Bullish Bat Pattern

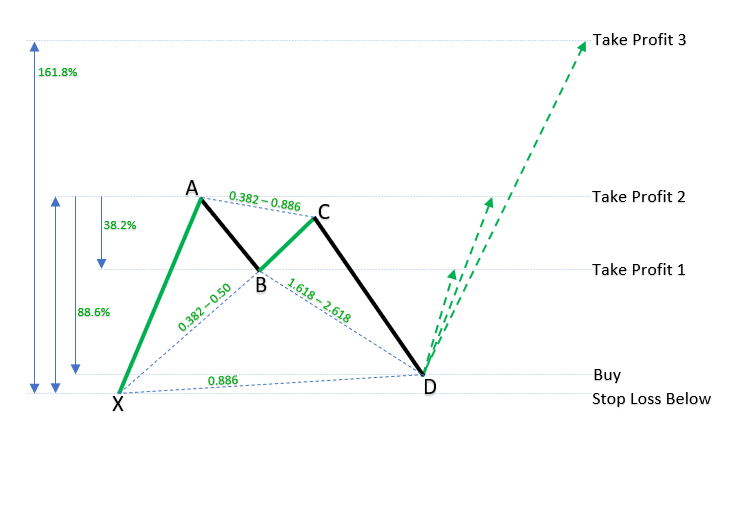

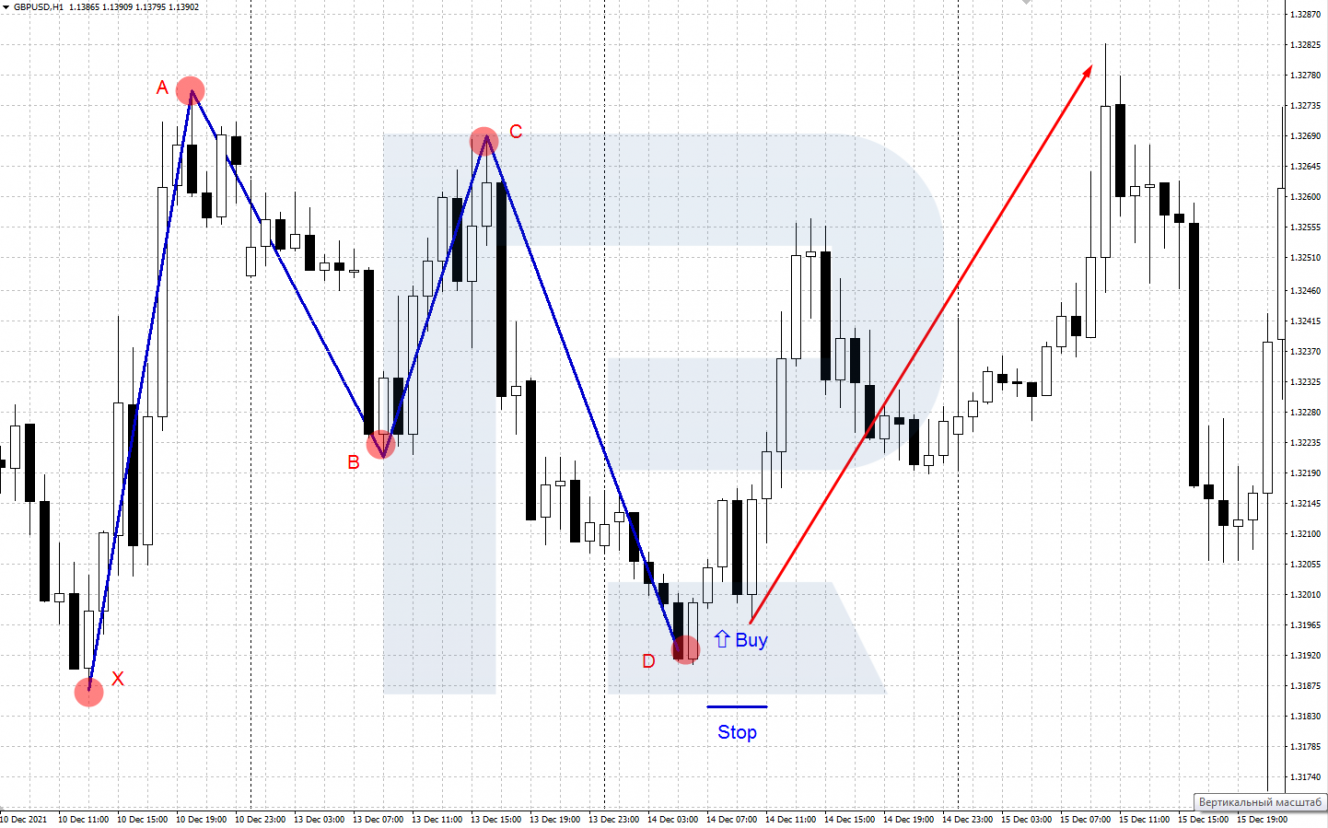

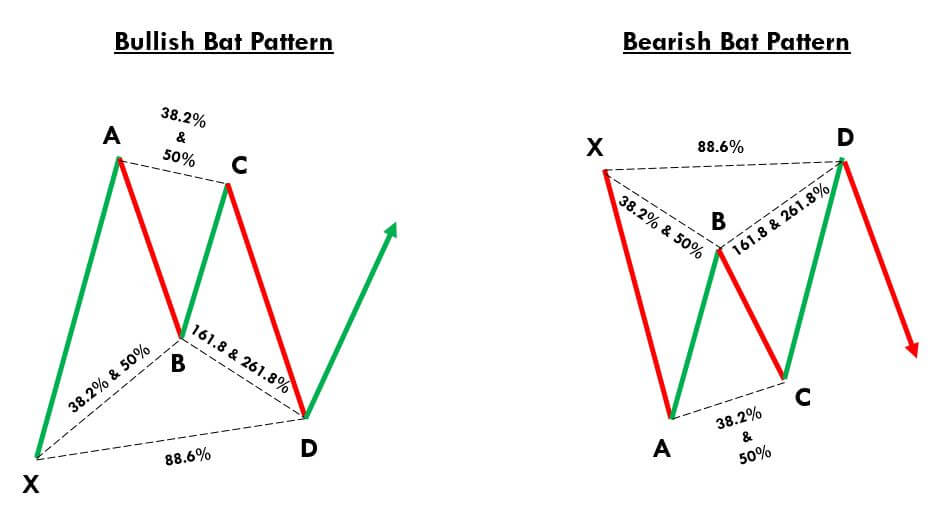

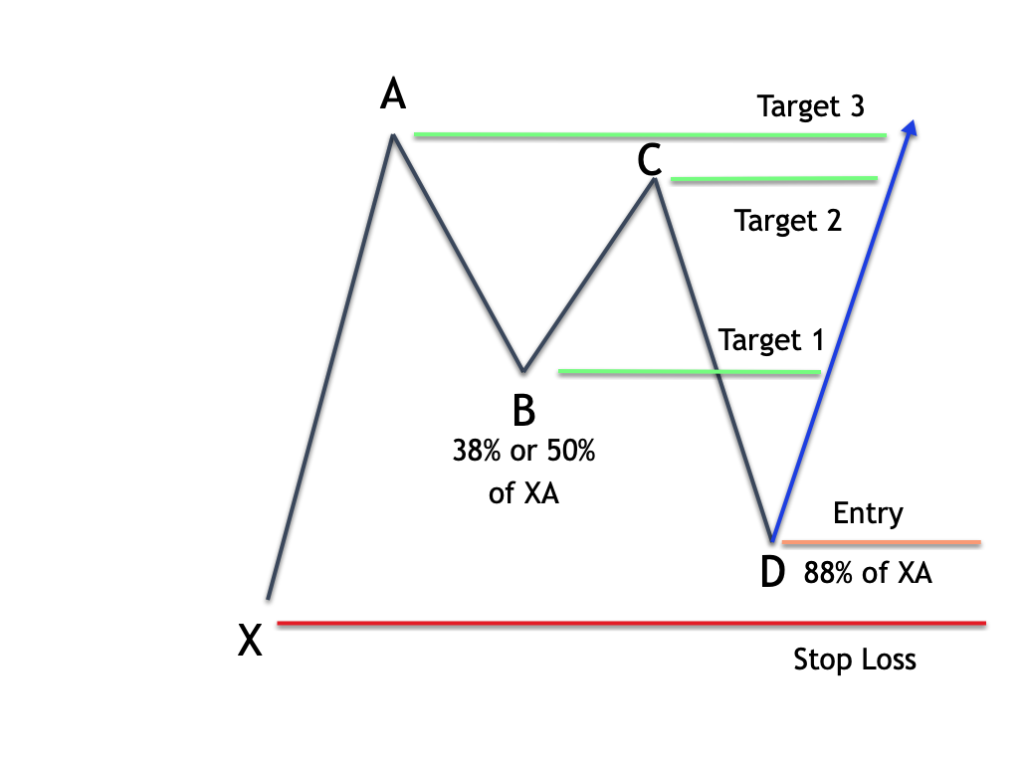

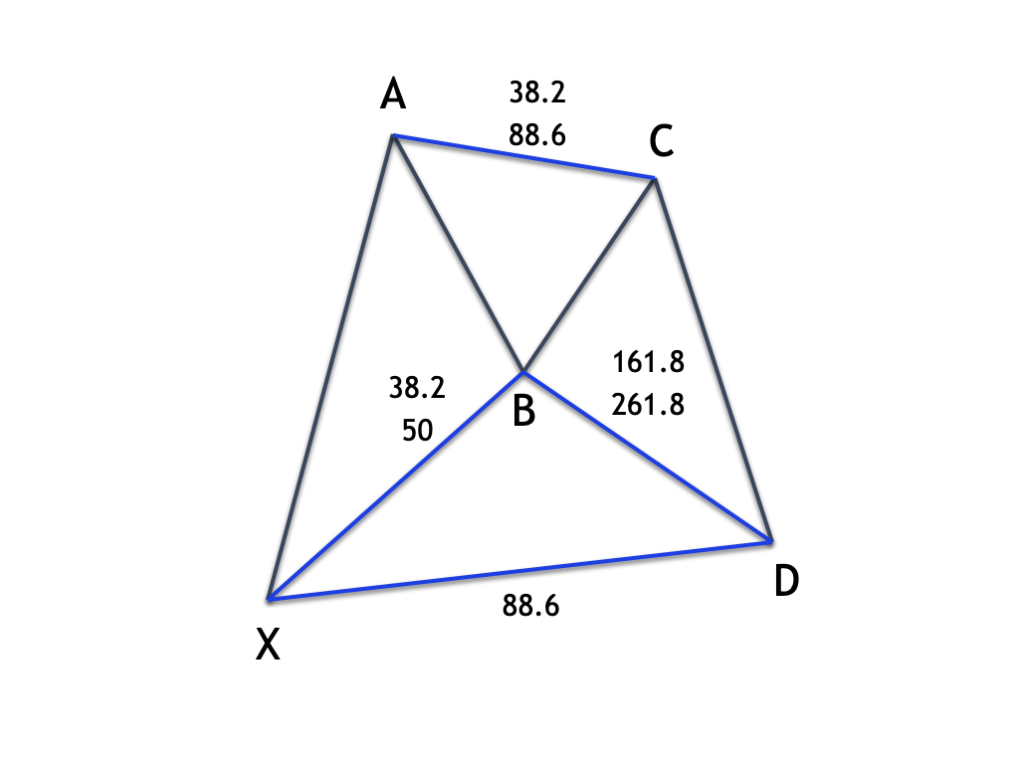

Bullish Bat Pattern - Web a proper bat pattern needs to fulfill the below criteria. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. Notice on the above illustration of the bullish bat pattern, the initial xa leg is bullish, and kicks off the. You can see that point b is at about the 61.8% retracement of xa. Web the bat pattern is a retracement and continuation pattern that occurs when a trend temporarily reverses its direction but then continues on its original course. When trading the harmonic bat pattern, traders enter a position at point d. Explore this fascinating harmonic for. Web a widely followed crypto strategist believes that bitcoin (btc) can skyrocket over 337% based on a classical chart pattern. The bat harmonic pattern follows different fibonacci ratios. One of the key ways to differentiate a bat structure from a cypher pattern is the b point which, if it doesn’t go beyond the 50% fibonacci retracement of the xa leg then it’s a bat, otherwise it can turn into a cypher structure. Secondly, bullish divergences in both the rsi and macd (green) accompanied the most recent bounces. The outlines of these patterns are the same, the difference is in fibonacci ratios that define the positions of the main points. Web the bat is a harmonic trend reversal pattern that has specific fibonacci ratios. Explore this fascinating harmonic for. One of the major. Web the bat pattern, is a precise harmonic pattern discovered by scott carney in 2001. The aforementioned gartley pattern is one of the more popular harmonic patterns technical analysts use. Web firstly, shib has created what resembles a triple bottom pattern inside the $0.000022 support area. The bat utilizes a minimum 1.618bc projection. Web the bat pattern is a variation. • a green candle is one that closes with a close price equal to or above the price it opened. The bat utilizes a minimum 1.618bc projection. Web bat patterns can be bearish and bullish. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50. Web. Your stop loss level can be. The b point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the xa leg. The aforementioned gartley pattern is one of the more popular harmonic patterns technical analysts use. Besides being a bullish pattern, the triple bottom is combined with long lower wicks (green icons). • a red candle. • a red candle is one that closes with a close price that is lower than the price it opened. Web bat harmonic pattern | bullish pattern | perfect take profitunlock the beauty of the bat harmonic pattern setting 🦇📈! The bat utilizes a minimum 1.618bc projection. Secondly, bullish divergences in both the rsi and macd (green) accompanied the most. Web i'd be happy to explain the bullish bat pattern to you as if you were 10 years old! Besides being a bullish pattern, the triple bottom is combined with long lower wicks (green icons). Scott carney, who first recognized the bat pattern, suggests that a 50% retracement at b is the best signal. The ab wave is a 38.2%. It's very rare, and you'll need a computer with pattern recognition software to fine it. The bat harmonic pattern follows different fibonacci ratios. Web the bearish bat pattern, in particular, relies on an optimal fibonacci level of 88.6% retracement at the ab swing, promising fruitful ventures when these criteria align seamlessly with market movements. Web bullish bat patterns are corrective. Web the bat pattern can be a bullish formation, or a bearish formation. Your stop loss level can be. The pattern incorporates the 0.886xa retracement, as the defining element in the potential reversal zone (prz). Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. The bc wave can be either a. Looking at the trader’s chart, he seems to suggest that bitcoin looks bullish following a fakeout to the downside. The b point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the xa leg. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. The head and shoulders pattern is exactly. The aforementioned gartley pattern is one of the more popular harmonic patterns technical analysts use. Bullish gartley patterns are shaped like m’s, while bearish gartley patterns are. Web the bullish bat often resembles a big m chart pattern except that the turns are located using fibonacci ratios. The pattern incorporates the 0.886xa retracement, as the defining element in the potential. These divergences usually lead to. The ab wave is a 38.2% or 50.0% retracement of the xa wave. Web harmonic bat pattern trading rules. When trading the harmonic bat pattern, traders enter a position at point d. Web the bearish bat pattern, in particular, relies on an optimal fibonacci level of 88.6% retracement at the ab swing, promising fruitful ventures when these criteria align seamlessly with market movements. Web i'd be happy to explain the bullish bat pattern to you as if you were 10 years old! When the pattern terminates at the d point of the pattern, the pattern ends and price. The pattern incorporates the 0.886xa retracement, as the defining element in the potential reversal zone (prz). Scott carney, who first recognized the bat pattern, suggests that a 50% retracement at b is the best signal. The criteria for identifying the bat pattern are as follows: The aforementioned gartley pattern is one of the more popular harmonic patterns technical analysts use. It can give you the opportunity to enter the market at a good price, just as the pattern ends and the trend resumes, and has a bullish and bearish version. The outlines of these patterns are the same, the difference is in fibonacci ratios that define the positions of the main points. Web bat patterns can be bearish and bullish. And, in a bearish bat, c can retrace. Web this indicator automatically draws bullish bat harmonic patterns and price projections derived from the ranges that constitute the patterns.

Harmonic Bat Pattern in Forex The Most Powerful Harmonics Scanner

Bat Pattern Guide How to Use Bullish and Bearish Bat Pattern

Harmonic Chart Bat Pattern Forex Strategy Indicator Mt4 Trading Charts

Tips For Trading The Harmonic Bat Pattern Forex Training Group

Bullish BAT pattern complete for FXGBPJPY by vmanena — TradingView

GBPAUD Bullish Bat Pattern (H4) for FXGBPAUD by lukeboland — TradingView

How to Trade the Bat Harmonic Pattern (Trading Strategy)

Tips For Trading The Harmonic Bat Pattern Forex Training Group

Bullish bat trading harmonic patterns Royalty Free Vector

![Bat Pattern in Technical Analysis [Trading Guide] TradeVeda](https://tradeveda.com/wp-content/uploads/2021/02/Bullish-Bat.png)

Bat Pattern in Technical Analysis [Trading Guide] TradeVeda

It Resembles A Baseline With Three Peaks With The Middle Topping The Other Two.

Web A Proper Bat Pattern Needs To Fulfill The Below Criteria.

The Xa Wave Is A Normal Price Swing In The Upward Or Downward Direction.

Web The Bat Pattern Can Be A Bullish Formation, Or A Bearish Formation.

Related Post: