Bearish Chart Pattern

Bearish Chart Pattern - In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500, then reflects on the emergence of defensive sectors like consumer staples. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. Web a bearish pennant is a pattern that indicates a downward trend in prices. It works in the same manner as a bull flag, with the only difference being that it is a bearish pattern looking to push the price action further lower after the period of consolidation. Head and shoulders (bearish) descending triangle (bearish) rising wedges (bearish) double top (bearish) summary. The pattern consists of a long white candle followed by a small black candle. Web what is bearish chart patterns. Economists are torn on when the boe will. Web there are dozens of popular bearish chart patterns. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. The gbp/usd pair held steady after the uk published strong gdp numbers on friday. Web a bearish pennant is a pattern that indicates a downward trend in prices. Web the bearish rectangle is a continuation pattern that occurs when a. Here is list of the classic ones: Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. However, a descending triangle pattern can also be. How to identify. Economists are torn on when the boe will. The pattern consists of a long white candle followed by a small black candle. Free animation videos.master the fundamentals.find out today.learn finance easily. Its operating loss was $1.07 billion, compared to $1.47 billion in the previous year’s period. The rising wedge pattern typically. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading! Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex). It resembles a baseline with three peaks with the middle topping the other two. In this article we present most useful bearish reversal patterns of candlesticks and how to trade with them. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web the chipmaker’s gross margin rose 30.2% from the prior. Web the bearish measured move consists of a reversal decline, consolidation/retracement and continuation decline. Many of these are reversal patterns. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Here is list of the classic ones: Web the head and shoulders pattern is a market chart that crypto traders use to. The chart setups based on fibonacci ratios are very popular as well: Web the bearish measured move consists of a reversal decline, consolidation/retracement and continuation decline. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. Web there are dozens of popular bearish chart patterns. Web busy week ahead. Many of these are reversal patterns. According to the office of national statistics (ons), the economy expanded by 0.6% in q1, higher than. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. Web there are dozens of popular bearish chart patterns. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. He also recaps earnings movers, including dis, shop, and more. The chart setups. Because the bearish measured move cannot be confirmed until after the consolidation/retracement period, it is categorized as a continuation pattern. Web a rising wedge is often considered a bearish chart pattern that indicates a potential breakout to the downside. As a continuation pattern, the bear flag helps sellers to push the price action further lower. Web a bearish reversal candlestick. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Because the bearish measured move cannot be confirmed until after the consolidation/retracement period, it is categorized as a continuation pattern. In this article we present most useful bearish reversal patterns of candlesticks and how to trade with them. However, a descending triangle pattern can also be. Web a bearish pennant is a pattern that indicates a downward trend in prices. For traders, these patterns serve as alerts for potential selling opportunities or protective measures. Web what is bearish chart patterns. Web busy week ahead. Web the bearish measured move consists of a reversal decline, consolidation/retracement and continuation decline. Many of these are reversal patterns. Its operating loss was $1.07 billion, compared to $1.47 billion in the previous year’s period. Here is list of the classic ones: Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Without further ado, let’s dive into the 8 bearish candlestick patterns you need to know for day trading!

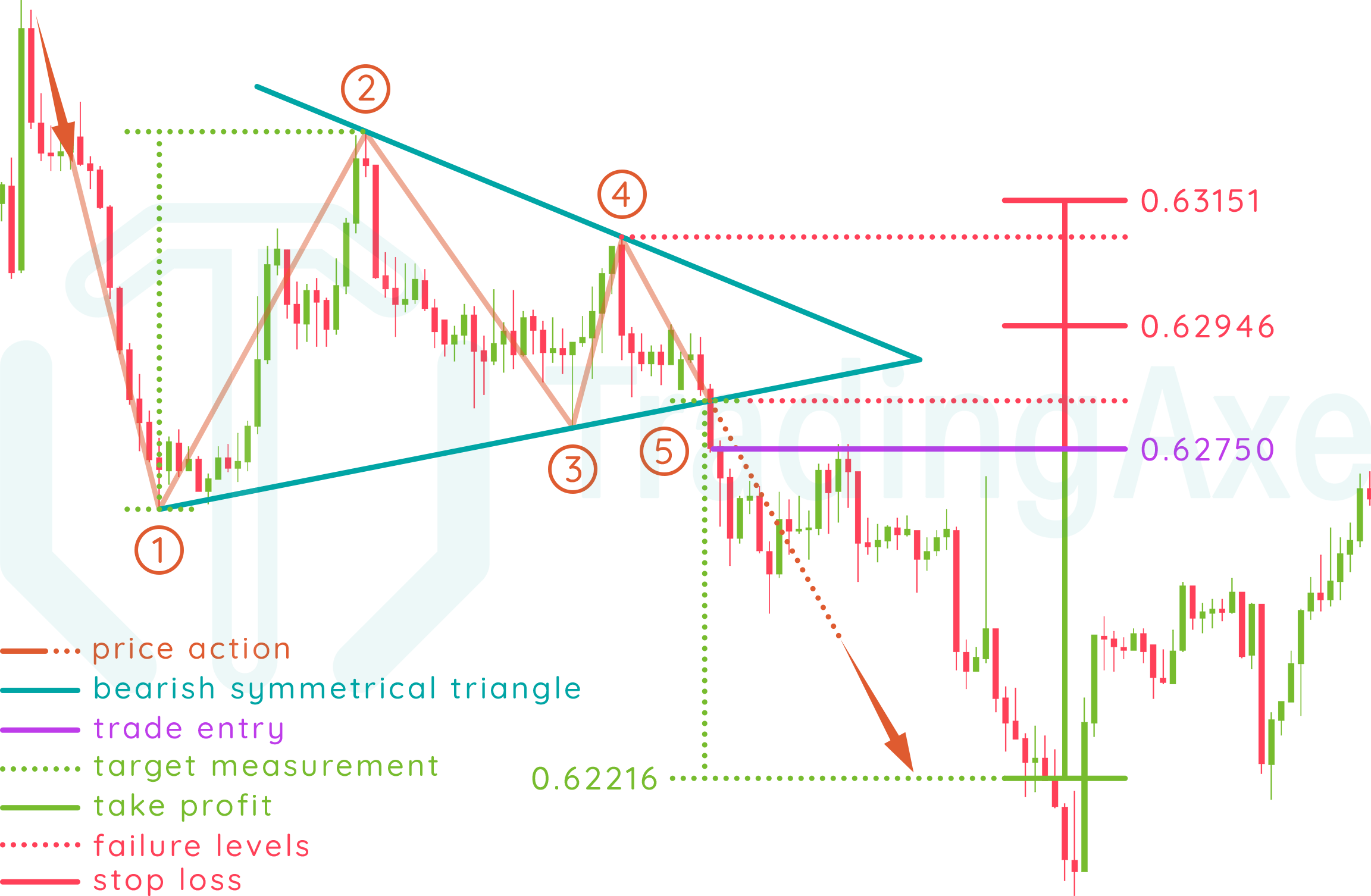

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

.png)

Bear Pennant How to Trade with a Bearish Chart Pattern Bybit Learn

Bearish Chart Patterns

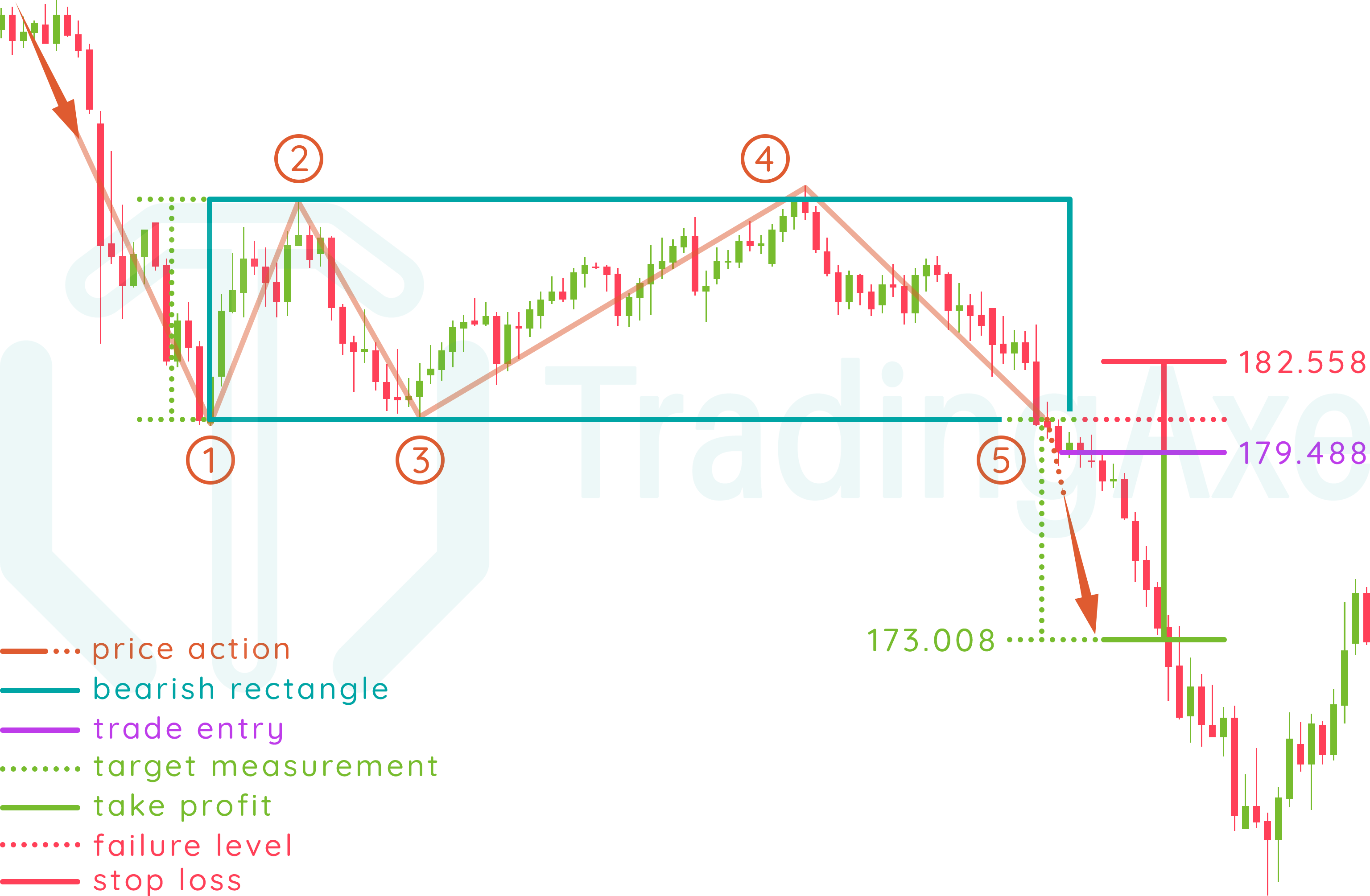

How To Trade Bearish Rectangle Chart Pattern TradingAxe

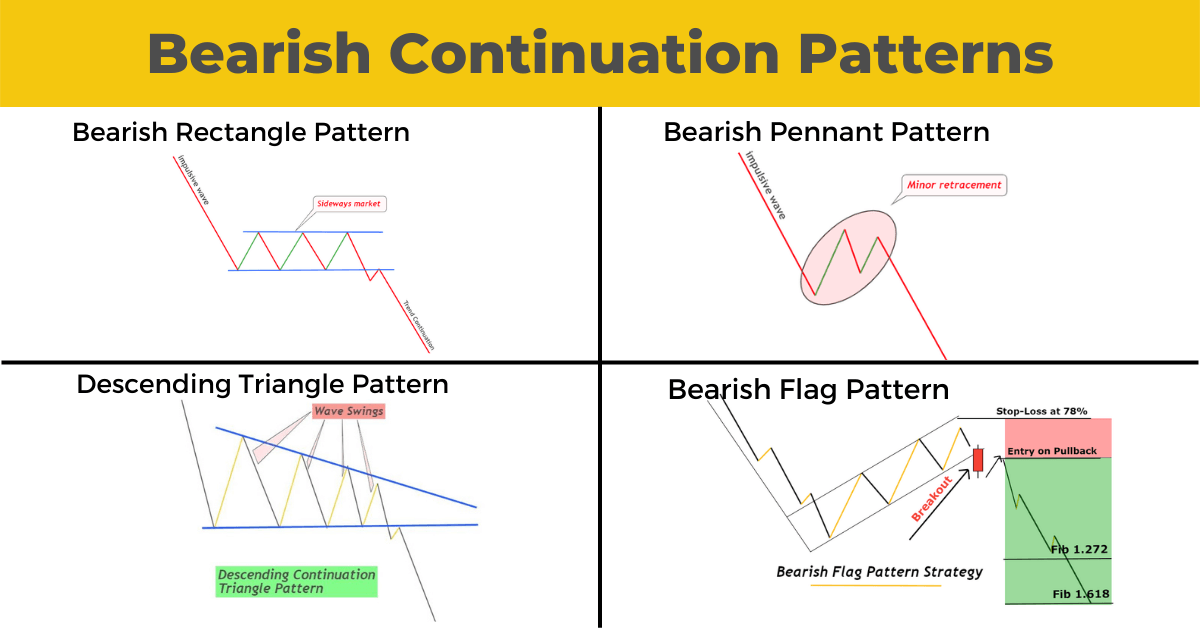

Bearish Continuation Patterns Full Guide ForexBee

Top 3 Bearish Chart Patterns New Traders Should Understand Warrior

Bearish Reversal Candlestick Patterns The Forex Geek

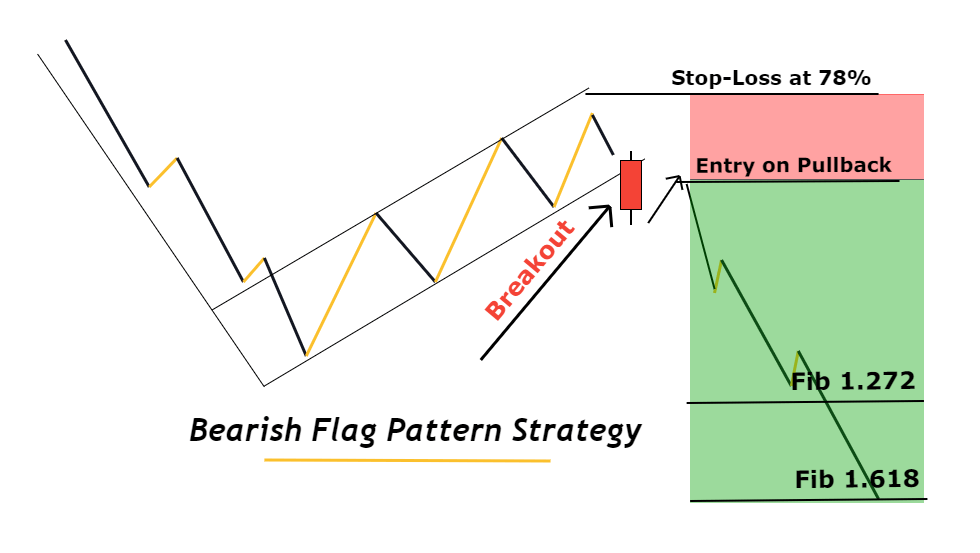

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

bearishreversalcandlestickpatternsforexsignals Forex trading training

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

That Increase Meant That The Country Moved Out Of A Recession.

The Signal Boasts The Upcoming Selling Pressure And A Series Of Lower Lows And Lower Highs In The Price Action.

The Pattern Consists Of A Long White Candle Followed By A Small Black Candle.

He Also Recaps Earnings Movers, Including Dis, Shop, And More.

Related Post: