Double Top Bullish Pattern

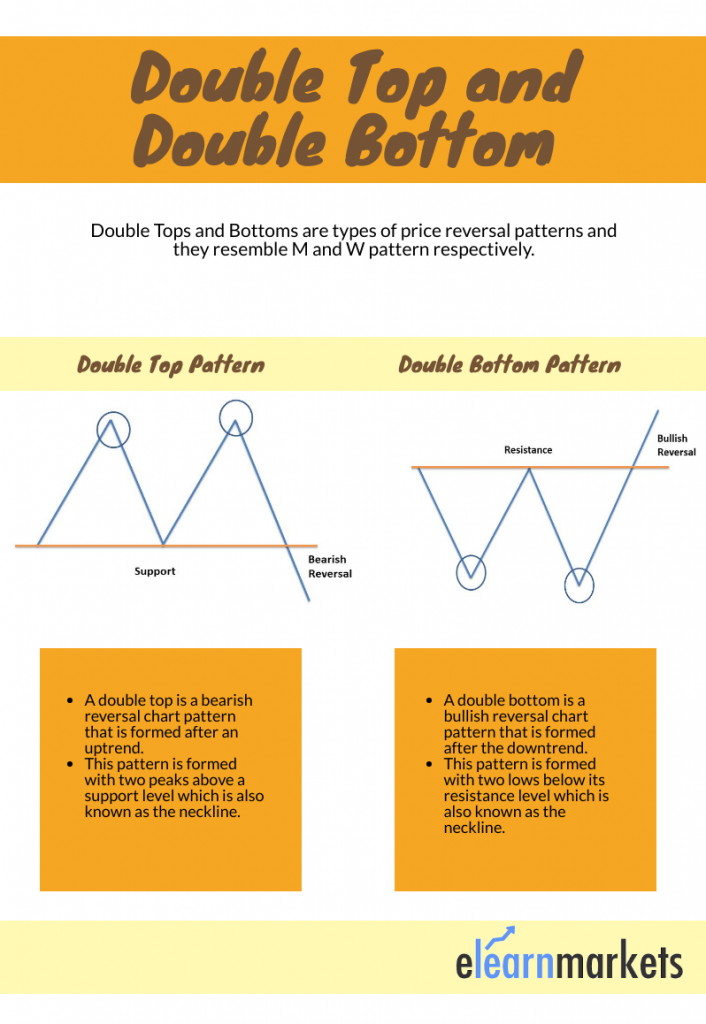

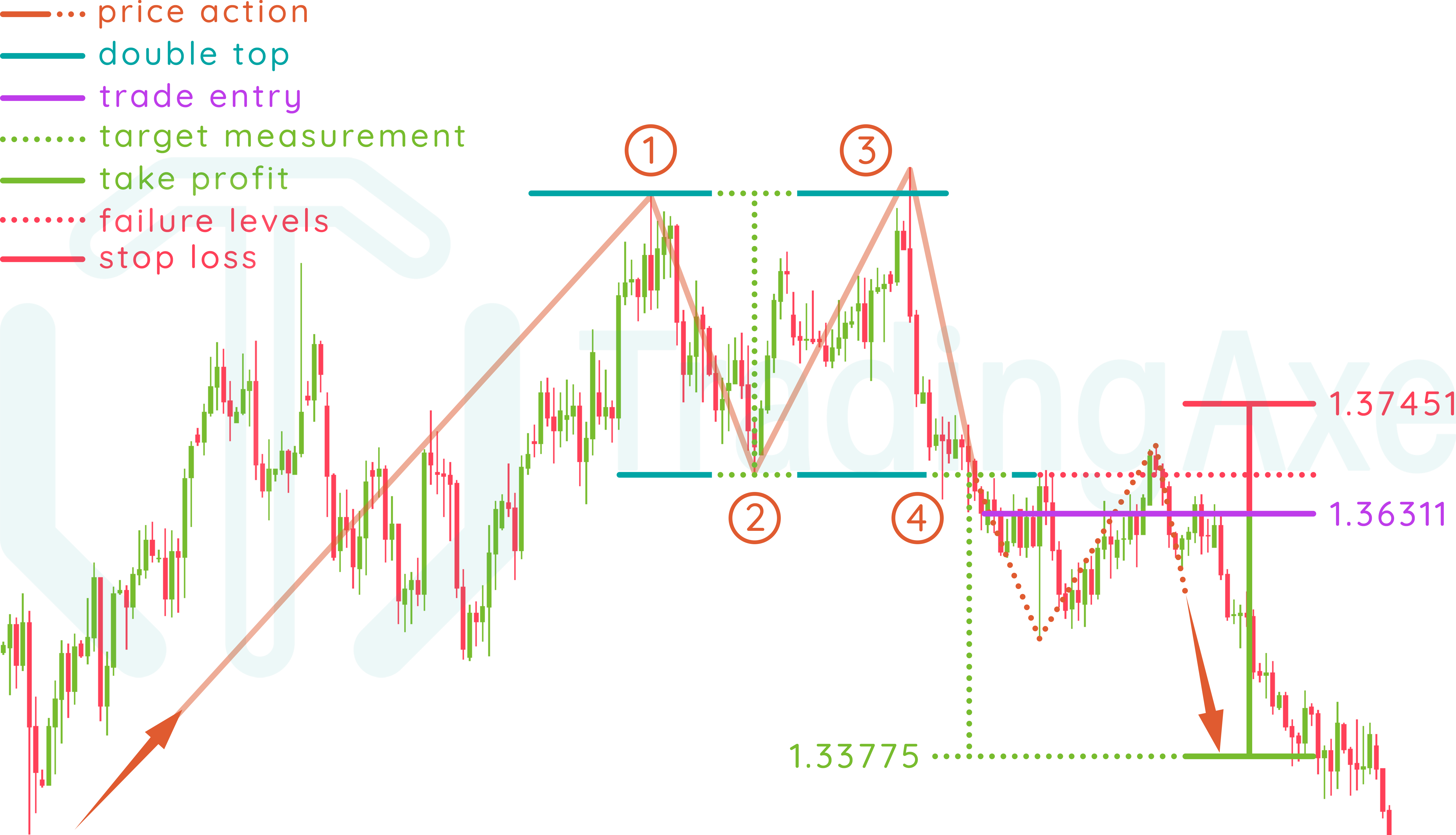

Double Top Bullish Pattern - Web a double top pattern acts as a herald of potential trend reversals in technical analysis, often suggesting a transition from bullish to bearish market phases. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two. What is a double top? The double top pattern entails two high points within a market which signifies an impending bearish reversal. What is a double top in technical analysis? It is formed at the end of an uptrend and indicates a potential downward reversal, which is why it is considered a bearish reversal pattern. The most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. What is a double top? Web namely, double top breakouts on p&f charts are bullish patterns that mark an upside resistance breakout. This chart pattern help traders to exist their trades if they go long on certain instrument and get prepared for. These patterns can occur in various timeframes and on different assets, including crypto, stocks, forex, and. A double top pattern means that the. — double top chart pattern. The upper side of this pattern was at 1.0807, near its highest swing on may 3rd. A double top is a bearish reversal trading pattern. The double top pattern is bearish. Web investopedia / laura porter. The eur/usd exchange rate formed a small evening star candlestick pattern on the 4h chart. It is formed at the end of an uptrend and indicates a potential downward reversal, which is why it is considered a bearish reversal pattern. What is a double top? Web the double top pattern is typically known as a bearish reversal pattern. Double top. Web the double top pattern is a bearish reversal pattern that can be observed at the top of an uptrend and signals an impending reversal. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. Web among these, the technical analysis double. Web double top is a bullish reversal chart pattern. The double top pattern is bearish. The hammer or the inverted hammer. A double top pattern means that the market may reverse from bullish price action to bearish price action. Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a. Web the double top pattern is a bearish reversal pattern that can be observed at the top of an uptrend and signals an impending reversal. The bulls try to push the price twice before giving in to the bears. The creation of an inverse head and shoulders pattern and the daily macd supports the bullish bitcoin scenario. Web a double. It goes up, back down, back up, and down again to form what looks like a letter m. Double top pattern, which looks like the letter ‘m’, is a signal of upcoming prolonged bearish trend. Once it hits this level, the momentum will shift to bullish once again to form the second peak. Web a double top pattern is a. A double top pattern means that the market may reverse from bullish price action to bearish price action. In this potential inverse head and shoulders pattern, btc is completing the right shoulder. Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal. The first peak will come. What is a double top? It shows that the price is about to rise again, which describes a change in a previous trend and a momentum reversal from the most recent leading price. The eur/usd exchange rate formed a small evening star candlestick pattern on the 4h chart. Web trading double tops and double bottoms is a common strategy in. In this potential inverse head and shoulders pattern, btc is completing the right shoulder. The hammer or the inverted hammer. Web trading double tops and double bottoms is a common strategy in technical analysis used by traders to identify potential trend reversal points in financial markets. The eur/usd exchange rate formed a small evening star candlestick pattern on the 4h. What is a double top? The hammer or the inverted hammer. The asset experiences an uptrend and hits a specific price peak, only to come crashing down to its support level or neckline. Web what are double tops? From there, the asset travels up again but peaks at a price shy of the one before. The creation of an inverse head and shoulders pattern and the daily macd supports the bullish bitcoin scenario. From this basic pattern, the bullish breakout patterns become more complex and wider. It is confirmed once the asset price falls below a support level equal to the low between the two prior highs. The double top pattern entails two high points within a market which signifies an impending bearish reversal. It goes up, back down, back up, and down again to form what looks like a letter m. A double top is a bearish reversal trading pattern. What is a double top in technical analysis? These patterns can occur in various timeframes and on different assets, including crypto, stocks, forex, and. Web trading chart ebook double top pattern a double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. Unlike the double bottom formation that looks like the letter “w”, the double top chart pattern. Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal.

The Double Top Trading Strategy Guide

The Common Forex Candlestick Patterns

Double top chart pattern / double Top pattern / chart pattern YouTube

The Ultimate Guide to Double Top and Double Bottom Pattern

How To Trade Double Top Chart Pattern TradingAxe

Double Top Pattern A Forex Trader’s Guide

GBP/USD Double Top & Bullish AB=CD Pattern for FXGBPUSD by AMTrader

Double Top Chart Pattern Profit and Stocks

Forex Double Bottom How To Trade The Double Bottom Chart Pattern Fx

Double Top Forex Trading

Web Bullish Btc Pattern Leads To Breakout.

Web Education Double Top Chart Pattern A Double Top Chart Is A Classic Bullish Reversal, Which Signals End For Bullish Rally.

Web Double Top Is A Bullish Reversal Chart Pattern.

Web Investopedia / Laura Porter.

Related Post: