Candlestick Flag Patterns

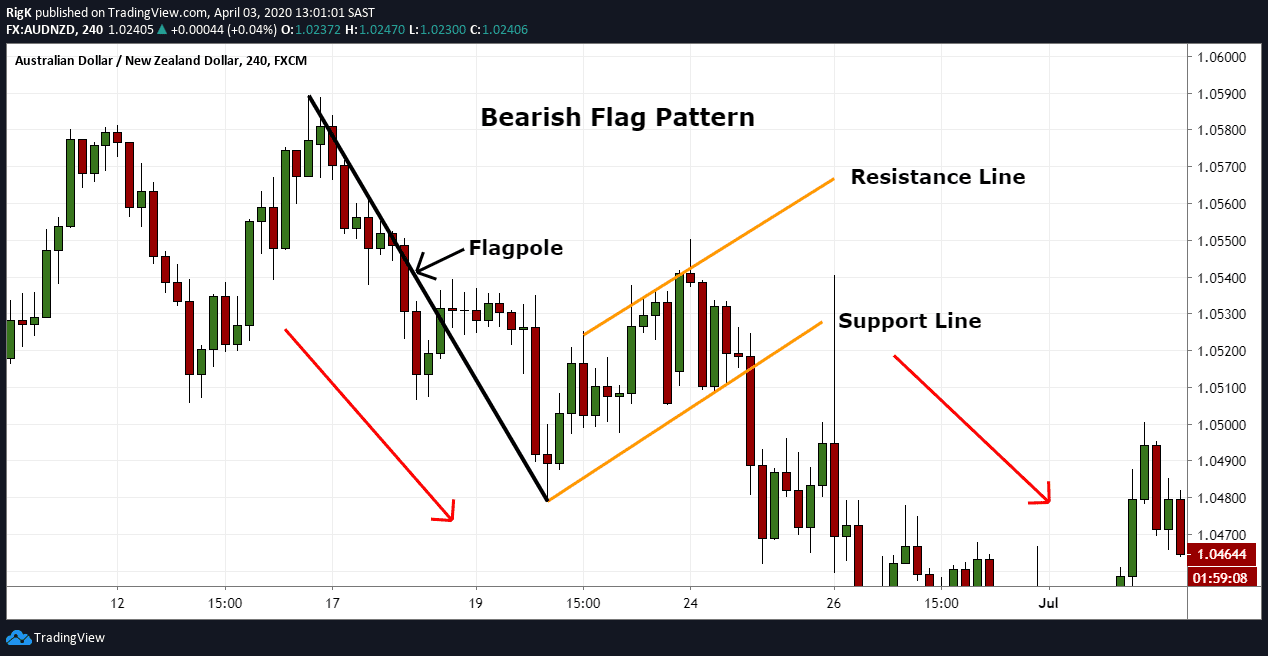

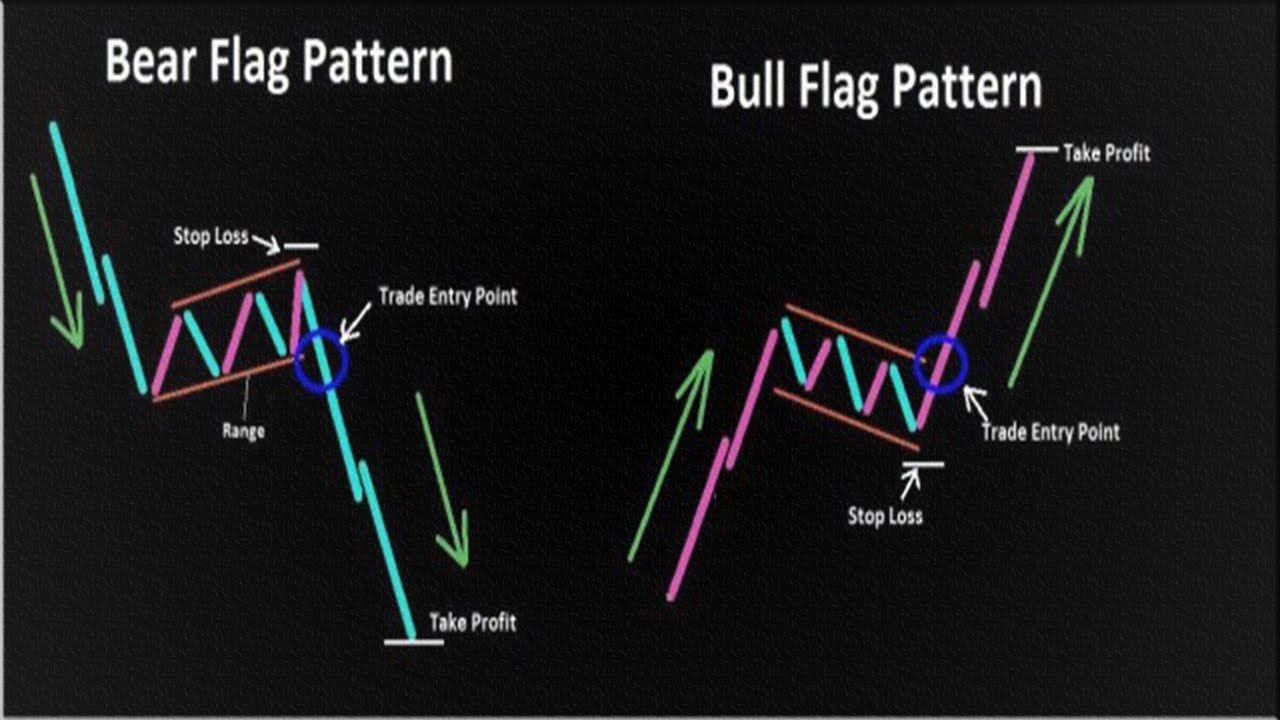

Candlestick Flag Patterns - Go beyond basic price charts and learn to recognize the hidden language of the markets. A pennant is a continuation pattern in technical analysis formed when there is a large movement in a stock, the flagpole, followed by a consolidation period with converging trendlines. Patterns are recognizable motifs created on charts. Here are some of the most common types of flags: Web the flag limit is the area where the price penetrates the sr flip, forms a narrow sideways price action with 1 or 2 candlesticks, and breaks the support or resistance undoubtedly. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. Web we looked at five of the more popular candlestick chart patterns that signal buying opportunities. Followed by at least three or more smaller consolidation candles, forming the flag. Investing and trading are market activities with multiple participants and an infinite number of elements interacting with each other. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend. Web by oreld hadilberg. Web a bear flag pattern consists of a larger bearish candlestick (going down in price), which forms the flag pole. Traders noticed that certain price movements tend to follow specific candlestick patterns. Trading without candlestick patterns is a lot like flying in the night with no visibility. Then, we explore the flag pattern indicators that show potential buy or sell signals. The pattern consists of between five to twenty candlesticks. This makes them more useful than. Web there are many different types of flags that technical traders should keep an eye out. Web we looked at five of the more popular candlestick chart patterns that signal buying opportunities. Flags result from price fluctuations within a narrow range and mark a consolidation before the previous move. Bullish candlesticks are one of two different candlesticks that form on stock charts. Web how to trade the pennant, triangle, wedge, and flag chart patterns. Web the. Our app empowers you to identify key candlestick patterns, equipping you to make informed trading decisions based on historical price movements. Go beyond basic price charts and learn to recognize the hidden language of the markets. We start by discussing what flag patterns are and how they are presented on a chart. Web candlestick patterns are visual representations of how. Investing and trading are market activities with multiple participants and an infinite number of elements interacting with each other. Web 9 min read. They are typically green, white, or blue on stock charts. Web by oreld hadilberg. Web bull flag patterns are one of the most popular bullish patterns. Web candlestick patterns are used to predict the future direction of price movement. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. Our app empowers you to identify key candlestick patterns, equipping you to make informed trading decisions based on historical price movements. The price action consolidates within the two parallel trend. Web candlestick patterns are used to predict the future direction of price movement. As a continuation pattern, the bear flag helps sellers to push the price action further lower. We start by discussing what flag patterns are and how they are presented on a chart. Web the flag limit is the area where the price penetrates the sr flip, forms. They are typically green, white, or blue on stock charts. Go beyond basic price charts and learn to recognize the hidden language of the markets. The pattern consists of between five to twenty candlesticks. Web 9 min read. This makes them more useful than. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by several smaller bearish candlesticks pulling back down for consolidation, which forms the flag. Whilst using one and two candlestick. Then, we explore the flag pattern indicators that show potential buy or sell signals. What is a bull flag pattern? Patterns are recognizable motifs created on charts. Web there are many different types of flags that technical traders should keep an eye out for when analyzing chart patterns. Web a flag pattern is a type of chart continuation pattern that. Sure, it is doable, but it requires special training and expertise. The pattern consists of between five to twenty candlesticks. Followed by at least three or more smaller consolidation candles, forming the flag. Investing and trading are market activities with multiple participants and an infinite number of elements interacting with each other. Bullish candles show that a stock is going up in price. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. The stop is placed just below the lower flag or pennant line, in line (vertically) with the point of breakout. Web there are certain bullish patterns, such as the bull flag pattern, double bottom pattern, and the ascending triangle pattern, that are largely considered the best. To that end, we’ll be covering the fundamentals of. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Bullish candlesticks are one of two different candlesticks that form on stock charts. They consist of either a large bullish candlestick or several smaller bullish candlesticks up, forming the flag pole, followed by several smaller bearish candlesticks pulling back down for consolidation, which forms the flag. The other type is bearish candles. Web bullish reversal candlestick patterns. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. Then, we explore the flag pattern indicators that show potential buy or sell signals.

10 Powerful Candlesticks Patterns And Strategies You Need To Know

How to use the flag chart pattern for successful trading

Flag Pattern Full Trading Guide with Examples

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

Bullish Pennant Patterns A Complete Guide

How To Trade Flag Pattern Basics Candlestick Chart The Waverly

Top Continuation Patterns Every Trader Should Know

Flag Pattern Forex Trading

The Common Forex Candlestick Patterns

Flag Candlestick Pattern Candlestick Pattern Tekno

Web The Flag Limit Is The Area Where The Price Penetrates The Sr Flip, Forms A Narrow Sideways Price Action With 1 Or 2 Candlesticks, And Breaks The Support Or Resistance Undoubtedly.

Web Candlestick Patterns Are Used To Predict The Future Direction Of Price Movement.

The Price Action Consolidates Within The Two Parallel Trend Lines In The Opposite Direction Of The Uptrend, Before Breaking Out And Continuing The Uptrend.

Web Unleash The Power Of Technical Analysis With Our Comprehensive Candlestick Pattern Application!

Related Post: