Reverse Falling Wedge Pattern

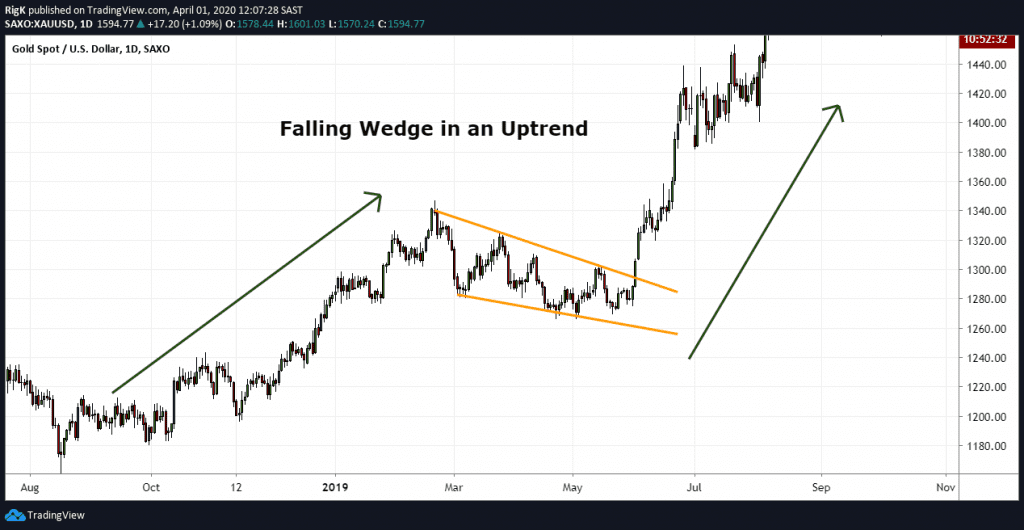

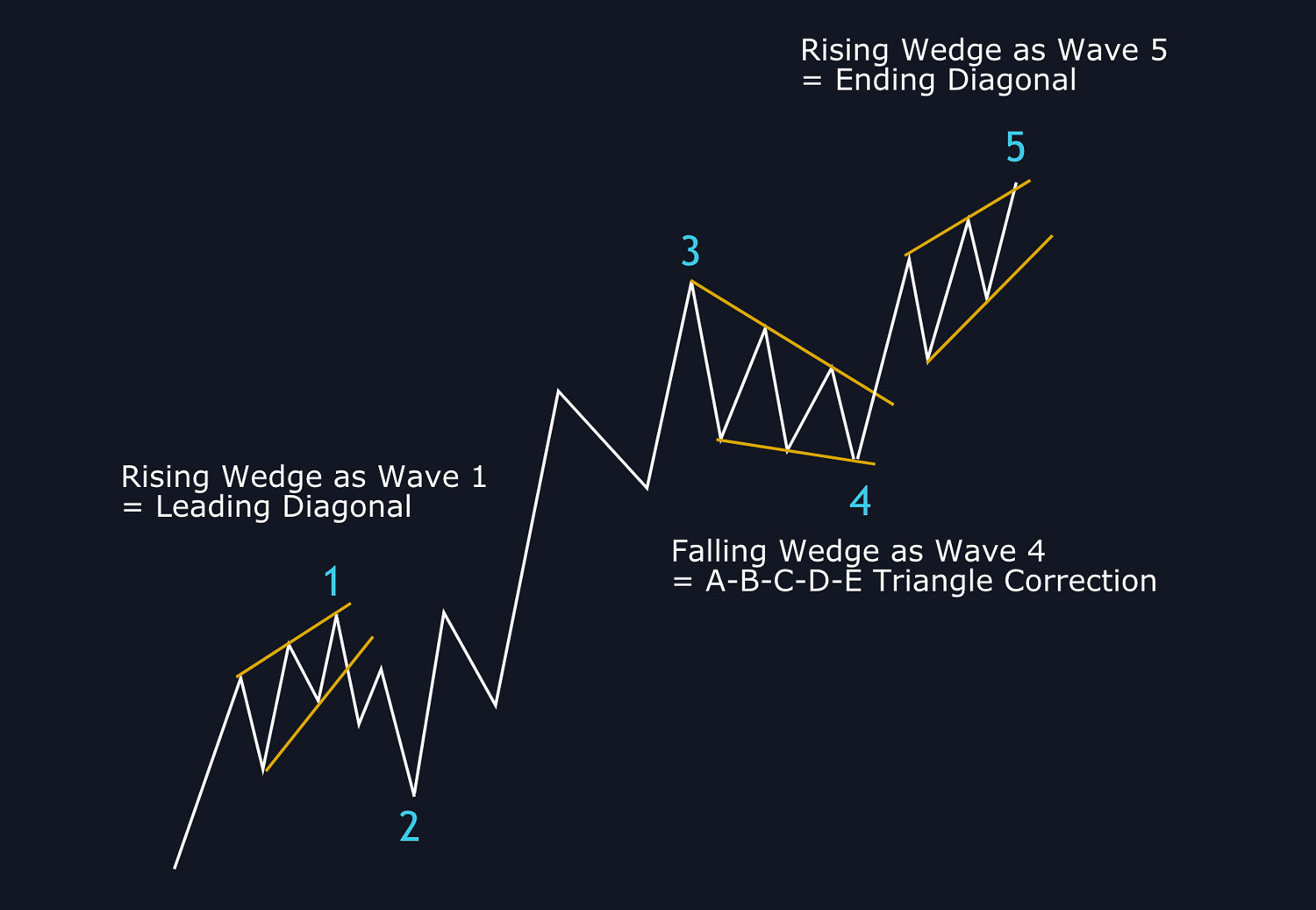

Reverse Falling Wedge Pattern - There are 2 types of wedges indicating price. Web a falling wedge pattern is a technical formation that signifies the conclusion of the consolidation phase, which allows for a pullback lower. Web a wedge pattern is a good indicator of both a continuation or reversal of a trend. Depending on where the wedges are located, this indication can be obtained. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. It is formed by two descending trend. It occurs when the price is making lower highs and lower lows which form two contracting lines. Web the falling wedge can serve as a bullish reversal pattern when seen after a panicked climax trough. It’s easy to spot on a chart and once you know how it works, you can use it to enter. Web the falling wedge pattern is a reversal pattern that occurs in downtrends. Web a falling wedge pattern is a technical formation that signifies the conclusion of the consolidation phase, which allows for a pullback lower. It occurs when the price is making lower highs and lower lows which form two contracting lines. Web as a reversal chart pattern, the wedging pattern provides valuable trading clues: Web the most common reversal pattern is. Web a falling wedge pattern is a technical formation that signifies the conclusion of the consolidation phase, which allows for a pullback lower. It is defined by two trendlines drawn through peaks and bottoms, both headed downward. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of. Web falling wedges are typically reversal signals that occur at the end of a strong downtrend. Web hence, it is known as a reversal pattern. Web the most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. Hints that an eventual breakout or breakdown is coming as price movements. Web the. The bullish bias of a falling wedge cannot be confirmed until a breakout. Web hence, it is known as a reversal pattern. Web in general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend. Depending on where the wedges are located, this indication can be. Web the falling wedge pattern is the opposite of the rising wedge: Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Web the most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. Web in general, a falling wedge. Web the falling wedge pattern is the opposite of the rising wedge: Web the falling wedge pattern is a reversal pattern that occurs in downtrends. The pattern consists of two trendiness which contract price leading to. There are 2 types of wedges indicating price. It is defined by two trendlines drawn through peaks and bottoms, both headed downward. There are 2 types of wedges indicating price. Web the falling wedge pattern is a reversal pattern that occurs in downtrends. Web in general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend. Web a wedge pattern is a good indicator of both a continuation. Web a wedge pattern is a good indicator of both a continuation or reversal of a trend. Until it breaks out, ride the downside using puts. The bullish bias of a falling wedge cannot be confirmed until a breakout. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction.. The pattern consists of two trendiness which contract price leading to. Web a falling wedge pattern is a technical formation that signifies the conclusion of the consolidation phase, which allows for a pullback lower. Web as a reversal chart pattern, the wedging pattern provides valuable trading clues: It’s easy to spot on a chart and once you know how it. Web the falling wedge pattern is a reversal pattern that occurs in downtrends. Web hence, it is known as a reversal pattern. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Hints that an eventual breakout or breakdown is coming as price movements. Web falling wedges are typically. Hints that an eventual breakout or breakdown is coming as price movements. It’s easy to spot on a chart and once you know how it works, you can use it to enter. However, they can occur in the middle of a strong upward movement, in which case the. It occurs when the price is making lower highs and lower lows which form two contracting lines. It is formed by two descending trend. Web the most common reversal pattern is the rising and falling wedge, which typically occurs at the end of a trend. The bullish bias of a falling wedge cannot be confirmed until a breakout. Web the falling wedge pattern is a widely recognized chart pattern that indicates a potential bullish reversal in the market. Web a falling wedge pattern is a technical formation that signifies the conclusion of the consolidation phase, which allows for a pullback lower. Web hence, it is known as a reversal pattern. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Depending on where the wedges are located, this indication can be obtained. Web in general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend. Web the falling wedge pattern is a bullish chart pattern that can indicate a potential continuation of an uptrend or a reversal of a downtrend. Web if the falling wedge appears in a downtrend, it is considered a reversal pattern. Web the falling wedge can serve as a bullish reversal pattern when seen after a panicked climax trough.

Simple Wedge Trading Strategy For Big Profits

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

The Falling Wedge Pattern Explained With Examples

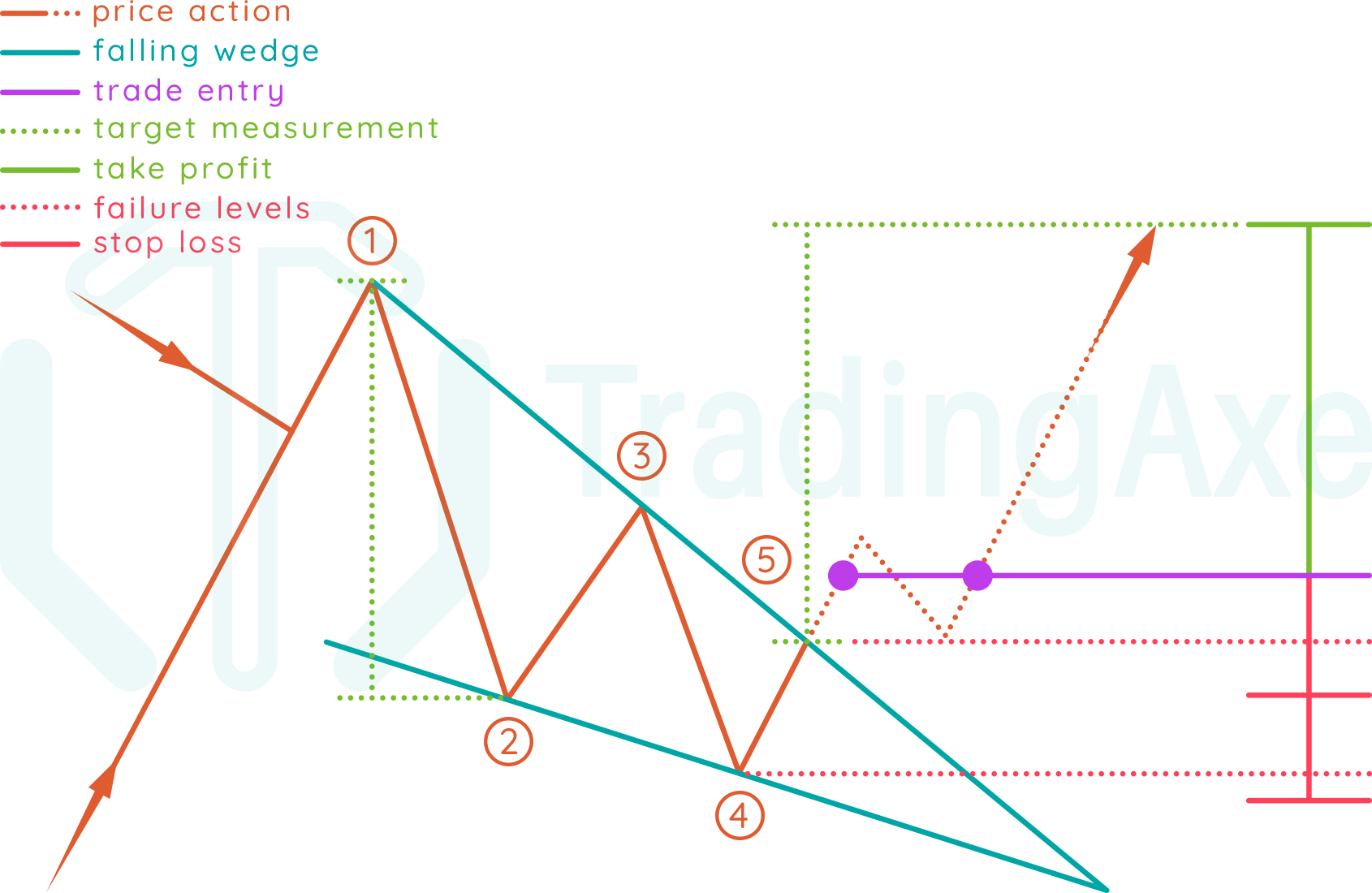

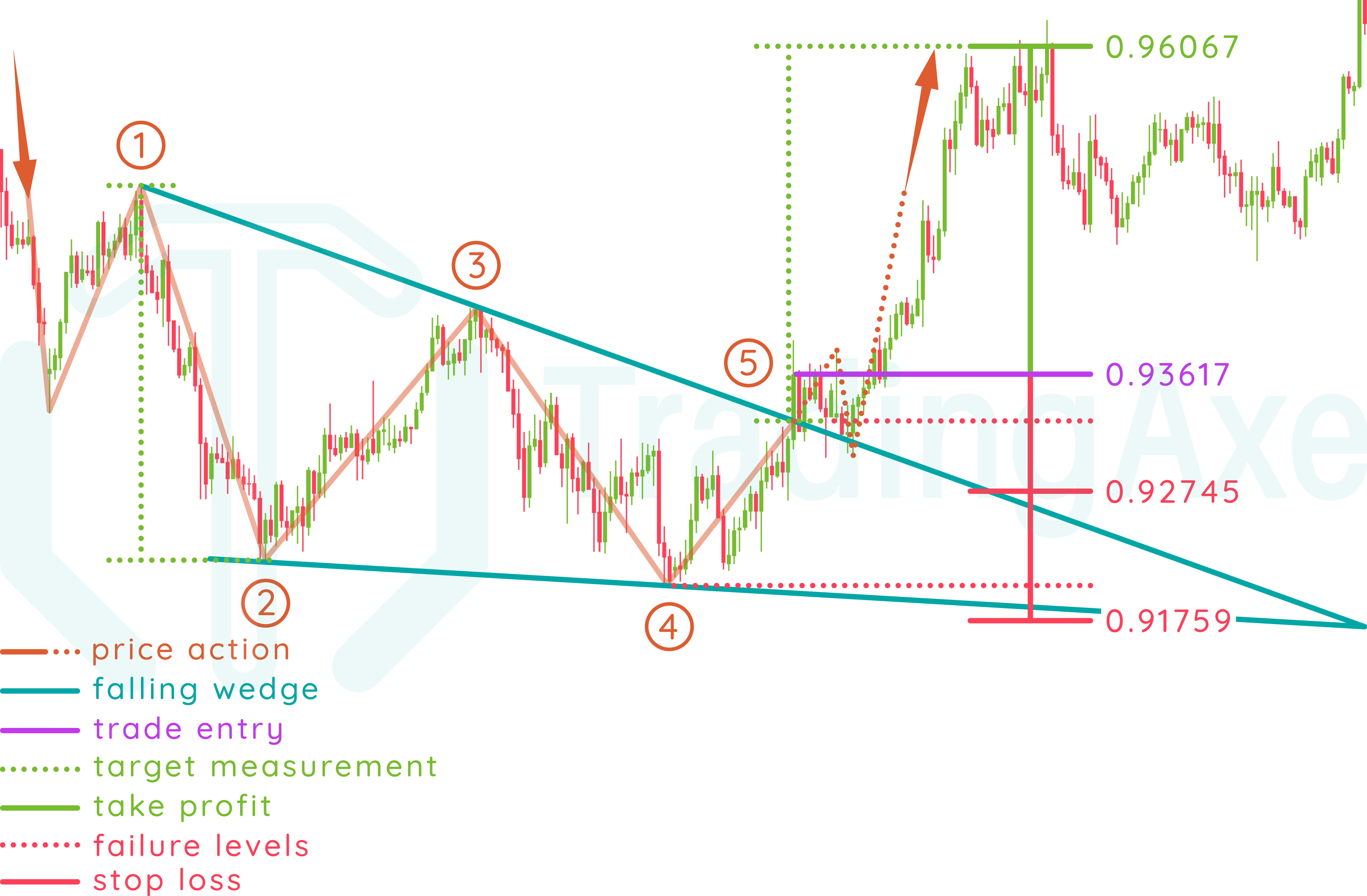

Trading Strategy for the Falling Wedge Pattern

Trading the Falling Wedge Pattern

![Falling Wedge Pattern Ultimate Guide [2021] PatternsWizard](https://i0.wp.com/patternswizard.com/wp-content/uploads/2020/05/fallingwedge.png?fit=864%2C576&ssl=1)

Falling Wedge Pattern Ultimate Guide [2021] PatternsWizard

Reversal Chart Patterns Part3 (Trading Fuel Research Team

How To Trade Falling Wedge Chart Pattern TradingAxe

How To Trade Falling Wedge Chart Pattern TradingAxe

Wedge Pattern Reversal and Continuation Financial Freedom Trading

Web The Falling Wedge Pattern Is A Reversal Pattern That Occurs In Downtrends.

There Are 2 Types Of Wedges Indicating Price.

It Is Defined By Two Trendlines Drawn Through Peaks And Bottoms, Both Headed Downward.

The Pattern Consists Of Two Trendiness Which Contract Price Leading To.

Related Post: