Zero Based Budgeting Template

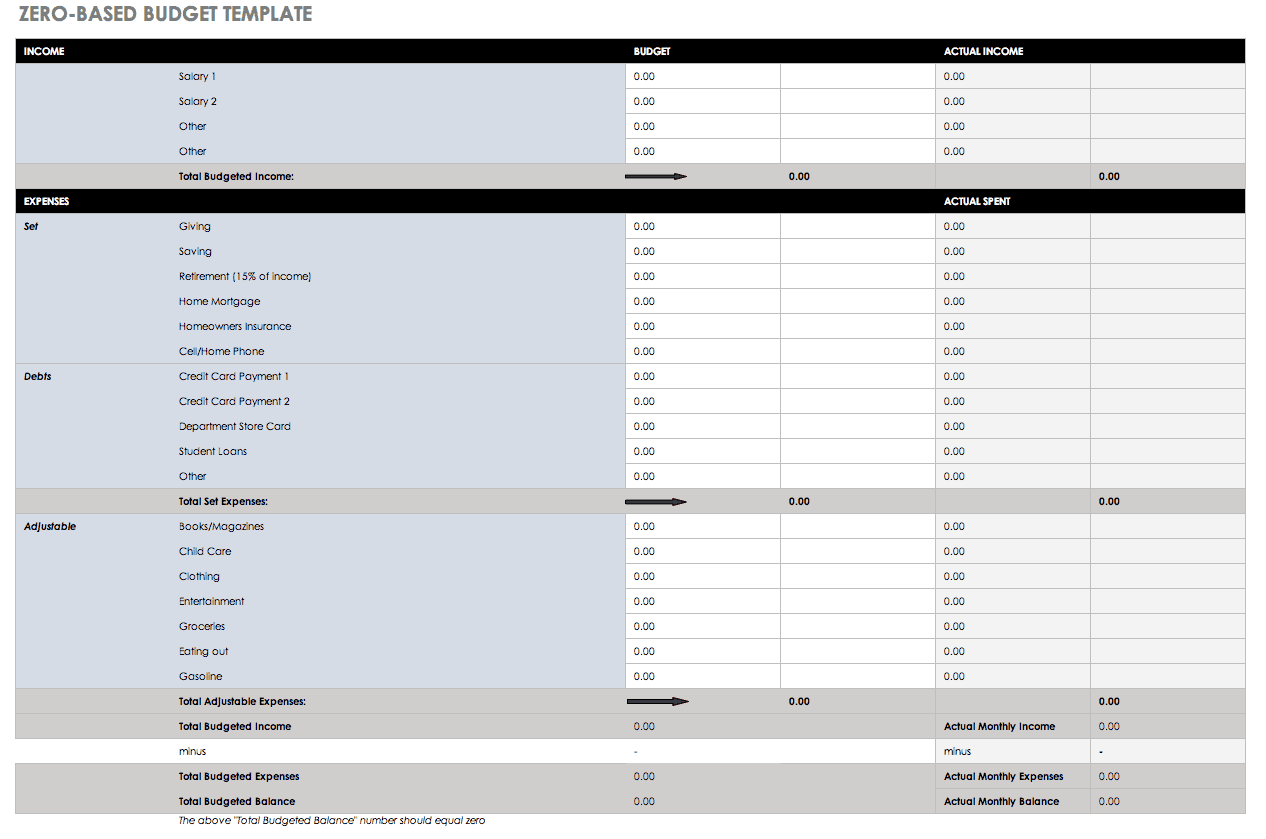

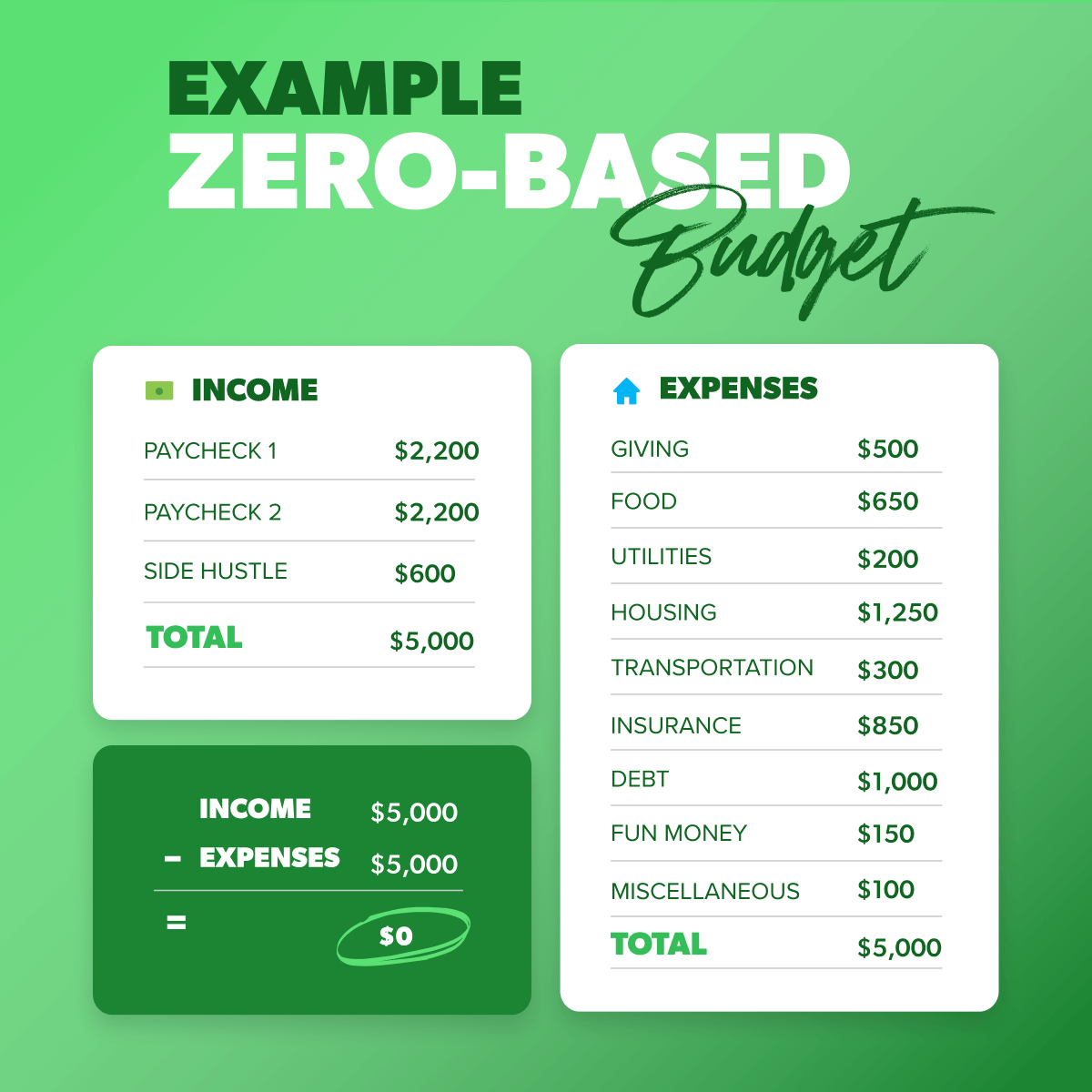

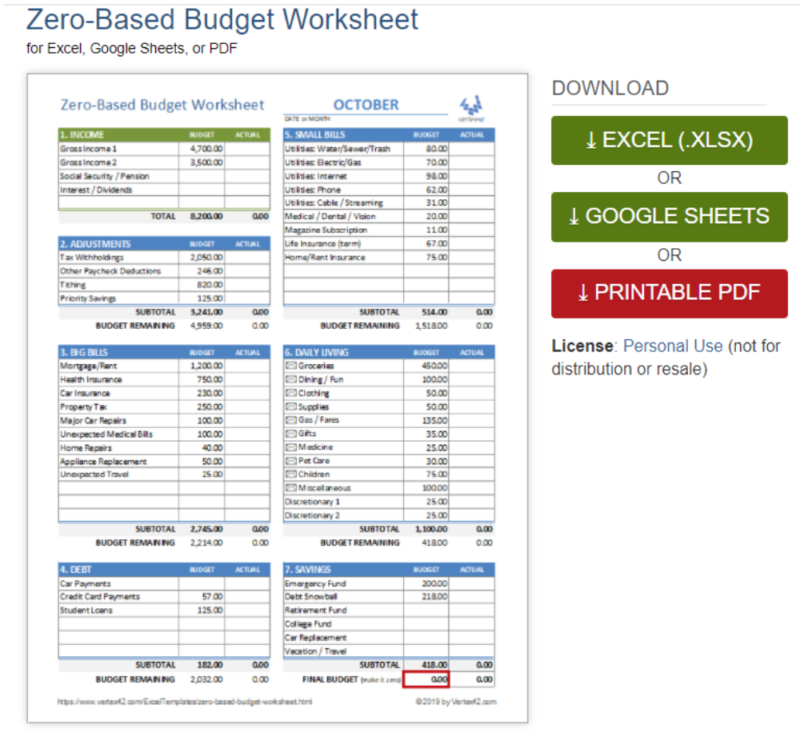

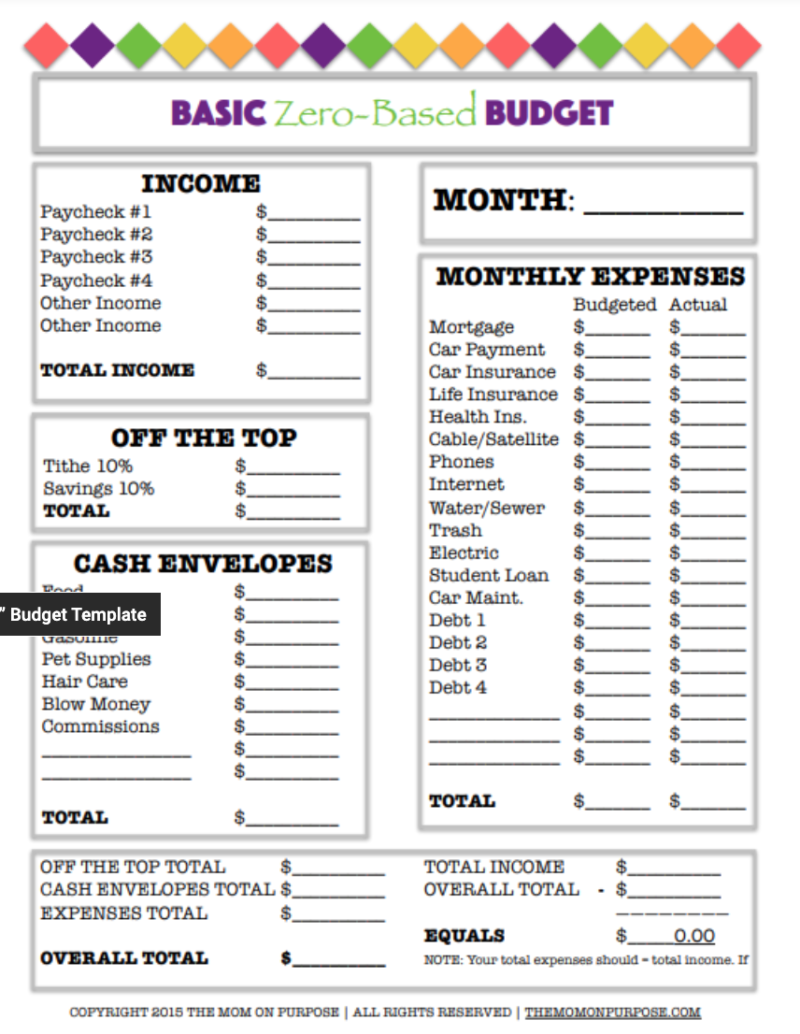

Zero Based Budgeting Template - This ensures that your monthly expenses equal your monthly income. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. Every dollar that comes in has a purpose, a job, a goal. With this budget, every single dollar you earn goes toward a purpose. Just because every dollar has a job doesn’t mean you spend every. Determine budgeting time period (month, quarterly, yearly). Set up your income and expenses. Free and easy budget template. The goal is that your. For personal use only, not to be copied, distributed, altered, or sold. Setting up a zero based budget is a fairly simple process, it just requires you take the time to get things right. Web the zero budget plan or zbb is a budgeting process that focuses on the allocation of funding based on program necessity and efficiency, instead of your budget history. No matter what you want to do with your. For personal use only, not to be copied, distributed, altered, or sold. For instance, if your paycheck is $3,000 a month, you divvy all $3,000 up among your expenses, debt payments, and savings goals until you're left with $0. Determine the final totals and remaining money. Implemented effectively, zbb is a cost discipline enabling businesses to improve resource planning, employee. Free and easy budget template. Web don't get me wrong; What is the 50/30/20 budget rule? Enter your budget (planned saving and spending) make changes until the final budget = zero. When you use a zero based budgeting template, the basic formula is: Web how to use the cash envelope system without cash. Your income will create the foundation for your budget and allow you to understand precisely how much money you have for your expenses, savings, investments, and debt payments. In other words, you track what you do with every dollar. Begin by documenting every reliable source of income you have, from. Write down your recurring monthly expenses. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. Make a plan for leftover money. 5/5 (50 reviews) Enter your budget (planned saving and spending) make changes until the final budget = zero. Web don't get me wrong; List all sources of income. Free animation videos.master the fundamentals.learn finance easily.learn at no cost. No matter what you want to do with your money, it starts with a budget. In other words, you track what you do with every dollar. How to budget when you get paid biweekly. Setting up a zero based budget is a fairly simple process, it just requires you take the time to get things right. For personal use only, not to be copied, distributed, altered, or sold. Web don't get me wrong; This ensures that your monthly expenses equal your monthly income. At the beginning of each month, plan out your budget for the next month by creating a new copy of the spreadsheet and adjust budget & income info. Because a budget is a plan for your money —you tell it where to go, so you stop wondering where the heck it went. With this budget, every single dollar you earn. Web what is zero based budgeting? Set up your income and expenses. Determine the final totals and remaining money. In other words, you track what you do with every dollar. Web the zero budget plan or zbb is a budgeting process that focuses on the allocation of funding based on program necessity and efficiency, instead of your budget history. Make a plan for leftover money. So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. In other words, you track what you do with every dollar. When you use a zero based budgeting template, the basic formula is: For instance, if your paycheck is $3,000 a month, you divvy all $3,000. How to budget when you get paid biweekly. Figure out your common spending. All free printables ©saturdaygift ltd. When you use a zero based budgeting template, the basic formula is: List all sources of income. Web don't get me wrong; Implemented effectively, zbb is a cost discipline enabling businesses to improve resource planning, employee engagement, and organizational collaboration. Determine the final totals and remaining money. Web what is zero based budgeting? For instance, if your paycheck is $3,000 a month, you divvy all $3,000 up among your expenses, debt payments, and savings goals until you're left with $0. Just because every dollar has a job doesn’t mean you spend every. What is the 50/30/20 budget rule? In other words, you track what you do with every dollar. So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. 5 min read | apr 26, 2024. Also, you can download and use this template in excel, google sheets, or pdf format.

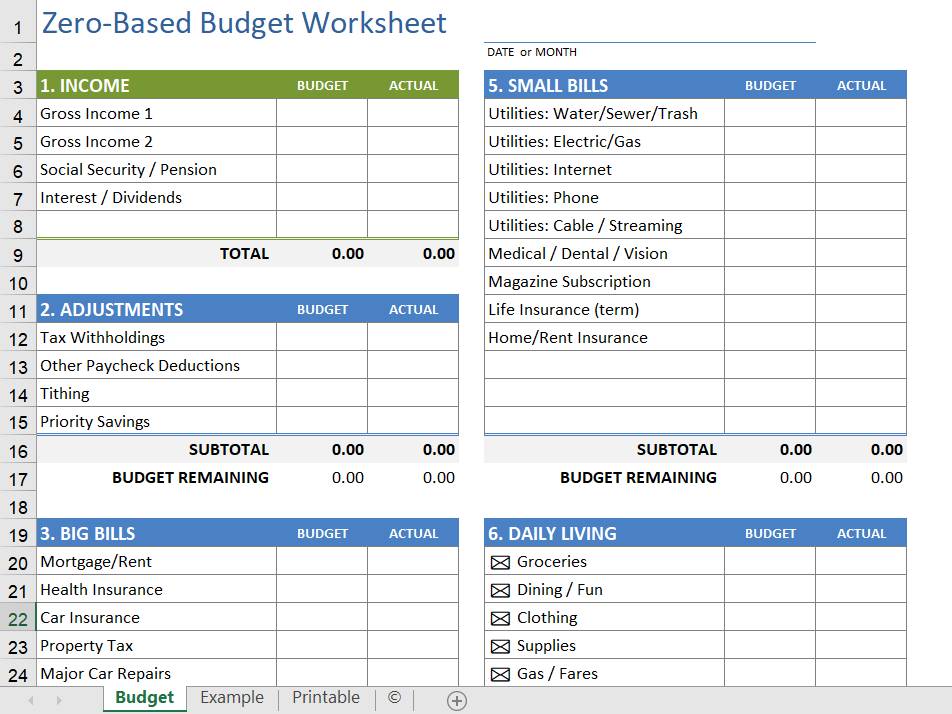

Zero Based Budget Excel Template

Zero Based Budget Template

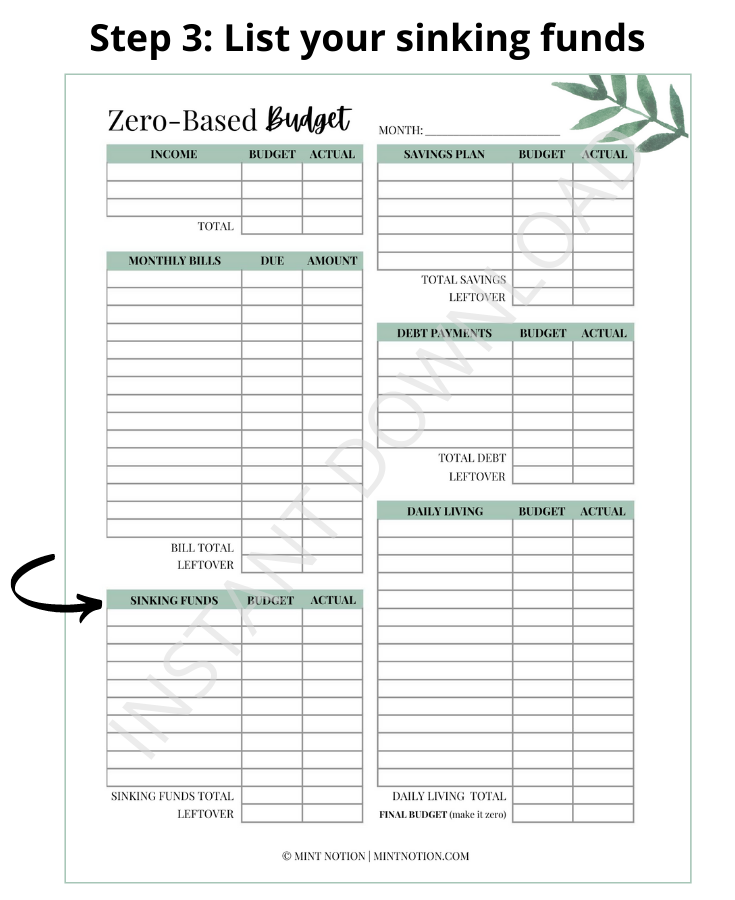

ZeroBased Budget (Printable) Mint Notion Shop

Zero Based Budgeting Template

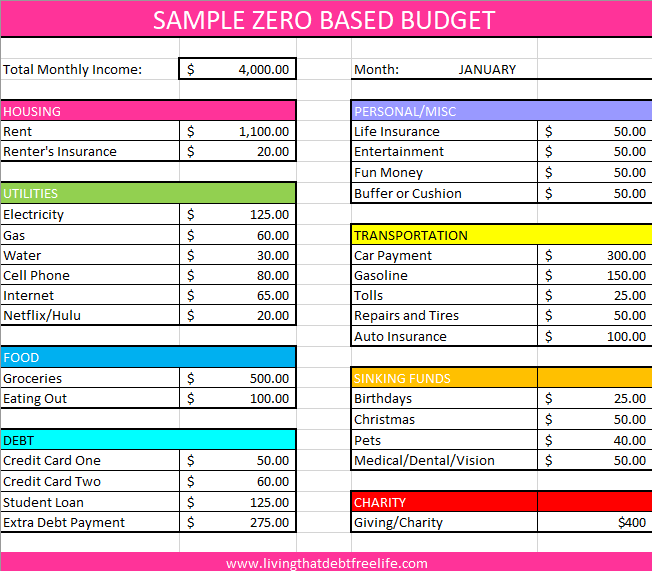

A Detailed Guide to Making A Zero Based Budget — Living that Debt Free Life

How to Make a ZeroBased Budget Ramsey

12 Free Budget Templates That'll Help You Save Without Stress

How To Make A ZeroBased Budget Mint Notion

ZeroBased Budget + Templates and Examples

ZeroBased Budget + Templates and Examples

At The Beginning Of Each Month, Plan Out Your Budget For The Next Month By Creating A New Copy Of The Spreadsheet And Adjust Budget & Income Info.

No Matter What You Want To Do With Your Money, It Starts With A Budget.

Determine Budgeting Time Period (Month, Quarterly, Yearly).

Setting Up A Zero Based Budget Is A Fairly Simple Process, It Just Requires You Take The Time To Get Things Right.

Related Post: