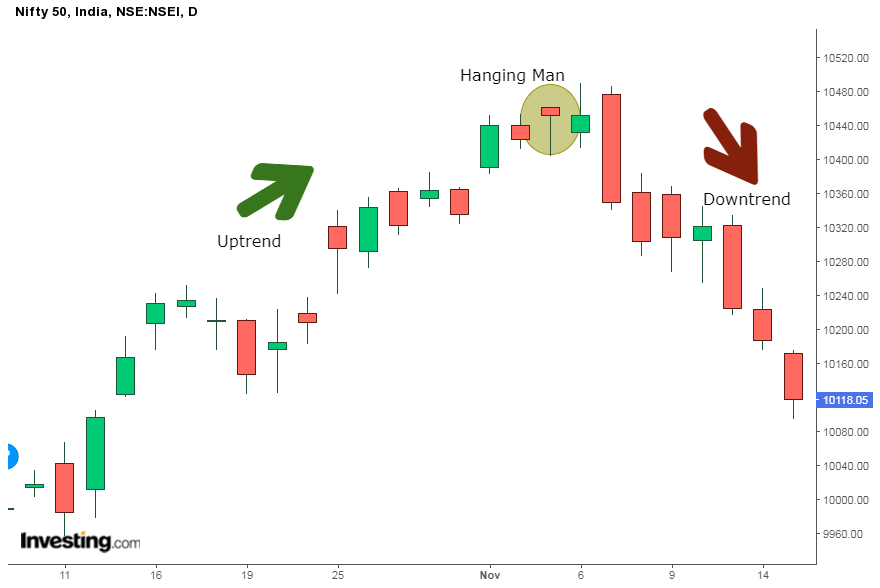

Hanging Man Pattern Candlestick

Hanging Man Pattern Candlestick - Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Web what is the hanging man pattern? The advance can be small or large, but should be composed of at least a few price bars moving. Candlesticks display a security's high,. Omn = original manufacturers name; As to the characteristics of the hanging man pattern, its body is small, and confined to the upper half of the range, with a long wick to the downside. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. Web the hanging man candlestick meaning is a sign that buyers are losing control. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement. Specifically, the hanging man candle has: Similar to the hammer candlesticks charting pattern. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. A hanging man is considered a bearish candlestick pattern that issues a. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Web this pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. Web a hanging man is a single candlestick pattern that forms after an uptrend.. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. As to the characteristics of the hanging man pattern, its body is small, and confined to the upper half of the range, with a long wick to the downside. Web the hanging man is a type. Web what is the hanging man pattern? It is an early warning to the bulls that the bears are coming. Trend prior to the pattern: Join thousands of traders who make more informed decisions with our premium features. Web a hanging man is a bearish reversal candlestick pattern that occurs after a price advance. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. The following features characterize it: This article will cover identifying, interpreting, and trading the hanging man. Check our candlescanner software and start trading candlestick patterns! Web this pattern is popular amongst traders as it is considered a reliable tool for. This video dives deep into this powerful stra. Web a hanging man is a bearish reversal candlestick pattern that occurs after a price advance. The following features characterize it: The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Web hanging man is a bearish. The hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. What is the hanging man candlestick? Price reversals are a common occurrence while trading stocks, commodities, currencies, and other instruments in the financial market. As to the characteristics of the hanging man pattern, its body is small, and confined to the. As to the characteristics of the hanging man pattern, its body is small, and confined to the upper half of the range, with a long wick to the downside. Web a hanging man is a single candlestick pattern that forms after an uptrend. A bearish reversal single candlestick pattern: The pattern is bearish because we expect to have a bear. See our patterns dictionary for other patterns. Web a hanging man candle (aptly named) is a candlestick formation that reveals a sharp increase in selling pressure at the height of an existing uptrend. The red flag is there even though the bulls regained control at the end of the day. This is generally brought about by many. Consider the bulls. The hanging man candlestick gets its name from the grotesque imagery that the candle looks like a man hung out to dry. This article will cover identifying, interpreting, and trading the hanging man. Join thousands of traders who make more informed decisions with our premium features. Hanging man candlestick pattern illustration. Web the hanging man candlestick meaning is a sign. Web want to identify potential trend reversals with ease? It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. How to identify and use the hanging man candlestick? Web the hanging man is a type of candlestick pattern that refers to the candle's shape and appearance and represents a potential reversal in an uptrend. As to the characteristics of the hanging man pattern, its body is small, and confined to the upper half of the range, with a long wick to the downside. Web a hanging man is a bearish reversal candlestick pattern that occurs after a price advance. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement. Web this pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. After a long bullish trend, this pattern is a warning that the trend may reverse soon,. The advance can be small or large, but should be composed of at least a few price bars moving. Web a hanging man is a single candlestick pattern that forms after an uptrend. Hanging man candlestick pattern illustration. The red flag is there even though the bulls regained control at the end of the day. Web a hanging man candle (aptly named) is a candlestick formation that reveals a sharp increase in selling pressure at the height of an existing uptrend. Price reversals are a common occurrence while trading stocks, commodities, currencies, and other instruments in the financial market.

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

Hanging Man Candlestick Pattern (How to Trade and Examples)

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

Hanging Man Candlestick Pattern Trading Strategy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging man candlestick chart pattern. Trading signal Japanese

What Is Hanging Man Candlestick Pattern With Examples ELM

Web The Hanging Man Candlestick Meaning Is A Sign That Buyers Are Losing Control.

The Pattern Is Bearish Because We Expect To Have A Bear Move After A Hanging Man Appears At The Right Location.

Web What Is The Hanging Man Candlestick Pattern.

A Hammer Shows That Although There Were Selling Pressures During The Day, Ultimately A Strong Buying Pressure Drove The.

Related Post: