Stock Double Top Pattern

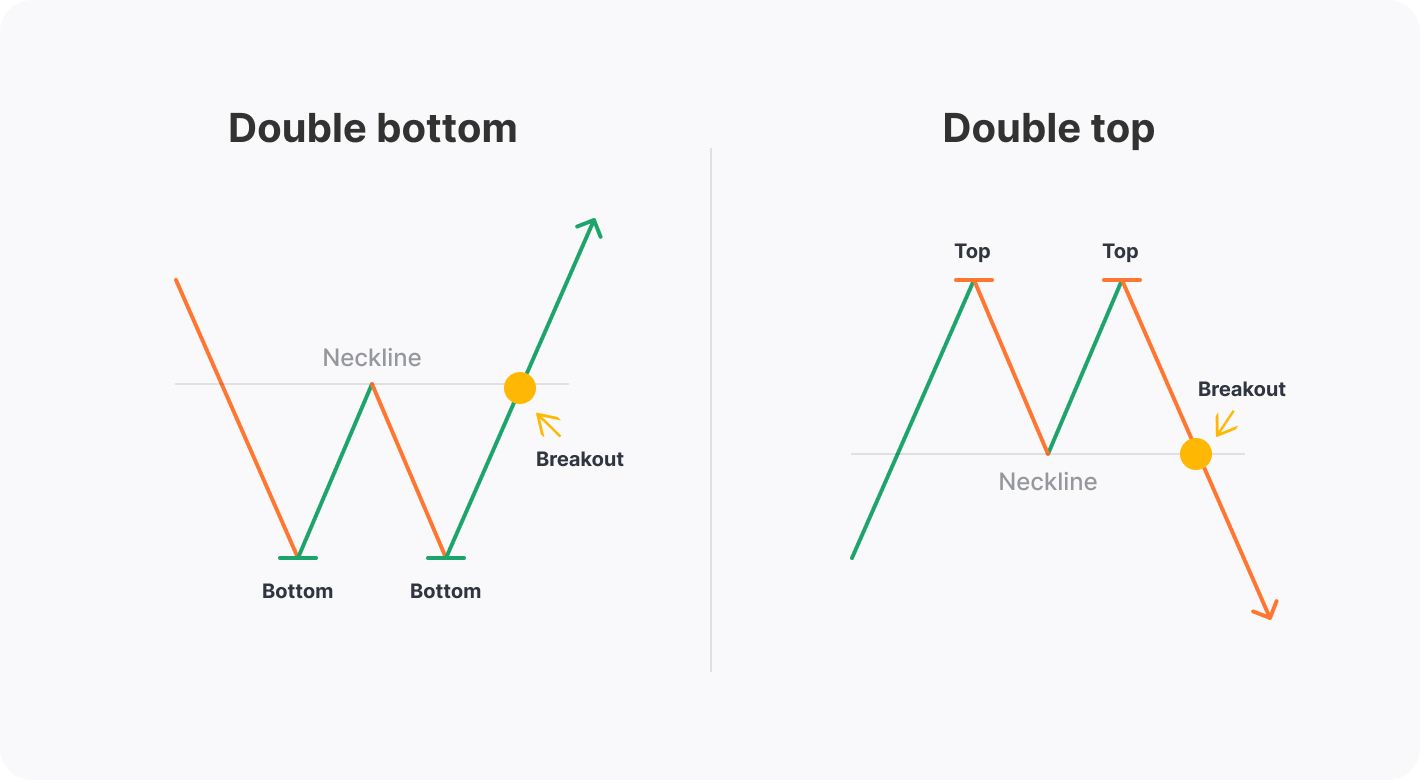

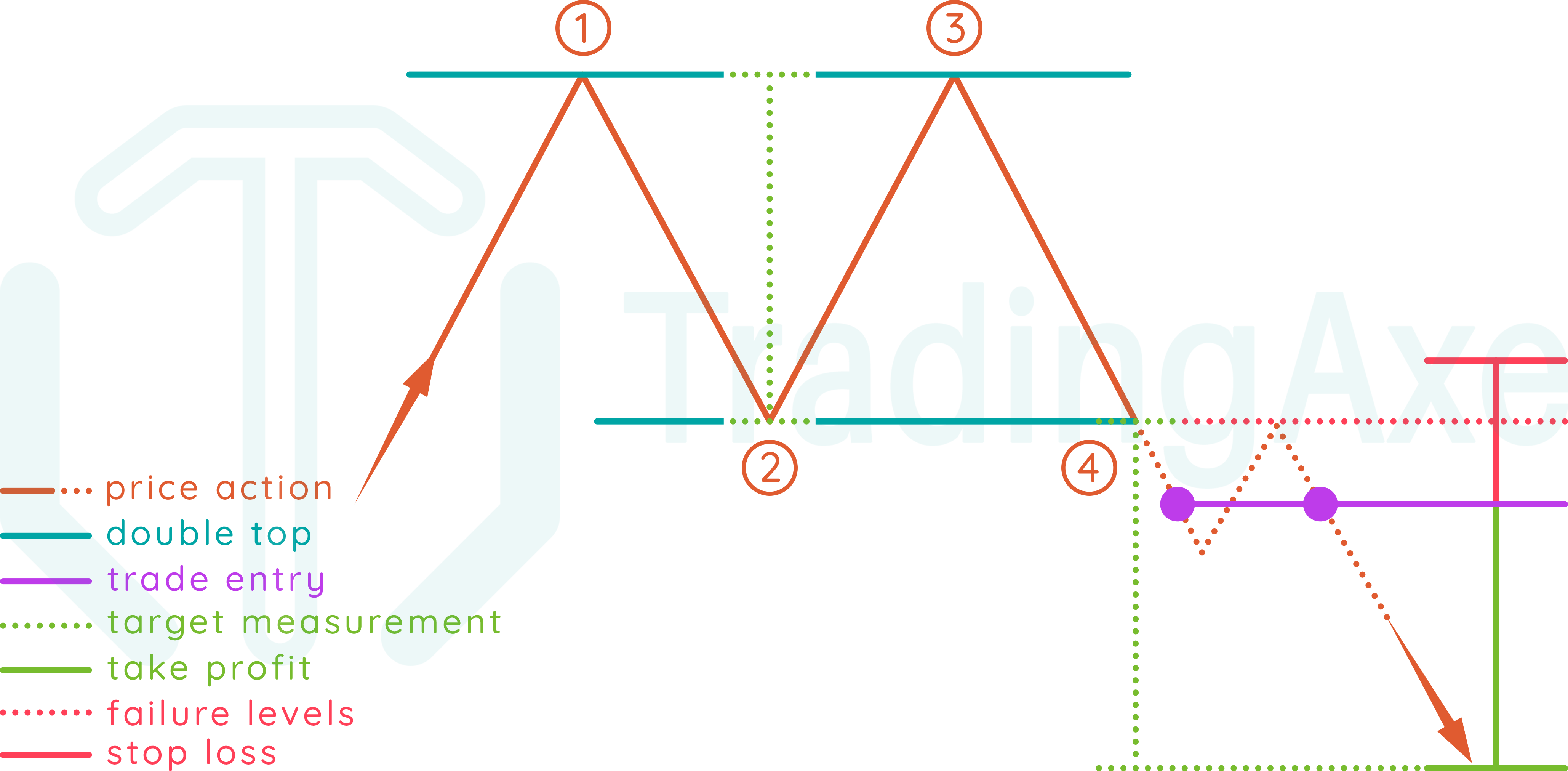

Stock Double Top Pattern - They are formed by twin highs that can’t break above to form new highs. Web double top helps to know the immediate resistance level for a stock. Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal. As you may already know, the double top is a major bearish reversal pattern. Double top pattern, which looks like the letter ‘m’, is a signal of upcoming prolonged bearish trend. A double top or bottom is another reversal pattern, which is common and easily recognized. Web the double top is a popular chart pattern in the stock market technical analysis. It visually represents a period in the market where the price hits a certain high twice, but fails to break through this resistance level. As a result, it is important to correctly analyze this formation. Web april 4, 2024 by finnegan s. What is a double top? The double bottom pattern looks like the letter w.. Web double top is a bearish reversal chart pattern that occurs after a stock reaches similar high prices in two sessions with a drop in price in between. A measured decline in price will occur between the two high points,. Web a double top pattern is. Web a double top is a common bearish reversal chart pattern used in technical analysis. What is double top and bottom? Definition, patterns, and use in trading. A double top or bottom is another reversal pattern, which is common and easily recognized. What is a double top? Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal. The converse is true for down trends. They are formed by twin highs that can’t break above to form new highs. As you may already know, the double top is a major bearish reversal pattern. Web double. There are a few requirements to classify a chart pattern as a double top: A measured decline in price will occur between the two high points,. The double top pattern is formed when two peaks are formed at approximately the same level and the price closes below this level on two consecutive occasions. Web double top pattern: The double top. Web the double top pattern entails two high points within a market which signifies an impending bearish reversal signal. Double top pattern, which looks like the letter ‘m’, is a signal of upcoming prolonged bearish trend. Learn how to use the double top charting formation to make risk contained and reward focused trades selling breakouts past the confirmation line. Web. Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal. Web the double top is a chart pattern with two swing highs very close in price. For investors and traders looking to navigate the complexities of the stock market, understanding technical patterns is crucial. Web the double. A double top or bottom is another reversal pattern, which is common and easily recognized. * a prior uptrend sets a new high, usually on increased volume. Typically, when the second peak forms, it can’t break above the first peak and causes a double top failure. After a strong downtrend, the market bounces higher. They are formed by twin highs. The double top pattern is formed when two peaks are formed at approximately the same level and the price closes below this level on two consecutive occasions. Web april 4, 2024 by finnegan s. [1] [2] double top confirmation. It visually represents a period in the market where the price hits a certain high twice, but fails to break through. There are a few requirements to classify a chart pattern as a double top: Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. The design is used to identify a potential trend reversal. Web the double top reversal is a bearish reversal pattern typically found on. This observation applies in any of the three trends; A measured decline in price will occur between the two high points,. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. A stock double top emerges as a prominent figure in the tapestry of market trends, often serving as a. The design is used to identify a potential trend reversal. Web double top pattern is an bearish signal in technical analysis whereas double bottom is a bullish setup. These reversal chart patterns take a longer period to be formed. What is double top and bottom? Note that a double top reversal on a bar or line chart is completely different from a double top. This observation applies in any of the three trends; Double top resembles the m pattern and indicates a bearish reversal whereas double bottom resembles the w pattern and indicates a bullish reversal. They are formed by twin highs that can’t break above to form new highs. Web a double top is a common bearish reversal chart pattern used in technical analysis. Web a double bottom pattern consists of three parts: Two peaks that are near equal in price. Web the double top reversal is a bearish reversal pattern typically found on bar charts, line charts, and candlestick charts. In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse. Between these two peaks, the price declines, which creates a support level or neckline. Web double top pattern: A double top is an extremely bearish technical reversal pattern that forms after a stock makes two consecutive peaks.

A Comprehensive Guide to Double Top Pattern Trading Market Pulse

The Double Top Trading Strategy Guide

How to Identify a Double Top Stock Chart Pattern? StockManiacs

What Is A Double Top Pattern? How To Trade Effectively With It

:max_bytes(150000):strip_icc()/dotdash_Final_Double_Top_Definition_Oct_2020-02-24bead3ae99c4462b24745f285bb6515.jpg)

Double Top Definition, Patterns, and Use in Trading

Double Top Chart Pattern Profit and Stocks

Double Top Pattern A Forex Trader’s Guide

Double Top Pattern Your Complete Guide To Consistent Profits

Double Top Pattern Definition How to Trade Double Tops & Bottoms?

How To Trade Double Top Chart Pattern TradingAxe

[1] [2] Double Top Confirmation.

Web The Double Top Is A Popular Chart Pattern In The Stock Market Technical Analysis.

Web A Double Top Pattern Consists Of Several Candlesticks That Form Two Peaks Or Resistance Levels That Are Either Equal Or Near Equal Height.

A Measured Decline In Price Will Occur Between The Two High Points,.

Related Post: