Double Bottom Pattern Meaning

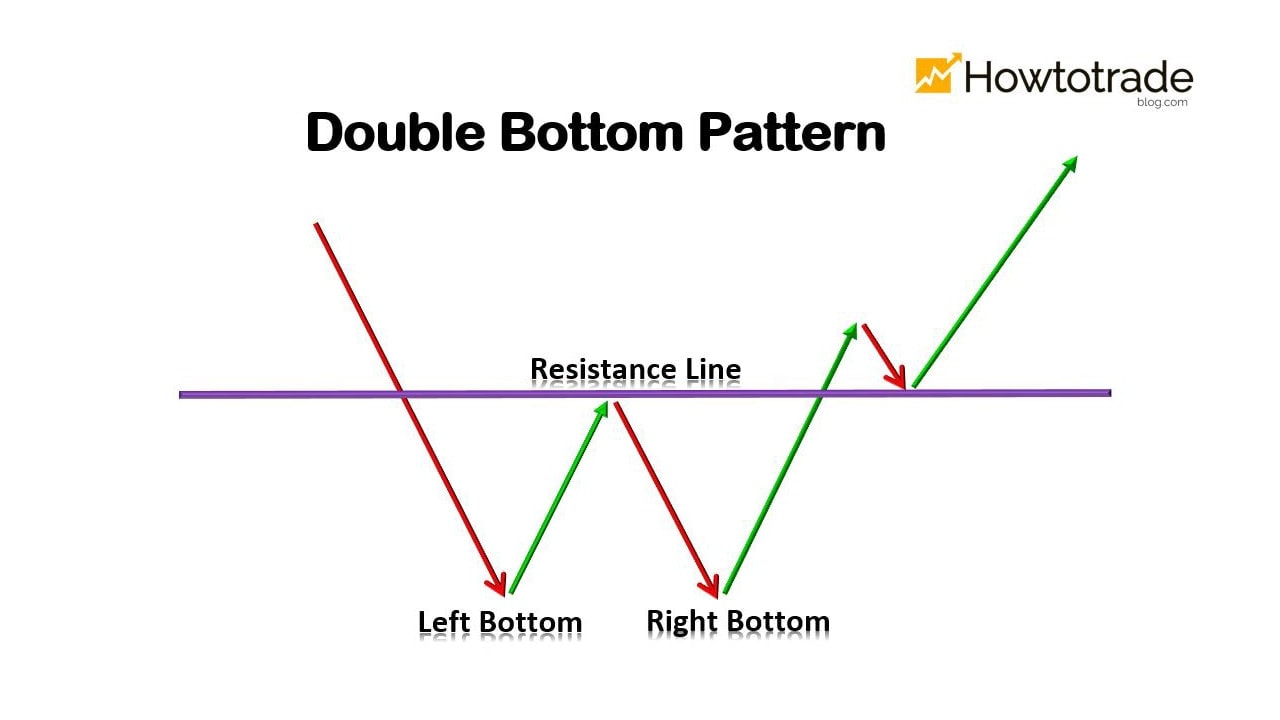

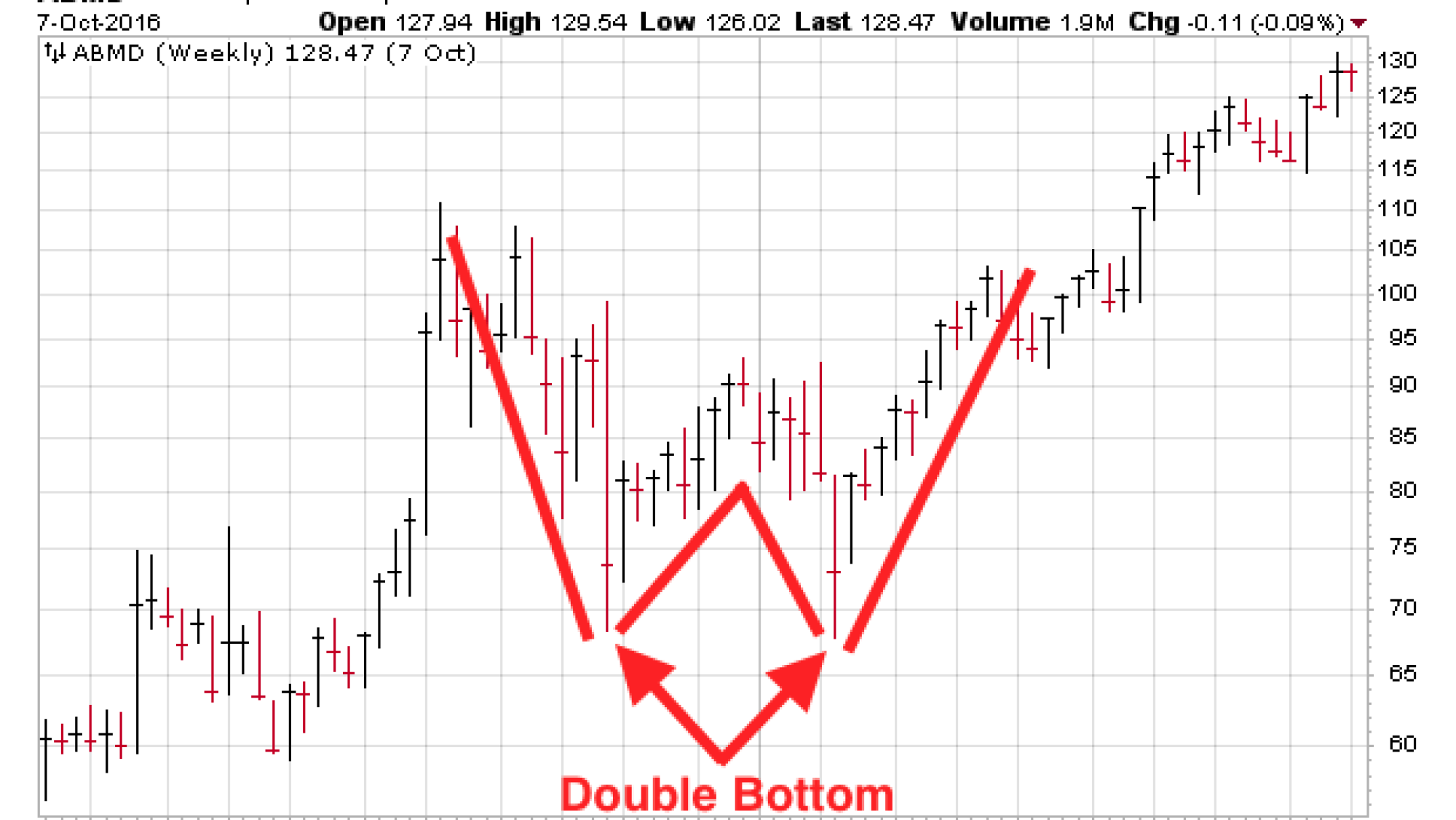

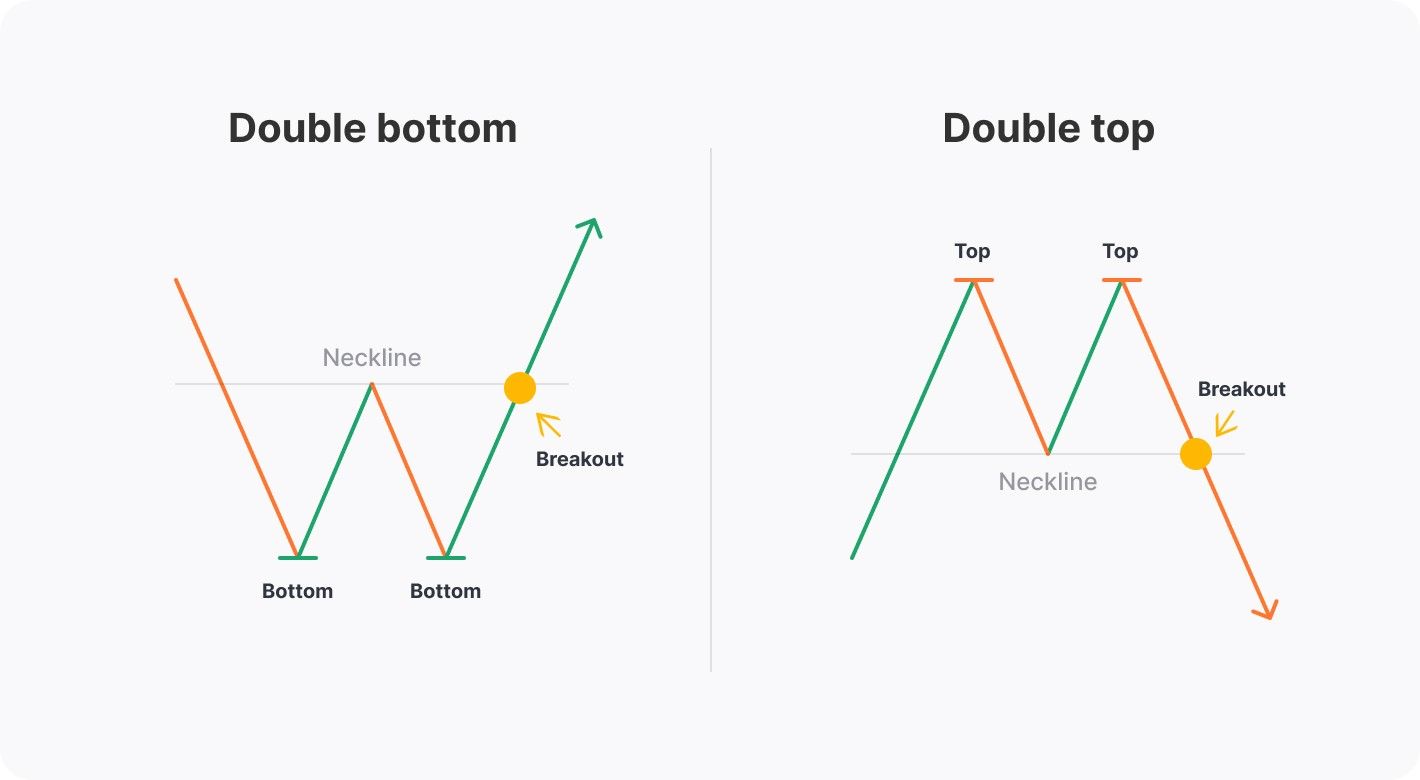

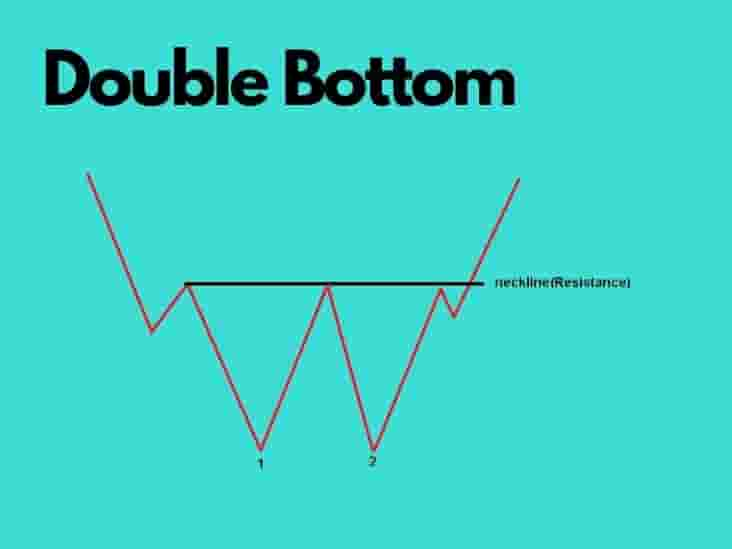

Double Bottom Pattern Meaning - Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. Web the double bottom pattern is a bullish reversal pattern that forms after a downtrend. Web when a double top or double bottom chart pattern appears, a trend reversal has begun. It is identical to the double top, except for the inverse relationship in price. The psychology behind why it forms in the market. Web what is the double bottom pattern? Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks,. Let’s learn how to identify these chart patterns and trade them. This pattern signals a possible shift from a downtrend. Web the double bottom pattern is considered a bullish reversal pattern because the pattern is initiated by a downtrend and finalized in an uptrend. The psychology behind why it forms in the market. The pattern is formed by two price. But how to identify and. A double bottom pattern is a technical analysis charting formation that shows a major change. Web the double bottom pattern is considered a bullish reversal pattern because the pattern is initiated by a downtrend and finalized in an uptrend. Web a double bottom is a bullish reversal trading pattern that consists of two market bottoms that form around the same level, which are followed by a breakout to. The two entry methods you can use.. The two entry methods you can use. It is identical to the double top, except for the inverse relationship in price. The psychology behind why it forms in the market. It consists of two consecutive troughs, or valleys, which are separated by a peak in between Web the double bottom pattern is a bullish reversal pattern that forms after a. A 3 step guide to trading the pattern. The pattern is formed by two price. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so. Web the double bottom pattern is a bullish reversal chart pattern that occurs. The pattern is formed by two price. Web a double bottom is the end formation in a declining market. Web a double bottom is a bullish reversal trading pattern that consists of two market bottoms that form around the same level, which are followed by a breakout to. But how to identify and. Web the double bottom shows chart patterns. A 3 step guide to trading the pattern. But how to identify and. A double bottom pattern is a technical analysis charting formation that shows a major change in trend and a momentum reversal from a prior down move in market trading. Web a double bottom is a bullish reversal trading pattern that consists of two market bottoms that form. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. The psychology behind why it forms in the market. Web the double bottom pattern is considered a bullish reversal pattern because the pattern is initiated by a downtrend and finalized in an uptrend. It is. But how to identify and. Web the double bottom pattern is considered a bullish reversal pattern because the pattern is initiated by a downtrend and finalized in an uptrend. It is identical to the double top, except for the inverse relationship in price. It indicates that after two lows, there will be a significant increase in price. The pattern is. It is identical to the double top, except for the inverse relationship in price. But how to identify and. A double bottom pattern is a technical analysis charting formation that shows a major change in trend and a momentum reversal from a prior down move in market trading. Web when a double top or double bottom chart pattern appears, a. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks,. The double bottom pattern is a momentum trading signal that’s used to predict when a downtrend might be. A 3 step guide to trading the pattern. Web the double bottom pattern stands as a key concept. Web the double bottom pattern is a bullish reversal pattern that forms after a downtrend. This pattern signals a possible shift from a downtrend. Web a double bottom pattern is a stock chart formation used in technical analysis for identifying and executing profitable trades, commonly to trade stocks,. The double bottom pattern is a momentum trading signal that’s used to predict when a downtrend might be. Web when a double top or double bottom chart pattern appears, a trend reversal has begun. Web what is the double bottom pattern? Web the double bottom shows chart patterns of a downtrend, a reversal pattern upward, another dip to a second bottom, and a final trend reversal that moves upward. It consists of two consecutive troughs, or valleys, which are separated by a peak in between A 3 step guide to trading the pattern. Web the double bottom pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the sellers, who were in control of the price action so. Web a double bottom is a bullish reversal trading pattern that consists of two market bottoms that form around the same level, which are followed by a breakout to. Web a double bottom is the end formation in a declining market. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. A double bottom pattern is a technical analysis charting formation that shows a major change in trend and a momentum reversal from a prior down move in market trading. Let’s learn how to identify these chart patterns and trade them. But how to identify and.

What Is A Double Bottom Pattern? How To Use It Effectively How To

Double Bottom Pattern How to Trade Stocks and Crypto Llitefinance

Double Bottom Chart Pattern 101 Should You Invest? Cabot Wealth Network

The Double Bottom Pattern Trading Strategy Guide

How to Trade Double Bottom Pattern A StepByStep Guide Trade

Learn About The Double Bottom Pattern ThinkMarkets EN

A double bottom represents a bullish chart pattern that is shaped in a

Double Bottom Pattern A Trader’s Guide

A Comprehensive Guide to Double Bottom Pattern Trading

Double Bottom Chart Pattern Definition With Examples

It Describes The Drop Of A Security Or Index, A Rebound, Another Drop To The Same Or Similar Level As The Original Drop, And Another.

It Is Identical To The Double Top, Except For The Inverse Relationship In Price.

Web The Double Bottom Pattern Is A Bullish Reversal Pattern That Occurs At The Bottom Of A Downtrend And Signals That The Sellers, Who Were In Control Of The Price Action So.

Web The Double Bottom Pattern Stands As A Key Concept In Technical Analysis, Often Seen As A Precursor To A Bullish Reversal.

Related Post: