Cup Handle Pattern

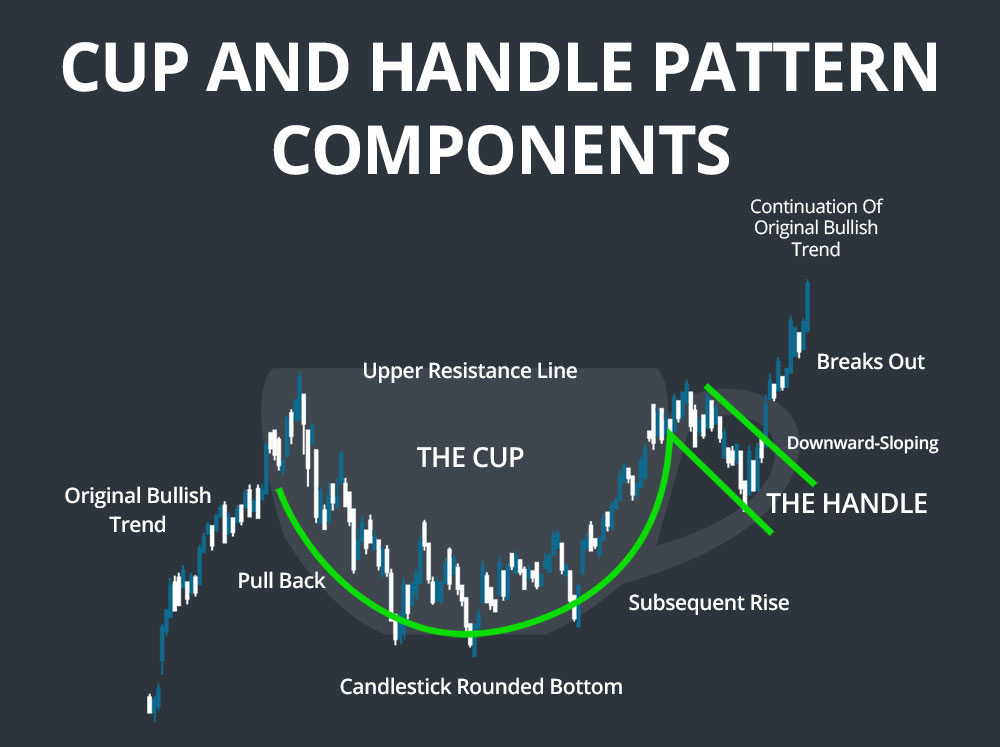

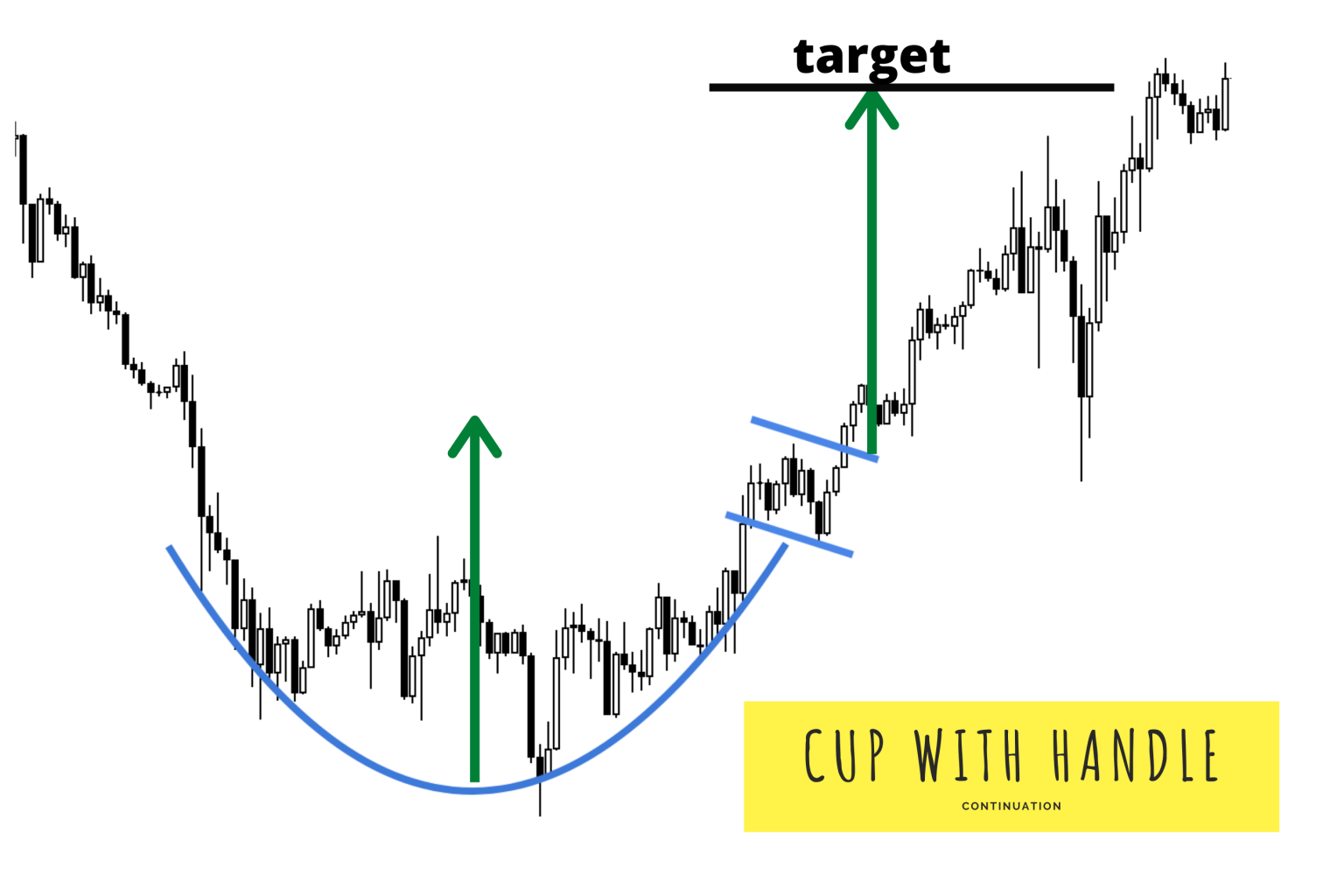

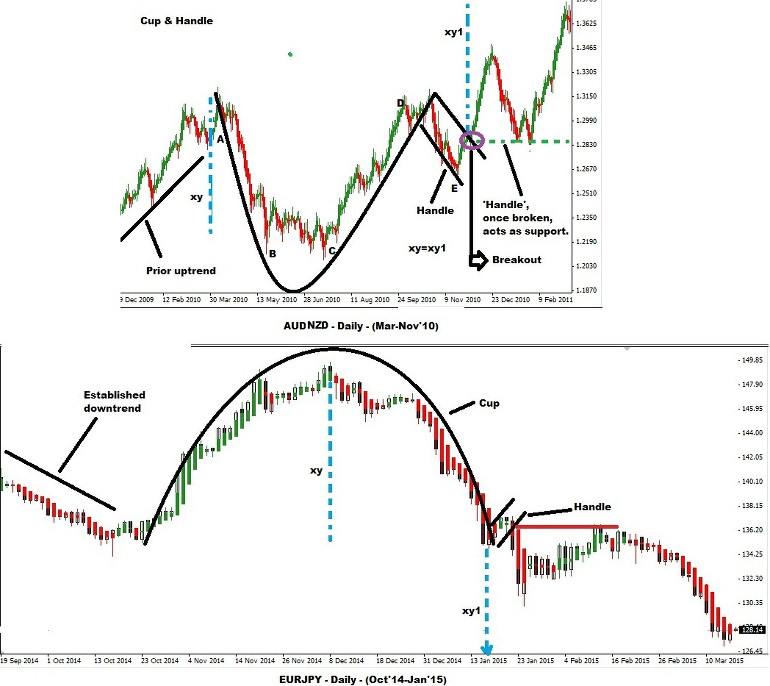

Cup Handle Pattern - The cup forms after an advance and looks like a bowl or rounding bottom. As its name implies, the pattern consists of two parts — the cup and the handle. Web a cup and handle can be used as an entry pattern for the continuation of an established bullish trend. Read this article for performance statistics, trading lessons, and more, written by internationally known author and trader thomas bulkowski. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. Web the cup and handle pattern is a bullish continuation pattern that is widely used by traders to identify potential buying opportunities in the market. The cup and the handle. The cup and handle chart pattern does have a few limitations. It is marked by a consolidation, followed by a breakout. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong uptrend. Web a cup and handle pattern consists of several candlesticks that form a u formation, which makes up the base of the cup. Here's how to spot and capitalize. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. It forms from a strong drive up that pulled back and consolidated over a period of time creating the cup before making another push to the resistance where it pulls back again but. Web a cup and handle pattern consists of several candlesticks that form a u formation, which makes up the base of the cup. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. The cup and. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web a cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. Then, near the top of the cup, the price is rejected and creates a falling. It´s one of the easiest patterns to identify. Learn how it works with an example, how to identify a target. At the base of the u formation, a new rising wedge or rising channel forms, thus creating the handle formation. The cup typically takes shape as a pull back and subsequent rise, with the candlesticks in the center of the. Web the cup and handle pattern is a bullish continuation pattern that is widely used by traders to identify potential buying opportunities in the market. Web do you know how to spot a cup and handle pattern on a chart? Once the pattern is complete, the stock should continue to trade upward, in the direction it was previously heading. Web. It is marked by a consolidation, followed by a breakout. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. As its name implies, there are two parts to the pattern—the cup and the handle. Learn how it works with an example, how to identify a target. Web a cup and handle. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Web the cup and handle pattern strategy is a formation on the price chart of an asset that resembles a cup with a handle. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. It. Here's how to spot and capitalize on the cup and handle. Learn how to read this pattern, what it means and how to trade. Free animation videos.master the fundamentals.find out today.learn finance easily. Deals of the dayread ratings & reviewsfast shippingshop best sellers Make money when you sellhuge savingsbuy it now availablemoney back guarantee Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. This is what forms the handle portion of the cup and handles. Web the cup and handle pattern is a bullish continuation pattern that is widely used by traders to identify potential buying opportunities in the market. Here are some. Web the cup and handle is a bullish continuation pattern. Web a cup and handle can be used as an entry pattern for the continuation of an established bullish trend. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. Learn how it works with an example, how to identify a target. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. It is a bullish pattern that indicates a potential trend reversal or continuation of an upward trend. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. It´s one of the easiest patterns to identify. Web a cup and handle pattern consists of several candlesticks that form a u formation, which makes up the base of the cup. It forms from a strong drive up that pulled back and consolidated over a period of time creating the cup before making another push to the resistance where it pulls back again but not as far creating. Web cup with handle is a price pattern that has a rounded downward turn followed by a short handle. Learn how to trade this pattern to improve your odds of making profitable trades. Here are some guidelines for identifying the cup and handle pattern: Web the cup and handle pattern strategy is a formation on the price chart of an asset that resembles a cup with a handle. Learn how it works with an example, how to identify a target.

Cup and handle chart pattern How to trade the cup and handle IG UK

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup And Handle Pattern How To Verify And Use Efficiently How To

Cup and Handle Pattern Guide New Trader U

Cup & Handle Pattern in Binary Trading Binary Trading

.png)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup And Handle Pattern How To Verify And Use Efficiently How To

The Cup Typically Takes Shape As A Pull Back And Subsequent Rise, With The Candlesticks In The Center Of The Cup Giving It The Form Of A Rounded Bottom.

The Cup And Handle Chart Pattern Does Have A Few Limitations.

This Is What Forms The Handle Portion Of The Cup And Handles.

Deals Of The Dayread Ratings & Reviewsfast Shippingshop Best Sellers

Related Post: