Bullish Harmonic Pattern

Bullish Harmonic Pattern - Web the cypher pattern can be either bearish or bullish. Solana / tether ( coinbase:solusdt ) 144.67 −1.41 −0.97%. The aforementioned gartley pattern is one of the more popular harmonic patterns technical analysts use. It is generally indicated by a small increase in price (signified by a white candle) that can be. Web the common types are the ab=cd pattern, gartley pattern, bat pattern, butterfly pattern, crab pattern, shark pattern, and cypher pattern, and each of them has a different geometrical shape and fibonacci ratio. Web the cypher pattern, which can be either bullish or bearish, has five points (x, a, b, c, and d) and four legs (xa, ab, bc, and cd). Traders interested in the technical analysis must have come across chart patterns or even used them in trading. Traders use harmonic chart formations in a variety of ways. In this way, a harmonic pattern may be a viable buy or sell signal. Best harmonic patterns in trading 3. Web examples of harmonic patterns. These patterns are formed by a series of price movements that adhere to specific ratios, and. Web traders can take a bearish or a bullish approach. Web the gartley, bat, and crab are among the most popular harmonic patterns available to technical traders. What do harmonic patterns look like? What are harmonic patterns and how to use them for effective forex trading? 1️⃣ ab leg 2️⃣ bc leg 3️⃣ cd leg the pattern is considered to be bullish if ab leg is bearish. Web harmonic patterns use the identification of quantified chart price action structures that have specific and consecutive fibonacci ratio alignments that form the visual structures. Web. How to draw harmonic patterns 5. The bat harmonic pattern follows different fibonacci ratios. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50 percent fibonacci. Targets can be set at the discretion of the trader as the reversal point could be the start of a. Gartley patterns are built by 2 retracement legs and 2. Harmonic patterns operate on the premise that fibonacci sequences can be used to build geometric structures, such as breakouts and. Best harmonic patterns in trading 3. The bat harmonic pattern follows different fibonacci ratios. Harmonic trading combines patterns and math into a. Please note that the ratio line between the a and c points represents how far c extended the xa leg. Web each has a bearish and bullish variant, which means that when the pattern is upside down, it might imply a price rise or decline. This pattern is composed of 3 main elements (based on wicks of the candles): Web. What do harmonic patterns look like? 1️⃣ ab leg 2️⃣ bc leg 3️⃣ cd leg the pattern is considered to be bullish if ab leg is bearish. Web harmonic abcd pattern is a classic reversal pattern. Traders use harmonic chart formations in a variety of ways. Traders interested in the technical analysis must have come across chart patterns or even. These patterns resemble “m” or “w” patterns and are defined by 5 key pivot points. Harmonic patterns operate on the premise that fibonacci sequences can be used to build geometric structures, such as breakouts and. Please note that the ratio line between the a and c points represents how far c extended the xa leg. In this article, i will. These patterns are formed by a series of price movements that adhere to specific ratios, and. Gartley patterns are built by 2 retracement legs and 2. Traders interested in the technical analysis must have come across chart patterns or even used them in trading. Web this is a video where i talk about harmonic patterns for beginners.fractal flow website: In. The most common is within the context of retracement and continuation patterns. A clear reversal will be a bullish momentum crossing above $93. Targets can be set at the discretion of the trader as the reversal point could be the start of a new trend. These patterns resemble “m” or “w” patterns and are defined by 5 key pivot points.. Web a few of the most popular are the gartley pattern, butterfly pattern, bat pattern, and crab pattern. Web harmonic abcd pattern is a classic reversal pattern. Tradingview has a smart drawing tool that allows users to visually identify this price pattern on a chart. Web the cypher pattern can be either bearish or bullish. Best harmonic patterns in trading. Web bullish harmonic patterns are technical chart patterns that traders use to identify potential bullish reversals in the market. The bat harmonic pattern follows different fibonacci ratios. All financial markets, including stocks, commodities, and the fx market, can benefit from harmonic patterns. In this way, a harmonic pattern may be a viable buy or sell signal. Like any other harmonic pattern, the theory behind the cypher chart pattern is that there is a strong correlation between fibonacci ratios and price movements. Web traders can take a bearish or a bullish approach. These patterns are formed by a series of price movements that adhere to specific ratios, and. Harmonic trading combines patterns and math into a. It is generally indicated by a small increase in price (signified by a white candle) that can be. Web a bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. Web the cypher pattern can be either bearish or bullish. Please note that the ratio line between the a and c points represents how far c extended the xa leg. Bearish harmonic patterns indicate a possible downturn in the market. A clear reversal will be a bullish momentum crossing above $93. This pattern is composed of 3 main elements (based on wicks of the candles): How to draw harmonic patterns 5.

How To Draw Bullish Gartley Harmonic Pattern Forex Trading Strategy

Bullish Harmonic Patterns Don’t to SAVE in 2021 Stock

Bullish Harami Candle Stick Pattern

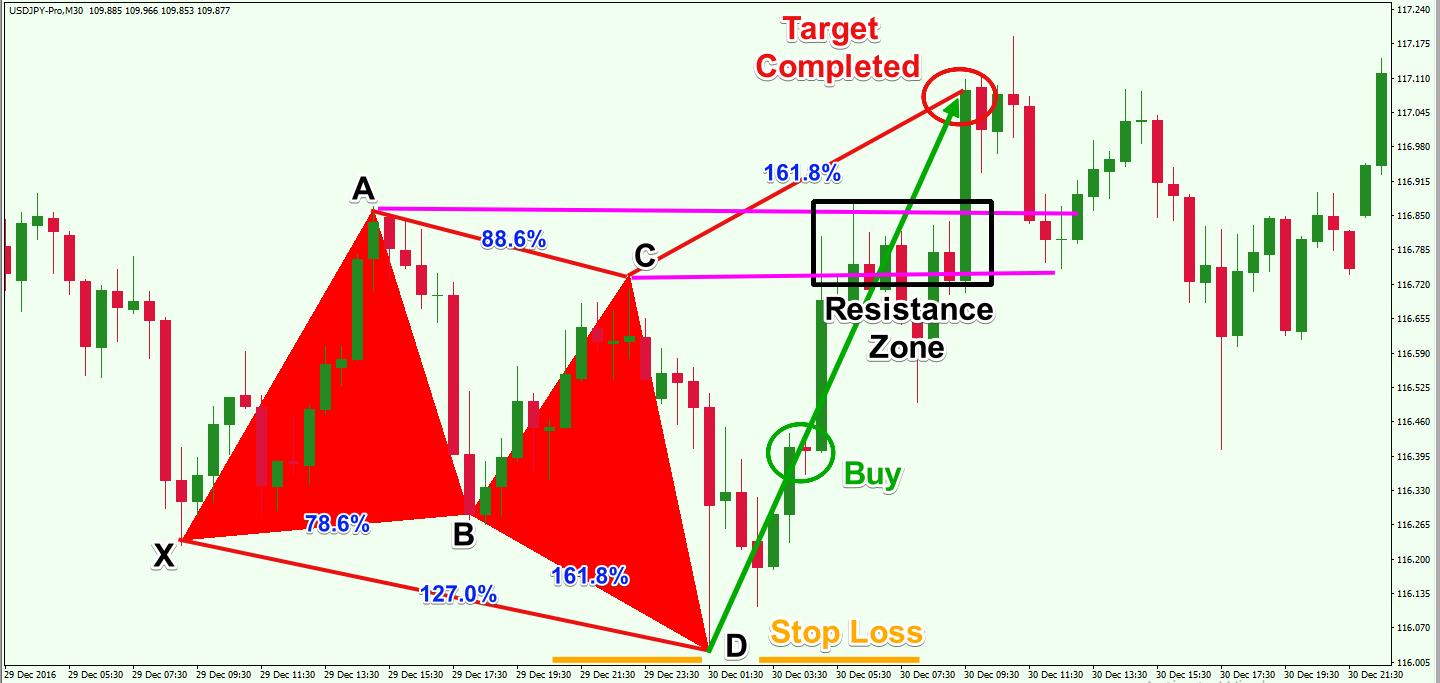

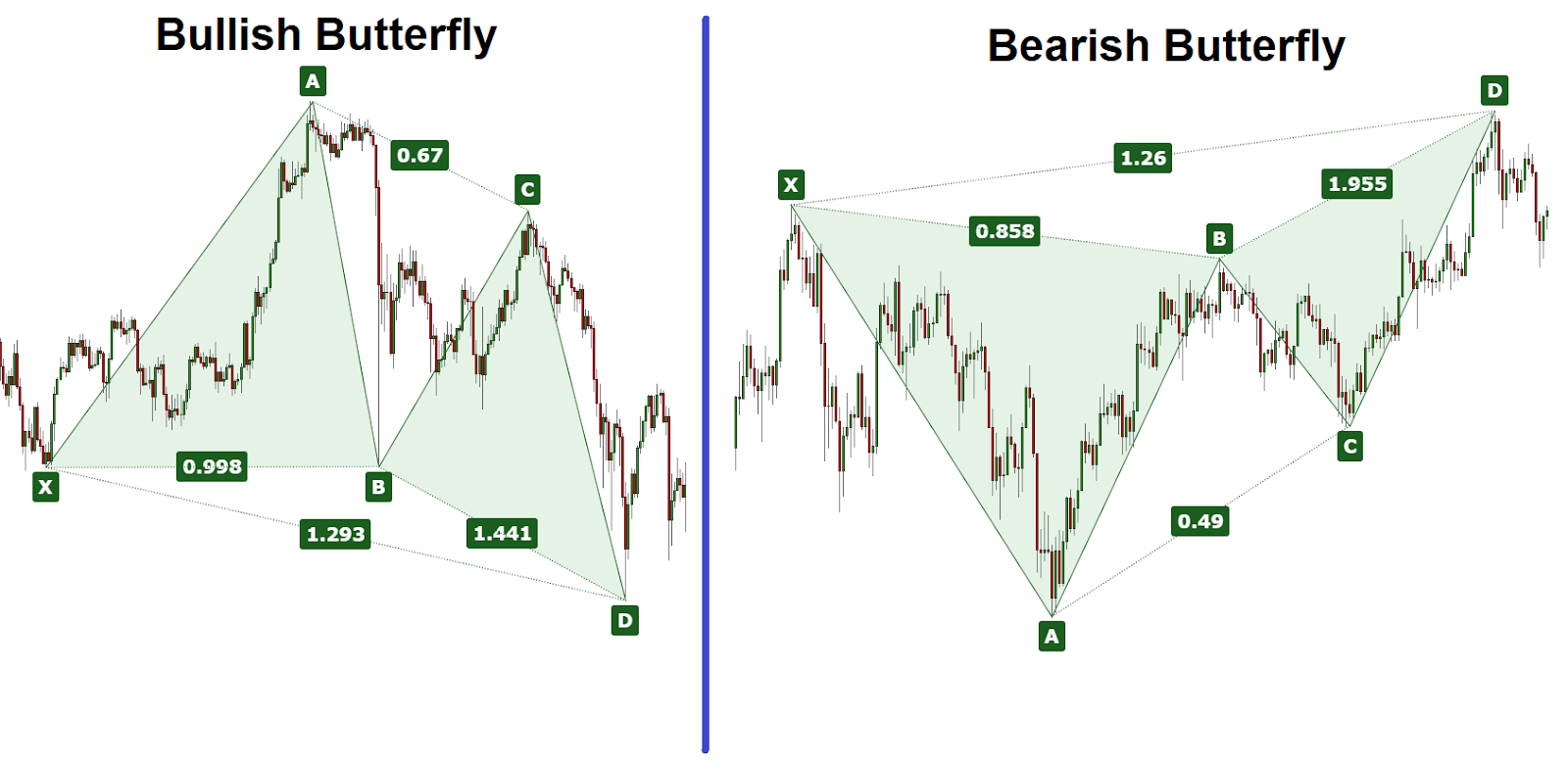

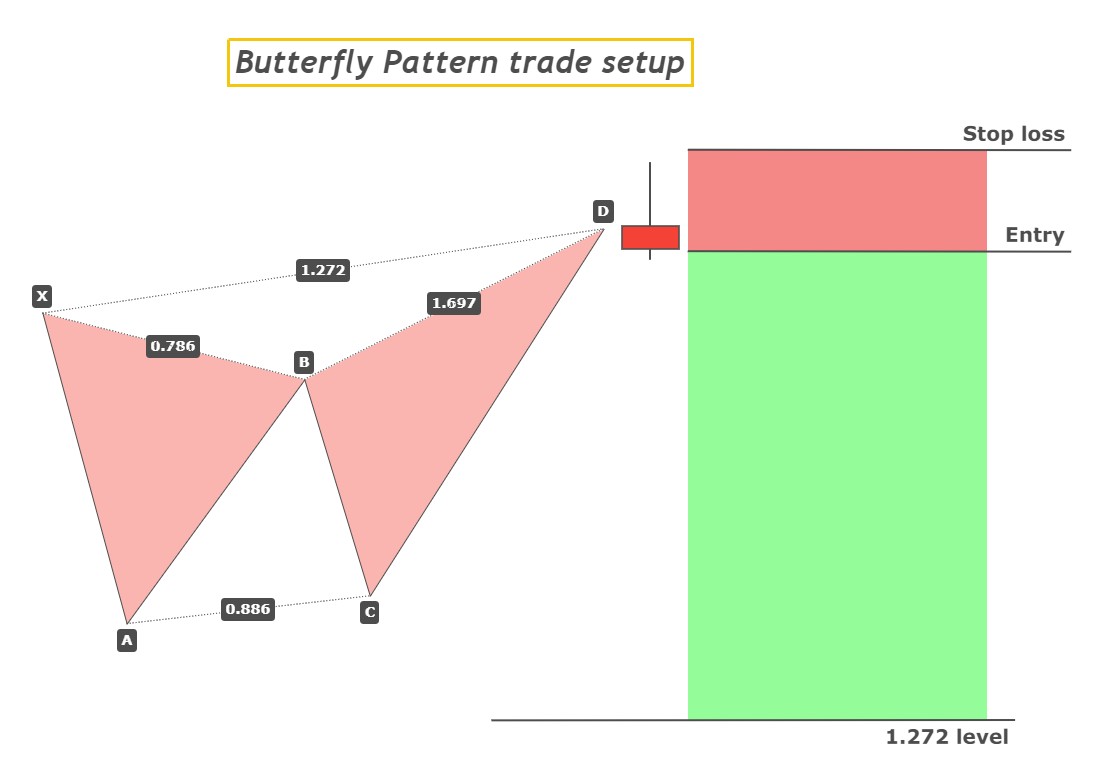

How To Trade the Harmonic Butterfly Pattern

How to Identify & Trade Harmonic Butterfly Pattern for Profits Bybit

Bullish shark trading harmonic patterns Vector Image

Harmonic Patterns An Introduction to Harmonic Trading Investar Blog

Bullish Butterfly Harmonic Parttern Complete Trading Strategy

Bullish Butterfly Harmonic Pattern Trading Strategy ForexBee

How To Trade The Harmonic Shark Pattern Forex Training Group

You Can Trade Using Harmonic Patterns By Opening A Trading Account With Us.

Web A Few Of The Most Popular Are The Gartley Pattern, Butterfly Pattern, Bat Pattern, And Crab Pattern.

Gartley Patterns Are Built By 2 Retracement Legs And 2.

Web In This Article, We'll Explore The World Of Bullish Harmonic Patterns, Including The Most Profitable And Strongest Patterns, Rules, And Best Bullish Patterns.

Related Post: