Candlestick Patterns Marubozu

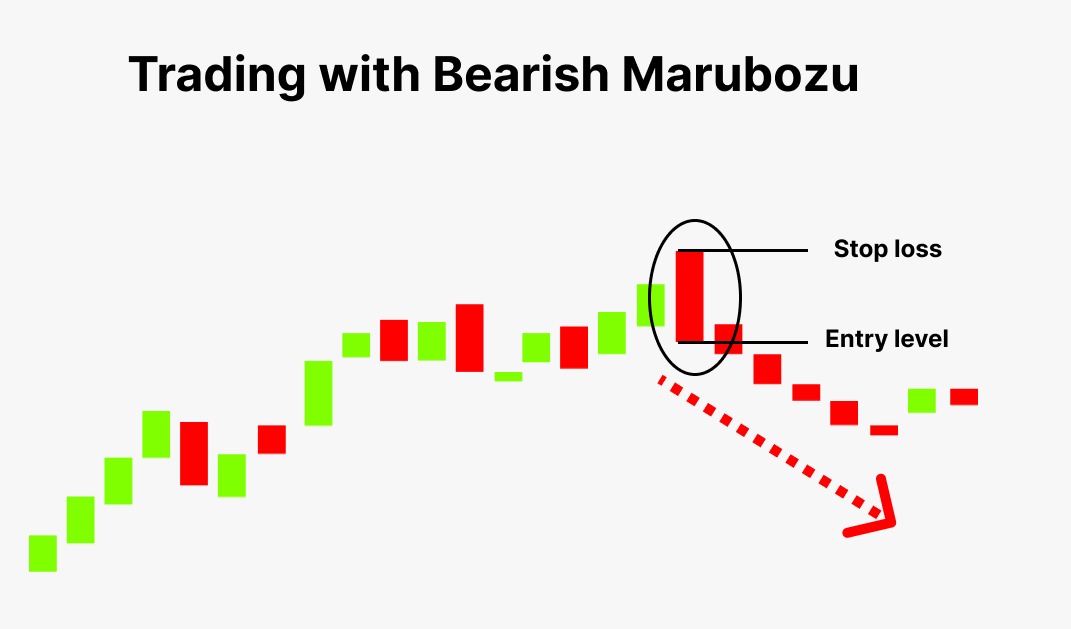

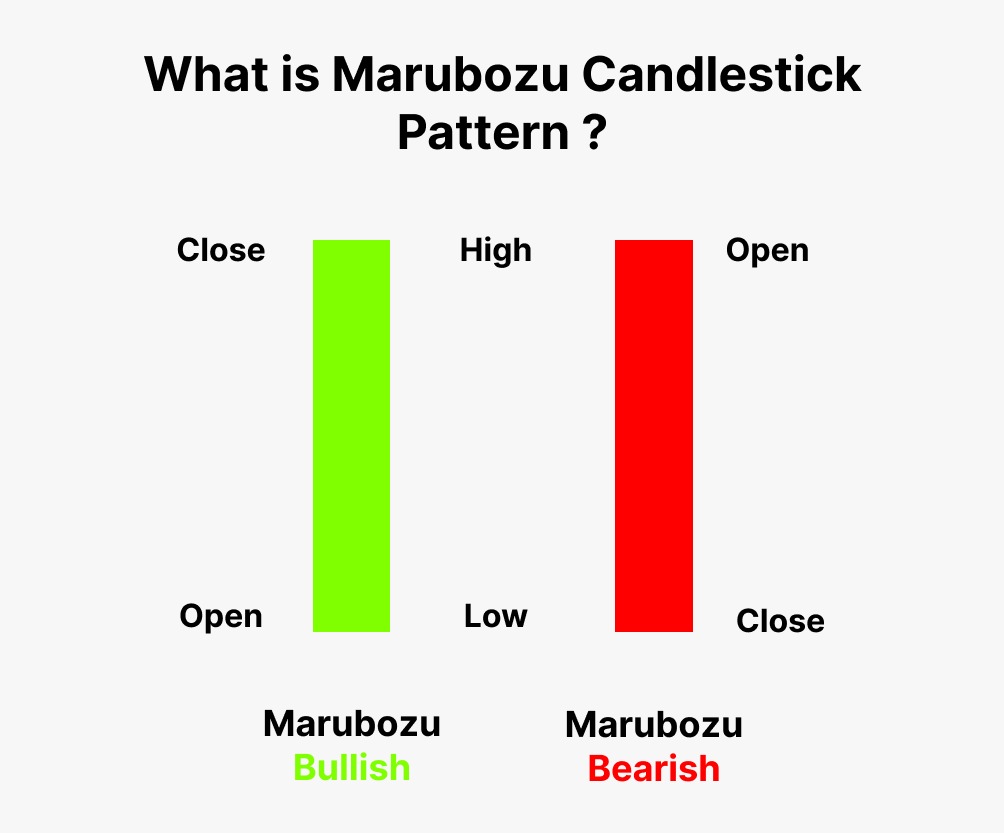

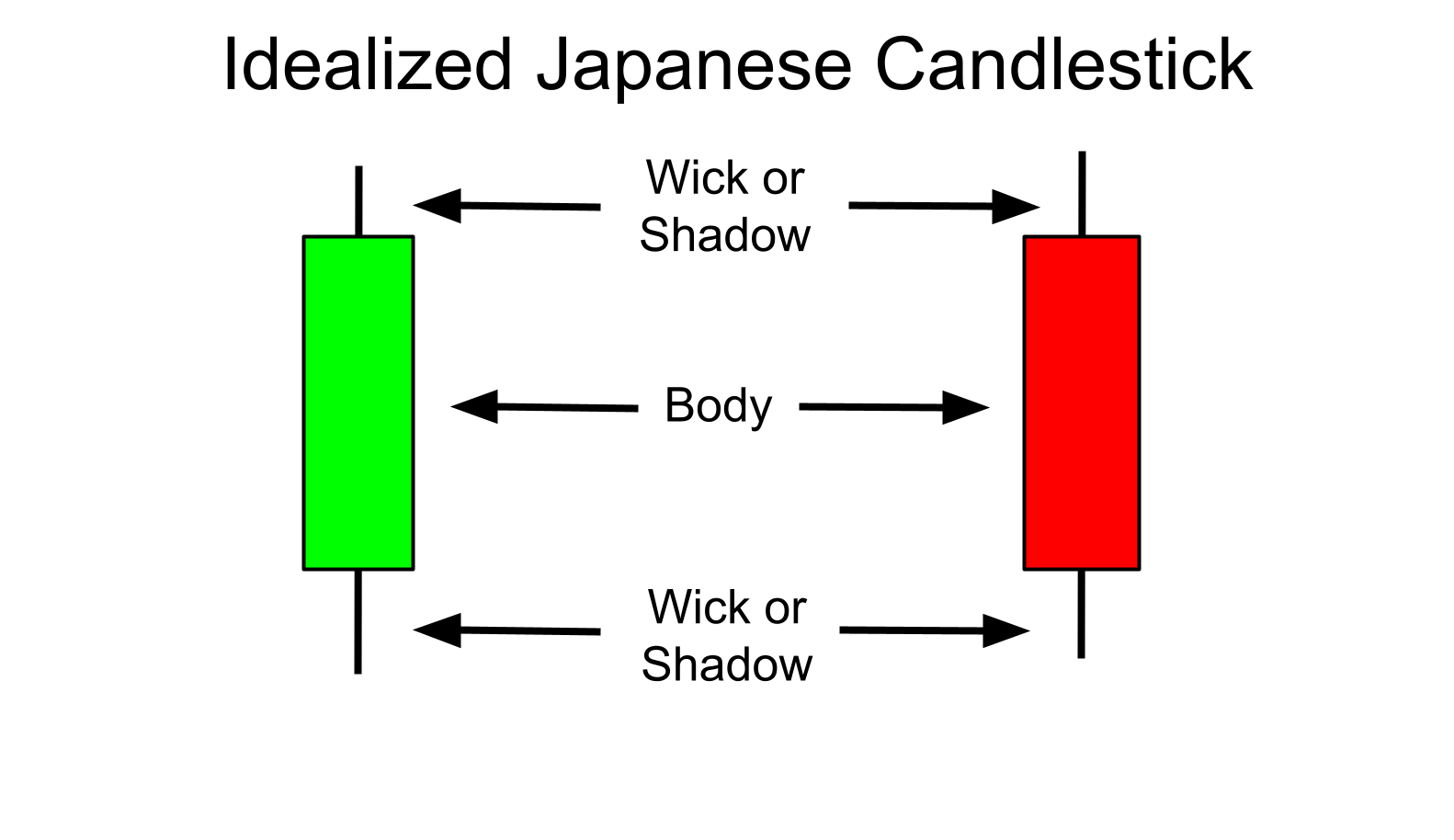

Candlestick Patterns Marubozu - Web a marubozu is a single candlestick pattern that can give some insight into market sentiment at a given time. Web a bearish marubozu candlestick pattern is characterized by a long bearish body candlestick with no upper or lower shadows, indicating strong bearish sentiment. Web the bullish marubozu and inverted hammer patterns are both candlestick patterns used in technical analysis, but they have distinct structures and interpretations. Web marubozu is a candlestick pattern which is a candle of specific shape: A marubozu can appear anywhere in the chart irrespective of the prior. Web the marubozu is a candlestick pattern that shows the market’s determination to move primarily in one direction without encountering significant opposition from the other side. Its appearance basically means that the market traded. It appears as a long green candle with no or minimal shadows, indicating that. Web candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a. They are larger candlesticks with no upper wicks or lower shadows. They are larger candlesticks with no upper wicks or lower shadows. Web marubozu is probably the only candlestick pattern that violates rule number 3, i.e., looking for a prior trend. He then summarizes which one is the best pattern. Web overview of marubozu candlestick pattern. Its appearance basically means that the market traded. Web a bearish marubozu candlestick pattern is characterized by a long bearish body candlestick with no upper or lower shadows, indicating strong bearish sentiment. A marubozu can appear anywhere in the chart irrespective of the prior. This solid body indicates a strong movement in any particular direction. Web a marubozu is a single candlestick pattern that can give some insight. Web marubozu is probably the only candlestick pattern that violates rule number 3, i.e., looking for a prior trend. Web marubozu is a candlestick pattern which is a candle of specific shape: A marubozois a type of candlestick charting formation that indicates a security's price did not trade beyond the range of the opening and closing price. The marubozu candlestick. Web the bullish marubozu and inverted hammer patterns are both candlestick patterns used in technical analysis, but they have distinct structures and interpretations. It comes in both a bearish (red or black) and a. The high and the low represent the. Web a bearish marubozu candlestick pattern is characterized by a long bearish body candlestick with no upper or lower. Web the bullish marubozu and inverted hammer patterns are both candlestick patterns used in technical analysis, but they have distinct structures and interpretations. Web a bearish marubozu candlestick pattern is characterized by a long bearish body candlestick with no upper or lower shadows, indicating strong bearish sentiment. This solid body indicates a strong movement in any particular direction. A marubozu. They are larger candlesticks with no upper wicks or lower shadows. Its appearance basically means that the market traded. Web overview of marubozu candlestick pattern. Web a marubozu is a single candlestick pattern that can give some insight into market sentiment at a given time. He then summarizes which one is the best pattern. Web marubozu is a candlestick pattern which is a candle of specific shape: Web the marubozu is a candlestick pattern that shows the market’s determination to move primarily in one direction without encountering significant opposition from the other side. A marubozu can appear anywhere in the chart irrespective of the prior. The color of this candle can signify the further. Web candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a. Web white marubozu is one of the strongest bullish reversal candlestick patterns. The high and the low represent the. It is characterised by a candlestick pattern with a long body and no wicks,. Shop. Web white marubozu is one of the strongest bullish reversal candlestick patterns. The color of this candle can signify the further trend direction (bullish. The high and the low represent the. The marubozu candlestick pattern is notable in technical analysis used by traders to predict potential market trends. He then summarizes which one is the best pattern. Long and missing both shadows. It appears as a long green candle with no or minimal shadows, indicating that. They are larger candlesticks with no upper wicks or lower shadows. Web marubozu is probably the only candlestick pattern that violates rule number 3, i.e., looking for a prior trend. Its appearance basically means that the market traded. The marubozu candlestick pattern is notable in technical analysis used by traders to predict potential market trends. Web white marubozu is one of the strongest bullish reversal candlestick patterns. Web candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a. Web the marubozu is a candlestick pattern that shows the market’s determination to move primarily in one direction without encountering significant opposition from the other side. It is characterised by a candlestick pattern with a long body and no wicks,. Web the marubozu candlestick pattern is a significant technical analysis tool commonly used in trading. The high and the low represent the. It comes in both a bearish (red or black) and a. Web a marubozu is a single candlestick pattern that can give some insight into market sentiment at a given time. They are larger candlesticks with no upper wicks or lower shadows. Web marubozu is a candlestick pattern which is a candle of specific shape: He then summarizes which one is the best pattern. This solid body indicates a strong movement in any particular direction. Do you know which one it. Web a marubozu candlestick is a full body either bullish or bearish candlestick. Web marubozu is probably the only candlestick pattern that violates rule number 3, i.e., looking for a prior trend.

Marubozu Candlestick How To Use It In Forex Trading Strategy

What is Marubozu Candlestick Pattern Meaning & Examples Finschool By

Marubozu Candlestick How To Use It In Forex Trading Strategy

What Is Marubozu Candlestick? And How To Trade It In Binary Options

Marubozu Candlestick How To Use It In Forex Trading Strategy

What is the Marubozu Candlestick Pattern ThinkMarkets EN

Bullish marubozu candlestick chart patterns. Japanese Bullish

Marubozu Candlestick How To Use It In Forex Trading Strategy

What is Marubozu Candlestick Pattern Meaning & Examples Finschool By

How to Use Marubozu Candlestick Pattern to Predict the Trend Direction

Web There He Will Take You Through The Extensive Backtesting Of The 26 Main Candlestick Patterns.

Web Overview Of Marubozu Candlestick Pattern.

Web The Bullish Marubozu And Inverted Hammer Patterns Are Both Candlestick Patterns Used In Technical Analysis, But They Have Distinct Structures And Interpretations.

A Marubozois A Type Of Candlestick Charting Formation That Indicates A Security's Price Did Not Trade Beyond The Range Of The Opening And Closing Price.

Related Post: