H Pattern Bullish Or Bearish

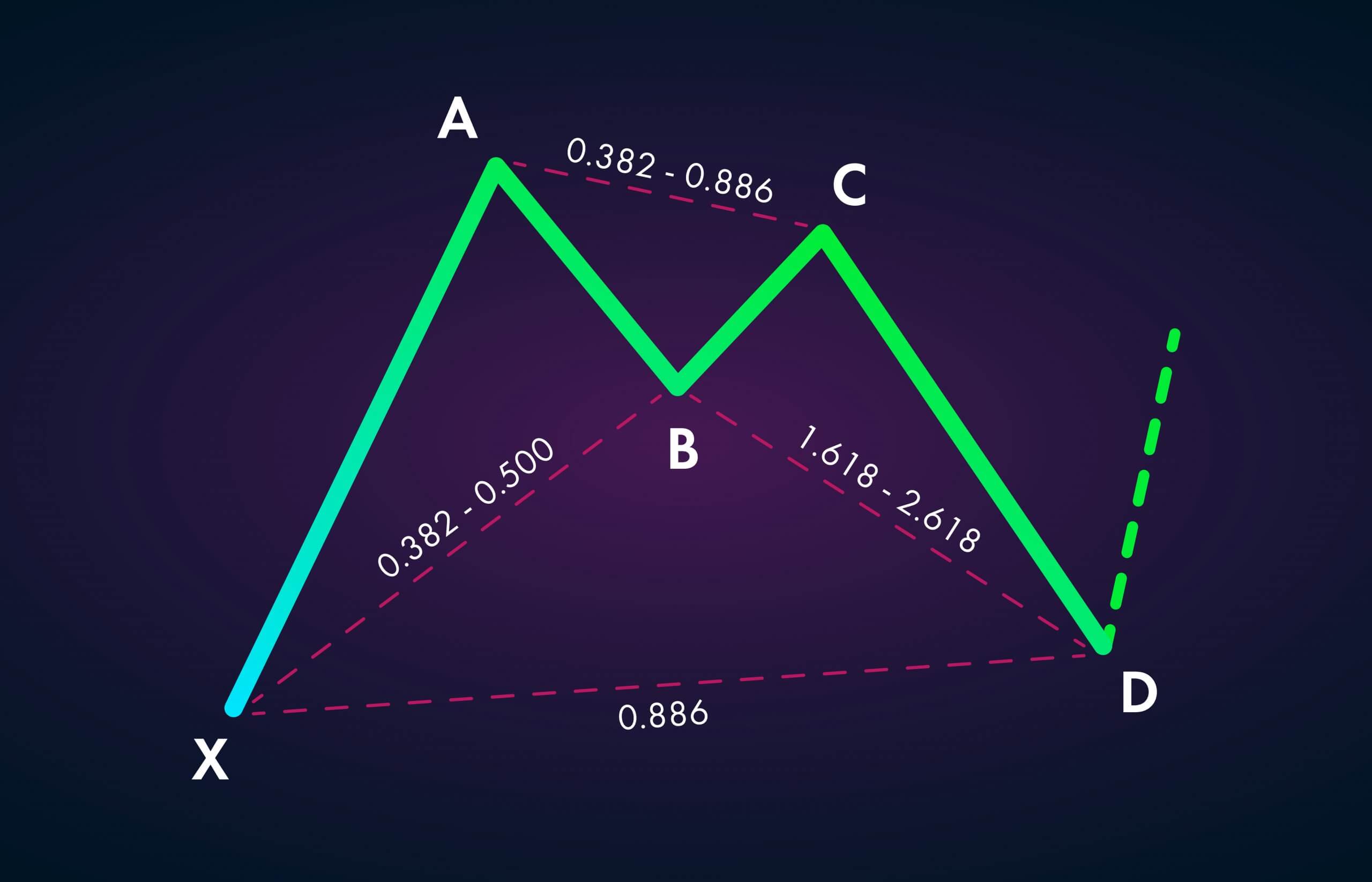

H Pattern Bullish Or Bearish - Web top 10 best bullish patterns tested & proven reliable. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and the tops being bearish. Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. Essentially, it is a red hammer that appears after a bullish section. A green arrow for bullish h signals. It all depends on the setup! The pattern resembles a human head and shoulders, hence the name. Web the head and shoulders stock pattern is a technical analysis chart pattern that indicates a potential trend reversal from bullish to bearish. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. The culminating phase of the pattern unfolds when the highest candle of the bullish price rebound hits the resistance line and the price action reverses, falling below the support. Split the range of the move in half. (emily smith/cnn) a stunning aurora, caused by a severe geomagnetic storm, is painting the sky shades of pink, purple and green as it spreads into. It’s called the “h” pattern, it’s rarely used amongst othe. Again, traders can be bearish on a stock for any time frame, depending on. Traders can be. The pattern resembles a human head and shoulders, hence the name. It could be a buy (in bullish patterns) or a sell (in bearish patterns). Web inverse head and shoulders: A red arrow for bearish h signals. Web conversely, bearish price action could result in the btc token plunging toward its crucial support level of $60,000. Web inverted h pattern: Ab is a down leg that extends from 1.13 to 1.618 beyond point x. A leg down labelled 0x, and a leg up labelled xa. Web top 10 best bullish patterns tested & proven reliable. Web reversal patterns can be either bullish or bearish; Here’s how to find the h pattern. It could be a buy (in bullish patterns) or a sell (in bearish patterns). An h pattern in cryptocurrencies and other markets is typically a bearish chart pattern. We find great success when we recognize this particular pattern before it even occurs. Usually, “d” is identified by a confluence of projections, retracements, and. The aim of the scanner is to detect the h patterns using the following indications: It could be a buy (in bullish patterns) or a sell (in bearish patterns). Web conversely, bearish price action could result in the btc token plunging toward its crucial support level of $60,000. Web here are the fibonacci levels to look for a bullish 5.0. On the other hand, reverse, or inverse head and shoulder patterns indicate a bullish chart reversal from a downward trend to an. Web the head and shoulders stock pattern is a technical analysis chart pattern that indicates a potential trend reversal from bullish to bearish. Now we move to the bearish candlestick patterns that foreshadow drops in price. A leg. Each can can be split into distinct sections that help identify when the patterns are forming, helping ready the investor for the next move, be it higher or lower. Since the h pattern shows a shift from bullish to bearish trends, there are opportunities for traders to enter new trades. Again, traders can be bearish on a stock for any. On the other hand, a breakdown can trigger a 46% drop to the closest support at $0.000012. Web inverse head and shoulders: (emily smith/cnn) a stunning aurora, caused by a severe geomagnetic storm, is painting the sky shades of pink, purple and green as it spreads into. Split the range of the move in half. A green arrow for bullish. It usually sends prices back down the same way the positive trend built them up before the indicator. An h pattern in cryptocurrencies and other markets is typically a bearish chart pattern. Split the range of the move in half. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak. It all depends on the setup! Web head and shoulders pattern: It’s called the “h” pattern, it’s rarely used amongst othe. The pattern resembles a human head and shoulders, hence the name. Known for its resemblance to the lowercase ‘h’, this pattern unfolds through a sharp fall in a stock’s price, followed by a false recovery that fails to sustain. We find great success when we recognize this particular pattern before it even occurs. Again, traders can be bearish on a stock for any time frame, depending on. Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Here’s how to find the h pattern. Hanging man sounds negative, and it is actually. The most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Each can can be split into distinct sections that help identify when the patterns are forming, helping ready the investor for the next move, be it higher or lower. An h pattern in cryptocurrencies and other markets is typically a bearish chart pattern. Web it’s similar to a bear flag however it’s distinctive. Web inverted h pattern: Web the h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. Essentially, it is a red hammer that appears after a bullish section. People expect a stock or market to trend downward. The aim of the scanner is to detect the h patterns using the following indications: Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. Known for its resemblance to the lowercase ‘h’, this pattern unfolds through a sharp fall in a stock’s price, followed by a false recovery that fails to sustain momentum—the infamous “dead.

BULLISH AND BEARISH PATTERNS Candlestick patterns, Forex trading

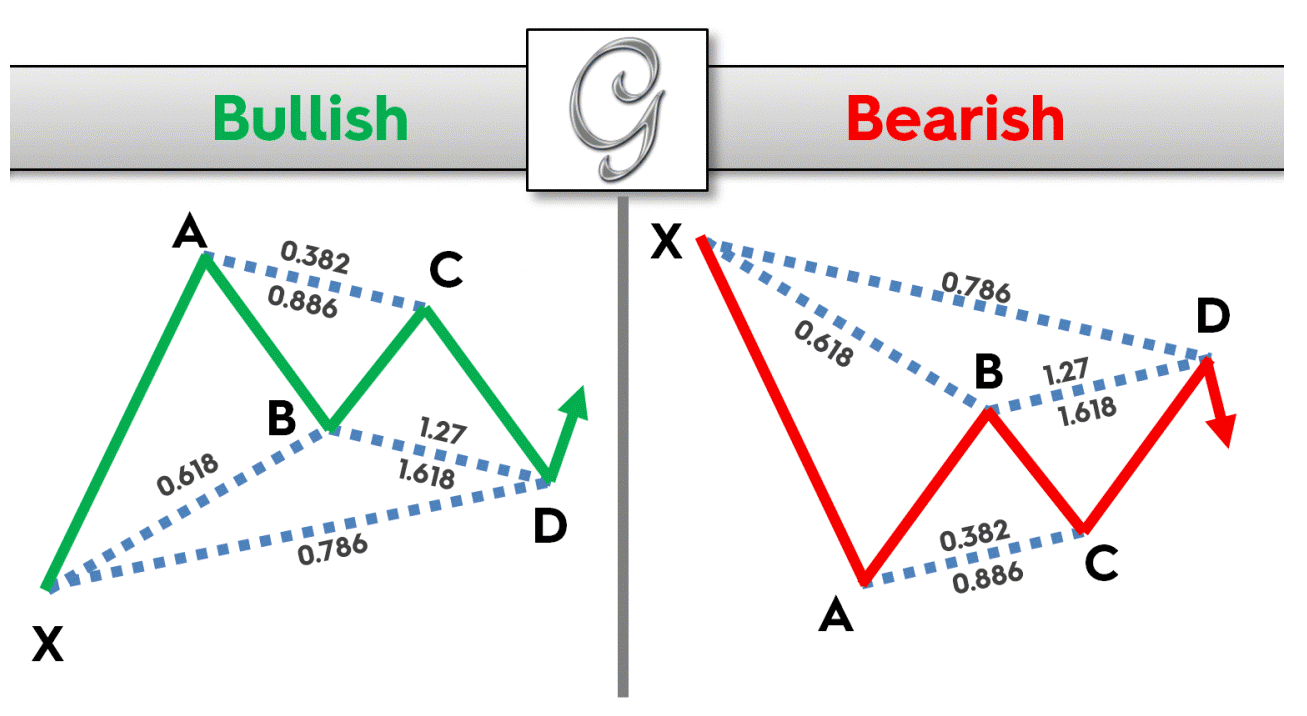

123. Trading The Bullish & Bearish Bat Pattern Forex Academy

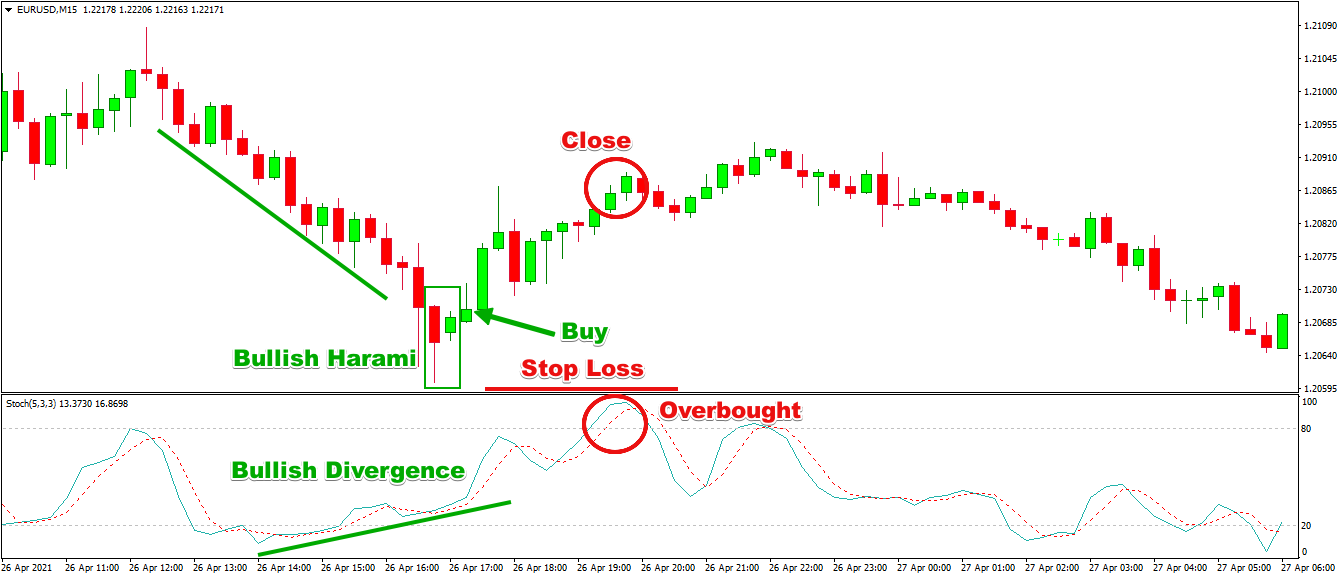

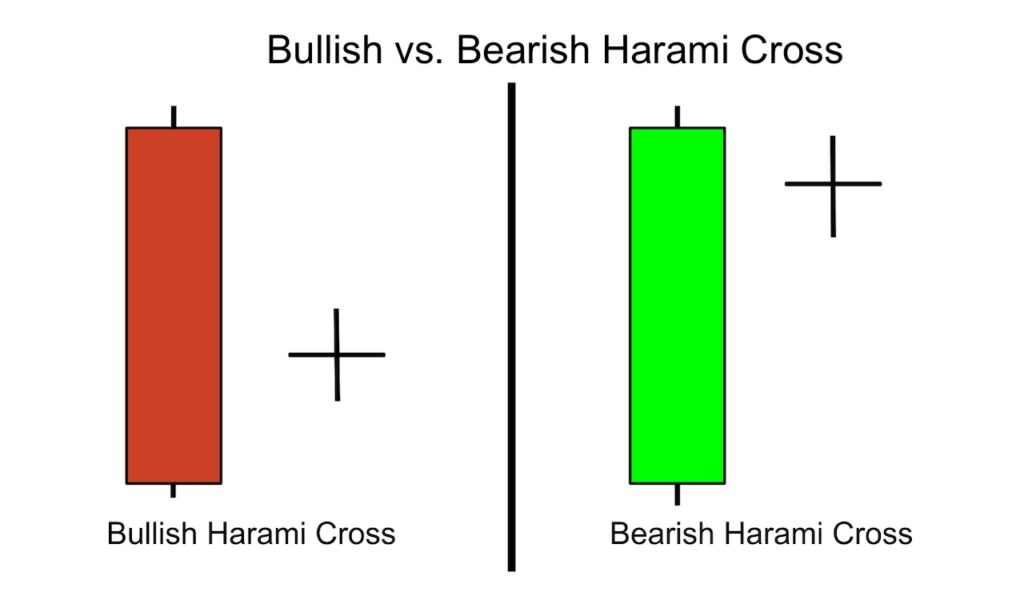

Bullish & Bearish Harami Patterns Forex Training Group

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals

Bullish vs Bearish Chart Pattern Intraday trading Market strategy

Bullish Vs Bearish how to tell if a market is bear or bullish

Bullish and bearish belt hold candlestick patterns explained on E

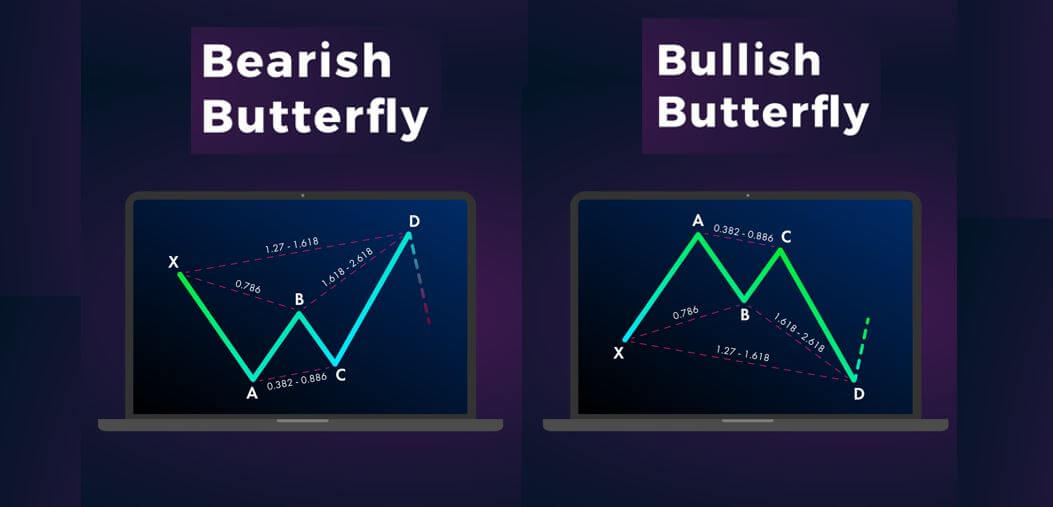

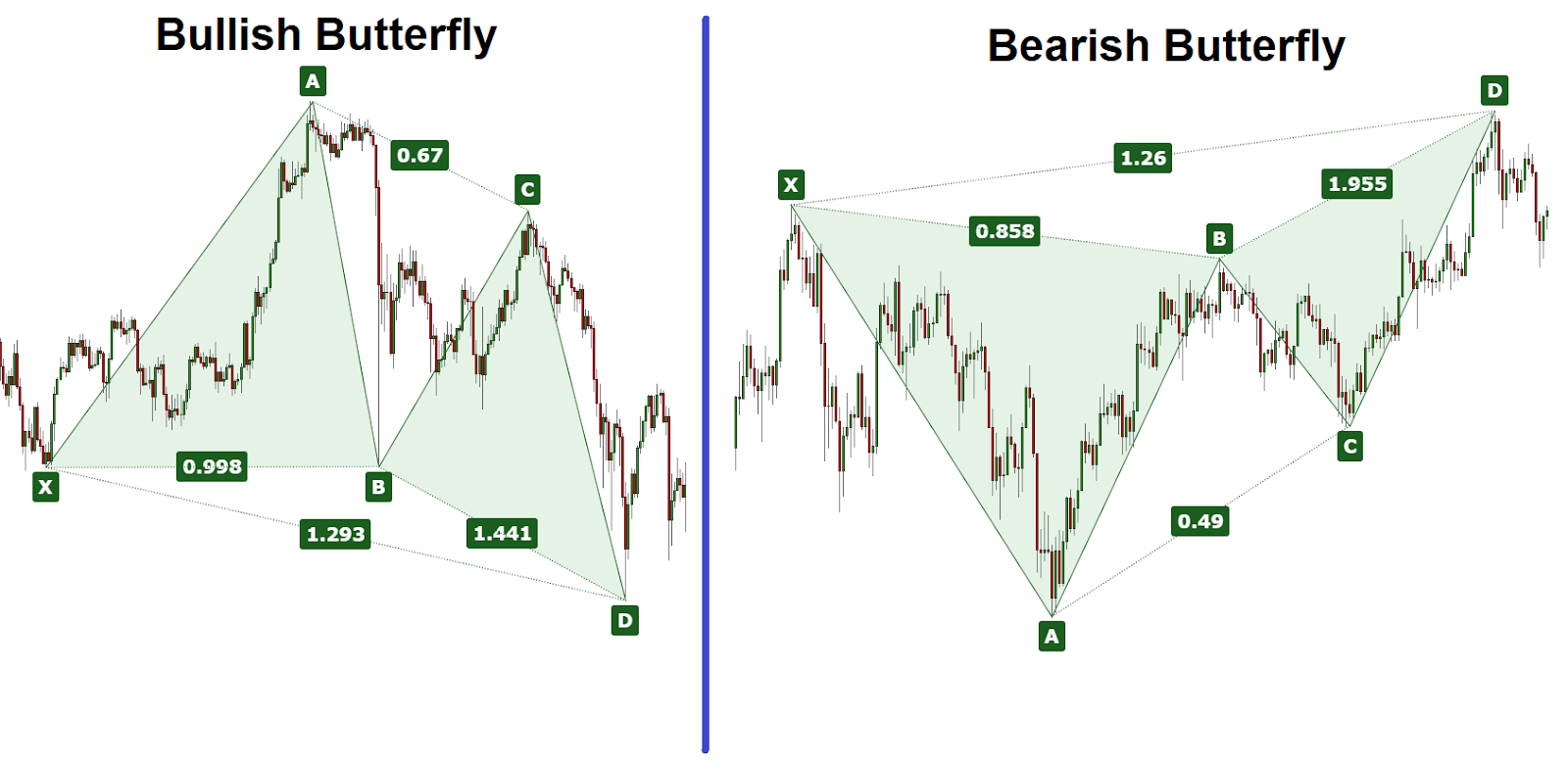

Learning To Trade The Bullish & Bearish ‘Butterfly’ Harmonic Pattern

How to Identify & Trade Harmonic Butterfly Pattern for Profits Bybit

The Culminating Phase Of The Pattern Unfolds When The Highest Candle Of The Bullish Price Rebound Hits The Resistance Line And The Price Action Reverses, Falling Below The Support.

Web Conversely, Bearish Price Action Could Result In The Btc Token Plunging Toward Its Crucial Support Level Of $60,000.

The Pattern Resembles A Human Head And Shoulders, Hence The Name.

Is An H Pattern Bullish Or Bearish?

Related Post: