Crypto Trading Patterns

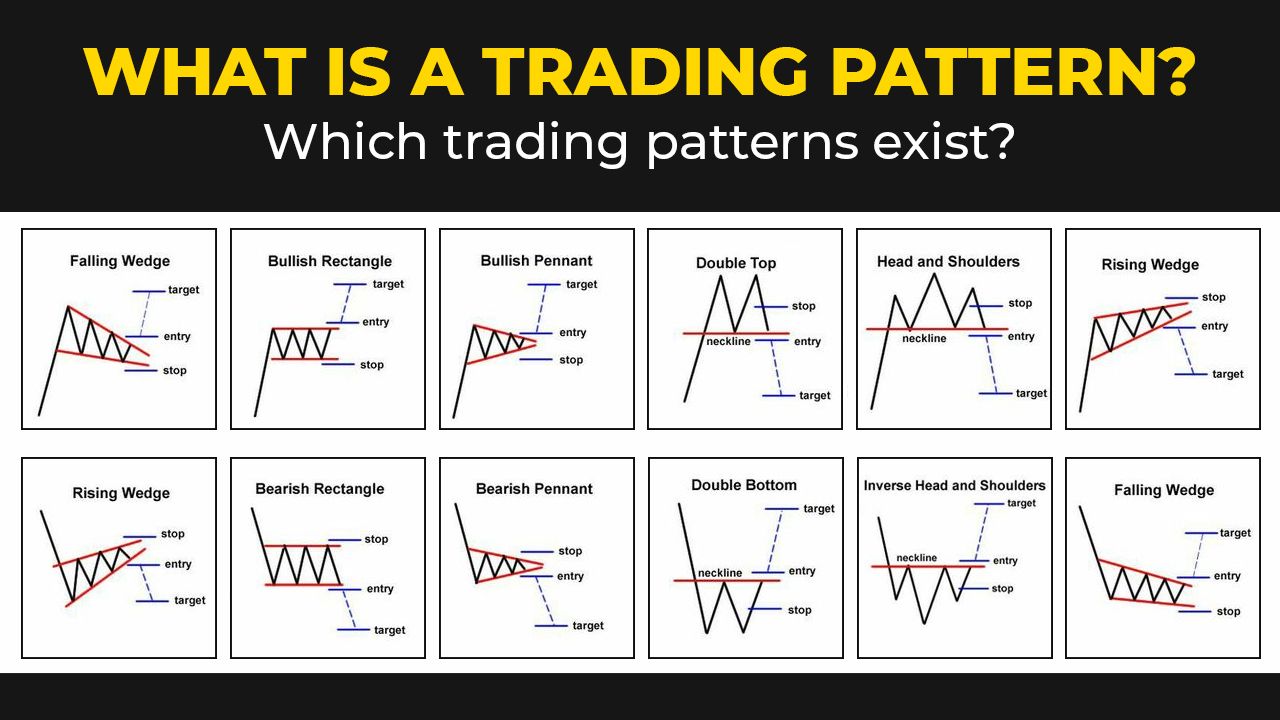

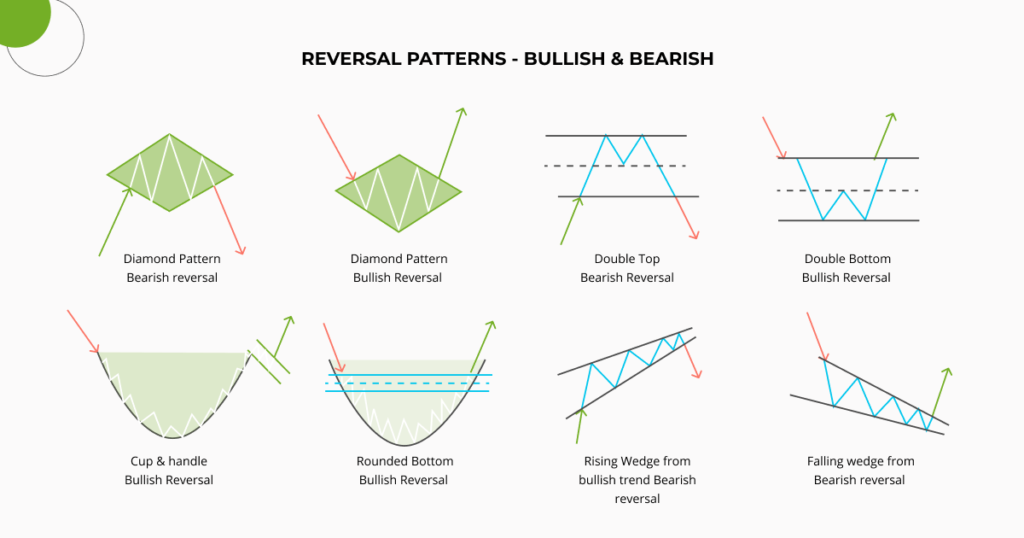

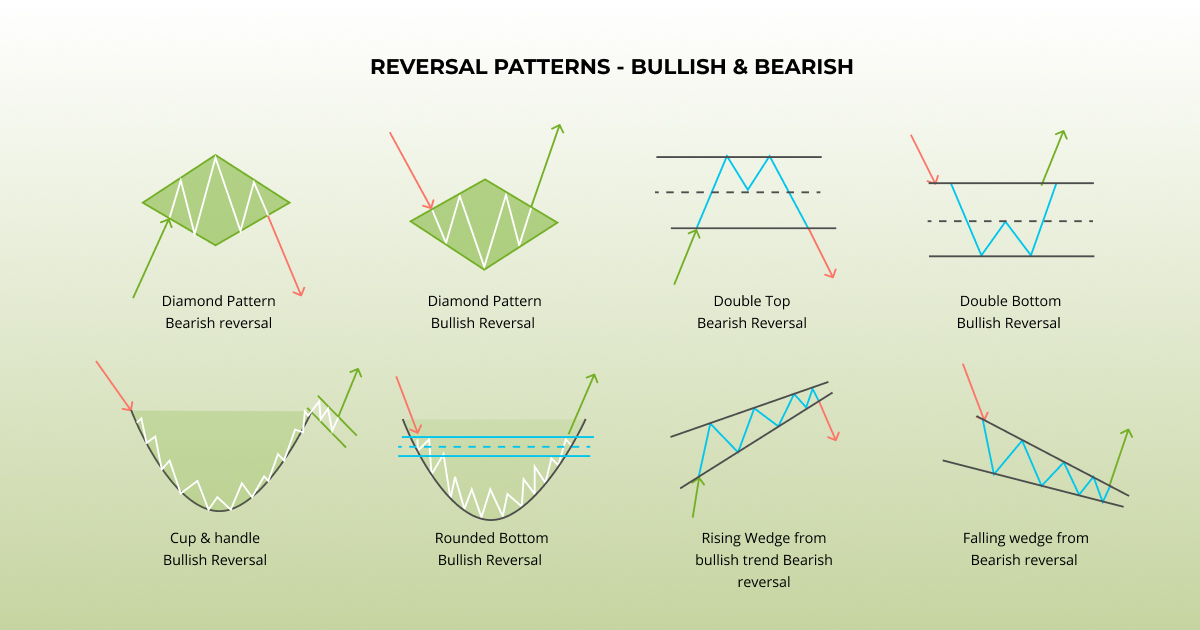

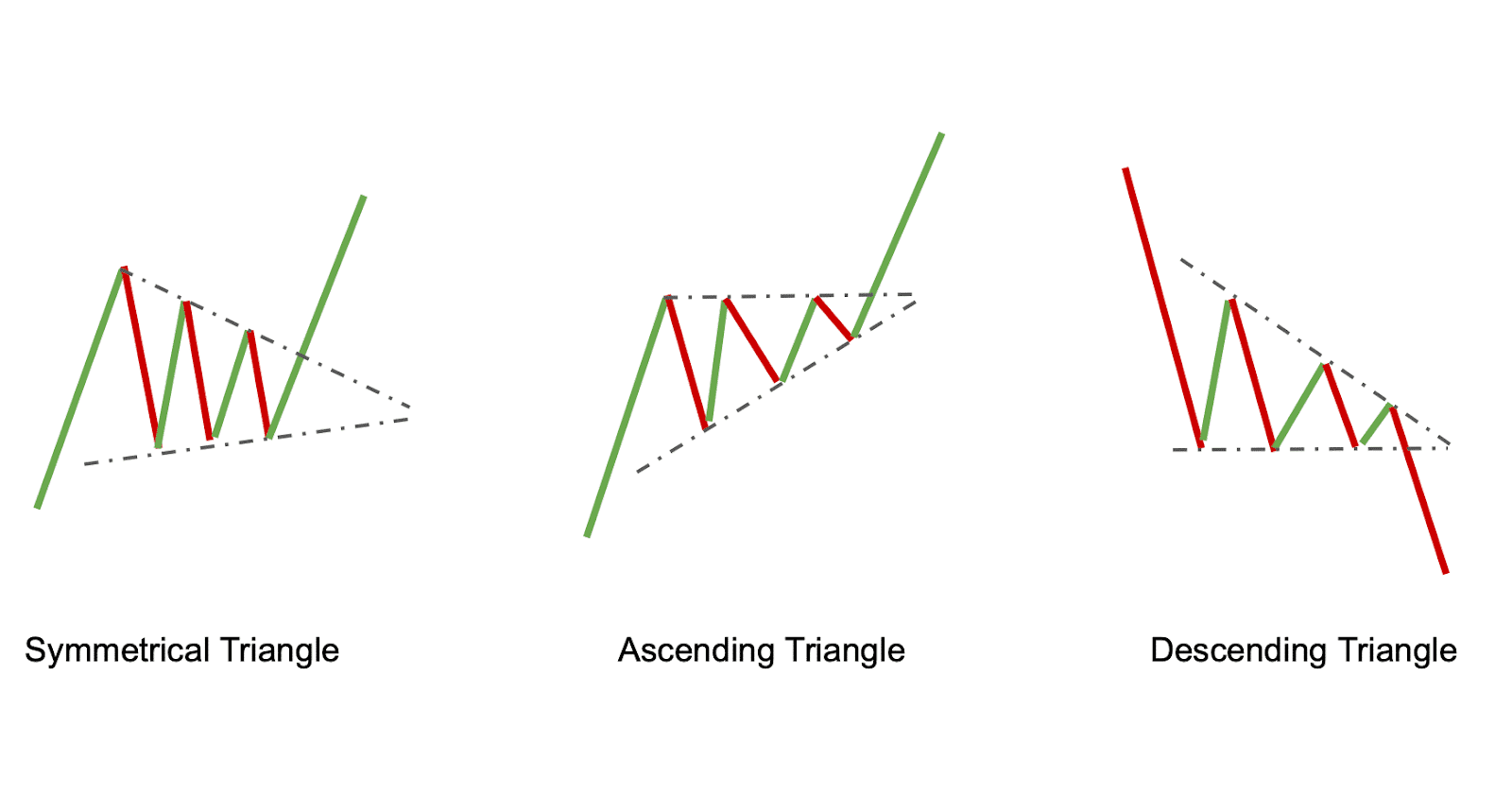

Crypto Trading Patterns - Here’s a selection of the most popular crypto chart patterns to trade. Bullish reversal patterns, bearish reversal patterns, and candlestick continuation patterns. Although 20 patterns may sound like a lot, it’s only 10 different patterns (as the others are inverted). These twenty trading patterns are categorized into four groupings: Web crypto trading patterns are chart formations of the price action of an asset. 🖨 every trader must print this cheatsheet and keep it on the desk 👍 🖼 printable picture below (right click > save image as…) Web technical analysis is a trading method that involves monitoring price movements and trading volume of cryptos to predict future price movements. In order to be able to fully utilize candlestick charts to predict upcoming trends, a trader (or investor) must be familiar with different patterns that candlesticks form on charts and what they could potentially signal. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. When to exit a trade. Analyst reveals imx displays crucial support at $1.70 and resistance at $3.00, influencing strategic trading decisions. Web typically, in the market, we see the following types of trading patterns: Although 20 patterns may sound like a lot, it’s only 10 different patterns (as the others are inverted). In order to be able to fully utilize candlestick charts to predict upcoming. Common types of crypto trading patterns. It’s the candlestick, the green and red bars that form the chart. Double top and double bottom. In order to be able to fully utilize candlestick charts to predict upcoming trends, a trader (or investor) must be familiar with different patterns that candlesticks form on charts and what they could potentially signal. Web typically,. Updated mar 11th, 2024 12 minutes read. Web published apr 7, 2020 updated oct 18, 2022. Some traders will use indicators and oscillators, while others will base their analysis only on price action. Triangle chart patterns (6) ascending triangle. Web there are several trading patterns that crypto investors should look out for when implementing a successful strategy. Chartpattern beyondta trendanalysis tradingpatterns cryptocurrency stocks forex tradingeducation bitcoin artemcrypto bonds howtotrade. It’s the candlestick, the green and red bars that form the chart. Why are crypto chart patterns so. Aug 1, 2023 • 5 min read. In fact, this skill is what traders use to determine the strength of. When to exit a trade. Web immutable (imx) faces volatility: Best time to enter a pattern trade. Oct 24, 2022 at 2:19 p.m. These charts offer a visual representation of the market's historical and current. In the world of crypto trading, recognizing patterns can yield more than insights. Head and shoulders (and inverse head and shoulders) 2.2. A chart pattern is a shape within a price chart that suggests the. Web crypto trading patterns are chart formations of the price action of an asset. Crypto graph patterns assess a market’s psychology through its price action. Web learn to spot flags, pennants, wedges and sideways trends and understand how those patterns can inform trading decisions. Basics of crypto chart patterns and technical analysis. Web updated jan 12, 2023 at 10:23 p.m. Web technical analysis is a trading method that involves monitoring price movements and trading volume of cryptos to predict future price movements. Updated mar 11th,. In this article, we show you how to read candlestick patterns and how they can assist when deciding on. Oct 24, 2022 at 2:19 p.m. Although 20 patterns may sound like a lot, it’s only 10 different patterns (as the others are inverted). What are classical chart patterns? Double top and double bottom. The head and shoulders pattern is a reliable guide for crypto investors. Which crypto assets are used for pattern recognition? Web updated jan 12, 2023 at 10:23 p.m. Head and shoulder, falling wedge, rising wedge, flag pattern, rectangle pattern, and more to help you with trading. In the world of crypto trading, recognizing patterns can yield more than insights. Understand the basics of chart patterns. Web published apr 7, 2020 updated oct 18, 2022. These twenty trading patterns are categorized into four groupings: What are classical chart patterns? Success rates of various patterns. Even if you're unfamiliar with trading, you've probably encountered candlestick charts. Web some primary ways to harness the power of candlestick patterns in crypto trading include: Key insights on trading patterns and resistance levels. Reversal patterns indicate the occurrence of a trend reversal. Chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. Double top and double bottom. Which crypto assets are used for pattern recognition? Web published apr 7, 2020 updated oct 18, 2022. 🖨 every trader must print this cheatsheet and keep it on the desk 👍 🖼 printable picture below (right click > save image as…) One such market chart is the head and shoulders pattern, a tool used for technical analysis in crypto. Head and shoulders (and inverse head and shoulders) 2.2. When to exit a trade. These can be easily singled out to predict a likely price direction in the near future. Web generally, there are two types of trading patterns: The coingape marketing editor team provided a neutral viewpoint when creating the content. Chartpattern beyondta trendanalysis tradingpatterns cryptocurrency stocks forex tradingeducation bitcoin artemcrypto bonds howtotrade.

Crypto Chart Pattern Explanation (Downloadable PDF)

Chart Patterns for Crypto Trading. Trading Patterns Explained

Trading Range Crypto Pattern what it is and how to trade it

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Chart Patterns for Crypto Trading. Trading Patterns Explained

A Beginner's Guide to Crypto Chart Patterns and Cheat Sheet Margex

Top Chart Patterns For Crypto Trading

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Understanding Crypto Chart Patterns A Beginner’s Guide to Trading

Chart Patterns for Crypto Trading. Trading Patterns Explained

What Is The Most Basic And Essential Element Of A Crypto Chart?

Head And Shoulder, Falling Wedge, Rising Wedge, Flag Pattern, Rectangle Pattern, And More To Help You With Trading.

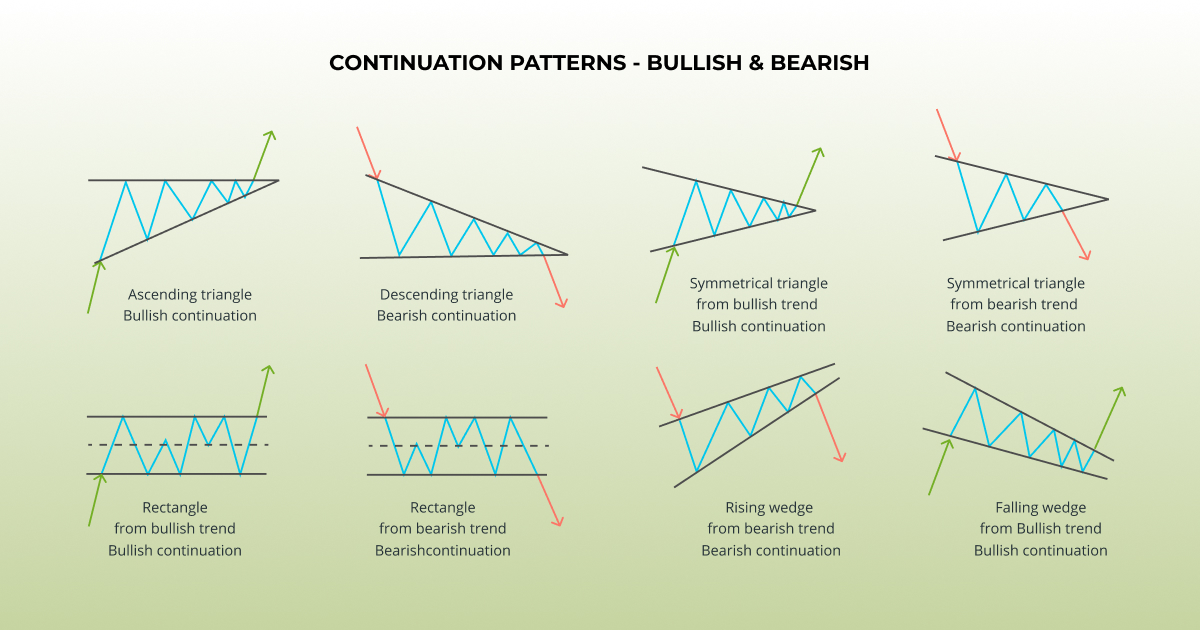

Continuation Patterns Indicate That A Trend Will Almost Certainly Continue In The Same Direction.

Web The World Of Cryptocurrency Is Fascinating Yet Complex, With Its Own Set Of Tools And Methods For Gauging Market Behavior.

Related Post: