Year End Donation Receipt Template

Year End Donation Receipt Template - However, to help keep everyone’s financial records organized, you should send receipts for every donation, no matter the size. Web the donor makes a single donation that is more than $250. Web jump to the donation receipt templates. Once supporters are thanked and appreciated, they’re more likely to give. You can print and sign the donation receipt or send it. You can also select all donors. A receipt is required for all donation types in excess of $250. Summit assistance dogs‘ short but powerful receipt works to effectively tie their donor’s gift to impact and their organization’s mission, helping to show donors the importance of their gift. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. The donation was $75 or more, and something was given in exchange for it. Summit assistance dog’s unleash your love donation receipt. The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card. Our receipt template can be used for donations and contains fields you can customize. It’s utilized by an individual that has donated cash or payment,. However, to help keep everyone’s financial records organized, you should send receipts for every donation, no matter the size. You can also select all donors. It would be wiser, though, to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions. You can print and sign the donation. You can also select all donors. Web our donation receipt templates can help you quickly send a receipt to all of your donors. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. Summit assistance dog’s unleash your love donation receipt. While donation receipt templates are all. Skynova has multiple templates and software to help small businesses, including nonprofit 501 (c) (3) organizations. Web customize receipt template with your organization’s information; Web just be sure to review your donation receipt templates annually to make any necessary updates. You can print and sign the donation receipt or send it. Our receipt template can be used for donations and. You can turn those boring documents into an opportunity to relate to your donors. An organization that receives contributions of $250 or more. An organization that provides goods or services to donors who make contributions of more than $75. With this receipt, donors walk. 57 west maple street, scootersbridge, ny 11406. Lather, rinse, and repeat until it looks the way you want. Web so, a donation just came in, and you need to acknowledge the donation by sending a donation receipt letter, or the end of the year has rolled around, and it’s time to get busy generating year end receipts and statements. While donation receipt templates are all about acknowledging. Summit assistance dogs‘ short but powerful receipt works to effectively tie their donor’s gift to impact and their organization’s mission, helping to show donors the importance of their gift. While donation receipt templates are all about acknowledging past gifts, they can also be used to inspire future giving (stick with us here). Web just be sure to review your donation. It’s common practice for nonprofits to send a summary of all a donor’s gifts at the end of the year. Do you need to send recurring donors monthly donation receipts? Web the donor makes a single donation that is more than $250. No goods or services were exchanged for this. All gifts of $250 or more legally require a receipt. You will want to send a donation receipt at the end of the year to remind your donors of the contributions they made throughout the year. You should send a year end donation receipt at the beginning of december (in the us) and before the end of february (for canada). Dear john donor, this receipt documents a gift of $100.00. The donation was $75 or more, and something was given in exchange for it. You can turn those boring documents into an opportunity to relate to your donors. It would be wiser, though, to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions. Web a year end. Our receipt template can be used for donations and contains fields you can customize. It would be wiser, though, to give out donation receipts and acknowledge the donations a lot sooner so that donors or benefactors would be encouraged to make contributions. Web to see how your letter will look, click the preview button.this will show you a preview of the first 5 letters in your mailing. Make their tax season easy while giving a. Dear john donor, this receipt documents a gift of $100.00 that was made by john donor to the valleyview church on april 1, 2017. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. Web use skynova for donation receipt templates and more. Web so, a donation just came in, and you need to acknowledge the donation by sending a donation receipt letter, or the end of the year has rolled around, and it’s time to get busy generating year end receipts and statements. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. If you need to make any adjustments, you can follow the link below to manage your giving options. Skynova has multiple templates and software to help small businesses, including nonprofit 501 (c) (3) organizations. You should send a year end donation receipt at the beginning of december (in the us) and before the end of february (for canada). Web just be sure to review your donation receipt templates annually to make any necessary updates. The completed receipt is printable, or it can also be sent via email to the donor along. All gifts of $250 or more legally require a receipt. When it comes to sending donation receipt letters for tax purposes, there are two major criteria for nonprofits:

Donation Receipts & Statements A Nonprofit Guide (Including Templates)

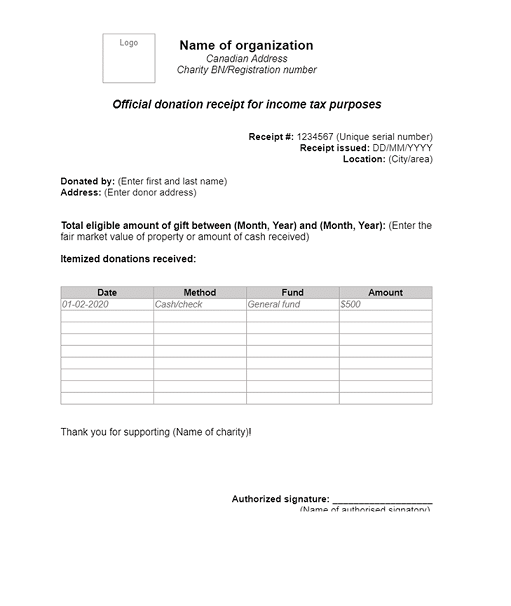

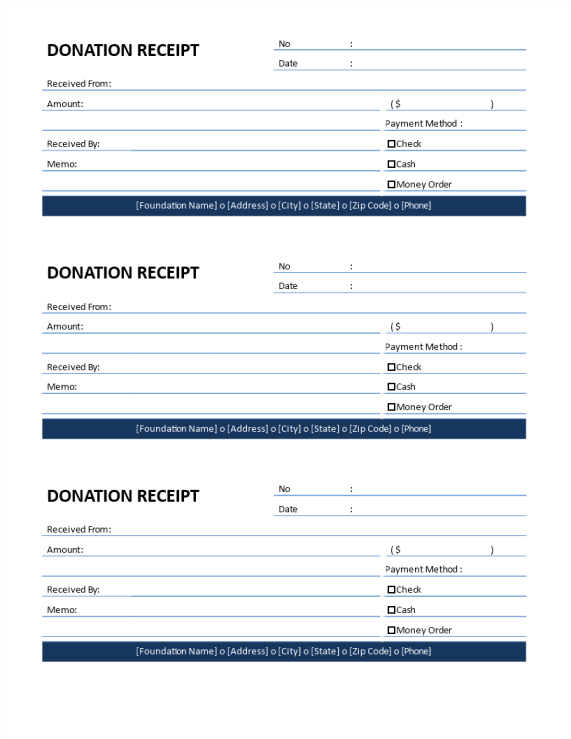

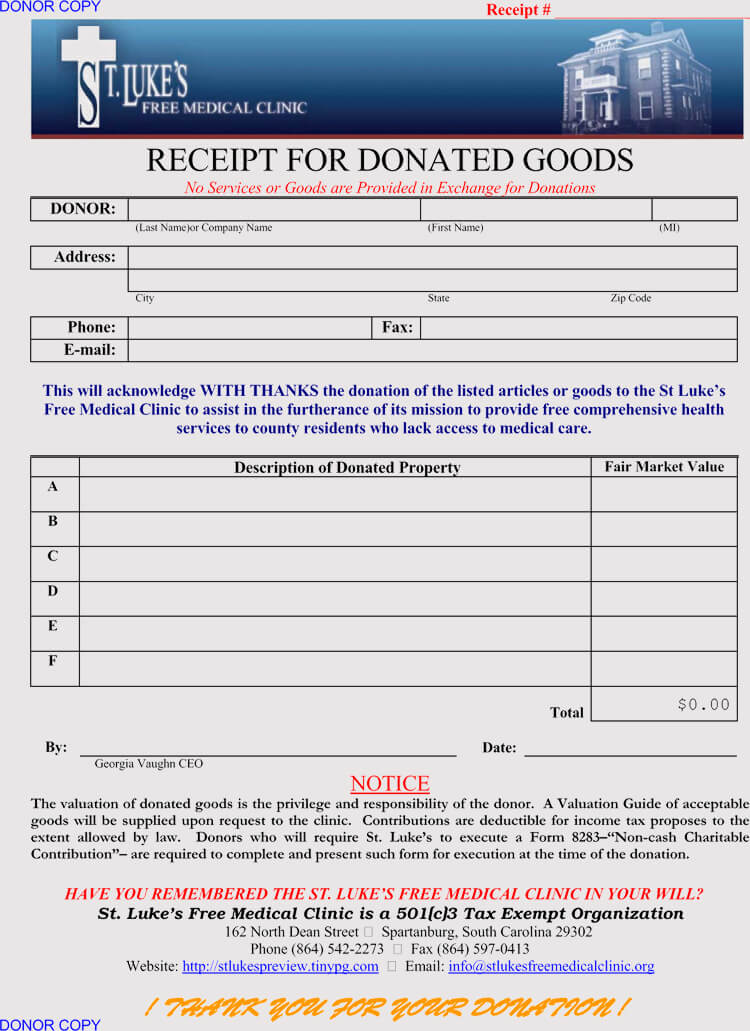

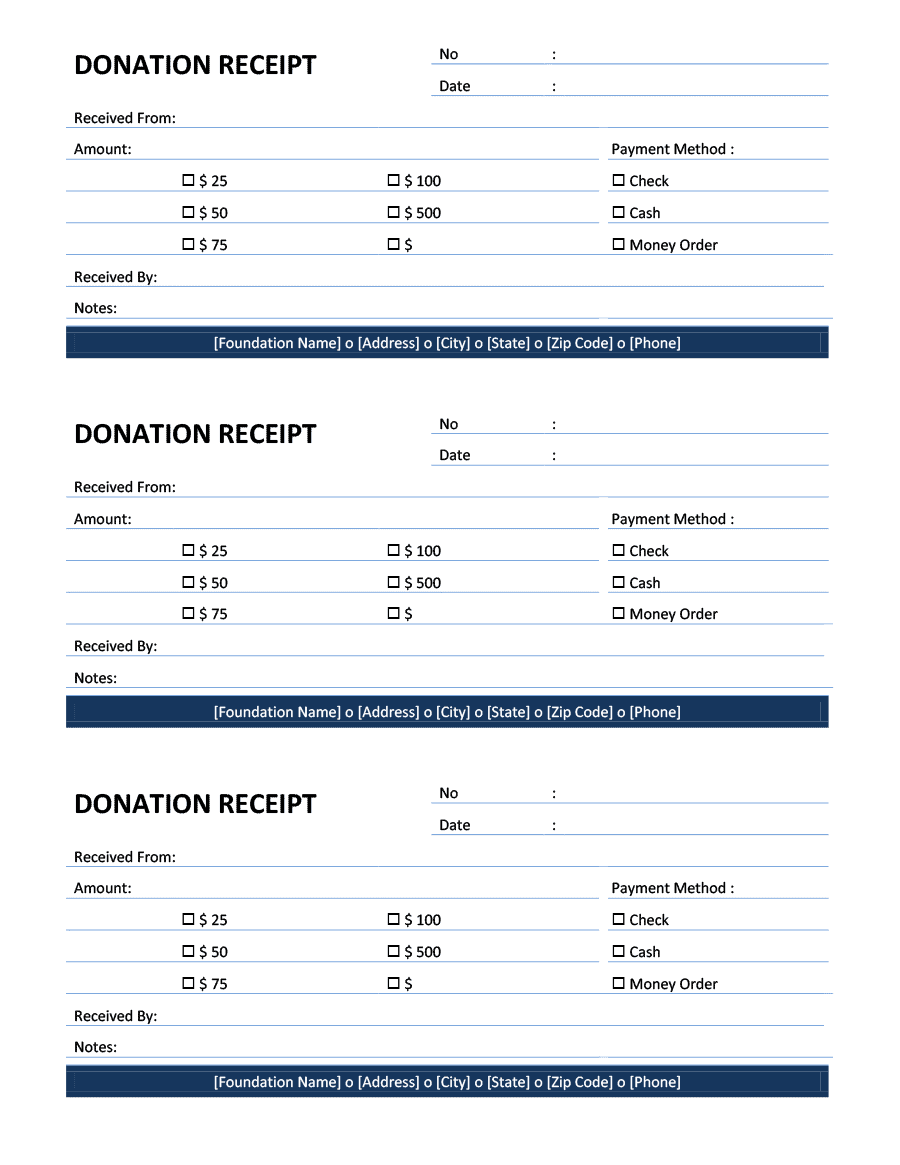

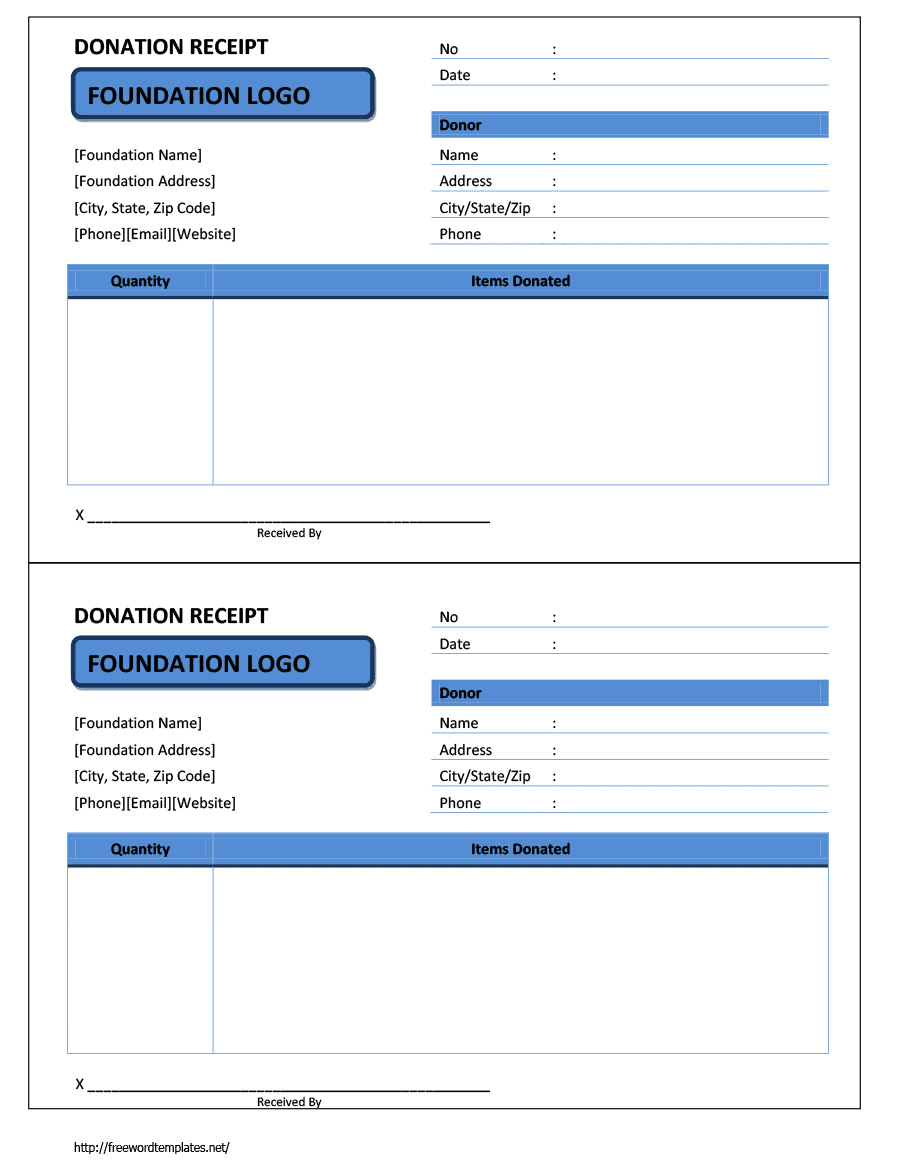

Ngo donation receipt Business templates, contracts and forms.

The Ultimate Guide to Nonprofit Donation Receipts GiveForms Blog

![Non Profit Donation Receipt Template Printable [Pdf & Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/04/Year-End-Donation-Receipt-Template-Printable-Pdf-Word.jpg?zoom=3&resize=300%2C300&ssl=1)

Non Profit Donation Receipt Template Printable [Pdf & Word]

46 Free Donation Receipt Templates (501c3, NonProfit)

5 Free Donation Receipt Templates in MS Word Templates

6+ Free Donation Receipt Templates

![YearEnd Donation Receipt Template Printable [Pdf & Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/04/Year-End-Donation-Receipt.jpg?fit=600%2C849&ssl=1)

YearEnd Donation Receipt Template Printable [Pdf & Word]

6+ Free Donation Receipt Templates

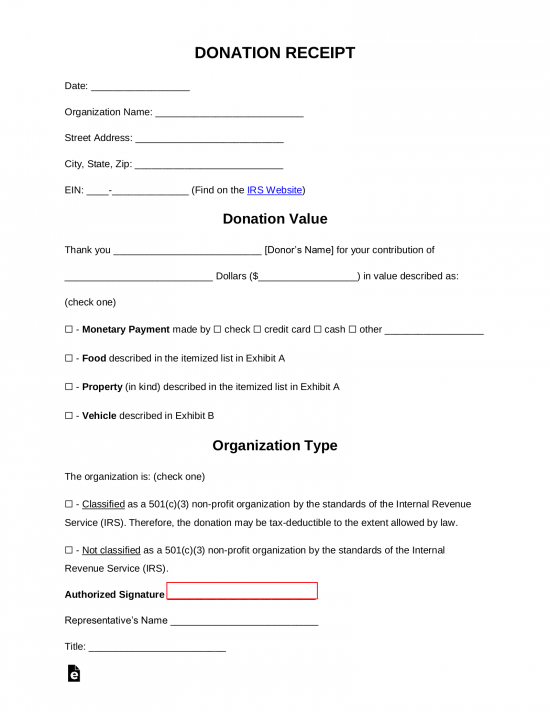

Free Donation Receipt Templates Samples PDF Word eForms

A 501 (C) (3) Donation Receipt Is Required To Be Completed By Charitable Organizations When Receiving Gifts In A Value Of $250 Or More.

You Can Also Select All Donors.

Web Sample 501(C)(3) Donation Receipt (Free Template) All Of These Rules And Regulations Can Be Confusing.

Once Supporters Are Thanked And Appreciated, They’re More Likely To Give.

Related Post: