Candle Pattern Morning Star

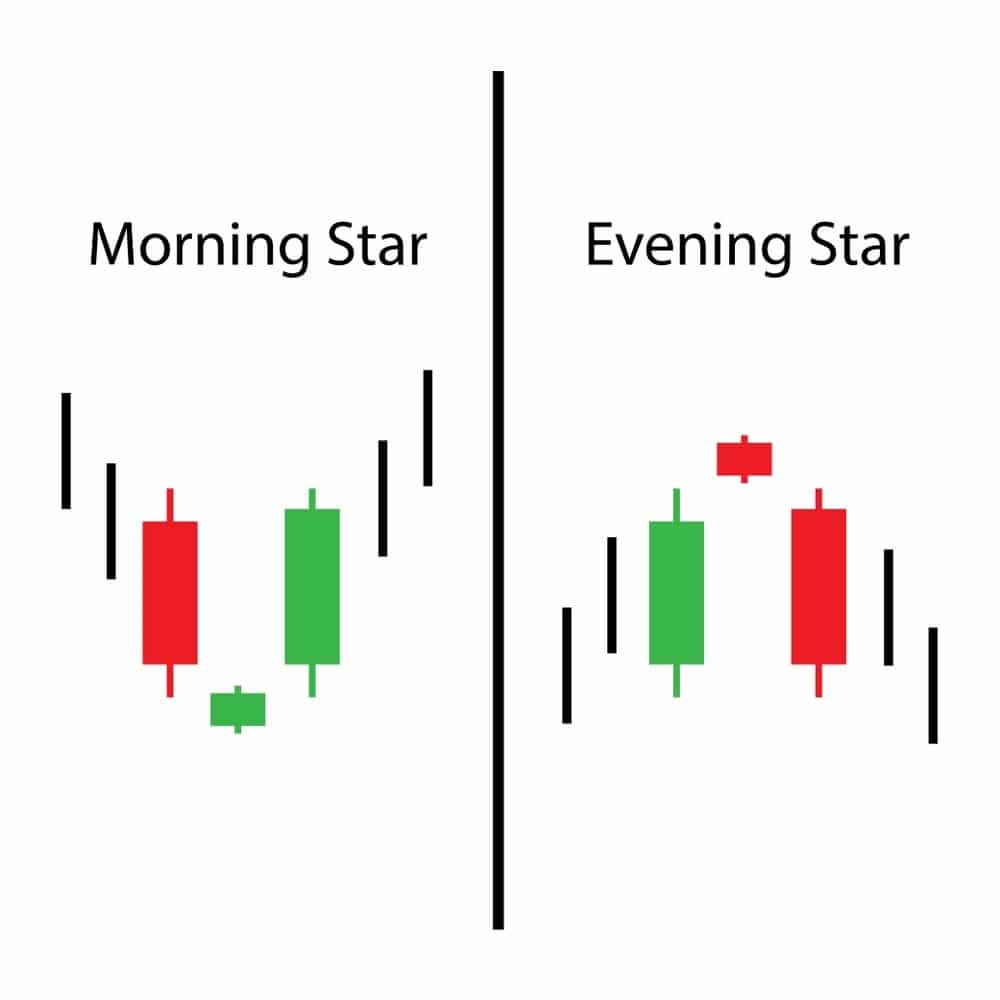

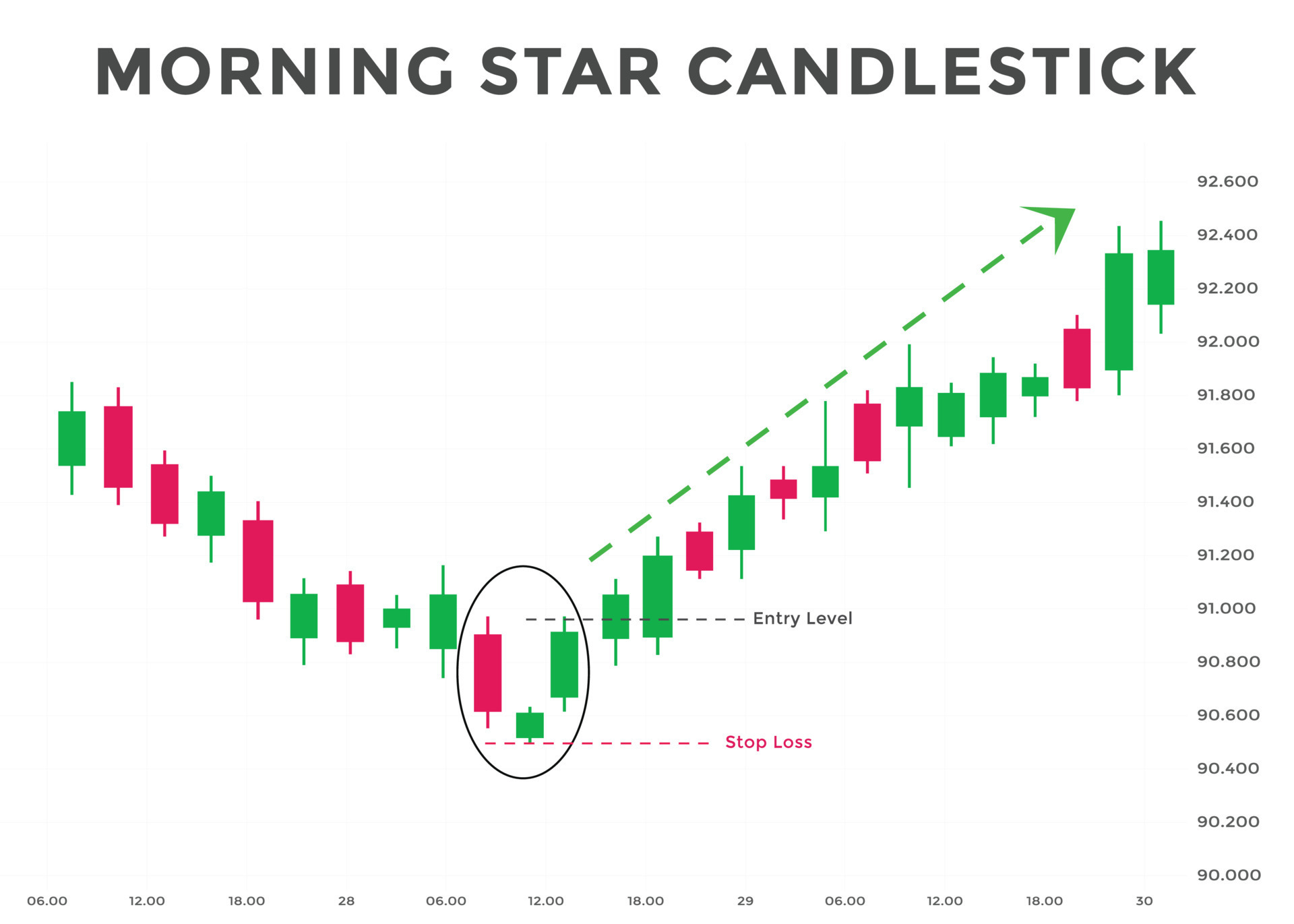

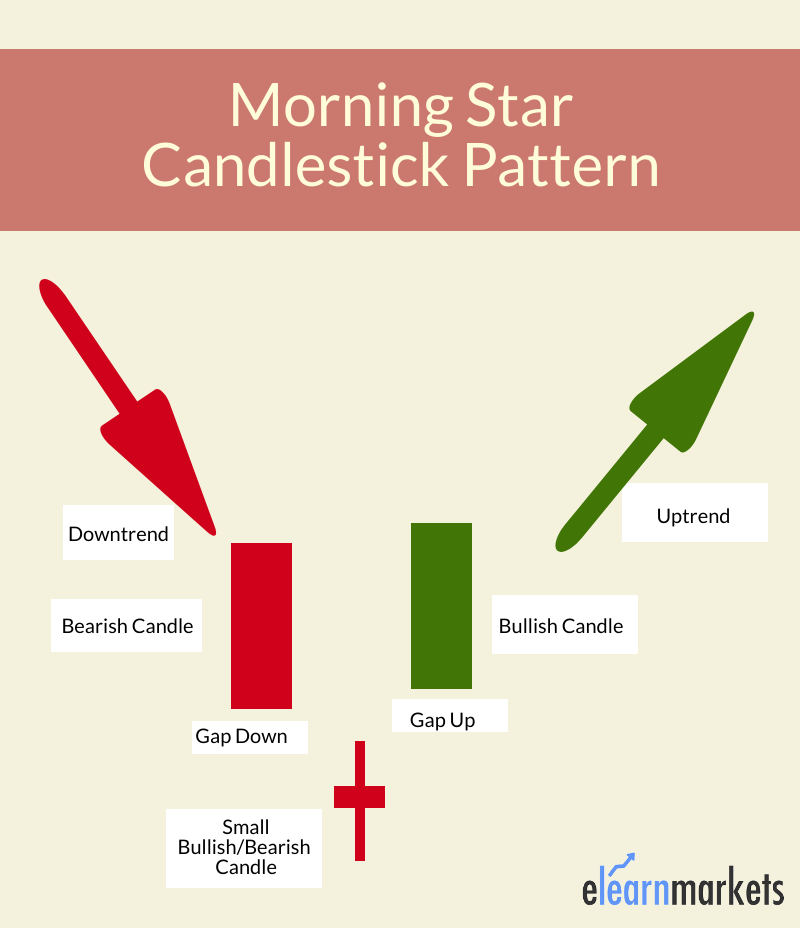

Candle Pattern Morning Star - It reveals a slowing down of downward momentum before a large bullish. Web what is the morning star pattern? This pattern reverses the downtrend to the uptrend. In the chart below the morning, the star is encircled. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. A morning star is a bullish candlestick pattern that consists of three candles. Web four elements to consider for a morning star formation. Web the japanese morning star candlestick pattern is a three candle formation that has a bullish implication. Web the morning star pattern is viewed as a bullish reversal pattern, usually occurring at the bottom of a downtrend. Trading the morning star with rsi divergences. Web the morning star candlestick pattern is the opposite of the evening star, which is a top reversal signal that indicates bad things are on the horizon. It consists of three candles: A morning star is a bullish candlestick pattern that consists of three candles. This pattern reverses the downtrend to the uptrend. The morning star pattern is a series. A long black candle strengthened a strong resistance zone. The second candle has a short real body and gaps down. The first candle is bearish and long. Web what is the morning star pattern? Trading the morning star with fibonacci. Normally a long bearish candle, followed by a short bullish or bearish doji or a small body candlestick, [1] which is then followed by a long bullish candle. Web the morning star candlestick pattern is the opposite of the evening star, which is a top reversal signal that indicates bad things are on the horizon. To identify morning star candles,. If a technical trader sees a morning star appear after a downtrend, they take it as a sign that selling sentiment may be losing ground to buyers. In the chart below the morning, the star is encircled. The second candle should be indecisive as the bulls and bears start to balance out over the session. The third candle is bullish. To identify morning star candles, look for a bearish candle in a bearish trend. It consists of three candles: It is a downtrend reversal pattern. The pattern is formed by combining 3 consecutive candlesticks. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. This pattern reverses the downtrend to the uptrend. A downtrend must be in place since a morning star is a bullish reversal pattern. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. The pattern signifies a potential shift from bearish to bullish momentum, especially when forming at the bottom of a. The pattern has three candles: The pattern signifies a potential shift from bearish to bullish momentum, especially when forming at the bottom of a downtrend or downward price. To identify morning star candles, look for a bearish candle in a bearish trend. It is a downtrend reversal pattern. With a high winning ratio, this pattern can be effectively utilized. The first one being a bearish candlestick, the second one can be bullish or bearish with. Consisting of three candlesticks, morning star candlestick patterns generate bullish. It consists of three candles: The pattern has three candles: In the chart below the morning, the star is encircled. Web the morning star pattern is a bullish candlestick pattern found in financial charts. Web four elements to consider for a morning star formation. Morning star candlestick is a triple candlestick pattern that indicated bullish reversal. The pattern signifies a potential shift from bearish to bullish momentum, especially when forming at the bottom of a downtrend or downward price. Web. Web what is the morning star pattern? The first candle is a large bearish can. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. It reveals a slowing down of downward momentum before a large bullish. The morning star appears at the bottom end of. It consists of three candles: The morning star appears at the bottom end of a downtrend. Web the morning star is a bullish reversal pattern composed of three candlesticks: Millions of americans were able to see the magical glow of the northern lights on friday night when a powerful geomagnetic storm reached earth. The morning star pattern is a series of three candlesticks on a market’s chart that indicate an upcoming bullish reversal. The first candle should be a bearish candle, preferably longer. This pattern is considered a strong signal for a reversal in market sentiment from bearish to bullish. The second candle has a short real body and gaps down. It consists of three candles and is interpreted as a sign of a potential turnaround in a declining market. Web the following are the requirements for a valid morning star candlestick pattern: Although prior the morning star, three other bullish reversal patterns occurred (bullish harami, three inside up and inverted hammer), the. The second candle should be indecisive as the bulls and bears start to balance out over the session. The first candle is bearish and long. A morning star appearance is preceded by a strong downtrend which was started by a falling window formed at a very high trading volume. Normally a long bearish candle, followed by a short bullish or bearish doji or a small body candlestick, [1] which is then followed by a long bullish candle. The third candle is another red (bearish) candle that closes below the.

Morning Star Candlestick Pattern

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

Understanding The Morning Star Candlestick Pattern InvestoPower

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning and evening star pattern candlestick chart pattern. Bullish and

Morning Star Candlestick Pattern definition and guide

How To Trade Blog Morning Star Candlestick Pattern How To Trade and

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick? Formation & Uses ELM

If A Technical Trader Sees A Morning Star Appear After A Downtrend, They Take It As A Sign That Selling Sentiment May Be Losing Ground To Buyers.

The First Candle Shows That A Downtrend Was Occurring And The Bears Were In Control.

A Big Red Candle, A Small Doji, And A Big Green Candle.

Web The Morning Star Pattern Is A Bullish Candlestick Pattern Found In Financial Charts.

Related Post: