Bullish Engulfing Candlestick Pattern

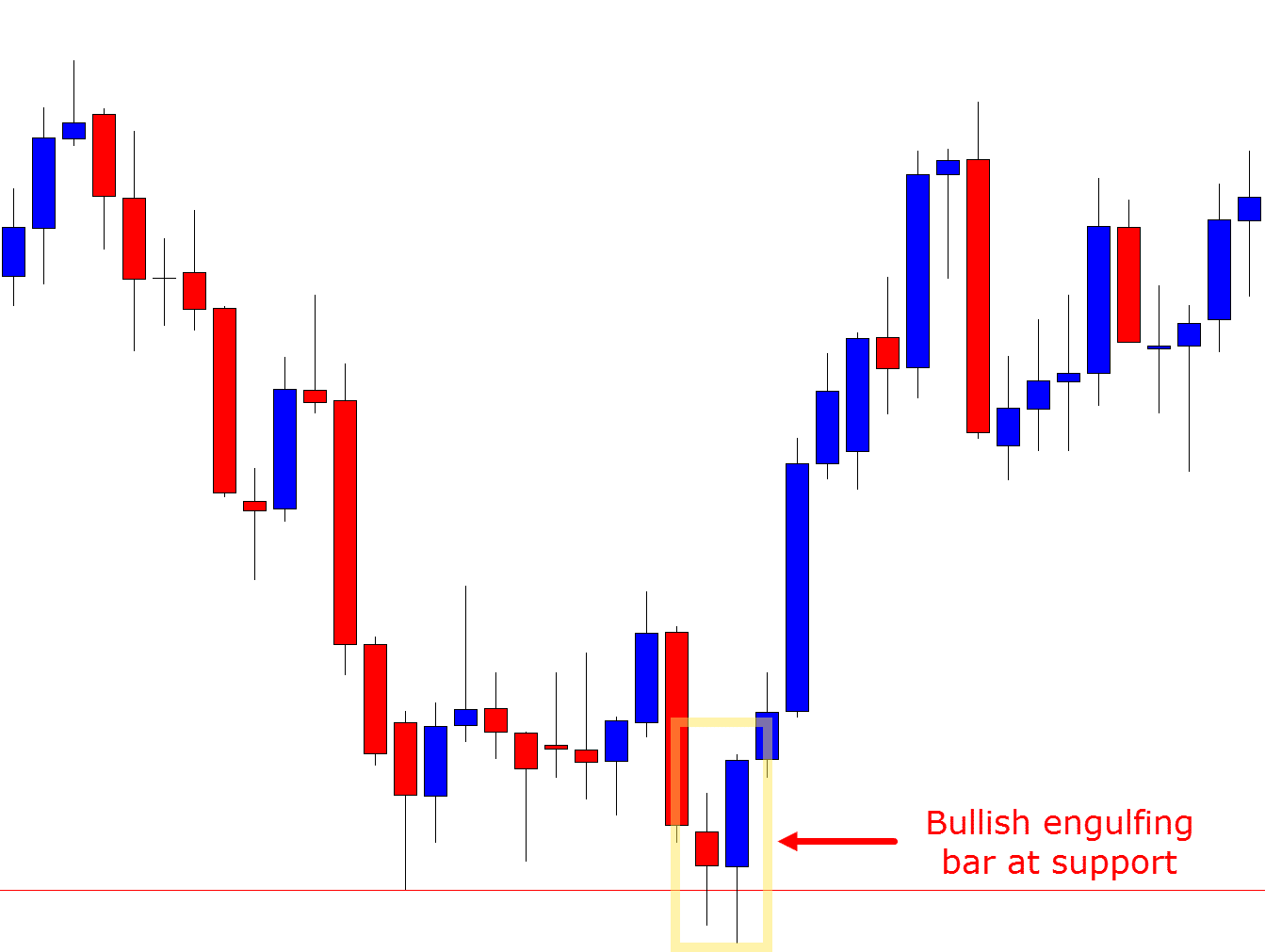

Bullish Engulfing Candlestick Pattern - The engulfing pattern most likely signals a trend reversal. The body of the second candle must engulf the body of the first candle. In other words, the green candle closes above the red candle’s opening price after opening lower than the latter’s closing price. Web the bullish engulfing pattern occurs when a black or red candlestick is followed by a green or white or hollow candlestick the next day in a graph. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. This pattern arises within a downtrend, featuring a dark candle followed by a larger hollow one. What is a bullish engulfing candle? Web a bullish engulfing pattern indicates a potential trade setup when it occurs within a downswing, signaling a potential reversal to an upswing. A bullish engulfing candlestick pattern occurs at the end of a downtrend. This quick introduction will teach you how to identify the pattern, and how traders use this in technical analysis. It indicates that the bears have lost control of the market and the bulls are likely to take control in the near future. Web bearish engulfing candlestick pattern; This script serves as the 'engulfing candles v2' indicator in tradingview. The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high,. It emphasizes a development in which buying pressure increases and selling pressure becomes difficult. It signals a potential shift to a bullish trend. You're looking for a pronounced downtrend. The body of the second candle must engulf the body of the first candle. Black or red candlesticks indicate that the opening price was higher than the closing price. Web bullish and bearish engulfing candlestick patterns are powerful reversal formations that generate a signal of a potential reversal. If the green candle formed at the. A bullish engulfing candlestick pattern occurs at the end of a downtrend. Web there is a bullish divergence developing in the macd’s momentum, aligning with this positive outlook. Updated on october 13, 2023. This two candlestick pattern occurs after a downtrend and is formed by one bearish candlestick (which is covered) and one bullish candlestick (which does the covering). A small red/black candlestick is followed by a large white candlestick that completely eclipses or engulfs the previous day's candlestick. Web bearish engulfing candlestick pattern; Engulfing bullish consists of a small black body that. After having basic knowledge of all candlestick patterns, we will explore bearish candlestick patterns in depth. This pattern arises within a downtrend, featuring a dark candle followed by a larger hollow one. The 2nd bullish candle engulfs the smaller 1st bearish candle. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a. A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle that completely engulfs the previous candle. This two candlestick pattern occurs after a downtrend and is formed by one bearish candlestick (which is covered) and one bullish candlestick (which does the covering). What does a bullish engulfing pattern tell you? Web there are. Scanner guide scan examples feedback. After having basic knowledge of all candlestick patterns, we will explore bearish candlestick patterns in depth. Web a bullish engulfing pattern consists of two candlesticks that form near support levels; Web a bullish engulfing pattern indicates a potential trade setup when it occurs within a downswing, signaling a potential reversal to an upswing. Web by. The first candle in the pattern is bearish, followed by a bullish candle that completely engulfs the body of the first candle. The body of the second candle must engulf the body of the first candle. Important bullish reversal candlestick patterns to know. Web this technical pattern, characterized by a red candlestick engulfing the preceding bullish candlestick, is widely regarded. It may be a strong choice for investors to strengthen the possibility of buying at the bottom. This script serves as the 'engulfing candles v2' indicator in tradingview. Bullish candlestick patterns as per their strenghts and weakness. Web the bullish engulfing pattern occurs when a black or red candlestick is followed by a green or white or hollow candlestick the. They are popular candlestick patterns because they are easy to spot and trade. Updated on october 13, 2023. A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle that completely engulfs the previous candle. Web there are two types: What does a bullish engulfing pattern tell you? The body of the second candle must engulf the body of the first candle. You're looking for a pronounced downtrend. Engulfing bullish consists of a small black body that is contained within the following large white candlestick. It indicates that the bears have lost control of the market and the bulls are likely to take control in the near future. What does a bullish engulfing pattern tell you? Web by leo smigel. This two candlestick pattern occurs after a downtrend and is formed by one bearish candlestick (which is covered) and one bullish candlestick (which does the covering). Web bearish engulfing candlestick pattern; Here's how you can spot this pattern: Web gold has formed a bullish engulfing candle above $2334.65, followed by a double doji pattern, indicating a weakening downtrend. Web this is the modified version of the engulfing candles indicator: The first type occurs when the current candle's close is higher than its open and higher than the previous candle's high, and. Web a bullish engulfing pattern indicates a potential trade setup when it occurs within a downswing, signaling a potential reversal to an upswing. It may be a strong choice for investors to strengthen the possibility of buying at the bottom. Web the bullish engulfing pattern features one candlestick covering (or engulfing) another. The second candle completely ‘engulfs’ the real body of the first one, without regard to the length of the tail shadows.

Bullish Engulfing Candlestick Pattern & How To Trade Forex With It

Bullish Engulfing Candlestick Pattern & How To Trade Forex With It

How to Use a Bullish Engulfing Candle to Trade Entries Bybit Learn

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

Trading the Bullish Engulfing Candle

Bullish Engulfing Pattern What is it? How to use it?

What are Bullish Candlestick Patterns?

Engulfing Candle Patterns & How to Trade Them

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)

Bullish Engulfing Pattern Definition, Example, and What It Means

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

Black Or Red Candlesticks Indicate That The Opening Price Was Higher Than The Closing Price.

To Identify The Bullish Engulfing Pattern, Look For The Following Crucial Criteria:

The Candles Must Be Opposite Colors (Except If The First Candle Is A Doji) For The Engulfing Pattern To Indicate A Reversal, The Pattern Must Occur After A Clear Downtrend (For The Bullish Engulfing Pattern To Signal A Potential Bullish Reversal)

First, Determine The Direction Of The Trend.

Related Post: