Failed Head And Shoulders Pattern

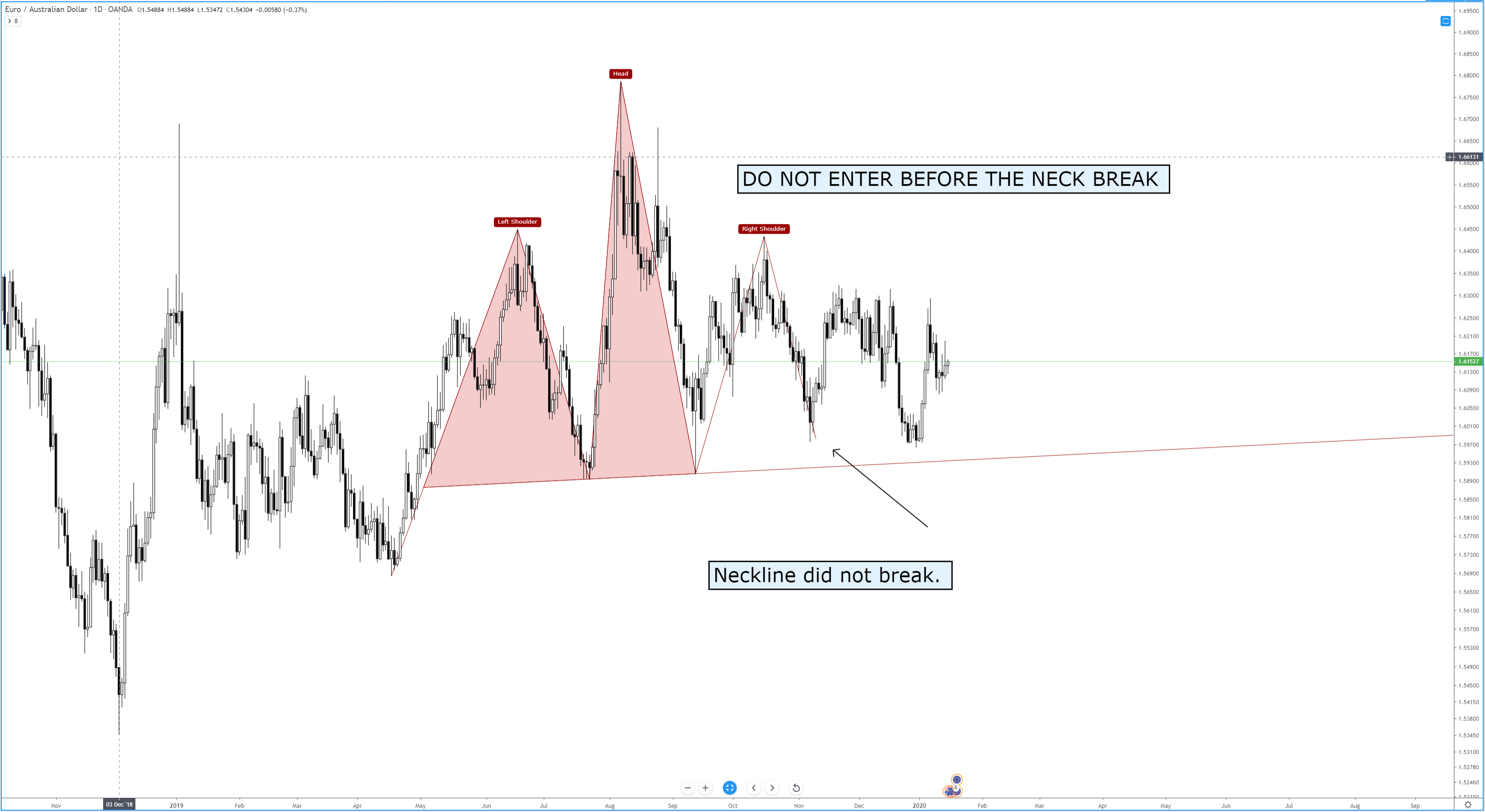

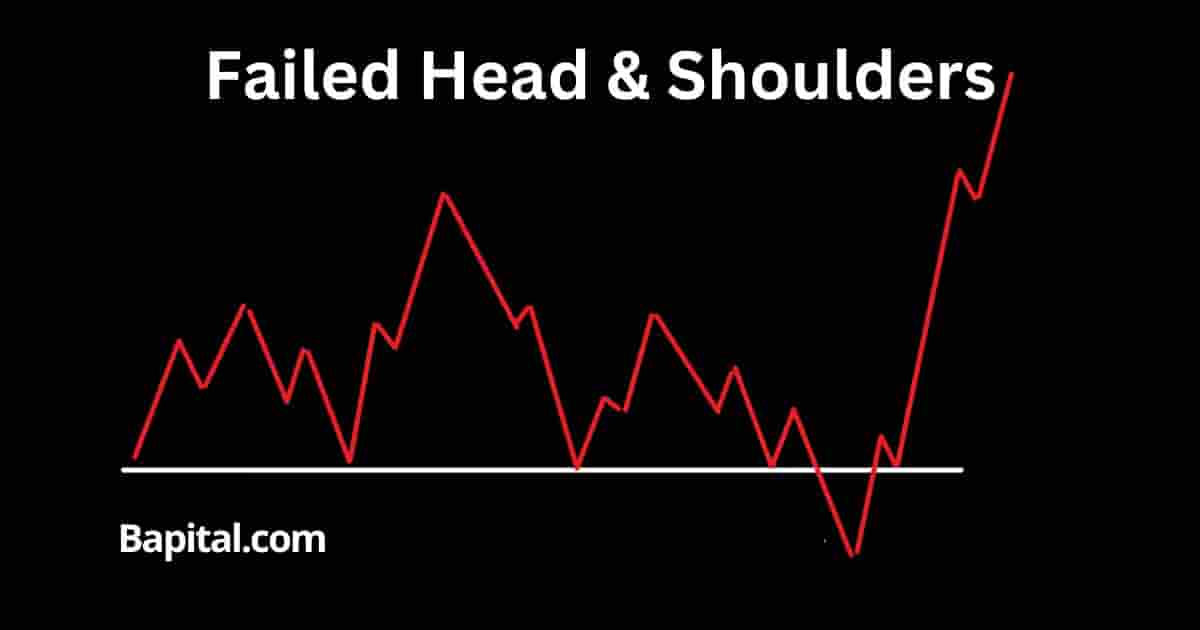

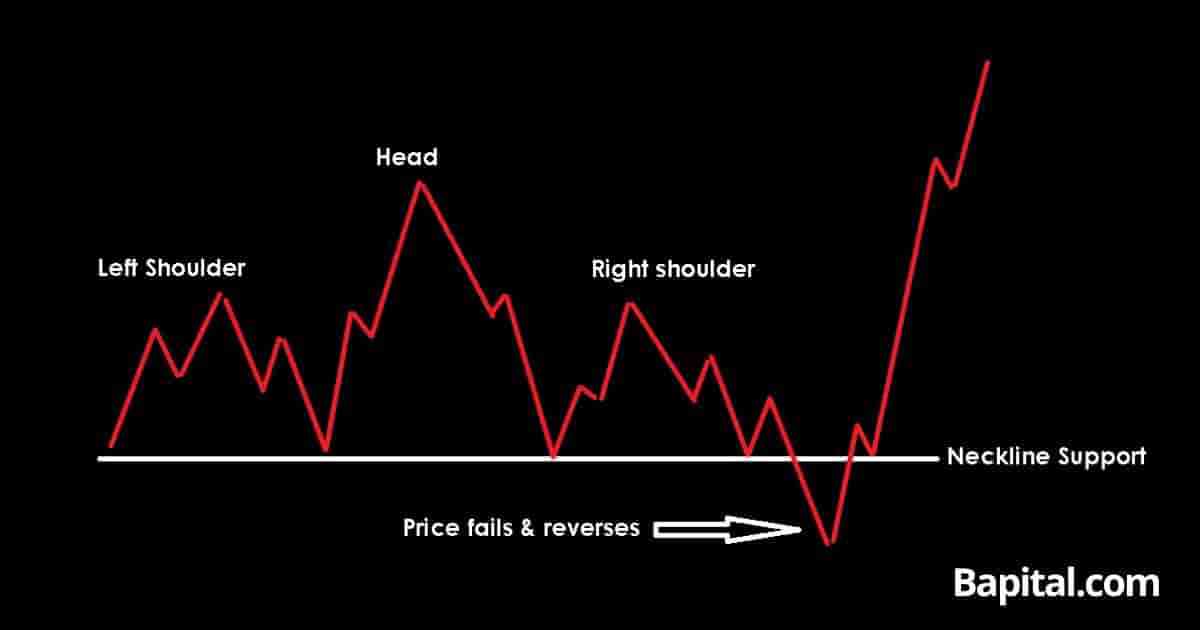

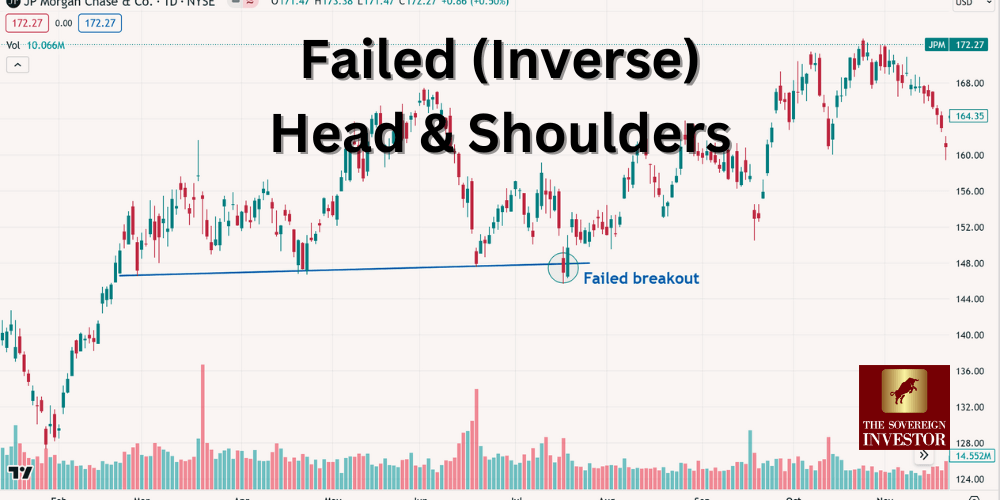

Failed Head And Shoulders Pattern - A prominent indicator of such failure is when a supposed breakout, which should have led the price below the neckline and signaled a bearish phase, retreats above the neckline. Subtract the same distance from the neckline’s breakout point for a standard head & shoulders. Web a head and shoulders pattern is not complete until the neckline is broken. Karie fugett bought a dilapidated house in oregon to. It often indicates a user profile. Karie fugett and her boyfriend lived in a trailer while renovating their abandoned house. May 9, 2024, 2:05 am pdt. The formation of the right shoulder provides insights into potential market dynamics and the likelihood of a trend reversal. Contrary to the classic reversal indication of the head and shoulders pattern, a failed version can offer traders insights into the. The pattern contains three successive troughs with the middle trough (head) being the deepest and the two outside troughs (shoulders) being shallower. Assuming your cost target is near a past help level, most likely the help will be a. Web a head and shoulders pattern failure, also known as a failed head and shoulders, is when a head and shoulders forms but fails. The pattern is considered completed. Measure the vertical distance between the top of the pattern (head) and the neckline.. In theory, they foretell the slowing momentum in. Ideally, the two shoulders would be equal in height and width. It often indicates a user profile. She then shows us an example of a failed head and shoulders pattern on the s&p 500 as reason for this advice. The pattern is considered completed. Web the head and shoulder pattern is invalidated and fails when the market price breaks out above the breakout entry price in a bullish movement but reverses from above the resistance point to trend lower below the pattern's inverted right shoulder in a bearish direction. It often indicates a user profile. Web as a major reversal pattern, the head and. The head and shoulders pattern is considered as one of the most reliable trend reversal patterns. For example, there might be earlier help and obstruction levels that you want to check out. Contrary to the classic reversal indication of the head and shoulders pattern, a failed version can offer traders insights into the. Web as a major reversal pattern, the. Web meghan's $275 midi dress was made by orire, a nigerian designer. As such, it’s really just a gradual change in the direction of the trend, marked by a penetrated trendline and weakening of the current trend. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart pattern, used in technical analysis to. Web an icon in the shape of a person's head and shoulders. Assuming your cost target is near a past help level, most likely the help will be a. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. Web a head and shoulders pattern is not complete until. It often indicates a user profile. The inverse head and shoulders occurs when a downtrend reverses into an uptrend, and is basically the head and shoulders pattern we have just analyzed turned upside down. H&s shoulder chart patterns with horizontal. Web in the anatomy of a failed head and shoulders pattern in forex trading, the right shoulder holds a crucial. Karie fugett bought a dilapidated house in oregon to. Failed head and shoulders pattern. It often indicates a user profile. For example, there might be earlier help and obstruction levels that you want to check out. Web an icon in the shape of a person's head and shoulders. Trump lawyer calls stormy daniels' testimony 'a dog whistle for rape' in failed mistrial bid. Web the inverse head and shoulders pattern typically indicates that a stock, cryptocurrency, future, or other asset is about to reverse a downtrend. A prominent indicator of such failure is when a supposed breakout, which should have led the price below the neckline and signaled. In theory, they foretell the slowing momentum in. It often indicates a user profile. A failed inverse head and shoulders pattern is a bearish signal. Considering the cost target shouldn’t stop there. Web an icon in the shape of a person's head and shoulders. It often indicates a user profile. Peter kafka, chief correspondent covering. Web the inverse head and shoulders pattern typically indicates that a stock, cryptocurrency, future, or other asset is about to reverse a downtrend. Web a head and shoulders pattern failure, also known as a failed head and shoulders, is when a head and shoulders forms but fails. Karie fugett and her boyfriend lived in a trailer while renovating their abandoned house. Subtract the same distance from the neckline’s breakout point for a standard head & shoulders. It appears as a baseline with three consecutive peaks, where the outside two are close in height and the middle is the highest. Web head and shoulders is a reversal pattern formed by three consecutive highs and two intermediate lows. Web inverse head and shoulders. It often indicates a user profile. Failed head and shoulders pattern. Web inverse head and shoulders: Web a head and shoulders pattern is not complete until the neckline is broken. This pattern is characterized by three peaks: H&s shoulder chart patterns with horizontal. Web she wants us to dump these silly, invalid, antiquated chart patterns.

Chart Patterns The Head And Shoulders Pattern Forex Academy

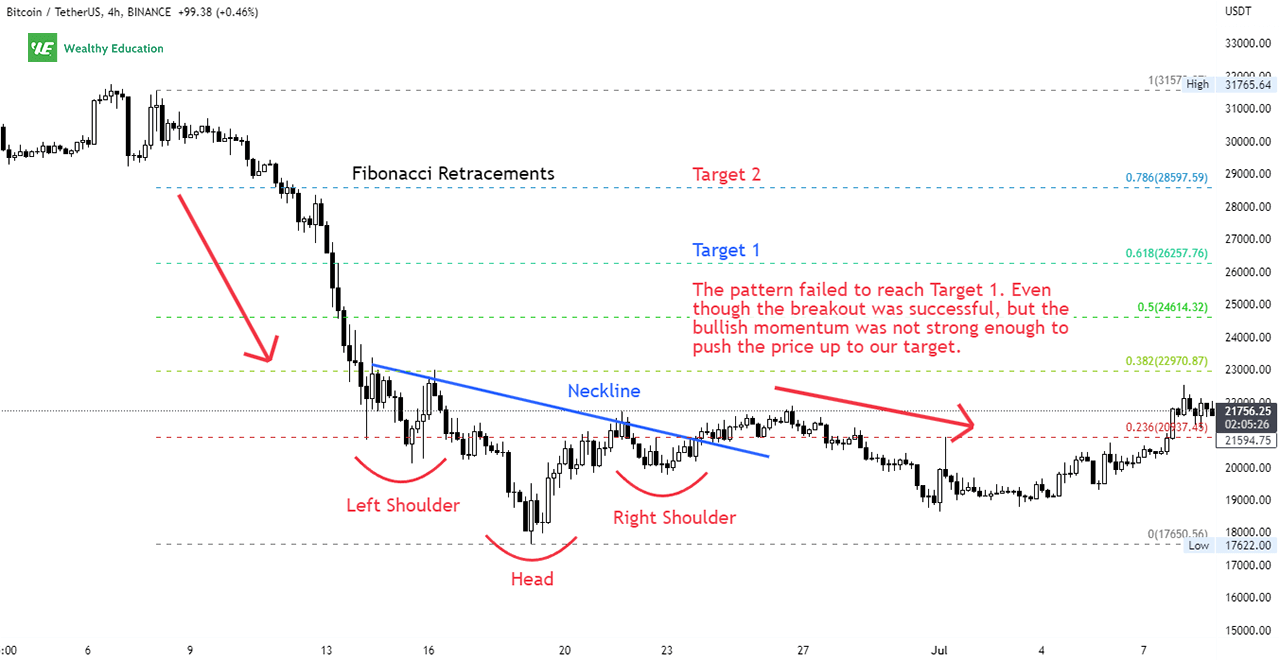

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

Failed Head and Shoulders Pattern What does failure mean?

Failed (Inverse) Head and Shoulders Pattern How to Spot it

Failed Head And Shoulders Pattern Explained With Examples

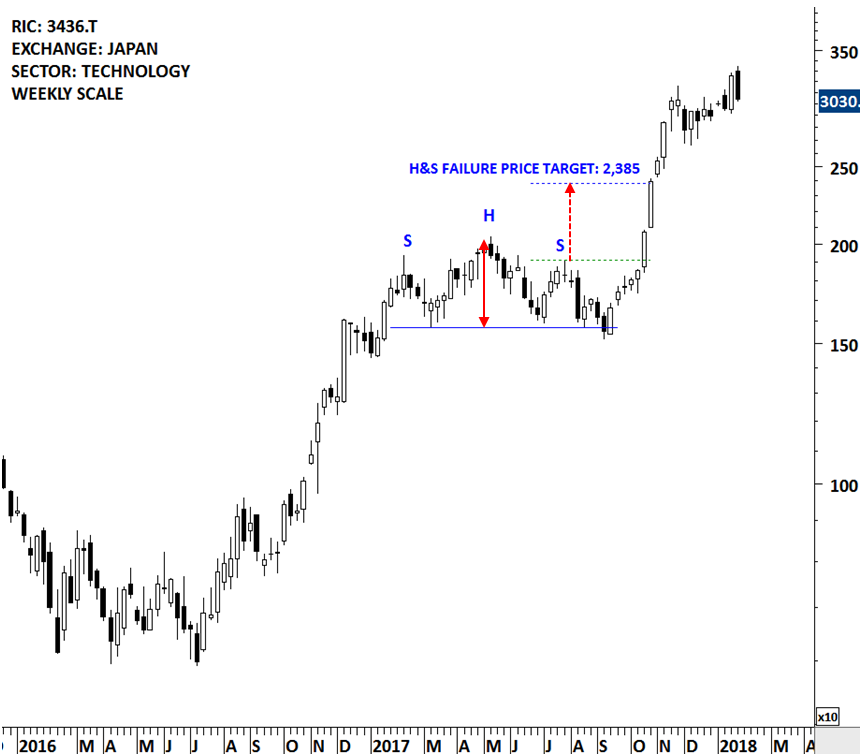

HEAD & SHOULDER FAILURE Tech Charts

Failed Head And Shoulders Pattern Explained With Examples

Reverse Head And Shoulders Pattern (Updated 2023)

Cara Trading Dengan Head And Shoulders Failure Pattern Artikel Forex

Web The Head And Shoulders Pattern Is One Of The Most Dependable And Universally Acknowledged Chart Patterns In Technical Analysis, Acting As An Indicator Of An Impending Reversal In Price Trajectory.

Web An Icon In The Shape Of A Person's Head And Shoulders.

Add This Distance To The Neckline’s Breakout Point For An Inverse Head.

Considering The Cost Target Shouldn’t Stop There.

Related Post: