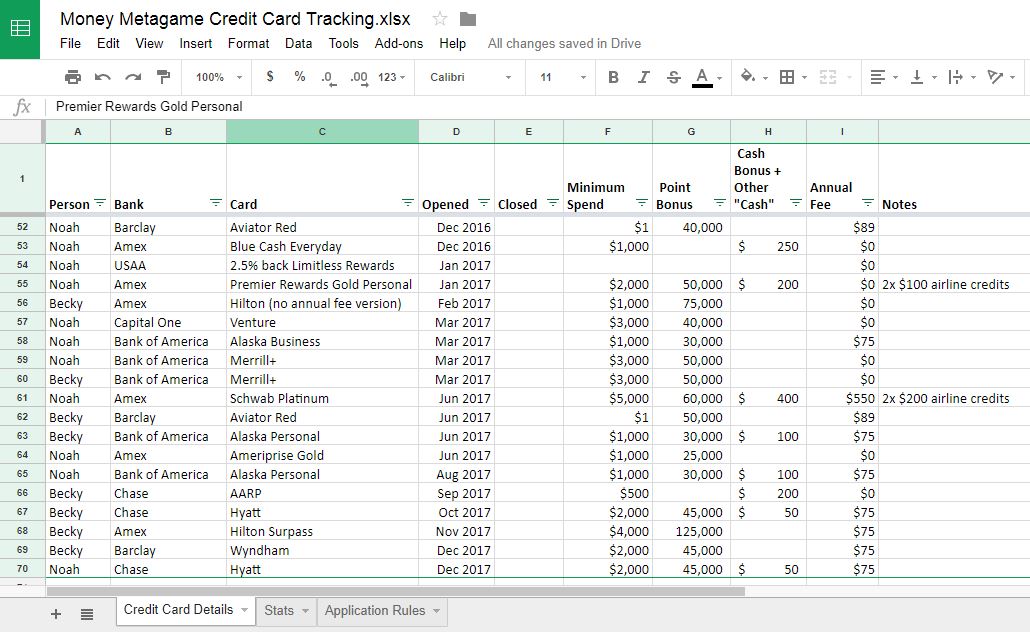

Credit Card Debt Excel Template

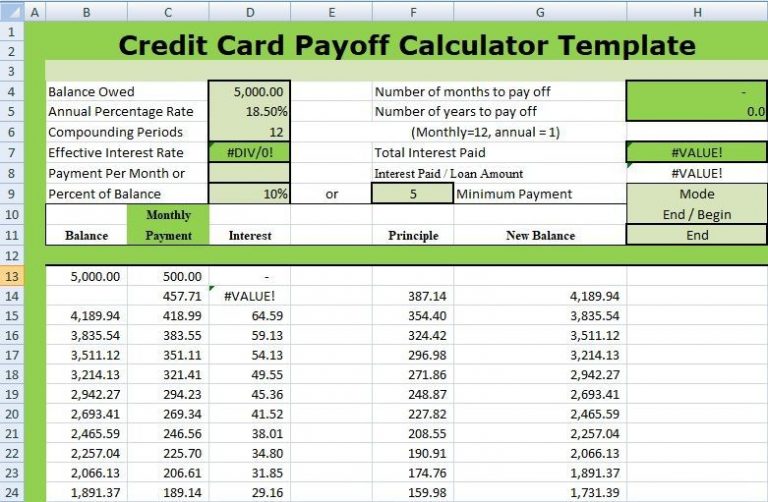

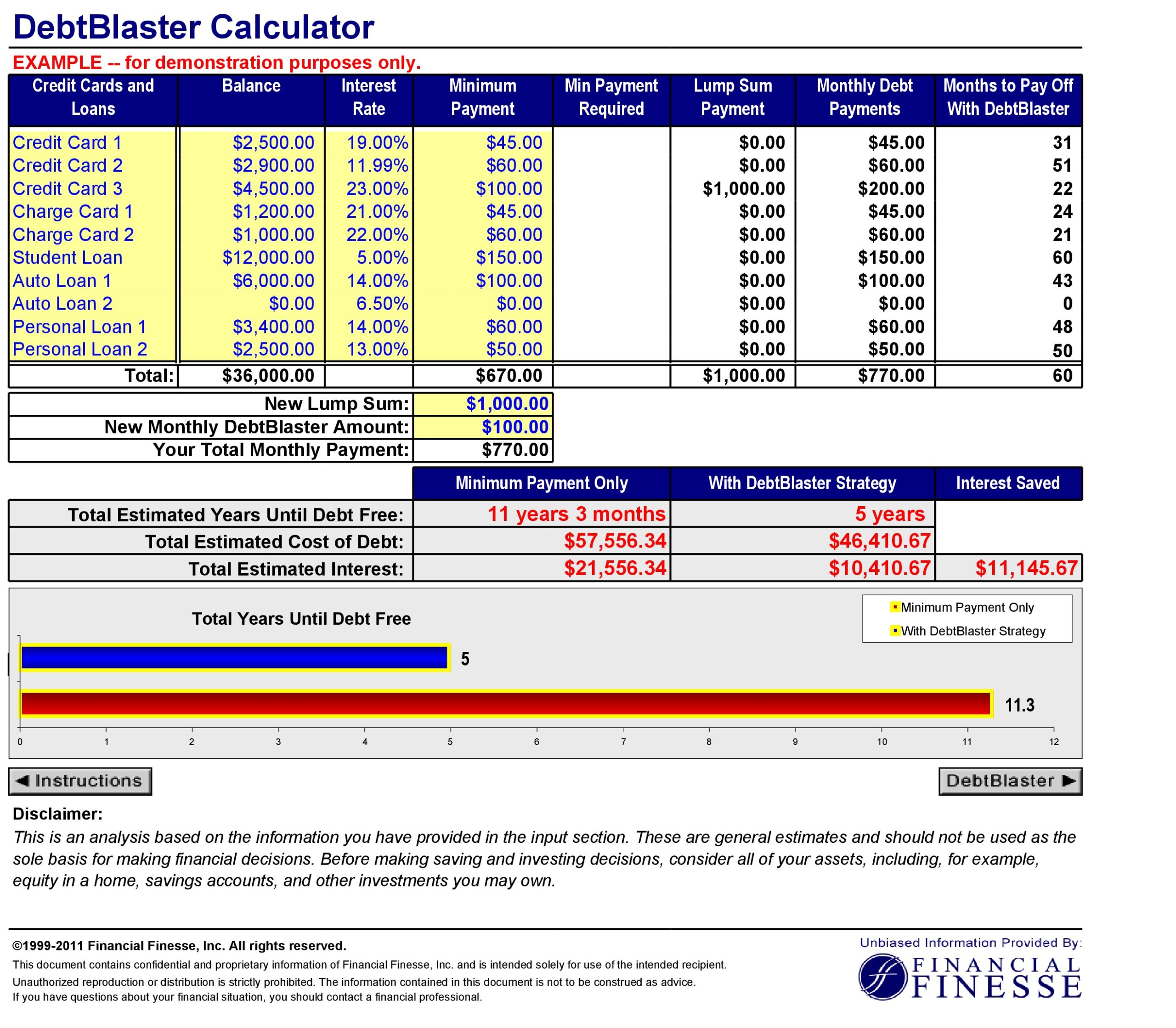

Credit Card Debt Excel Template - Shred them if you need to. Enter your old credit card information in a new table. 2) list your debts across the top with your balance, minimum payment, and interest rates. You owe $2,000 on each credit card. Free downloadable debt reduction template. This mistake is so critical, it should probably also be nos. Credit card a has a fixed rate of 12 percent. And then—once it opens—at the top of the file select “open with google sheets”. $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. Web following is a rundown of how you can calculate your payoff using a credit card payoff template in excel: Entering the starting balance and interest rate. Web following is a rundown of how you can calculate your payoff using a credit card payoff template in excel: $1,000 ($50 minimum payment) 2nd debt: Web the author of the spreadsheet and the squawkfox blog, kerry taylor, paid off $17,000 in student loans over six months using this downloadable debt reduction spreadsheet.. Web call your credit card company(ies) and ask them to lower your interest rates. Next, select “ credit card payoff calculator ” from the search result. Your credit history influences your eligibility for loans and balance transfer cards. For the first method, we will input information about the debt. To name a few, our selection includes various loan payment calculators,. Open a blank debt snowball calculator as shown below. The minimum payment represents the amount of cash flow you will free up by completely paying off the debt. Web click “new” in the upper left. You can now add extra payments into the payment schedule to see how making occasional extra. Firstly, there will be three debts for us and. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly. Has a fixed rate of 18 percent. This credit card debt reduction calculator. Type “ credit card ” and press enter. To create a credit card payoff spreadsheet for your debt snowball method, you can use. Web now to see it in action, assume the following is your debt snowball strategy. Web following is a rundown of how you can calculate your payoff using a credit card payoff template in excel: And then—once it opens—at the top of the file select “open with google sheets”. This calculator is the first one in the series of debt. You can now add extra payments into the payment schedule to see how making occasional extra. Here's how to input the necessary data: You can change formulas to tweak your. Your credit history influences your eligibility for loans and balance transfer cards. Web use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other. Your first credit card is $1000 at 12% interest. It also creates a payment schedule and graphs your payment and balance over time. Record the creditor and the minimum payment at the top of the worksheet. This credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. Tagged. Web call your credit card company(ies) and ask them to lower your interest rates. Enter your old credit card information in a new table. Begin by entering the starting balance of your credit card debt in one cell, and the annual. Type “ credit card ” and press enter. As of january, she’s paid off $12,000 in. 2, 3 and 4 on this list. You can now add extra payments into the payment schedule to see how making occasional extra. Nothing else will be purchased on the card while the debt is being paid off. Managing debt is a normal part of the modern financial journey. Create a table to insert all the necessary inputs. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. Creating a credit card payoff spreadsheet in excel requires inputting various pieces of data to accurately calculate and track your progress. $1,000 ($50 minimum payment) 2nd debt: Find “the best debt avalanche excel. Web this page is a collection of various excel templates to manage debt and loans. To begin with, press alt, f, n, then s to activate the search feature for creating a new workbook based on a template. The note on line 3 mentions that you only need to input values in cells marked yellow. Travel credit cards are a great way to earn points and miles and accrue other. The second credit card is $9,000 at 9% interest. Free downloadable debt reduction template. For the first method, we will input information about the debt. Web setting up the debt snowball spreadsheet is relatively simple whether you are in excel or google sheets. Has a fixed rate of 18 percent. 2) list your debts across the top with your balance, minimum payment, and interest rates. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy. Begin by entering the starting balance of your credit card debt in one cell, and the annual. Here are the steps to create a perfect one. Web this printable worksheet can be used to track individual debts you are trying to pay off. 2, 3 and 4 on this list. Your first credit card is $1000 at 12% interest.

Credit Card Payment Spreadsheet Template

Excel Credit Card Payoff Calculator and Timeline Easy Etsy

![]()

Credit Card Debt Payoff Tracker Template in Excel, Google Sheets

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

Single Debt Analysis Template

Credit Card Statement Template Excel

![]()

50 Free Credit Card Tracking Spreadsheet

Excel Credit Card Payment Tracker Template

credit card payoff ExcelTemplate

Credit Card Debt Excel Template

As Of January, She’s Paid Off $12,000 In.

Entering The Starting Balance And Interest Rate.

Enter Your Old Credit Card Information In A New Table.

Card B Has A Fixed Rate Of 14 Percent, And Card C.

Related Post: