Candlestick Patterns Spinning Top

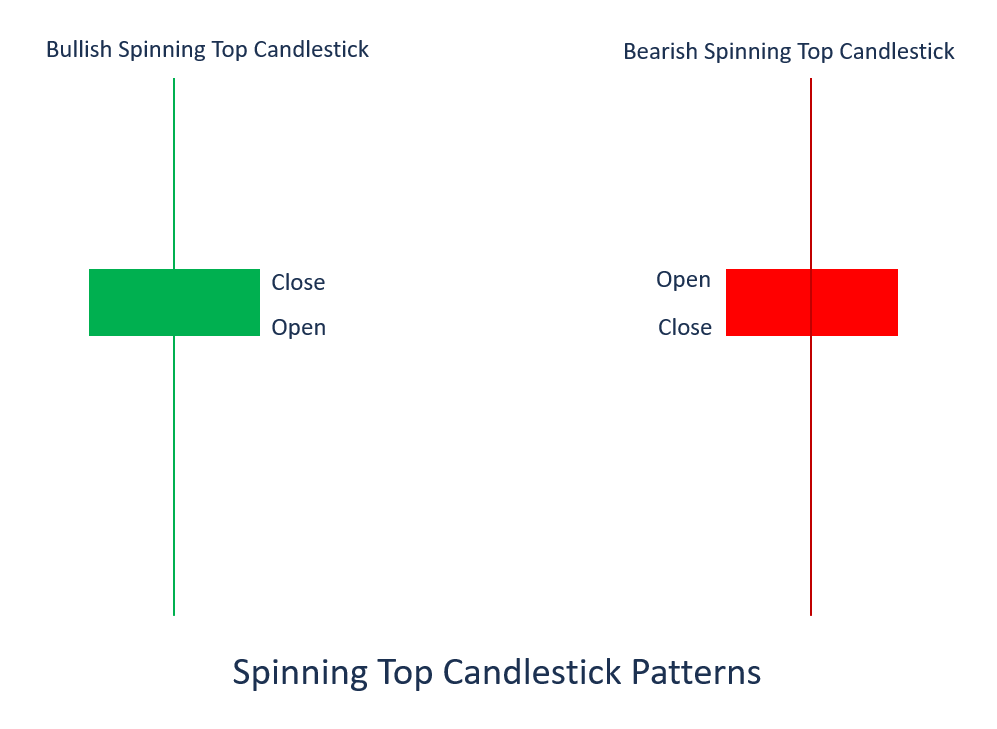

Candlestick Patterns Spinning Top - Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and. The high and the low represent the. It means that neither buyers nor sellers could gain the upper hand. Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is. Similar to a doji pattern, a spinning top is considered a neutral pattern,. Web what is spinning top candlestick? Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. It has a small body closing in the. The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! The high and the low represent the. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Web what is spinning top candlestick? This candlestick pattern has a short real body with long upper and. Web there are three types of candlestick pattern: It means that neither buyers nor sellers could gain the upper hand. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and. Web the spinning top is a single candlestick pattern with a relatively small real body and an upper and lower shadow. Web what is a spinning top in candlestick patterns? A spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. Web what is spinning top candlestick? While past performance is no guarantee of. It demystifies technical and chart analysis and gives you. The spinning top illustrates a scenario. It demystifies technical and chart analysis and gives you. Web spinning top is a japanese candlesticks pattern with a short body found in the middle of two long wicks. A spinning top is indicative of a situation where neither the buyers nor. Web what is a spinning top in candlestick patterns? Web there are three types of candlestick pattern: Web what is spinning top candlestick? A spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. The high and the low represent the. The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! The candlestick pattern represents indecision about the future direction of the asset. The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Web the spinning top candlestick chart pattern develops when buyers and sellers reach an equilibrium, leading to minimal changes between opening and closing. Web a spinning top candlestick can be defined as an asset. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and. The spinning top illustrates a scenario. Web spinning top is a japanese candlesticks pattern with a short. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. A spinning top is indicative of a situation where neither the buyers nor. Similar to a doji pattern, a spinning top is considered a neutral pattern,. Web there are three types of candlestick pattern: Spinning top candlestick is a pattern with a short. Web what is the inverted hammer candlestick pattern? It demystifies technical and chart analysis and gives you. The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is. The spinning top illustrates a scenario. While past performance is no guarantee of. Web what is spinning top candlestick? The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. A spinning top is a candlestick pattern with a short real body that's vertically centered between. The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is. This is based on the number of sticks that make up the pattern. Web what is the inverted hammer candlestick pattern? The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. Web spinning top is a japanese candlesticks pattern with a short body found in the middle of two long wicks. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. A spinning top is indicative of a situation where neither the buyers nor. The candlestick pattern represents indecision about the future direction of the asset. A spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. While past performance is no guarantee of. This candlestick pattern has a short real body with long upper and. It means that neither buyers nor sellers could gain the upper hand. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Similar to a doji pattern, a spinning top is considered a neutral pattern,.

Spinning Top Candlestick Pattern Forex Trading

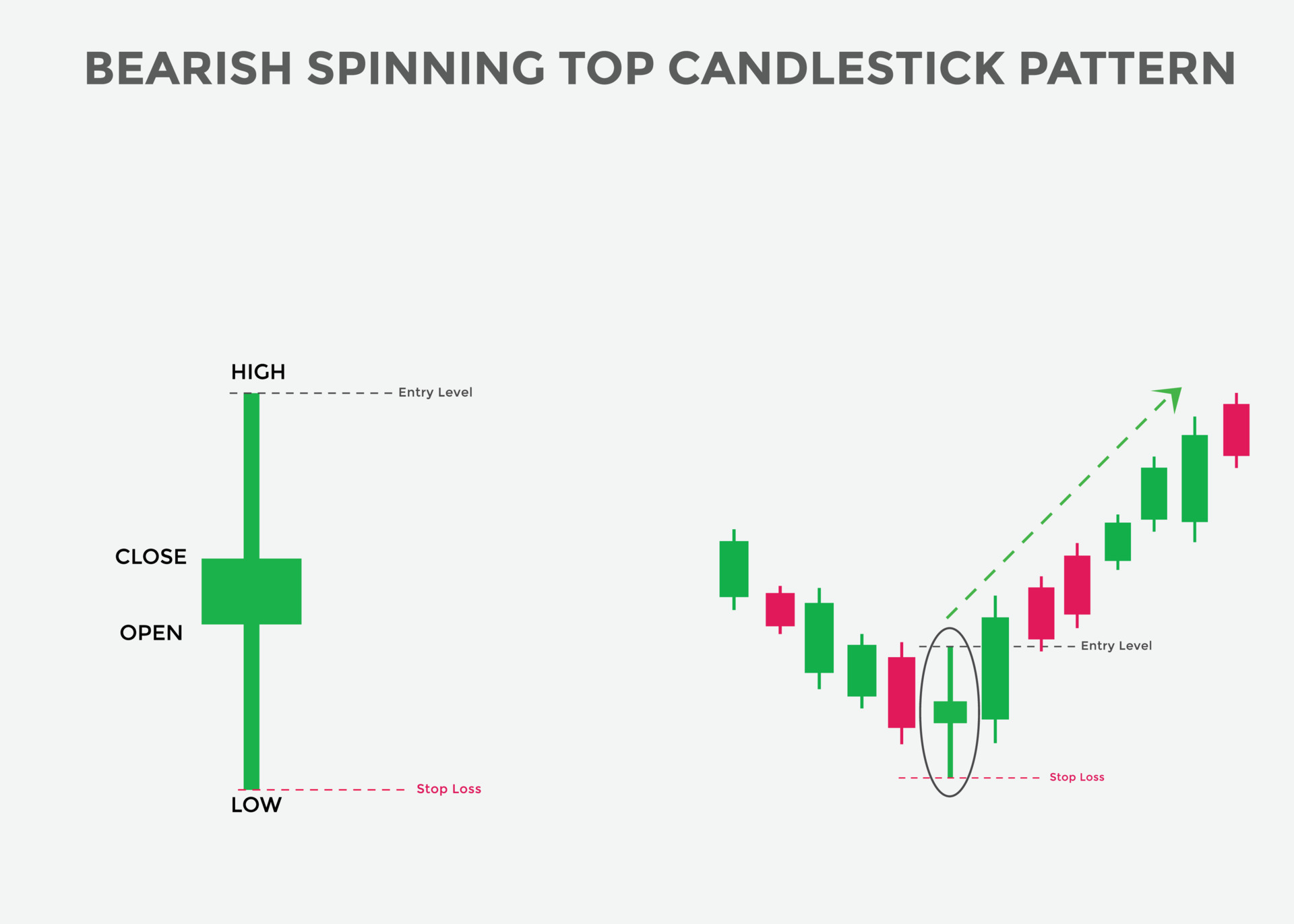

How to Trade with the Spinning Top Candlestick IG International

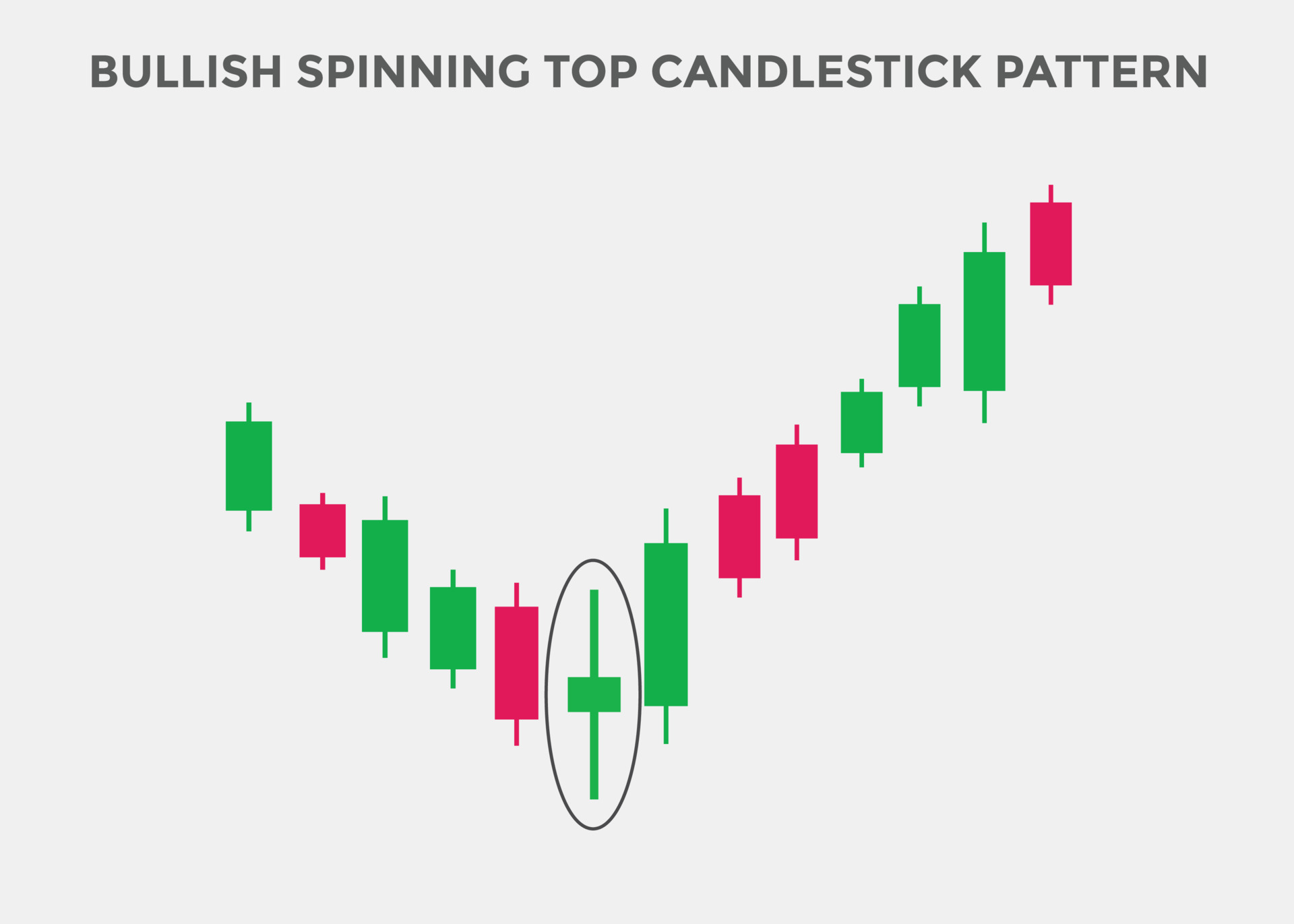

Bullish Spinning top candlestick pattern. Spinning top Bullish

:max_bytes(150000):strip_icc()/spinningtop-5c66d01f46e0fb0001e80a0c.jpg)

Spinning Top Candlestick Definition and Example

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Trading with the Spinning Top Candlestick

Trading with the Spinning Top Candlestick

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)

Spinning Top Candlestick Definition

Bullish Spinning top candlestick pattern. Spinning top Bullish

Trading with the Spinning Top Candlestick

It Has A Small Body Closing In The.

Web The Spinning Top Is A Single Candlestick Pattern With A Relatively Small Real Body And An Upper And Lower Shadow That Is Longer Than The Length Of Its Real Body.

Web What Is A Spinning Top In Candlestick Patterns?

Web A Spinning Top Candlestick Can Be Defined As An Asset Price Movement Pattern Where The Candlestick Has A Short Real Body Positioned Between Long Upper And.

Related Post: