Bearish Ending Diagonal Pattern

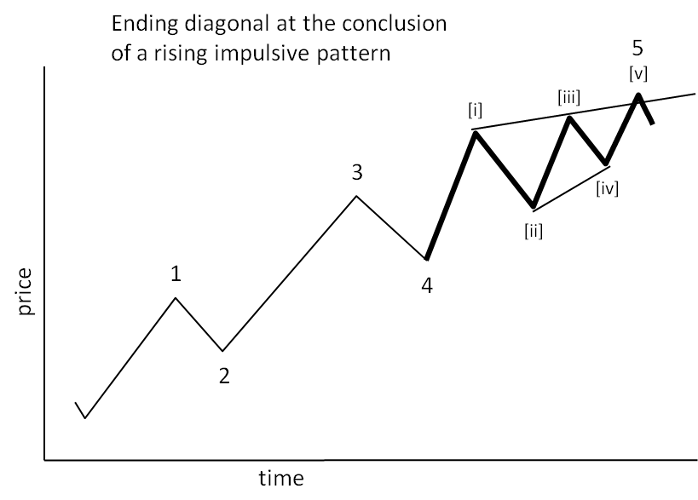

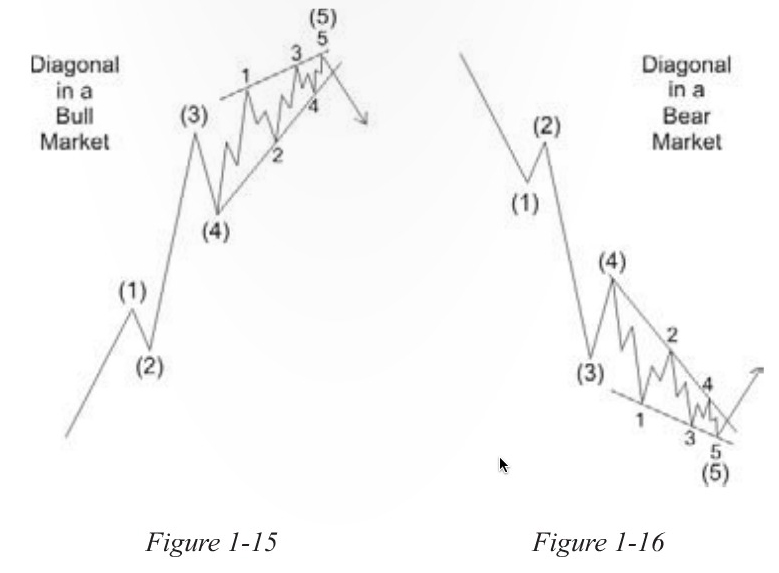

Bearish Ending Diagonal Pattern - Wave 3 always breaks the ending point. A diagonal is a motive pattern with two corrective characteristics. Web wave c is always an impulse or an ending diagonal. Web frost and prechter did not mention a bearish version of the leading diagonal triangle. Ending diagonal pattern explained for beginners. Waves a and c are motive, wave b is corrective. 4.1 elliott wave 1 and wave 2. Web the ending diagonal is the end of an impulse or zigzag. Zigzag is one of the most important price waves, and you can spot it after almost every impulsive wave (impulse that. The pattern appears in the ending stage,. Ending diagonal pattern explained for beginners. Mostly, the first wave of a contacting ending diagonal is the. Ending diagonal pattern has different names. This pattern is subdivided into five waves. Wave c is longer than wave b. 4.1 elliott wave 1 and wave 2. In this video i have explained the standard structure of ending diagonal. When you spot an ending diagonal (the most common type of diagonal), be ready for a fast. Web main rules for an ending diagonal. Waves a and c are motive, wave b is corrective. Web leading diagonal in elliott wave is a sort of impulsive pattern, but it differs in shape and internal structure. Mostly, the first wave of a contacting ending diagonal is the. It reflects a “calming” of market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave.. 4.9k views 2 years ago. Ending diagonal pattern has different names. Web an ending diagonal pattern is a type of consolidation that can occur at the completion of a strong move. Mostly, the first wave of a contacting ending diagonal is the. Web the ending diagonal triangle shown to the right is bearish because price usually breaks out downward from. A diagonal is a motive pattern with two corrective characteristics. Some conventional traders call it “wedge” while others prefer using the original name of the pattern when diving deep into technical analysis. This chapter describes the concepts of swift and sharp reversal. Wave b is shorter than wave a. Web leading diagonal in elliott wave is a sort of impulsive. Web an ending diagonal pattern is a type of consolidation that can occur at the completion of a strong move. Web main rules for an ending diagonal. Web wave c is always an impulse or an ending diagonal. This pattern consists of zigzags or more complex correction formations. Waves a and c are motive, wave b is corrective. Wave 2 never ends beyond the starting point of wave 1. Web the ending diagonal pattern is a pattern that appears in the final stage of a trend, typically in wave 5 or wave c; Web the ending diagonal triangle shown to the right is bearish because price usually breaks out downward from the pattern with price often retracing back. Web wave c is always an impulse or an ending diagonal. The pattern appears in the ending stage,. Web an ending diagonal pattern is a type of consolidation that can occur at the completion of a strong move. Web frost and prechter did not mention a bearish version of the leading diagonal triangle. A duration of a correction. Wave 3 always breaks the ending point. It reflects a “calming” of market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. Waves a and c are motive, wave b is corrective. Ending diagonal pattern has different names. 4.1 elliott wave 1 and wave 2. If it exists, it would look like the chart flipped upside down. This pattern is subdivided into five waves. However, the leading diagonal occurs in waves 1 or a, & it. Mostly, the first wave of a contacting ending diagonal is the. Watch our currency pro service editor. Web the ending diagonal is the end of an impulse or zigzag. A diagonal is a motive pattern with two corrective characteristics. Wave c is longer than wave b. Web the ending diagonal triangle shown to the right is bearish because price usually breaks out downward from the pattern with price often retracing back to at least the start of the triangle. Watch our currency pro service editor. Web types of model. Waves a and c are motive, wave b is corrective. Wave b is shorter than wave a. Zigzag is one of the most important price waves, and you can spot it after almost every impulsive wave (impulse that. A duration of a correction. 4.9k views 2 years ago. However, the leading diagonal occurs in waves 1 or a, & it. It reflects a “calming” of market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. This wave often occurs when the preceding move of the trend has gone too far, too fast and has run out of steam. When you spot an ending diagonal (the most common type of diagonal), be ready for a fast. Web main rules for an ending diagonal.

USDJPY Bearish Crab + Ending diagonal ? for FX_IDCUSDJPY by Fx

Ending diagonal patterns Trading On The Mark

BTCUSD Bear Market Wave C Ending Diagonal Pattern for COINBASEBTCUSD

ENDING DIAGONAL PATTERN ALL YOU NEED TO KNOW!! YouTube

Pin on coding

USDCHF Bearish Trend Begins Ending Diagonal Orbex Forex Trading Blog

Tổng hợp 93+ hình về mô hình ending diagonal triangle NEC

Ending Diagonal — Wave Analysis — Education — TradingView

Ending Diagonal — Wave Analysis — Education — TradingView

Ending Diagonal

If It Exists, It Would Look Like The Chart Flipped Upside Down.

This Pattern Is Subdivided Into Five Waves.

This Chapter Describes The Concepts Of Swift And Sharp Reversal.

Web Wave C Is Always An Impulse Or An Ending Diagonal.

Related Post: