Candlestick Patterns Evening Star

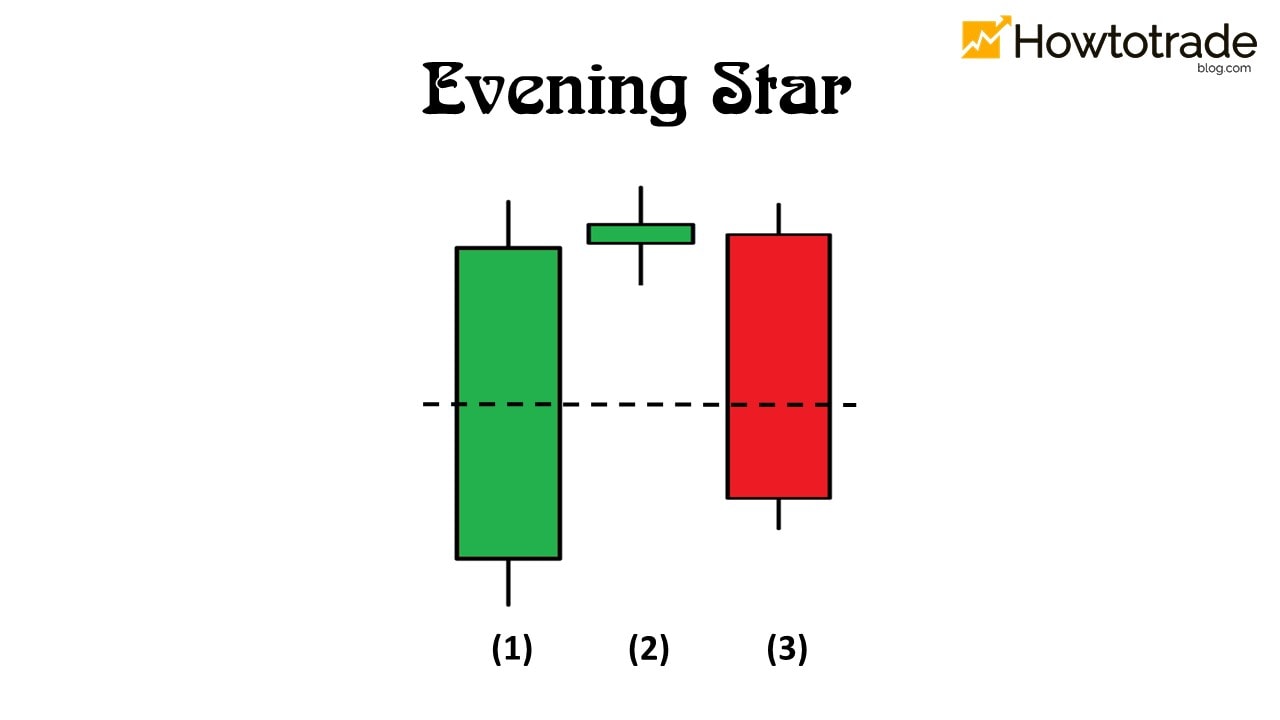

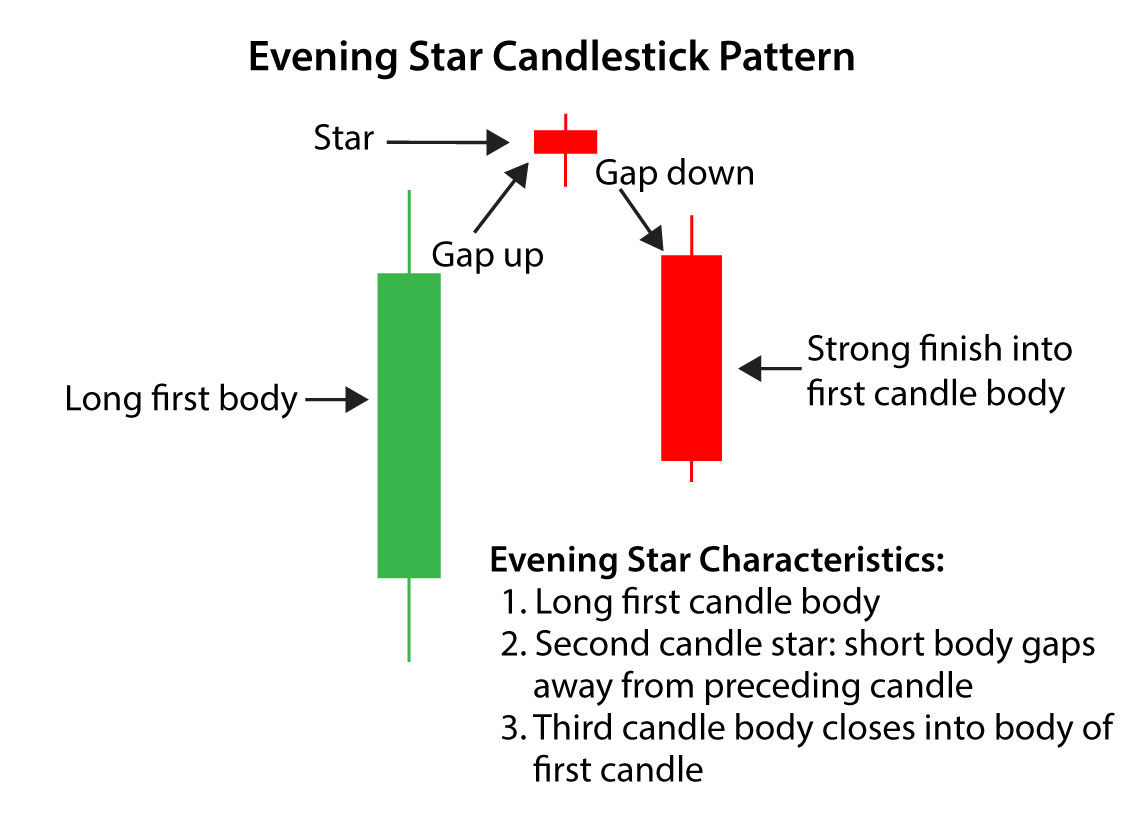

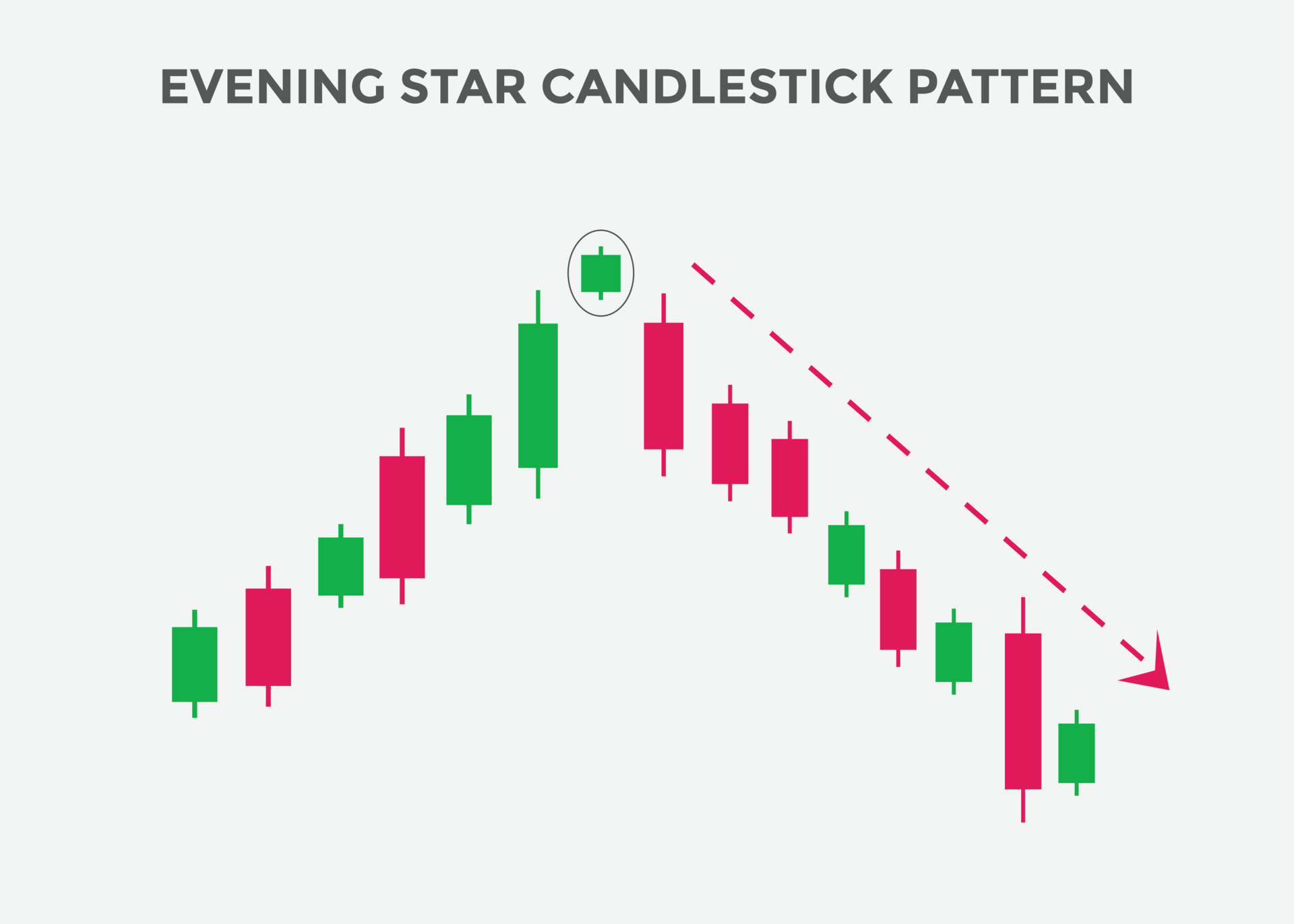

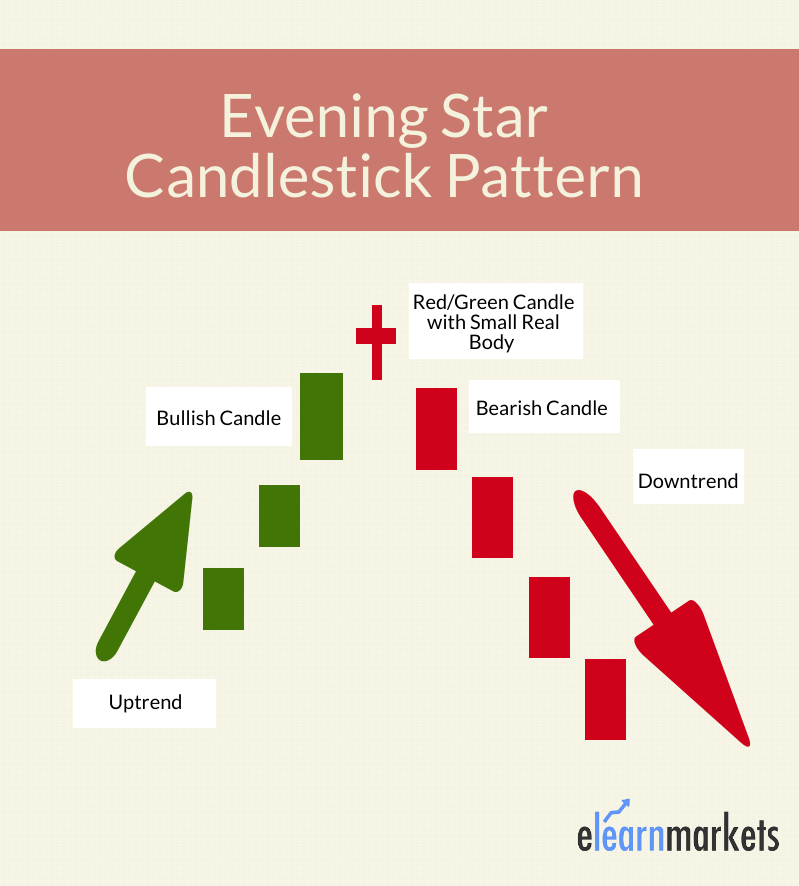

Candlestick Patterns Evening Star - The first candle is a short red body that is completely engulfed by a larger green candle. We’ll discuss what it means when you see it on your chart and how to. Candlestick charting is a type of financial chart used to analyze price movements in financial markets. It’s a bearish reversal pattern that traders. Web the evening star pattern is a candlestick pattern that appears at the top of the uptrend and predicts that a downtrend is approaching. The bullish engulfing pattern is formed of two candlesticks. An evening star is a. This is based on the number of sticks that make up the pattern. It also consists of three. Web the evening star pattern is a bearish reversal candlestick pattern that occurs at the top of the uptrend, and then the trend reverses to a downtrend. It presents the open, high,. It signals a potential shift. We’ll discuss what it means when you see it on your chart and how to. An evening star is a. While past performance is no guarantee. It signals the slowing down of upward. Web conversely, the evening star is a bearish signal that usually appears at the end of an uptrend, signaling the potential start of a downtrend. Web what is candlestick charting? We’ll discuss what it means when you see it on your chart and how to. It signals a potential shift. It consists of three candles: Web the evening star pattern unfolds over three trading days: It signals a potential shift. It signals the slowing down of upward. Web what is candlestick charting? As such, it usually appears at the end of an uptrend and. This is based on the number of sticks that make up the pattern. It signals a potential shift. To be valid, it must appear after a move to the upside. Web the evening star candlestick is a bearish trend reversal pattern, which typically emerges after a bullish trend. Web there are three types of candlestick pattern: Web the evening star is a bearish candlestick pattern that signifies a potential reversal in a bullish market. Web the evening star candlestick pattern is a significant tool used by traders and analysts within the scope of technical analysis. Noted for its predictive capabilities,. It presents the open, high,. An evening star is a. It presents the open, high,. Evening star patterns are associated with the top of a. Web in this article, we will explore one such important candlestick pattern: The first candle is a short red body that is completely engulfed by a larger green candle. The first candle is a short red body that is completely engulfed by a larger green candle. This is based on the number of sticks that make up the pattern. It presents the open, high,. Web in this article, we will explore one such important candlestick pattern: It also consists of three. As such, it usually appears at the end of an uptrend and. It signals the slowing down of upward. Web the evening star pattern unfolds over three trading days: The day starts with a large green candle, indicating a continued rise in prices. The bullish engulfing pattern is formed of two candlesticks. Web conversely, the evening star is a bearish signal that usually appears at the end of an uptrend, signaling the potential start of a downtrend. An evening star is a. It's a bearish candlestick patternthat consists of three candles: The bullish engulfing pattern is formed of two candlesticks. The day starts with a large green candle, indicating a continued rise. Candlestick charting is a type of financial chart used to analyze price movements in financial markets. The first candle is a short red body that is completely engulfed by a larger green candle. It’s a bearish reversal pattern, meaning that it signs a potential reversal to. While past performance is no guarantee. It consists of three japanese candlesticks: Web the evening star pattern unfolds over three trading days: Web conversely, the evening star is a bearish signal that usually appears at the end of an uptrend, signaling the potential start of a downtrend. An evening star is a stock price chart pattern that's used by technical analysts to detect when a trend is about to reverse. It presents the open, high,. To be valid, it must appear after a move to the upside. It’s a bearish reversal pattern that traders. It also consists of three. It signals a potential shift. Web there are three types of candlestick pattern: Web the evening star candlestick acts in theory as it does in reality, as a bearish reversal of the upward price trend 72% of the time. That gives it a rank of 10th,. An evening star is a. The day starts with a large green candle, indicating a continued rise in prices. This is based on the number of sticks that make up the pattern. The bullish engulfing pattern is formed of two candlesticks. Web the evening star pattern is a bearish reversal candlestick pattern that occurs at the top of the uptrend, and then the trend reverses to a downtrend.

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

Evening Star Definition and Use Candlestick Pattern

Evening Star Candlestick Pattern And How To Trade Forex Most

All 35 Candlestick Chart Patterns in the Stock MarketExplained

Evening Star Candlestick pattern How to Identify Perfect Evening Star

Evening Star Candlestick Pattern How to Trade It in 7 Steps Timothy

evening star chart candlestick pattern. Powerful bearish Candlestick

What Is Evening Star Candlestick Pattern? Meaning And How To Trade

What Is Evening Star Pattern Formation With Examples ELM

A Long Bullish Candle, Followed.

We’ll Discuss What It Means When You See It On Your Chart And How To.

It's A Bearish Candlestick Patternthat Consists Of Three Candles:

While Past Performance Is No Guarantee.

Related Post: