Zero Balance Budget Template

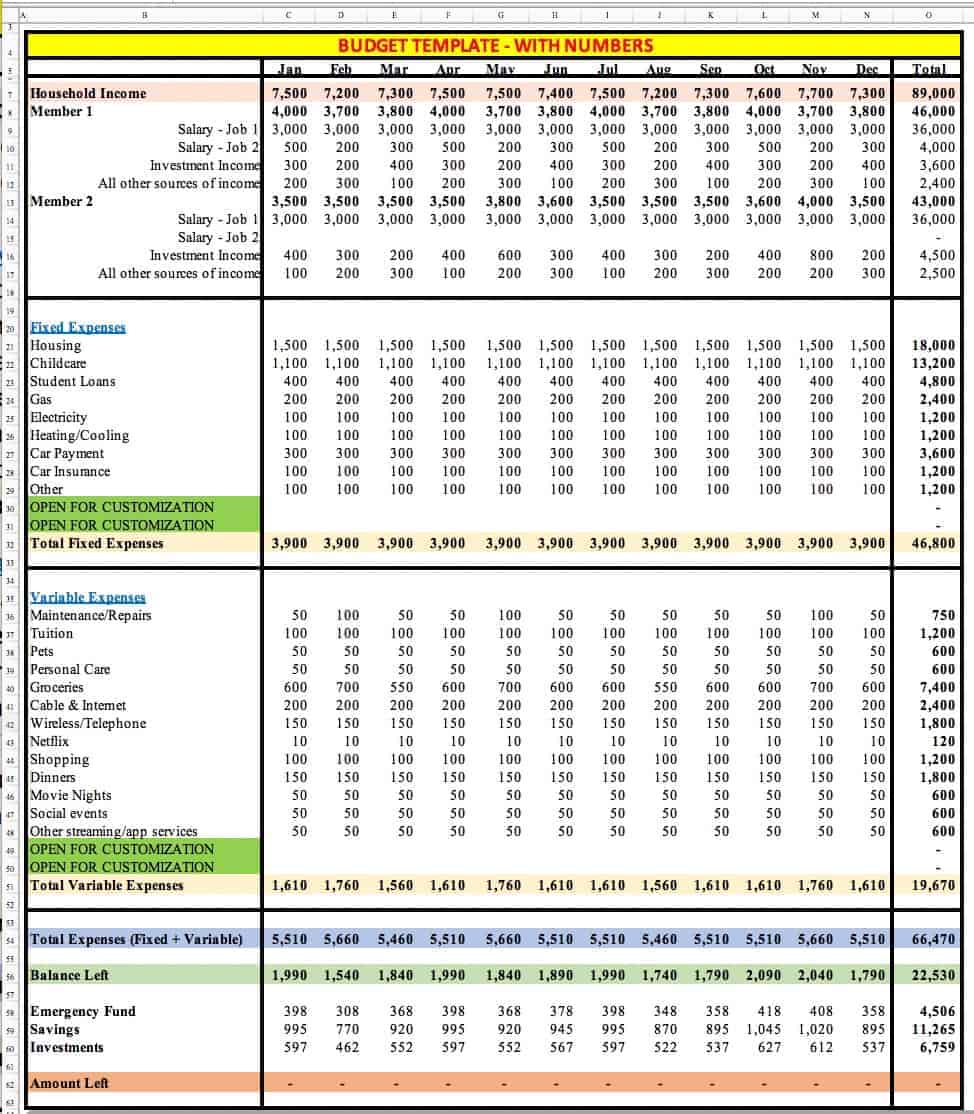

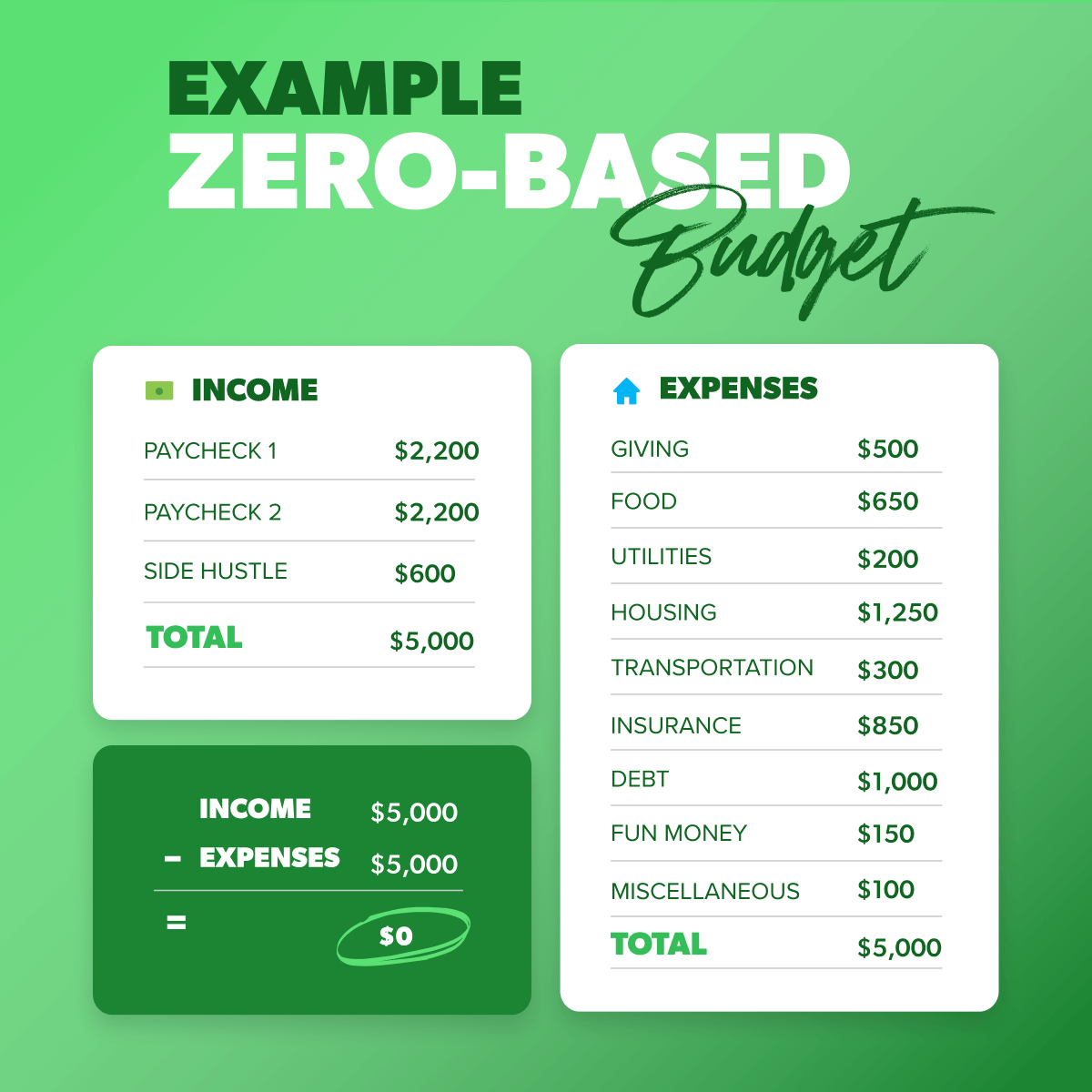

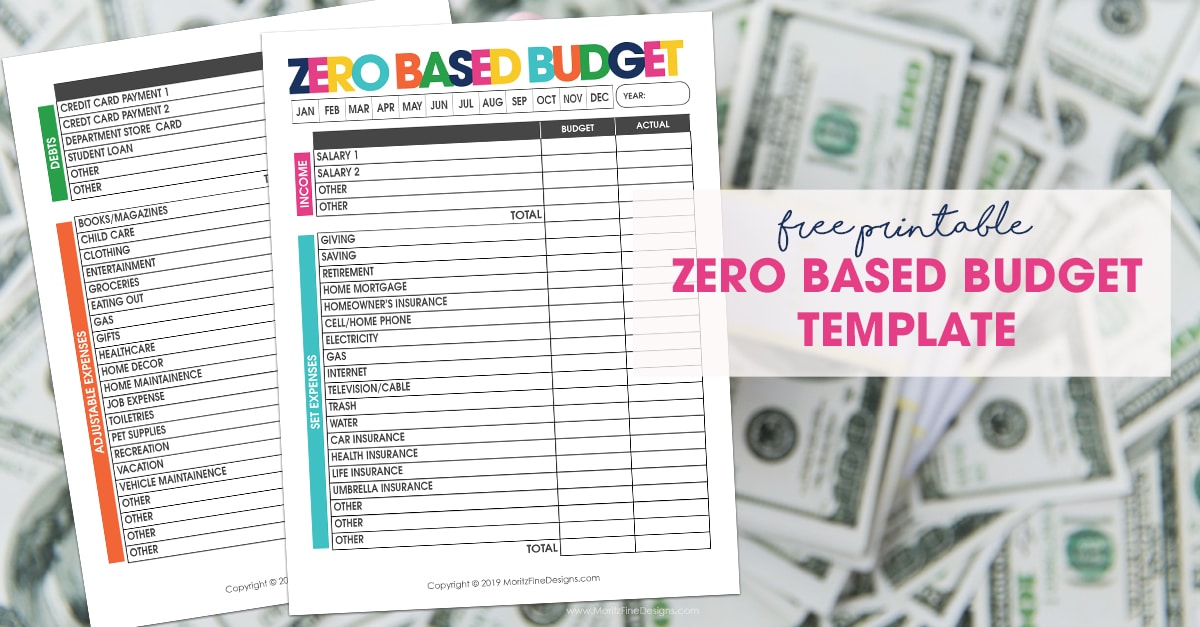

Zero Balance Budget Template - Create your own zero based budgeting spreadsheet from scratch. Write down your monthly bills and expenses. In the “editing” section of the ribbon, select “autosum.”. Total up your monthly income (after tax) 2. This gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. For example, we drag through cells b4 and b5 to select our income sources. Write all of these down and add the values to get your total monthly income. $0 to $20 per month. Start by listing your monthly net income at the top of the template. Use the zero based budget template to make a new budget. (trust me, the math that’s coming up is. Create your own zero based budgeting spreadsheet from scratch. Write down your sinking funds. Start with your needs from the list (in. Web go to the cell to the right of the first “subtotal” cell and head to the “home” tab. Income refers to your regular paychecks and anything extra that you bring every month. This gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. Track and enter actual income and expenses. Determine budgeting time period (month, quarterly, yearly). In the “editing” section of the ribbon, select “autosum.”. The goal is that your income. When you see the sum formula in the cell, select or enter the cell range for the values above it. Decide how much you’d like to budget for each spending category. Web everydollar budgeting app. No matter what, at the end of the worksheet your budget balance should be a big zero! Use the zero based budget template to make a new budget. I have 2 options for you. Web a couple of benefits of zero based budgeting are: Enter your budget (planned saving and spending) make changes until the final budget = zero. Write down your monthly bills and expenses. This gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. Start with your needs from the list (in. Don’t worry, i made this step by step video to help you. Total up your monthly income (after tax) 2. No matter what, at the end of the worksheet your budget balance should. Web a couple of benefits of zero based budgeting are: Decide how much you’d like to budget for each spending category. Also, you can download and use this template in excel, google sheets, or pdf format. Web that’s where a zero based budgeting template comes in. You can also take a look at our other useful articles: The goal is that your income. For example, we drag through cells b4 and b5 to select our income sources. This gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. Make changes until the final budget is zero. Web go to the cell to the right of the first “subtotal” cell. If you use gross income, add a place. Write all of these down and add the values to get your total monthly income. You can also take a look at our other useful articles: (trust me, the math that’s coming up is. This can come from a variety of sources, including: Now we need to add a few lines so that we can subtract your total budgeted expenses (mandatory and variable expenses combined) from your budgeted income. Write down your sinking funds. Ynab is best known for its awesome support community, and fantastic training and support. “paycheck income”, “paycheck expenses”, and a “track your purchases here” section. Web go to the. Creating a paycheck budget schedule will help you break down your monthly budget into smaller, more. Make changes until the final budget is zero. The value you get is what you will work with for the month. If you use gross income, add a place. This gives you the ability to ruthlessly cut down on expenses that don't align with. Enter your budget (planned saving and spending) make changes until the final budget = zero. Start by listing your monthly net income at the top of the template. ' delete this row before printing / submitting your invoice. With this template you can easily budget. When you see the sum formula in the cell, select or enter the cell range for the values above it. Figure out your monthly income. This gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. Create your own zero based budgeting spreadsheet from scratch. The free everydollar app lets you customize your budget, create savings funds and track your debt payments. “paycheck income”, “paycheck expenses”, and a “track your purchases here” section. Web assign your spending to the appropriate budget category. For example, we drag through cells b4 and b5 to select our income sources. This can come from a variety of sources, including: In the “editing” section of the ribbon, select “autosum.”. Income refers to your regular paychecks and anything extra that you bring every month. Total up your monthly income (after tax) 2.

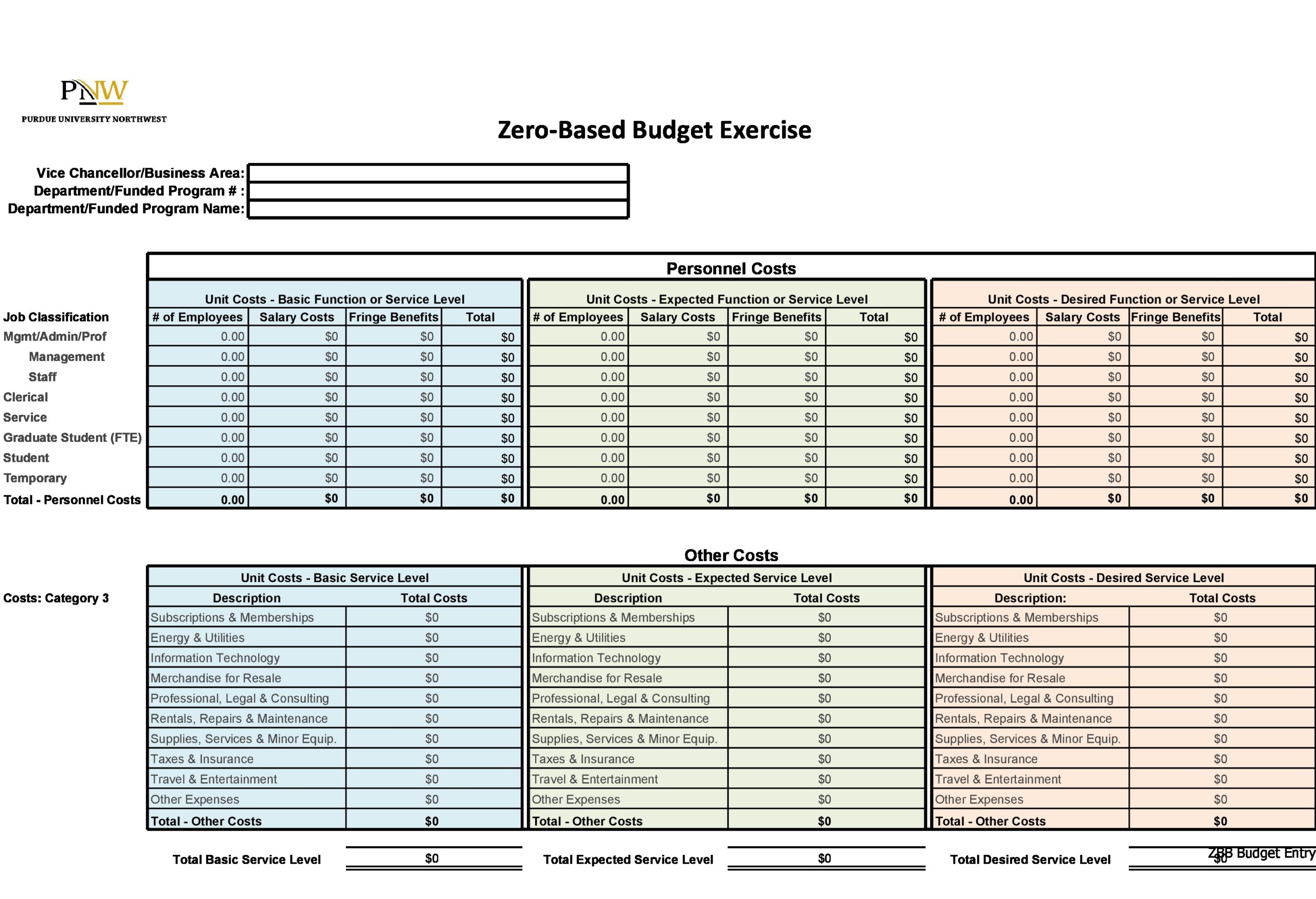

40 Best ZeroBased Budget Templates (Word & Excel)

12 Free Budget Templates That'll Help You Save Without Stress

Zero Based Budget Template Printable Templates Printable Download

A Detailed Guide to Making A Zero Based Budget — Living that Debt Free Life

ZeroBased Budget (Printable) Mint Notion Shop

Zero Based Budget Printable Printable Budget Sheet Zero Etsy Australia

What Is A ZeroBased Budget A StepByStep Guide For Your Budget

How to Create a ZeroBased Budget Financial Expert

Zero Balance Budget Template

How to Make a ZeroBased Budget Budget template free, Budgeting

$0 To $20 Per Month.

List Out All Of Your Expenses On This Needs And Wants Worksheet.

Web You Can Do This Either By Using A Sheet Of Paper And A Pen Or You Can Use A Budgeting App.

Start With Your Needs From The List (In.

Related Post: