Bear Trap Pattern

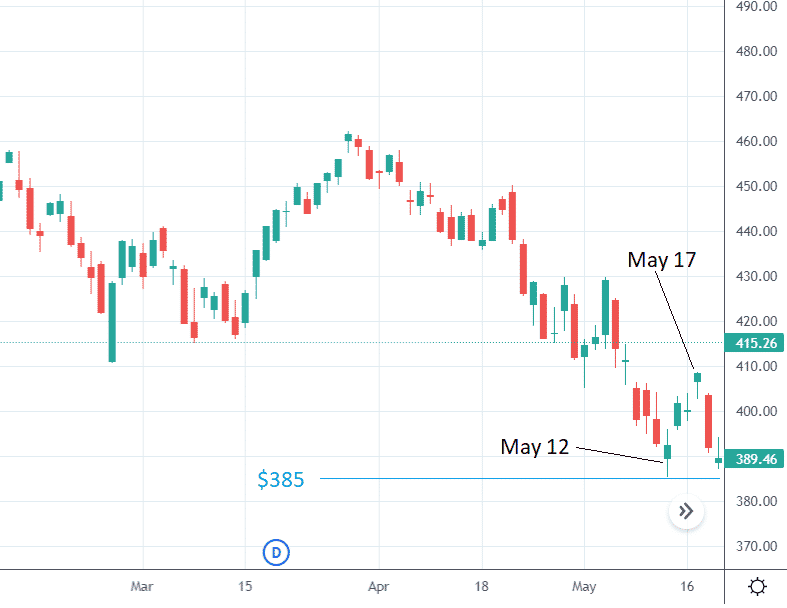

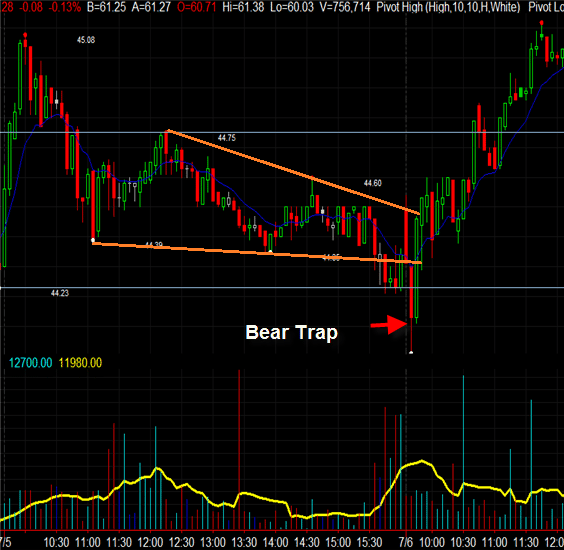

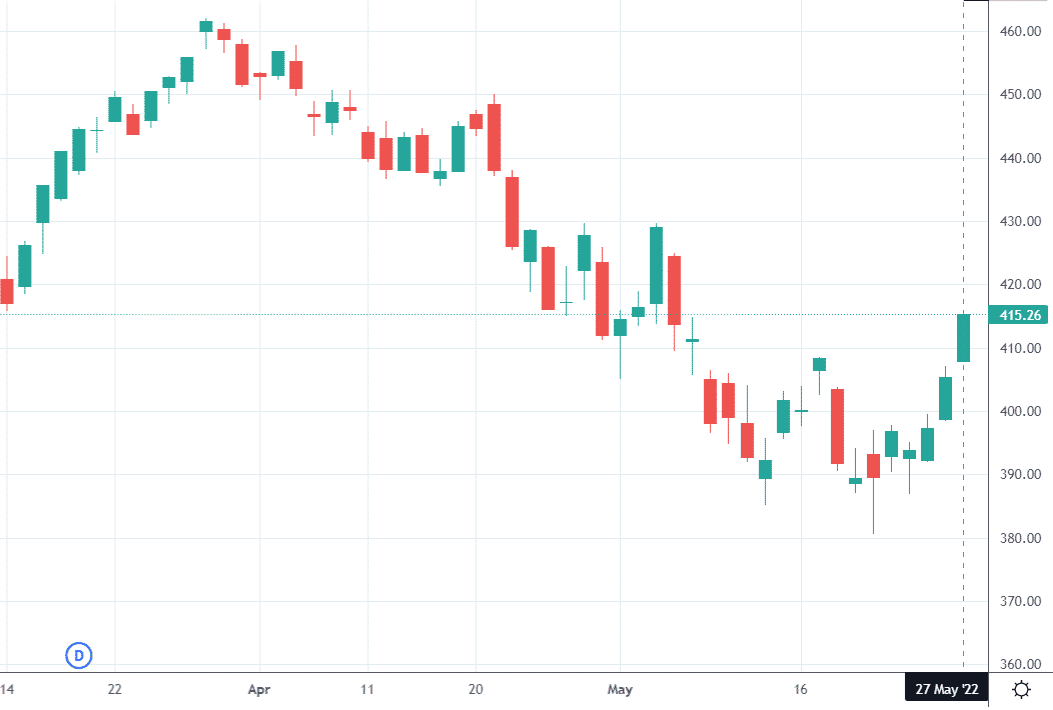

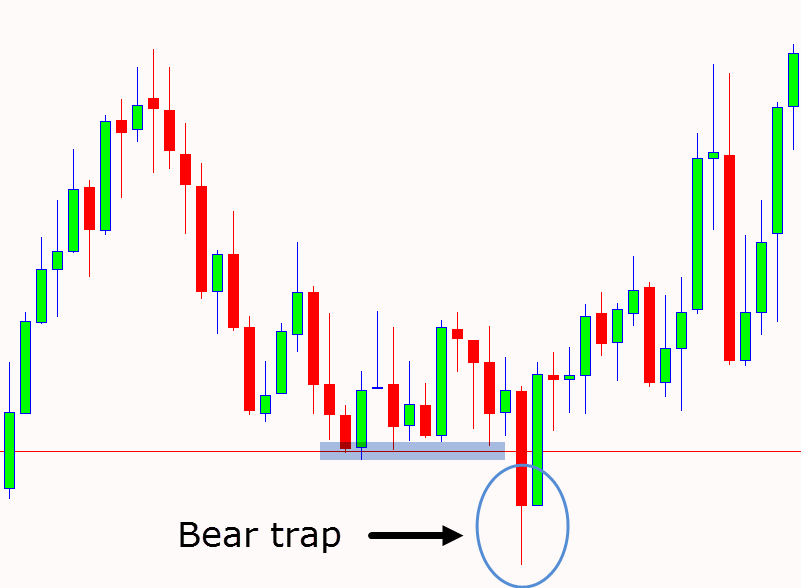

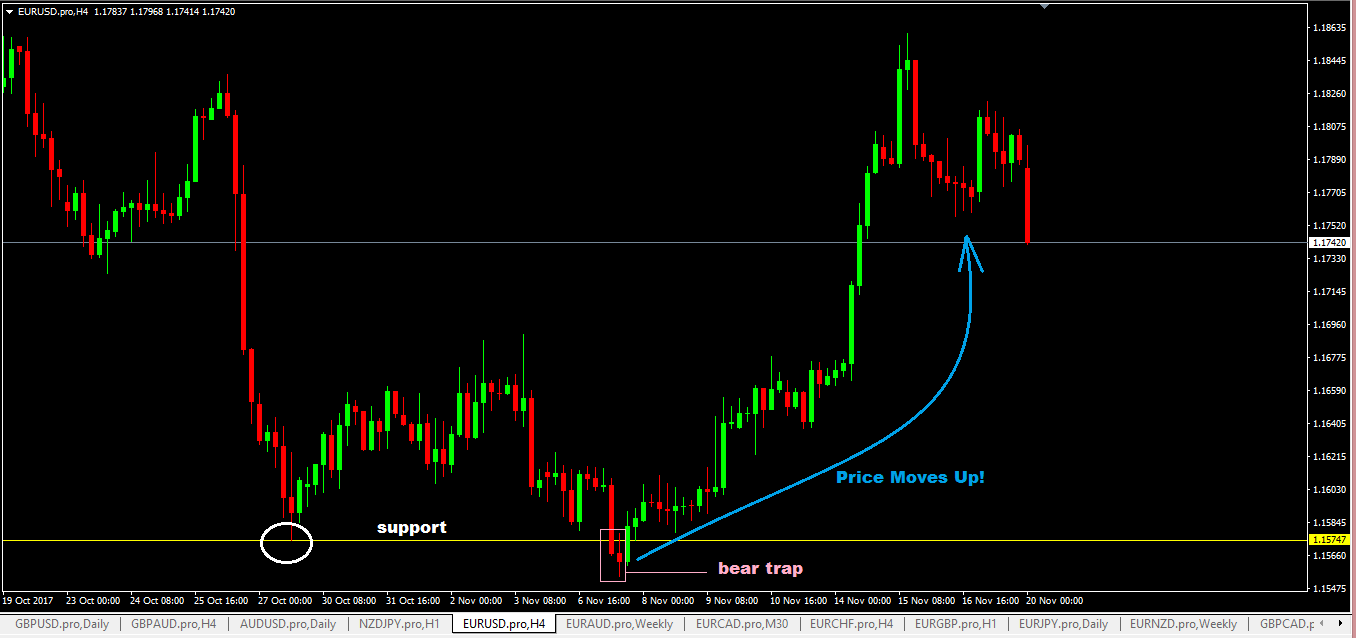

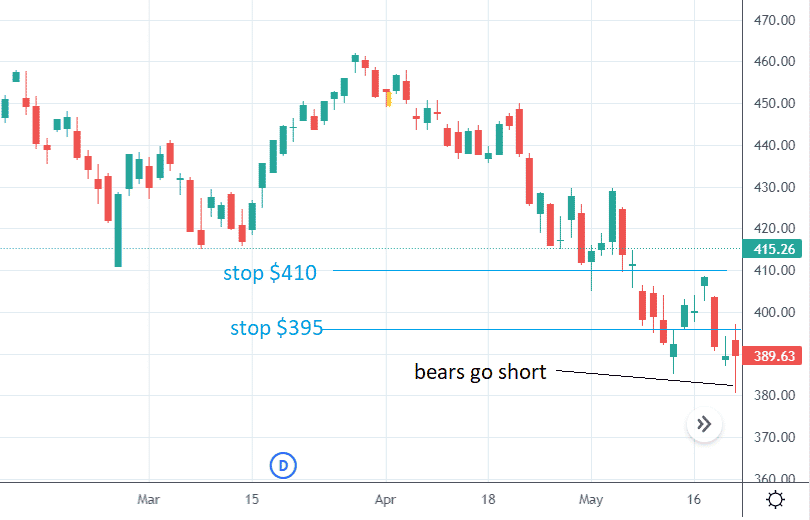

Bear Trap Pattern - Web a bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. In particular, a bull trap is a multiple top breakout that reverses after exceeding the prior highs by one. This pattern is defined as a bear trap pattern in which the double bottom sell pattern (bearish breakout pattern) is immediately followed by the reverse double top buy pattern (bullish breakout pattern). Web bear trap definition: A bear trap is a tricky market situation that traders often face. It presents a misleading signal indicating a downward trend in a. In reality, however, the price makes a. You will want a recent range to be broken to the downside with preferably high volume. A bear trap tricks traders into taking short positions on market setups that are seemingly going bearish. It is typically characterized by a bottoming tail candle (like may 20th), but it need not be. In reality, however, the price makes a. This pattern is defined as a bear trap pattern in which the double bottom sell pattern (bearish breakout pattern). Web bear trap definition: Web a bear trap in trading is a technical reversal pattern at the bottom. In particular, a bull trap is a multiple top breakout that reverses after exceeding the prior highs by one. This pattern is defined as a bear trap pattern in which the double bottom sell pattern (bearish breakout pattern) is immediately followed by. Web a bear trap in trading is a technical reversal pattern at the bottom. Web a bear trap is a trading pattern in which the prices of an individual stock or the market as a whole drops sharply, only to reverse shortly thereafter. Web bear trap definition: However, this downward movement is. It presents a misleading signal indicating a downward. It is typically characterized by a bottoming tail candle (like may 20th), but it need not be. At the time of the. Web bear trap definition: A sudden decline in volume along with a price reversal can be a strong indicator. In reality, however, the price makes a. The stock will need to. Web bear trap definition: Web at its core, a bear trap is a market scenario where prices appear to be heading downwards, suggesting a bearish trend. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. At the time of the. Bull and bear traps are p&f signals that quickly reverse. However, this downward movement is. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. Amateur traders fall into the trap of. It is typically characterized by a bottoming tail candle (like may. Web bear trap definition: A bear trap is a tricky market situation that traders often face. Web a bear trap is a false market signal that suggests a declining trend in a stock or index, enticing bearish traders to open short positions. This pattern is defined as a bear trap pattern in which the double bottom sell pattern (bearish breakout. A bear trap is a tricky market situation that traders often face. At the time of the. Web a bear trap is a trading pattern in which the prices of an individual stock or the market as a whole drops sharply, only to reverse shortly thereafter. Web a bear trap is a false market signal that suggests a declining trend. The pattern gives a false signal for the continuation of the downward trend, presenting that the price drops. Web this is, in essence the pattern of a bear trap. A bear trap tricks traders into taking short positions on market setups that are seemingly going bearish. However, this downward movement is. A bear trap is a tricky market situation that. Web bear trap definition: Amateur traders fall into the trap of. It is typically characterized by a bottoming tail candle (like may 20th), but it need not be. Web a bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. Web to spot a bear trap, pay attention to trading. Web this is, in essence the pattern of a bear trap. Web a bear trap is a trading pattern in which the prices of an individual stock or the market as a whole drops sharply, only to reverse shortly thereafter. Amateur traders fall into the trap of. The stock will need to. Web a bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. Web a bear trap is a technical analysis pattern in forex and other instruments that occurs when a downtrend fails to continue and the price reverses higher. A sudden decline in volume along with a price reversal can be a strong indicator. A bear trap is a tricky market situation that traders often face. Web bear trap definition: In reality, however, the price makes a. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web the bear trap chart pattern is a very basic setup. Bull and bear traps are p&f signals that quickly reverse. In particular, a bull trap is a multiple top breakout that reverses after exceeding the prior highs by one. You will want a recent range to be broken to the downside with preferably high volume. Web to spot a bear trap, pay attention to trading volume and price action.

What Is a Bear Trap Pattern?

Bear Trap Best Strategies to Profit from Short Squeezes TradingSim

Bear Trap Chart Patterns Indicator for MT4

bear trap pattern Options Trading IQ

Bear and Bull Trap Trading Guide

What is a bear trap in trading? LiteFinance (ex. LiteForex)

Bear Trap Forex Trading Strategy Learn How To Trade A Bear Trap Pattern

Bear trap strategy in 2022 Trading charts, Forex trading quotes

What is a Bear Trap Trading Bearish Trap Chart Pattern Technical

bear trap pattern Options Trading IQ

Web At Its Core, A Bear Trap Is A Market Scenario Where Prices Appear To Be Heading Downwards, Suggesting A Bearish Trend.

It Is Typically Characterized By A Bottoming Tail Candle (Like May 20Th), But It Need Not Be.

A Bear Trap Tricks Traders Into Taking Short Positions On Market Setups That Are Seemingly Going Bearish.

It Presents A Misleading Signal Indicating A Downward Trend In A.

Related Post: