H Pattern Trading

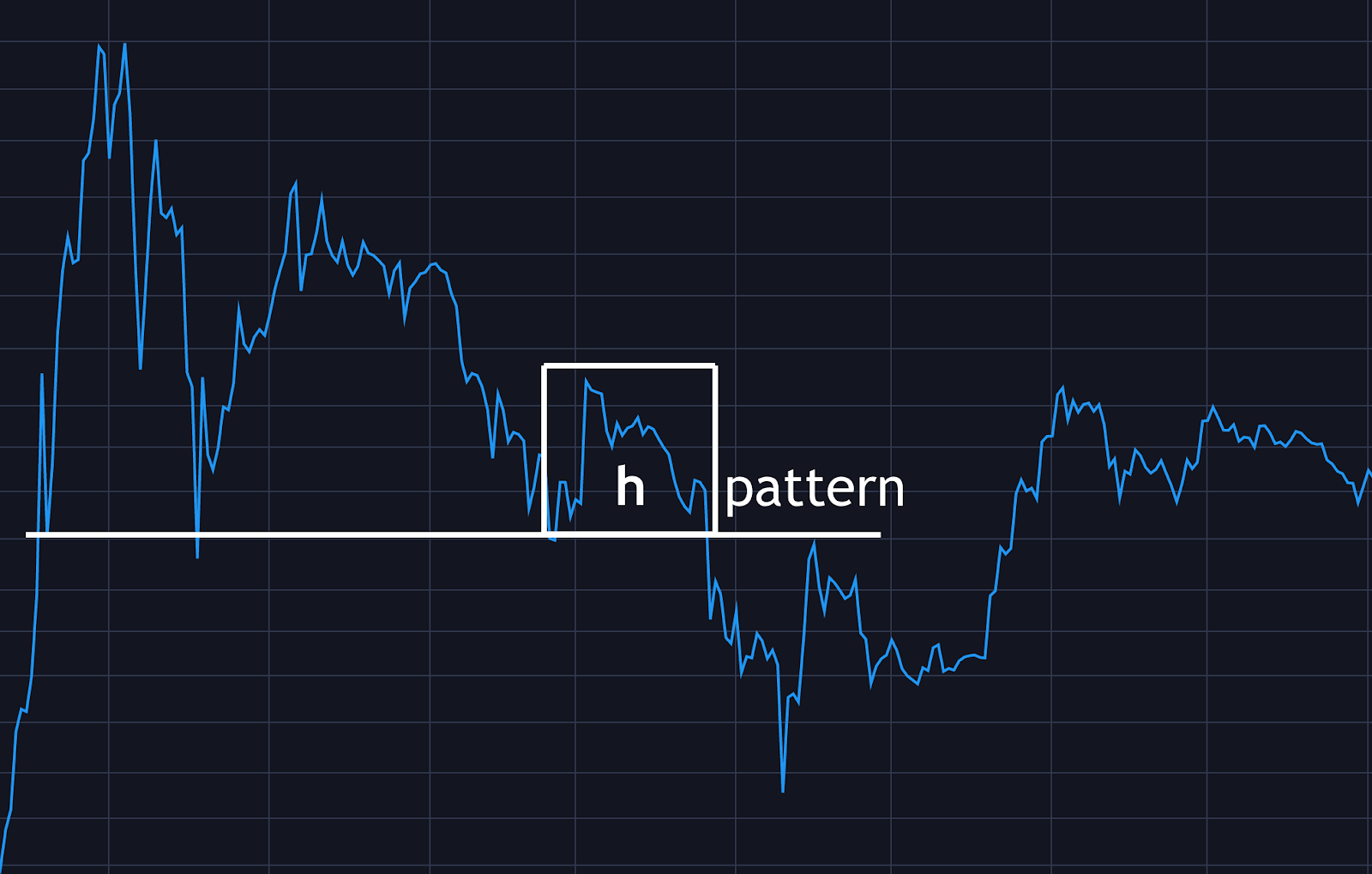

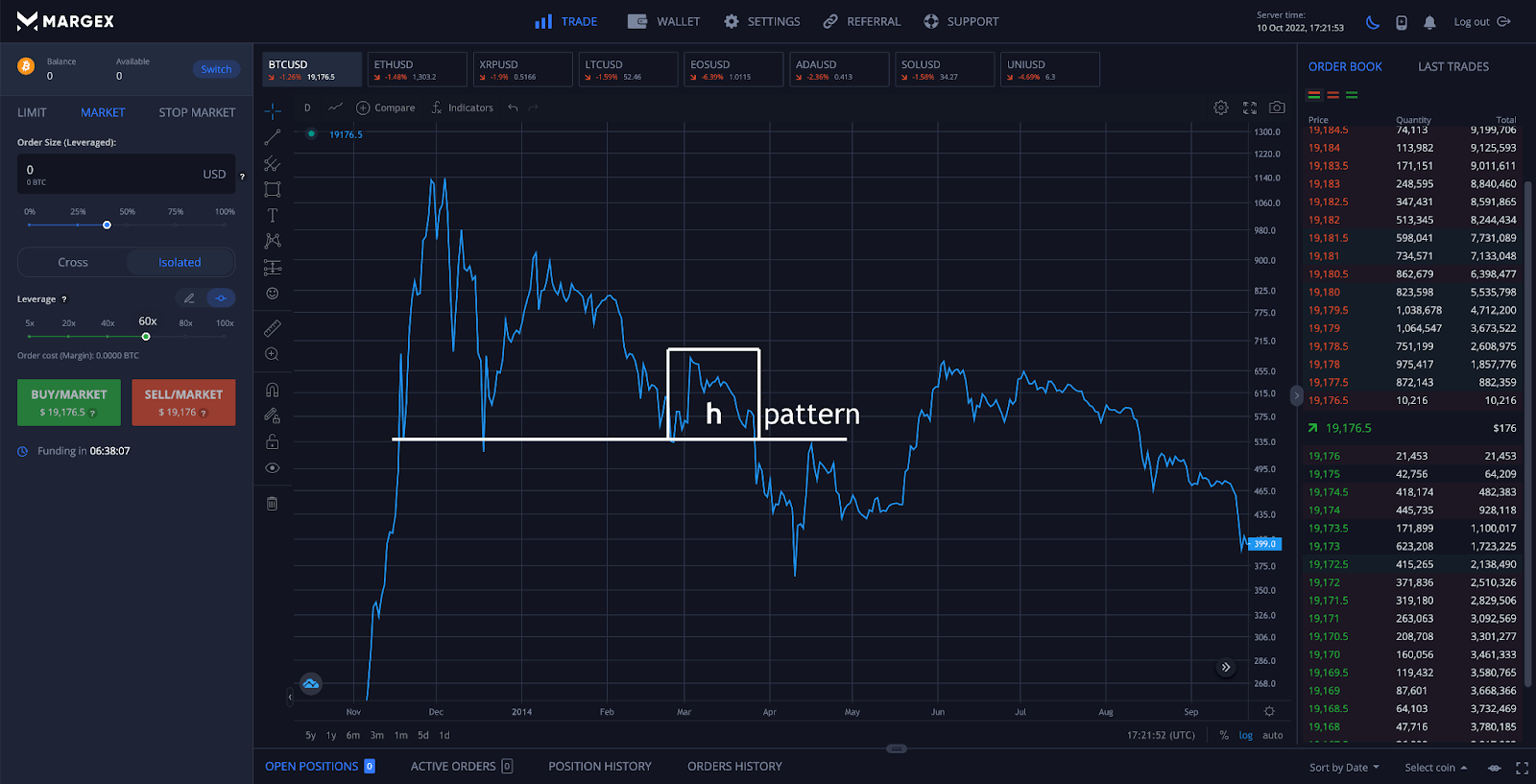

H Pattern Trading - 2.9k views 2 years ago. One could use fibonacci levels to identify key price targets, although there is. This pattern has delivered nothing but. Web many traders use the h pattern as a shorting strategy in trading stocks that are in decline. Web patterns are the connectors of trending phases and if you want to trade trends, you need to learn how to trade patterns. H is a key pattern to trade as a trader. Some may even consider them vital in research and trading. This requires educating yourself on understanding the market you are. H’s tend to appear everywhere, so it’s important to know what you’re looking for. In my case, i look for the first leg down. One could use fibonacci levels to identify key price targets, although there is. The bullish h is composed of a bullish candlestick that. It can also be used to enter new trades with stocks that are under correction. It resembles the letter ‘h’ on stock charts, indicating. H is a key pattern to trade as a trader. How to use the “h” pattern. This requires educating yourself on understanding the market you are. It helps traders where they can decide. This article presents the h pattern. It resembles the letter ‘h’ on stock charts, indicating. It resembles the letter ‘h’ on stock charts, indicating. This requires educating yourself on understanding the market you are. When the stock market starts pulling back and all we see is bearish setup, this bearish h. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within. It resembles the letter ‘h’ on stock charts, indicating. Web learn how to trade the h pattern, a rare and powerful pattern that occurs when the stock has a steep or sudden decline followed by a very weak bounce. 2.9k views 2 years ago. This bearish setup is one that has done very well in this market! Some may even. Web learn how to trade the h pattern, a rare and powerful pattern that occurs when the stock has a steep or sudden decline followed by a very weak bounce. Web here’s how to find the h pattern. 2.9k views 2 years ago. This bearish setup is one that has done very well in this market! It helps traders where. It can also be used to enter new trades with stocks that are under correction. H’s tend to appear everywhere, so it’s important to know what you’re looking for. Web what is an h pattern in trading? This requires educating yourself on understanding the market you are. In my case, i look for the first leg down. This pattern has delivered nothing but. Web what is an h pattern in trading? Ultimately, a trader aims to trade a 50% retracement of the total move. / best forex chart patterns. 2.9k views 2 years ago. Education bullish flag pattern this pattern is a bullish continuation which suggests further bullish rally. / best forex chart patterns. The pattern can exhibit on any. In my case, i look for the first leg down. It resembles the letter ‘h’ on stock charts, indicating. Web to successfully identify an h pattern, traders look for a specific structure in the price charts following a sharp decline. The pattern can exhibit on any. H’s tend to appear everywhere, so it’s important to know what you’re looking for. / best forex chart patterns. How to identify and trade? Web learn how to trade the h pattern, a rare and powerful pattern that occurs when the stock has a steep or sudden decline followed by a very weak bounce. This bearish setup is one that has done very well in this market! The bullish h is composed of a bullish candlestick that. When the stock market starts pulling back. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening. Ultimately, a trader aims to trade a 50% retracement of the total move. It can also be used to enter new trades with stocks that are under correction. Web patterns are the connectors of trending phases and if you want to trade trends, you need to learn how to trade patterns. H is a key pattern to trade as a trader. It resembles the letter ‘h’ on stock charts, indicating. One could use fibonacci levels to identify key price targets, although there is. H’s tend to appear everywhere, so it’s important to know what you’re looking for. This requires educating yourself on understanding the market you are. / best forex chart patterns. In my case, i look for the first leg down. Compare it with other chart patterns such as bear flag and head and shoulders. Web the h stands for “hell for shorts” as most traders mistakenly short the retest of the initial low and are then frustrated when prices fail to move lower. The pattern can exhibit on any. This pattern has delivered nothing but. Web what is an h pattern in trading?:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How to Trade the Head and Shoulders Pattern

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

HOW TO TRADE THE H PATTERN! DAY TRADING BEARISH PATTERNS DURING A

h pattern Shadow Trader

Head and Shoulders Pattern Trading Strategy Synapse Trading

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

Chart Patterns Cheat Sheet Stock trading, Stock chart patterns, Stock

How To Day Trade The "h Pattern" Live! E mini Futures trading The

H Pattern Trading Guide How To Identify And Trade The H Pattern In Crypto

How To Use The “H” Pattern.

Web Learn How To Trade The H Pattern, A Rare And Powerful Pattern That Occurs When The Stock Has A Steep Or Sudden Decline Followed By A Very Weak Bounce.

Web To Successfully Identify An H Pattern, Traders Look For A Specific Structure In The Price Charts Following A Sharp Decline.

Some May Even Consider Them Vital In Research And Trading.

Related Post: