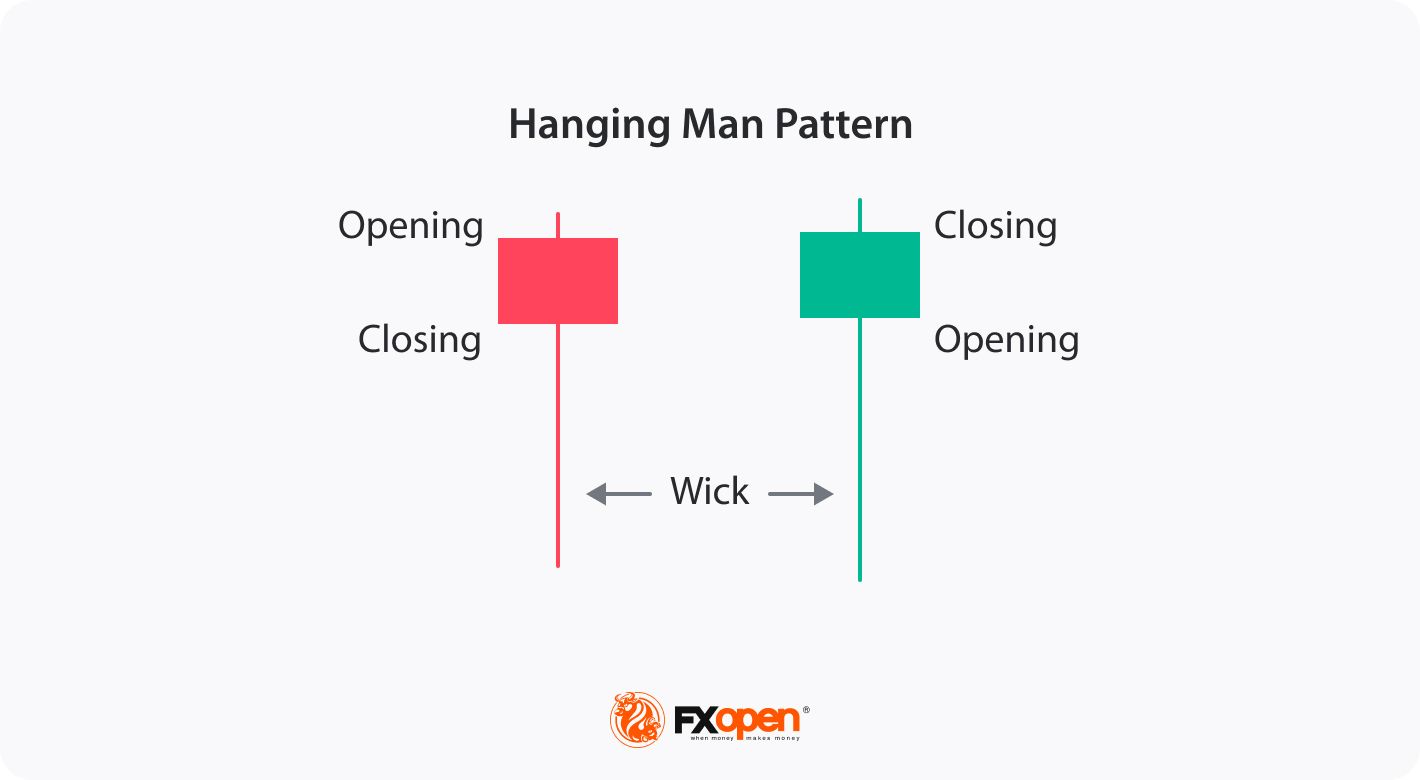

Hanging Man Pattern

Hanging Man Pattern - They are commonly formed by the opening, high, low, and closing prices of a financial instrument. You do not want to place a trade in. A long lower shadow or wick They are a bearish reversal pattern. If the candlestick is green or white,. These patterns have a small body that can be green or red with little to no upper wick. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Fact checked by lucien bechard. How to identify and use the hanging man candlestick? It indicates that sellers may be gaining momentum against buyers and could potentially lead to a price decline. It indicates that sellers may be gaining momentum against buyers and could potentially lead to a price decline. Perhaps this is a consequence of the impressive name referring to the shape of the candle resembling a hanged man. The location of a candlestick can qualify or disqualify a trade for a trader. A long lower shadow or wick The pattern. You do not want to place a trade in. Specifically, the hanging man candle has: How to identify and use the hanging man candlestick? They are commonly formed by the opening, high, low, and closing prices of a financial instrument. This also indicates that the bulls have lost their strength in moving the prices up, and bears are back in. Candlestick patterns are important to all traders, whether swing traders or day traders. This article will cover identifying, interpreting, and trading the hanging man. Identify the long term trend. They are commonly formed by the opening, high, low, and closing prices of a financial instrument. If the candlestick is green or white,. How is a hanging man candlestick pattern structured? Web the hanging man pattern is used by traders to identify potential changes in market sentiment and make informed trade decisions. How to identify and use the hanging man candlestick? It is a bearish reversal pattern that signals that the uptrend is going to end. It is a reversal pattern characterized by. How is a hanging man candlestick pattern structured? It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. What is the hanging man candlestick? These candles are typically red or black. Candlestick patterns are important to all traders, whether swing traders or day traders. If the opening price is above the closing price then a filled (normally red or black) candlestick is drawn. They are commonly formed by the opening, high, low, and closing prices of a financial instrument. These candles are typically red or black. They are shaped like a hammer with a long shadow and little to no upper wick. Web in. How is a hanging man candlestick pattern structured? Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Web the hanging man forex pattern is a singular candlestick pattern like the doji or hammer forex patterns, for example. Web a hanging man candlestick pattern is a. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. How is a hanging man candlestick pattern structured? If the candlestick is green or white,. It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. Web in. It indicates that sellers may be gaining momentum against buyers and could potentially lead to a price decline. The pattern appearing after a long uptrend indicates that buying pressure is waning and the bears are gaining control. The candle is formed by a long lower shadow coupled with a small real. Web the hanging man is a notable candlestick pattern. It indicates that sellers may be gaining momentum against buyers and could potentially lead to a price decline. Specifically, the hanging man candle has: It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. Fact checked by lucien bechard. Web hanging man is a pattern that is very popular among analysts. They are a bearish reversal pattern. Traders utilize this pattern in the trend direction of pattern changes. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. Candlestick patterns are important to all traders, whether swing traders or day traders. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. Web the hanging man candlestick pattern is a bearish reversal pattern that forms during an upward price swing. Fact checked by lucien bechard. Web in technical analysis, the hanging man patterns are a single candlestick patterns that forms primarily at the top of an uptrend. The location of a candlestick can qualify or disqualify a trade for a trader. In other words, while it is a single candlestick, you need the market to confirm it. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Perhaps this is a consequence of the impressive name referring to the shape of the candle resembling a hanged man. Web hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. It is a bearish reversal pattern that signals that the uptrend is going to end. The hanging man is a single candlestick pattern that appears after an uptrend. It signifies that the interest of investors who hold the security is waning they might be preparing to sell, thus bringing down the price.

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

Understanding the Hanging Man Candlestick Pattern Market Pulse

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging Man Candlestick Pattern Trading Strategy

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Pattern (How to Trade and Examples)

The Candle Is Formed By A Long Lower Shadow Coupled With A Small Real.

Web The Hanging Man Is A Japanese Candlestick Pattern That Signals The Reversal Of An Uptrend.

Web 6 Min Read.

It Also Signals The Trend Reversal Of The Market As Soon As The Bull Appears To Lose Its Momentum.

Related Post: