Diamond Pattern Stocks

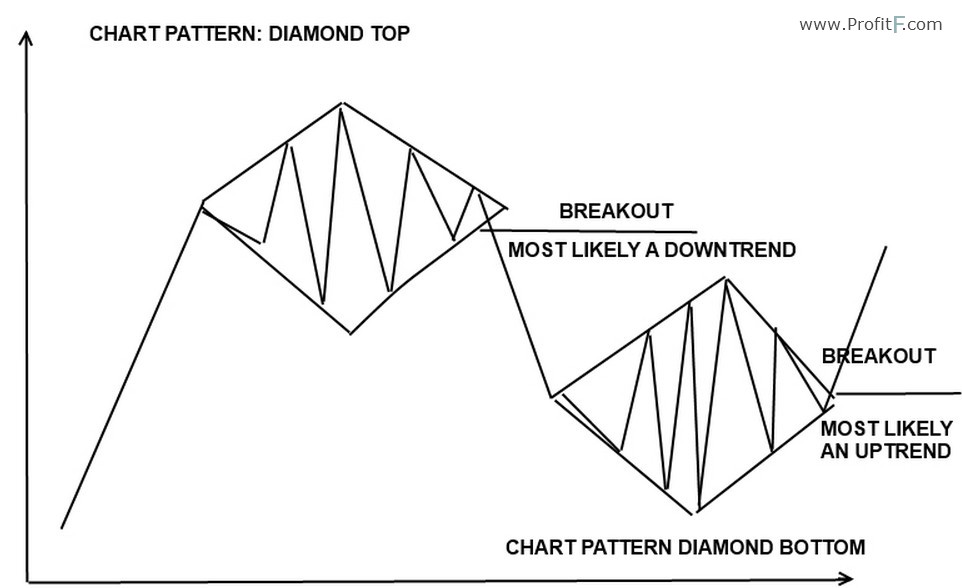

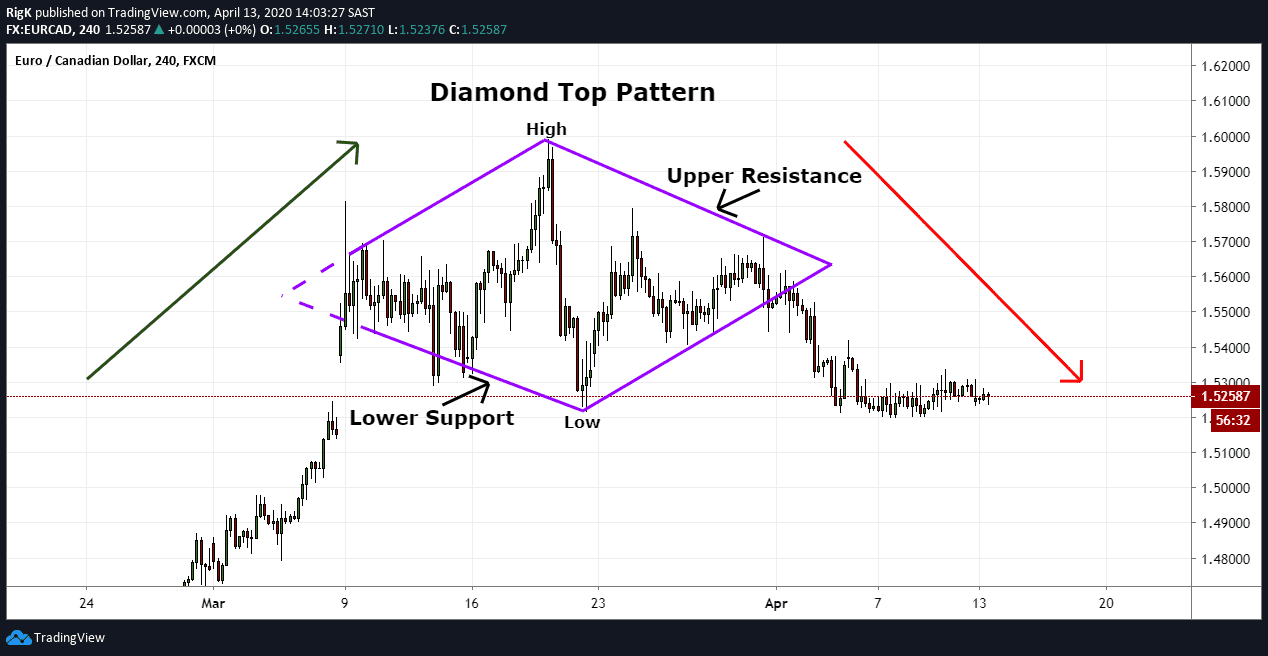

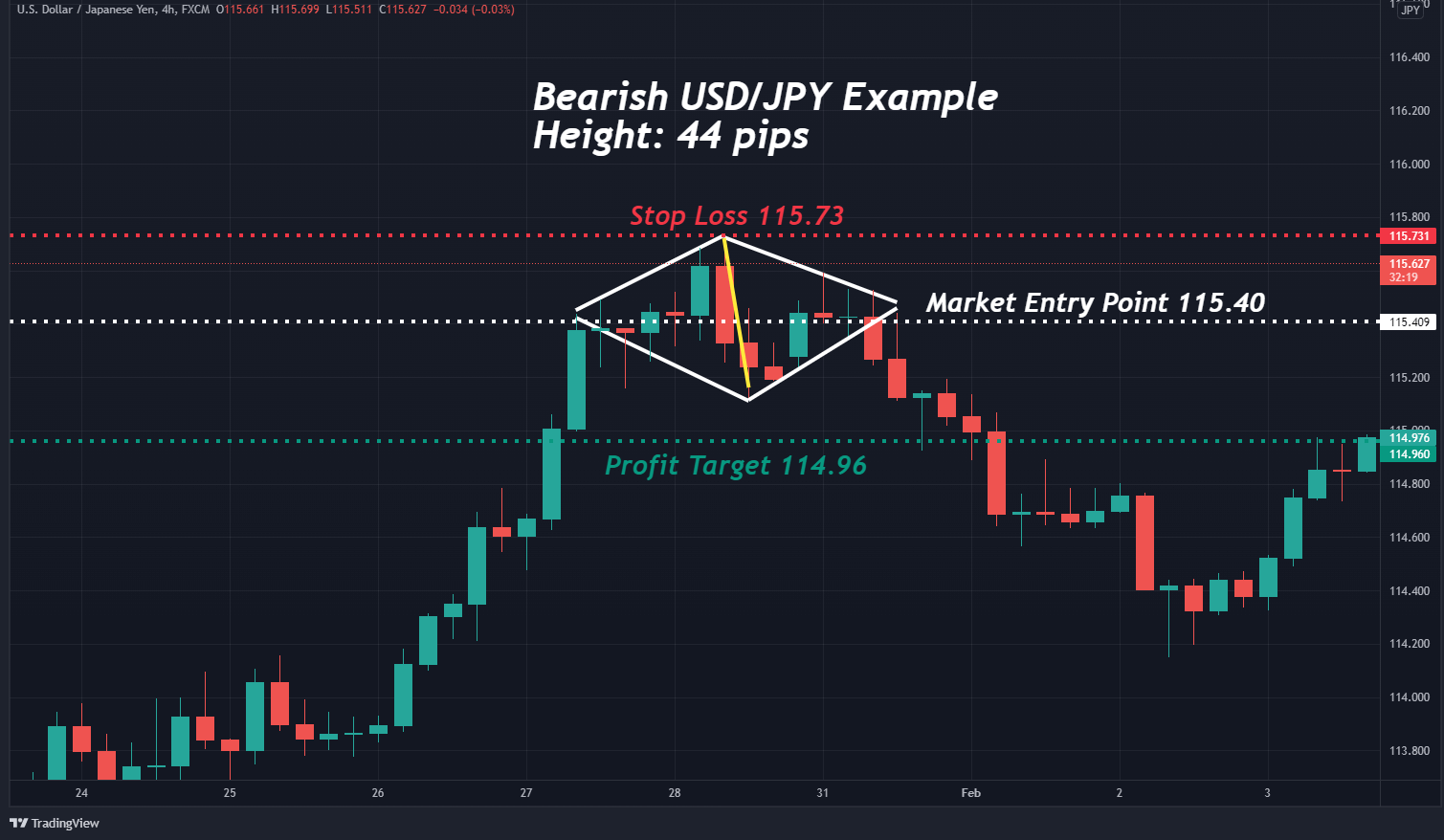

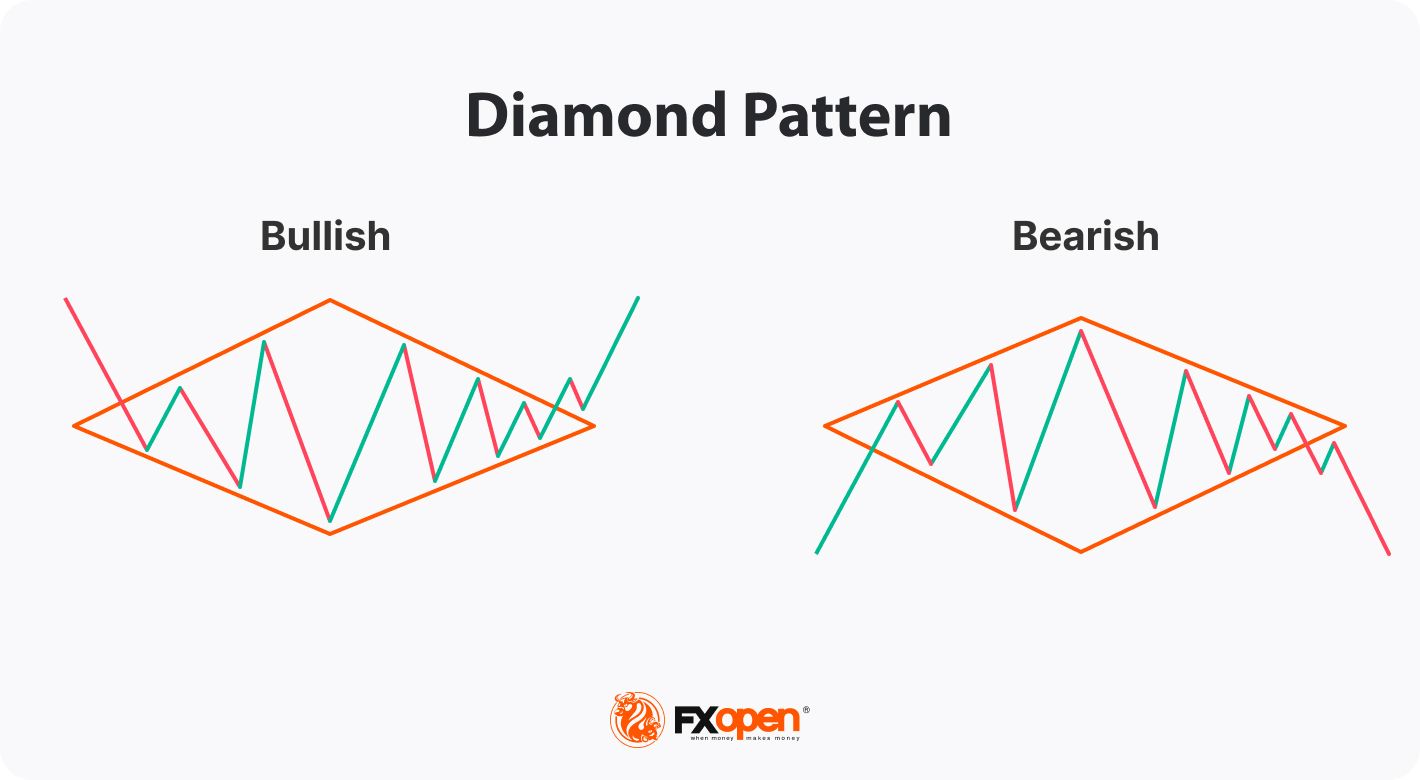

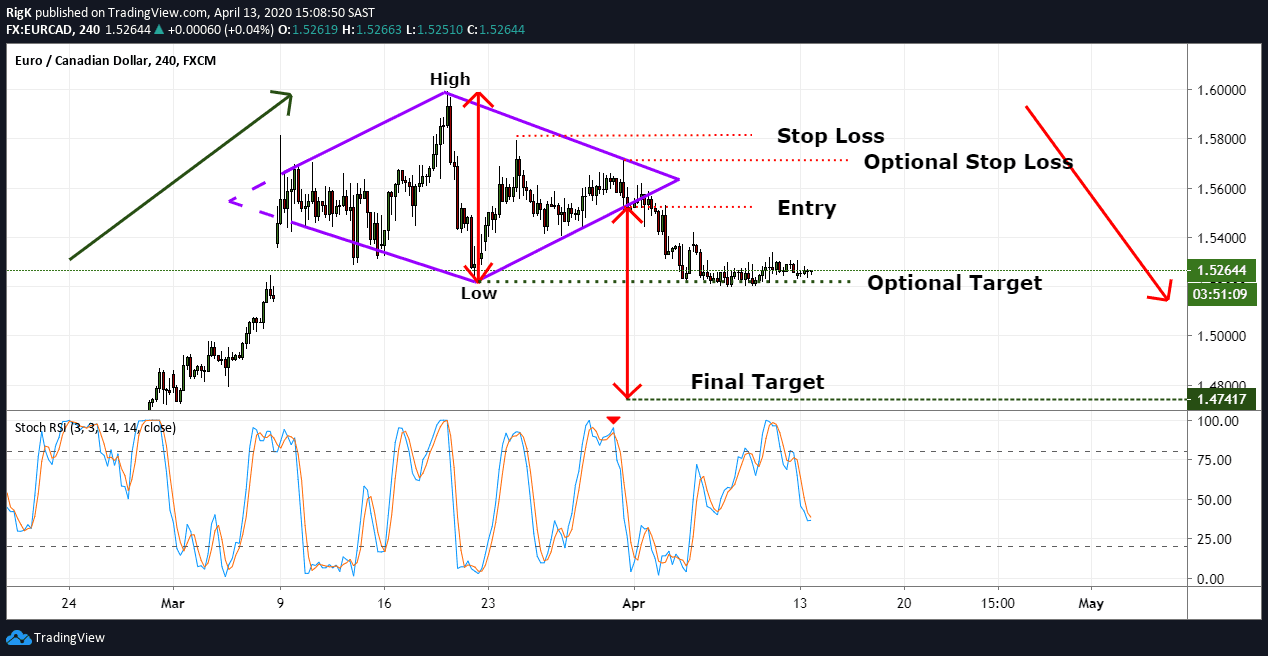

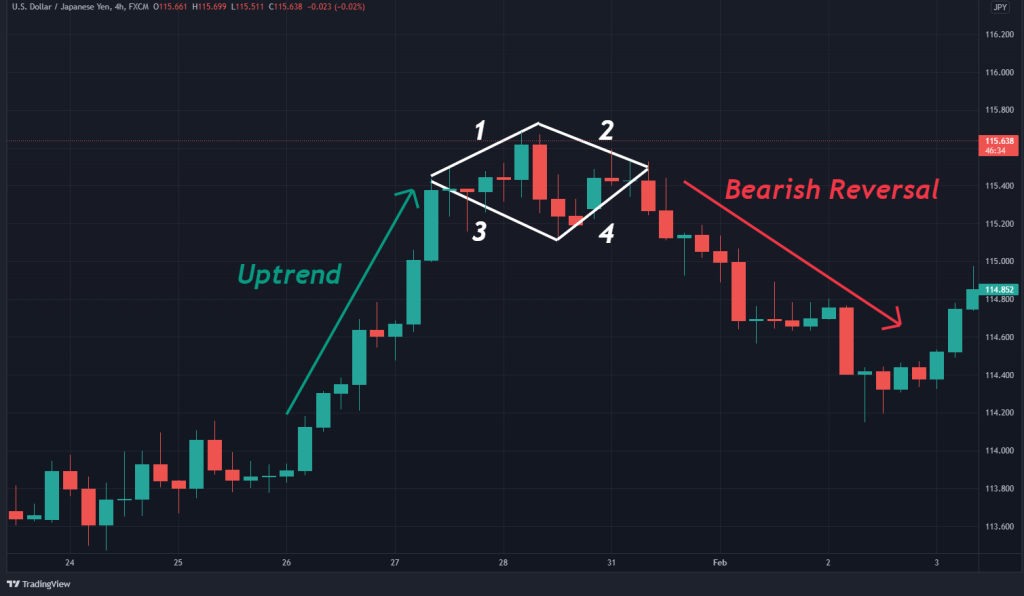

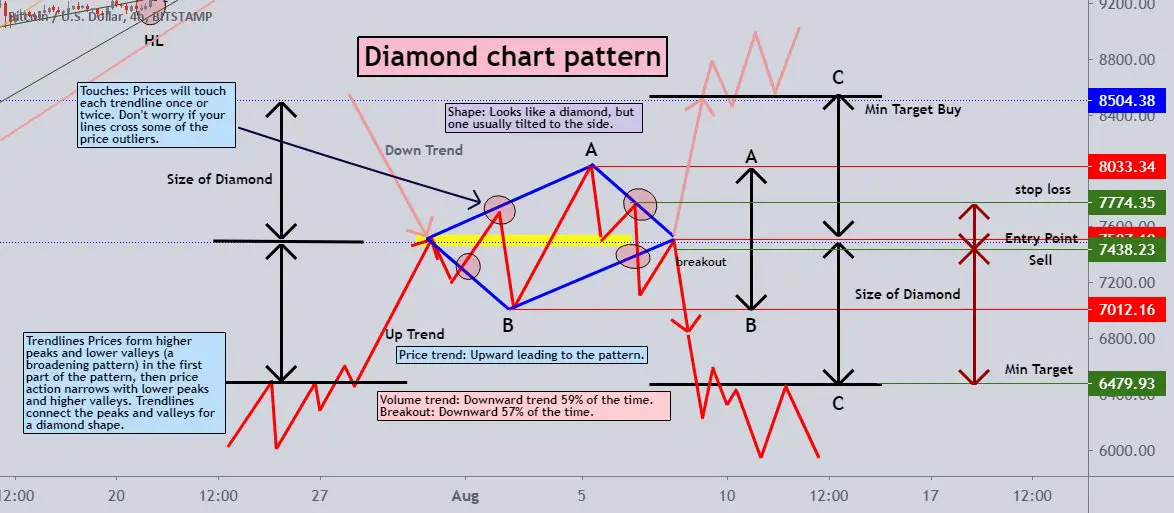

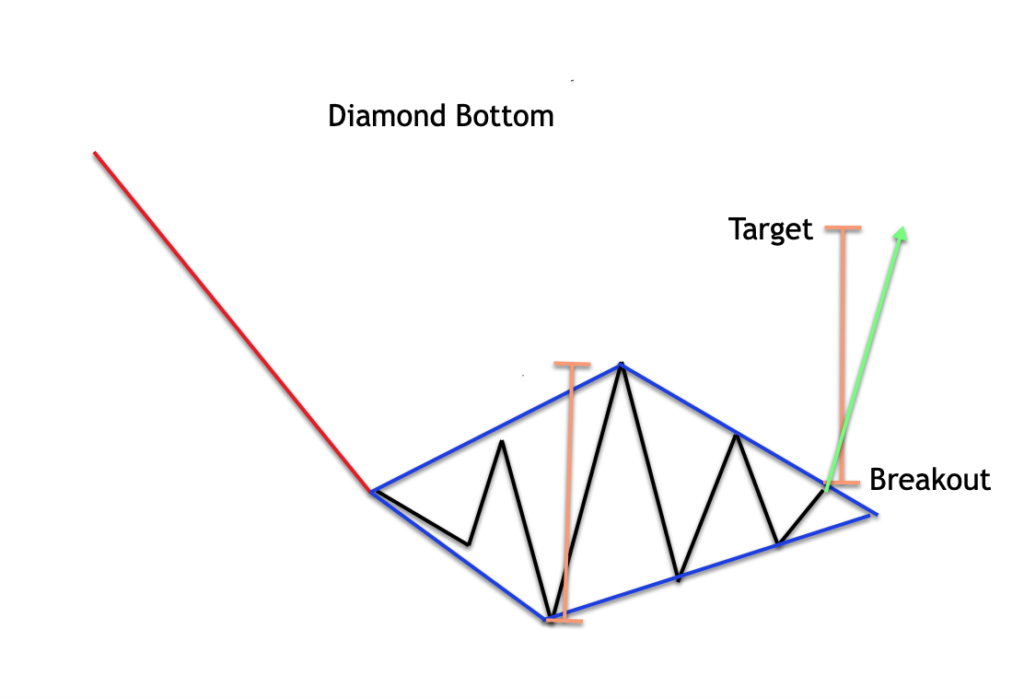

Diamond Pattern Stocks - The diamond chart pattern is actually two patterns — diamond tops and diamond patterns. A diamond bottom is formed by two juxtaposed symmetrical triangles, so forming a diamond. Web diamond top formation: One places a stop loss above the diamond top pattern. Web the diamond pattern in trading is a significant reversal chart formation, signaling potential trend reversals. In this article, we will look at what this chart pattern is, its characteristics and how you can use. A technical analysis reversal pattern that is used to signal the end of an uptrend. This pattern, resembling a diamond shape, is recognized for its rarity and the powerful signal it provides, often occurring at major market tops and bottoms. Bdtx may be one such company. A diamond bottom has to be preceded by a bearish trend. It is a very strong indicator, which can be used to trade both the long and short positions. Web a diamond top formation, a technical pattern often observed near market peaks, signifies a potential reversal of an uptrend. You can extend profits by simply adding a volume weighted moving average. In this article, we will take a look at the. This causes the first round of consolidation. This pattern is not only useful in forex but also in: Web the diamond pattern is one of the most popular formations in trading. Web one mobility player adjusts its financial planning based on pricing patterns it observes in the market. Usually you can identify it at market tops and can signal a. Usually you can identify it at market tops and can signal a reversal of an uptrend.its name comes from the fact that it has a close resemblance to a physical diamond. You can extend profits by simply adding a volume weighted moving average. Diamond patterns can predict both bullish and bearish reversals. Mcdonald’s corp (nyse:mcd) has recently formed a death. This is done as follows: Place a stop loss order above the last top inside the diamond shape on the chart. After a large movement, investors are eager either to take profits (bullish) or to short (bearish). Usually you can identify it at market tops and can signal a reversal of an uptrend.its name comes from the fact that it. It resembles a diamond shape on the chart. In technical analysis, the diamond pattern is a formation that can. Web a diamond top formation, a technical pattern often observed near market peaks, signifies a potential reversal of an uptrend. The first diamond bottom pattern trading step is to identify the diamond bottom in a market. As you scrutinize the price. Web the diamond top pattern explained. Imagine you’re a seasoned trader, meticulously analyzing the price movements of a particular stock. Web updated 9/17/2023 20 min read. Updated may 09, 2024, 9:08 am edt / original may 09, 2024, 1:00 am edt A stop loss can generally be placed a few. Web the diamond top pattern explained. This pattern, resembling a diamond shape, is recognized for its rarity and the powerful signal it provides, often occurring at major market tops and bottoms. Web a diamond top formation, a technical pattern often observed near market peaks, signifies a potential reversal of an uptrend. The first diamond bottom pattern trading step is to. Web let’s take a closer look at the illustration below which details the structure of the diamond chart pattern. Web find a market entry. Web one useful price pattern in the currency markets is the bearish diamond top formation. This pattern is not only useful in forex but also in: As you scrutinize the price chart, you notice a distinct. Web sell when the price breaks the lower right side of the diamond. This causes the first round of consolidation. That could be good for stocks. Web the diamond pattern and gaps are two different chart patterns used in the technical analysis of stocks. Investors are always looking for stocks that are poised to beat at earnings season and black. Web diamond recognition trading revolves around investor psychology, as most patterns do. Mcdonald’s corp (nyse:mcd) has recently formed a death cross pattern, a bearish technical signal indicating a potential downtrend. Web the diamond pattern is a relatively uncommon chart pattern in the financial market. The diamond top pattern is not a common formation but is considered a strong bearish reversal. Generally, one locates the stop loss above the upper or below the lower extreme of the diamond pattern. Web a diamond bottom is a bullish, trend reversal, chart pattern. Pypl) stock price implode has been painful to see. The diamond stock pattern is a crucial tool in trading. This development comes as mcdonald’s. One places a stop loss below the diamond bottom pattern. Web almond breeze milk products will stop being sold at woolworths, coles and all other national retailers once stock runs out, according to a notice issued on april 1. Volatility and oscillations increase in the. It resembles a diamond shape on the chart. Diamond patterns can predict both bullish and bearish reversals. After a large movement, investors are eager either to take profits (bullish) or to short (bearish). Web watching paypal’s (nasdaq: A stop loss can generally be placed a few. This is done as follows: Place a stop loss order above the last top inside the diamond shape on the chart. This causes the first round of consolidation.

Diamond Reversal Chart Pattern in Forex technical analysis

What Are Chart Patterns? (Explained)

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

How to Trade the Diamond Chart Pattern Market Pulse

Stock Market Chart Analysis S&P 500 with a diamond pattern

Diamond Top Pattern Definition & Examples (2023 Update)

How to Trade the Diamond Chart Pattern (In 3 Easy Steps)

Stock Market Chart Analysis NIFTY Diamond pattern

Diamond Pattern Explained New Trader U

Diamond Chart Pattern Explained Forex Training Group

If You See A Bearish Diamond, Sell It At The Level Beneath The Pattern.

Identify The Diamond Bottom On A Price Chart.

The Market Rallies To A High Point, And Then Retraces Lower.

Web The Diamond Pattern Is A Relatively Uncommon Chart Pattern In The Financial Market.

Related Post: