Forex Flag Pattern

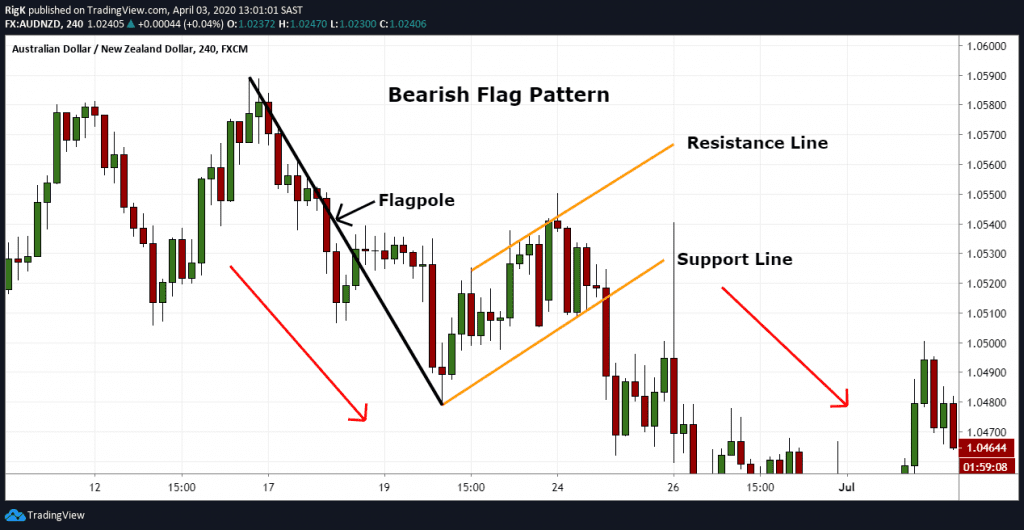

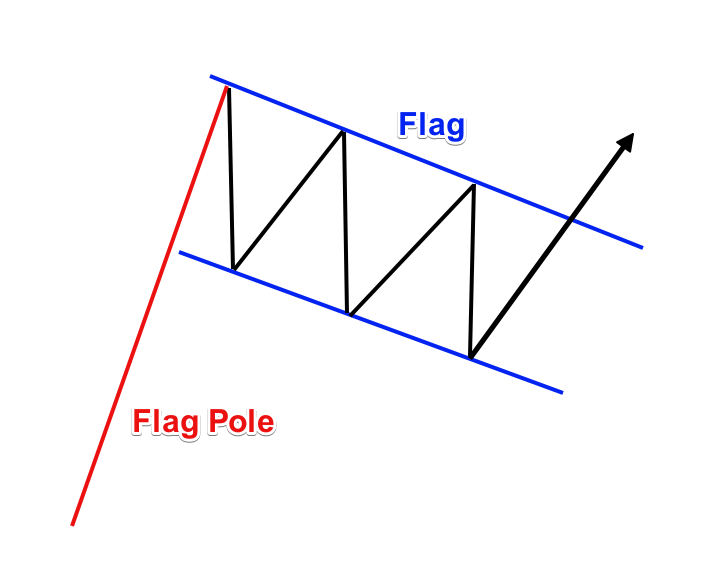

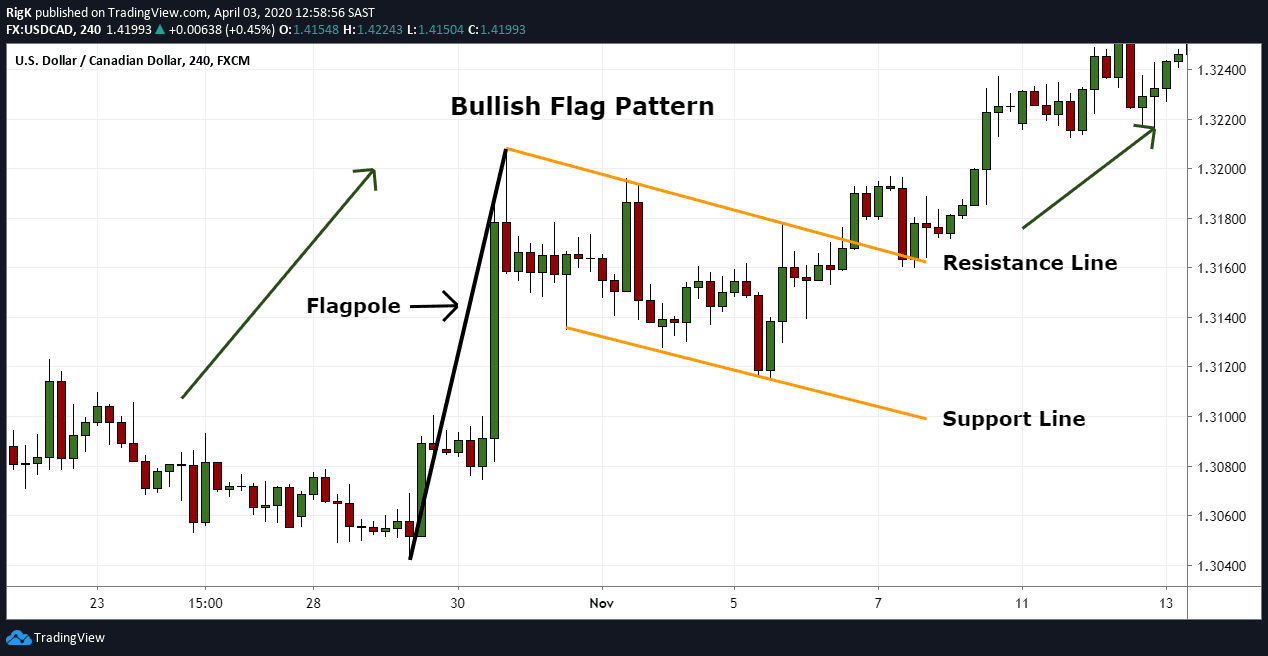

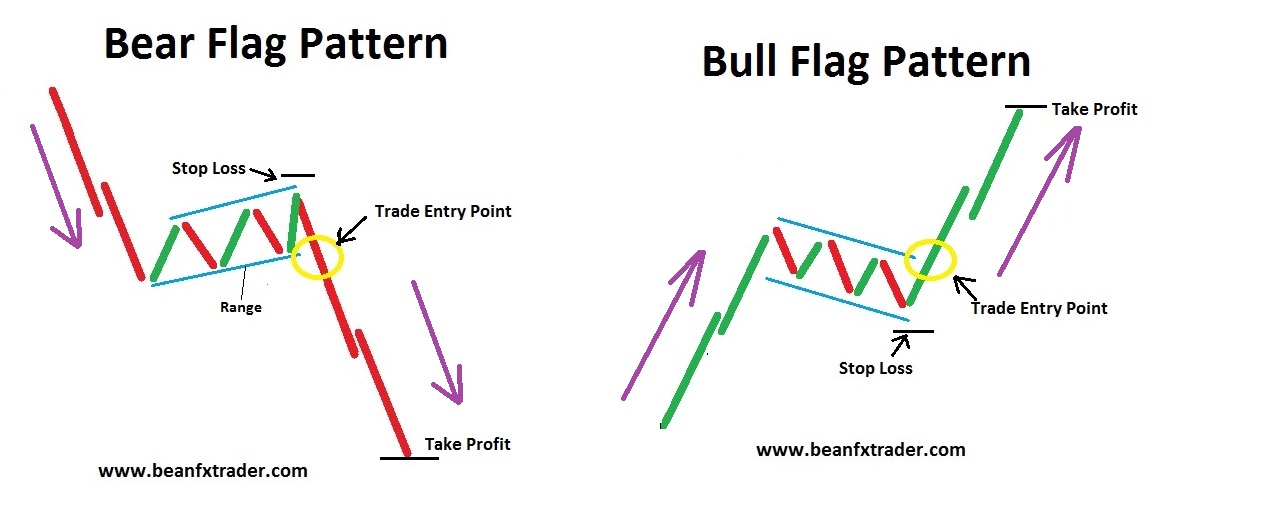

Forex Flag Pattern - Web a flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. The forex geek | published: Web / news & analysis. Web the bull flag pattern is a great pattern to add to a forex trader’s technical arsenal. The symmetrical triangle pattern is a classic sideways pattern where the market is consolidating. Web “flag” pattern in forex. In this article, we will explore what the flag pattern is, how to identify it, and how to trade it effectively. How to trade the flag pattern. , former senior financial writer. Web what is a flag pattern in forex? The flag pattern is used as an entry point for the continuation of a prevailing trend. Web a flag pattern is a technical analysis tool used to identify a continuation pattern in the forex market. Flag and pennant patterns are technical analysis formations that occur after a strong price movement, often referred to as a flagpole. these patterns are characterized. Web the flag pattern has two targets on the chart. The forex flag pattern is a chart pattern that appears when a trend begins to accelerate. This article will look at the potentially. The triangle is a continuation pattern. What is the bull flag pattern? When this pattern forms on the chart, there is a high likelihood that the price action will breakout in the direction of the prevailing trend. The forex flag pattern is a chart pattern that appears when a trend begins to accelerate. A forex flag pattern is a continuation chart pattern that occurs after a strong price movement. Web the strong. How to trade flag patterns; Web what are forex flag patterns? Web nextera energy partners has an 11.8% dividend yield. , former senior financial writer. How to trade the flag pattern. The forex geek | published: , former senior financial writer. The “flagpole” and the “flag” (the channel within which the price moves). The flag is usually formed by a series of lower highs and higher lows, which creates a triangular shape. There are three different triangle patterns that are each discussed below; Ascending triangle, descending triangle and symmetrical triangle. It resembles a flag on a flagpole, hence the name. , former senior financial writer. The first one stays above the breakout on a distance equal to the size of the flag. When this pattern forms on the chart, there is a high likelihood that the price action will breakout in the direction. , former senior financial writer. It resembles a flag on a flagpole, hence the name. It has a bigger yield than most popular dividend companies. Web the strong support level at $2,285 was discussed in april 2024 and proved to be strong support. What is the pennant pattern? Web what are forex flag patterns? What is the pennant pattern? Explosive moves are often associated with the bull flag. Slava loza forex trader & analyst. The flagpole can be either an upward or downward movement, depending on the prevailing market trend. If the price completes the first target, then you can pursue the second target that stays. Bear and bull flag patterns are two common motifs that can predict the continuation of a trend. There are three different triangle patterns that are each discussed below; August 11, 2022 12:35 pm. Learn to use bullish and bearish flags to aid in your. Web / news & analysis. Flag patterns are frequent and very popular. Ascending triangle, descending triangle and symmetrical triangle. The flagpole is the initial move in price, while the flag is the consolidation period that follows. What are bullish and bearish flags? Web the strong support level at $2,285 was discussed in april 2024 and proved to be strong support. The first one stays above the breakout on a distance equal to the size of the flag. August 11, 2022 12:35 pm. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. Although it is less popular than triangles and wedges, traders consider flags to be extremely reliable chart patterns. The flag pattern is a continuation pattern that occurs after a strong price movement in either direction. Flag and pennant patterns are technical analysis formations that occur after a strong price movement, often referred to as a flagpole. these patterns are characterized by a period of consolidation or sideways movement, which is followed by a continuation of the previous trend. This article will look at the potentially. Web a flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. The symmetrical triangle pattern is a classic sideways pattern where the market is consolidating. The flag is usually formed by a series of lower highs and higher lows, which creates a triangular shape. August 11, 2022 11:35 am. Explosive moves are often associated with the bull flag. The stock has formed a rising wedge pattern on the weekly chart. What is the bull flag pattern? What is the pennant pattern?

Flag Pattern Forex Trading

What Is Flag Pattern? How To Verify And Trade It Efficiently

Forex Chart Patterns You Need to Know Daily Price Action

Flag Pattern Full Trading Guide with Examples

Forex Flag Pattern Pdf

Introduction to Trading the Flag Pattern Action Forex

How to Trade Bearish and the Bullish Flag Patterns Like a Pro Forex

Flag Pattern Full Trading Guide with Examples

The Forex Chart Patterns Guide (with Live Examples) ForexBoat

FLAG PATTERNS FX & VIX Traders Blog

, Former Senior Financial Writer.

Web A Flag Pattern Is A Continuation Chart Pattern That Appears In An Uptrend Or A Downtrend And Signals Trend Continuation After Completion.

It Suggests Another Big Move In Trend Direction.

A Forex Flag Pattern Is A Continuation Chart Pattern That Occurs After A Strong Price Movement.

Related Post: