Wyckoff Pattern

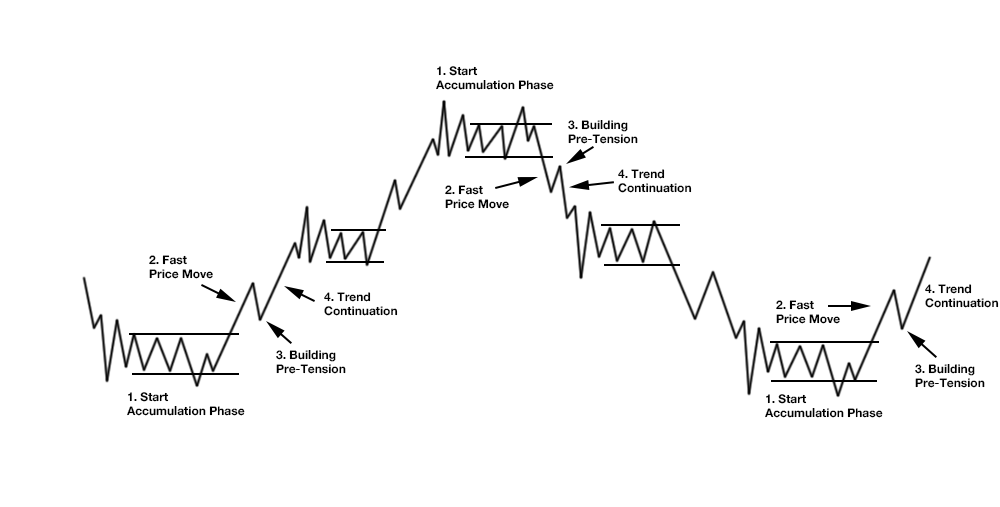

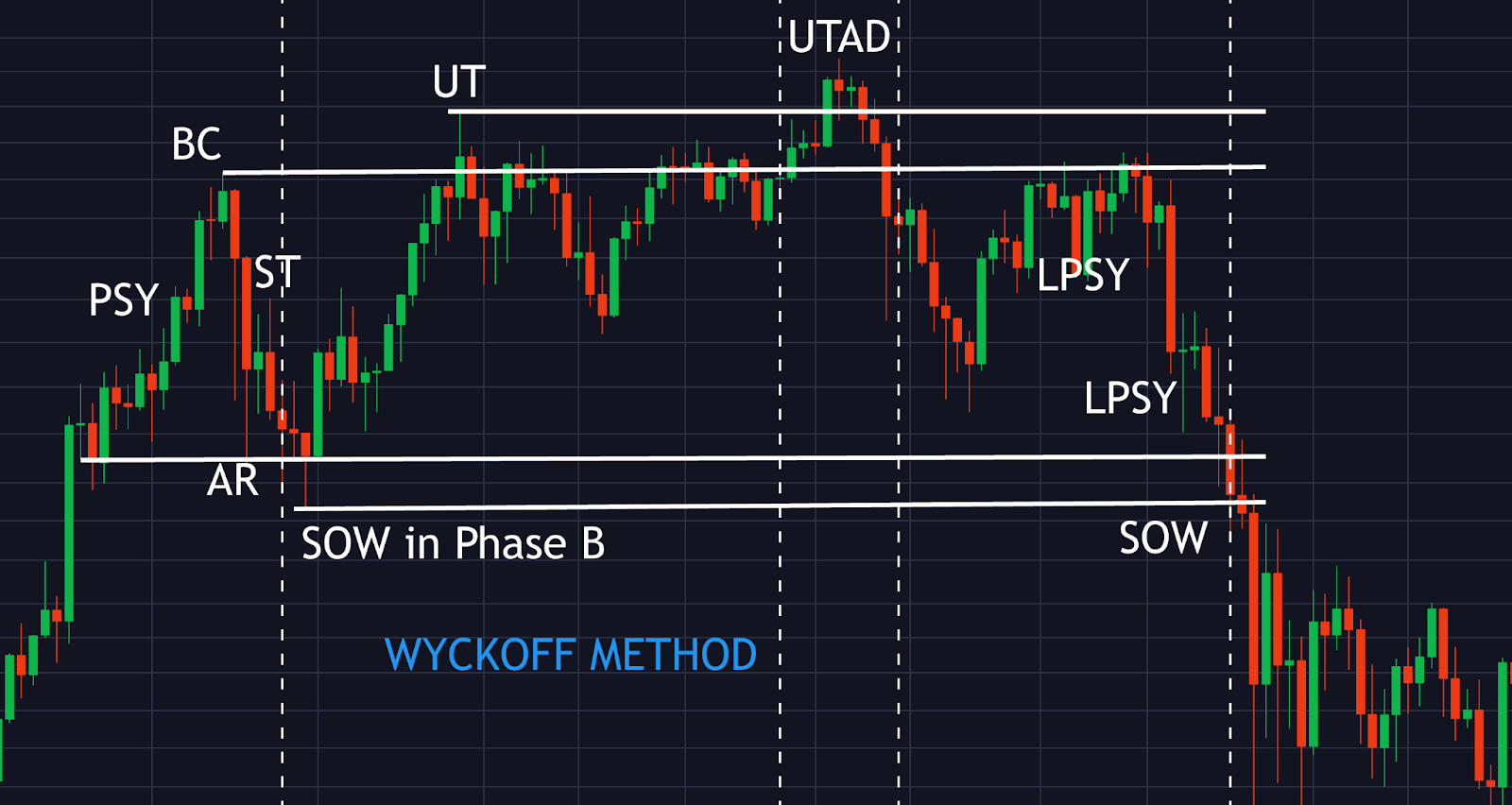

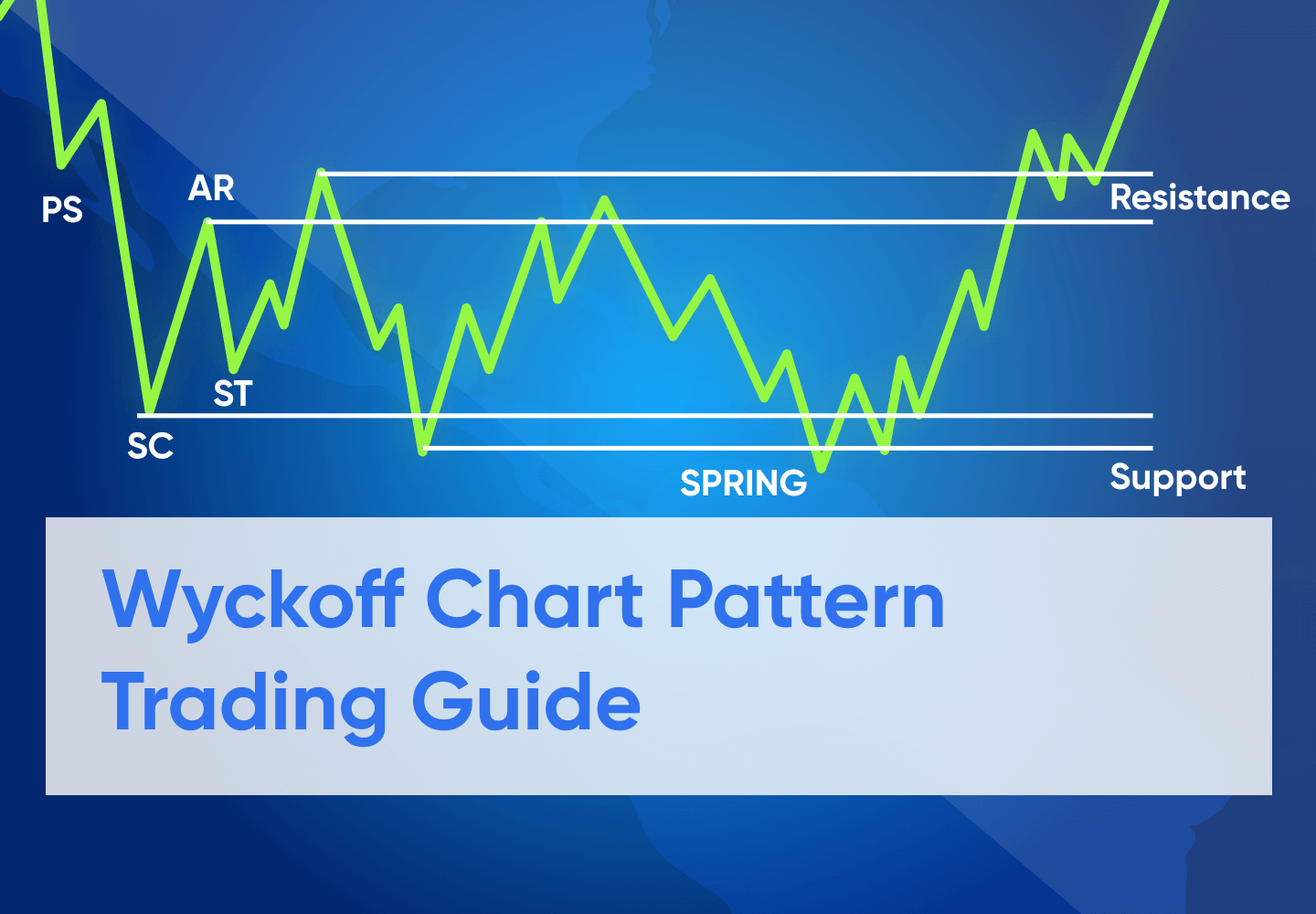

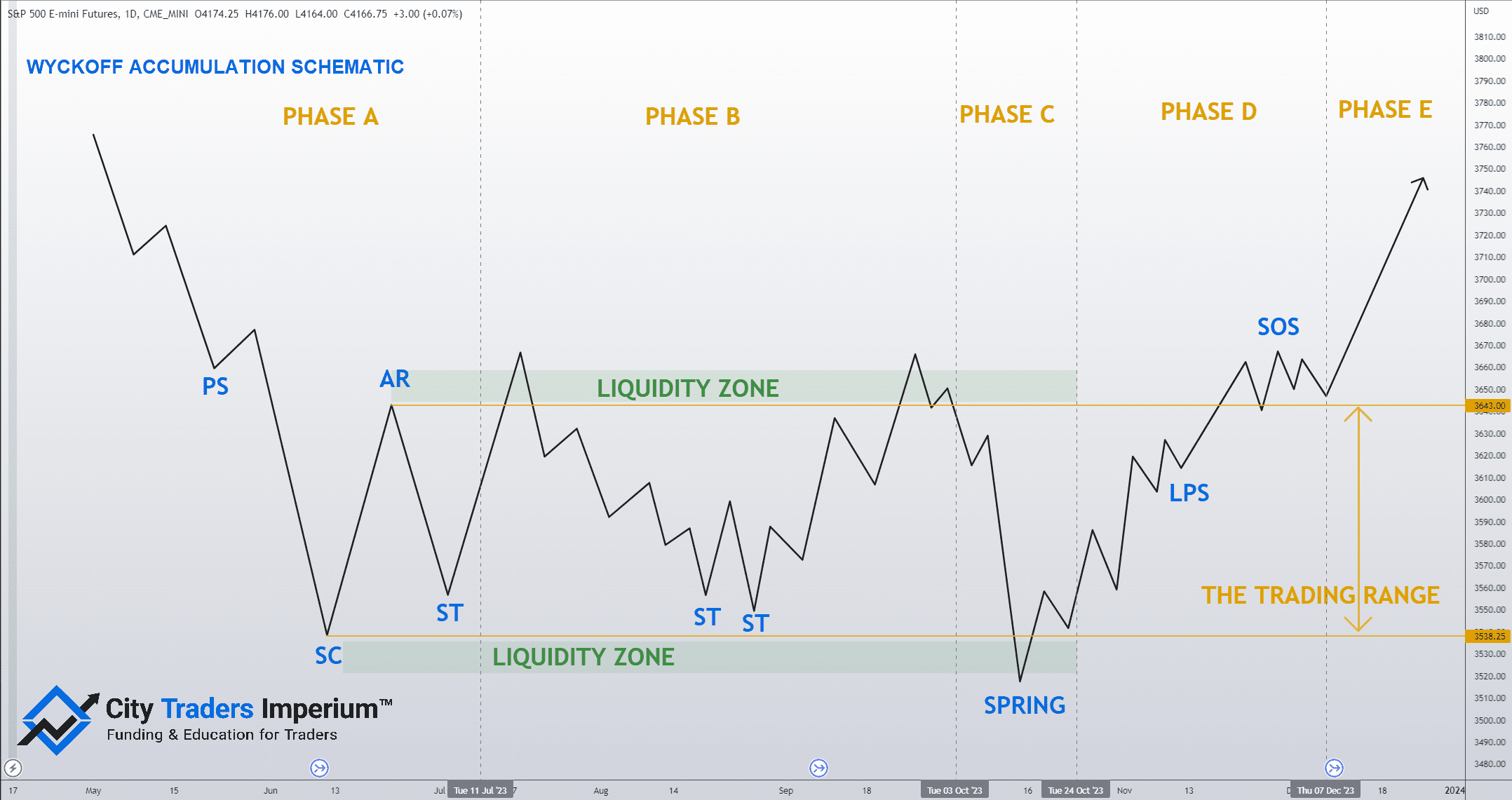

Wyckoff Pattern - Wyckoff, this pattern provides insights into the distribution phase of an asset, where institutional investors quietly unload positions before a significant. Web wyckoff offered a detailed analysis of the trading range, a posited ideal price bracket for buying or selling a stock. The wyckoff market cycle reflects wyckoff’s theory. Confirming markup and markdown phases. Web the wyckoff pattern, also known as the wyckoff method, is a renowned technical analysis approach utilized by investors for determining which stocks to buy and when to buy them. Web what is wyckoff method? This theory is the basis behind the price action wyckoff trading method. This article will explain how this method works and how to identify and use the wyckoff chart pattern. Web what are wyckoff patterns? Understanding the wyckoff events and phases. Determine the present position and probable future trend of the market. This article will explain how this method works and how to identify and use the wyckoff chart pattern. Web wyckoff’s method or wyckoff’s theory is one of the most complete and valuable trading theory. There are several market cycle theories. The three wyckoff laws explained. The wyckoff market cycle reflects wyckoff’s theory. The three wyckoff laws explained. Wyckoff, this pattern provides insights into the accumulation phase of an asset, where institutional investors quietly accumulate positions before a significant. Determine the present position and probable future trend of the market. Trend identification, reversal patterns, price projections and trend position. Wyckoff’s theory was simply that every cause in the market would lead to an equal and proportionate effect. Web the wyckoff pattern, also known as the wyckoff method, is a renowned technical analysis approach utilized by investors for determining which stocks to buy and when to buy them. The wyckoff market cycle reflects wyckoff’s theory. Web wyckoff’s method or wyckoff’s. Confirming markup and markdown phases. Trend identification, reversal patterns, price projections and trend position. The wyckoff pattern is a vital tool for traders to spot buying opportunities and anticipate price breakouts. Is the market consolidating or trending? What is wyckoff distribution cycle? Determine the present position and probable future trend of the market. Web the wyckoff pattern, also known as the wyckoff method, is a renowned technical analysis approach utilized by investors for determining which stocks to buy and when to buy them. In his later years, he turned his focus to more altruistic goals by teaching the public how to beat. Web wyckoff used price patterns and volume to generate signals for individual stocks. Web what are wyckoff patterns? The law of supply and demand, the law of cause and effect, and the law of effort vs. Fact checked by lucien bechard. Web wyckoff’s method or wyckoff’s theory is one of the most complete and valuable trading theory. Wyckoff’s theory helps trader understand major market swings (accumulation, distribution phases). Wyckoff introduced key rules for assessing market behavior and price movements. Implementing stop loss and take profit levels. The wyckoff market cycle reflects wyckoff’s theory. Web what is wyckoff method? Web the wyckoff pattern, also known as the wyckoff method, is a renowned technical analysis approach utilized by investors for determining which stocks to buy and when to buy them. In his later years, he turned his focus to more altruistic goals by teaching the public how to beat what he saw as an unfair market. Understanding the wyckoff events. Web what are wyckoff patterns? Web wyckoff offered a detailed analysis of the trading range, a posited ideal price bracket for buying or selling a stock. Determine the present position and probable future trend of the market. Trend identification, reversal patterns, price projections and trend position. Web developed in 1930 by richard wyckoff, the wyckoff candle pattern is one of. Web wyckoff’s method or wyckoff’s theory is one of the most complete and valuable trading theory. Wyckoff introduced key rules for assessing market behavior and price movements. Wyckoff's composite man wyckoff price cycle. This theory is the basis behind the price action wyckoff trading method. Recognizing accumulation and distribution phases. The law of supply and demand, the law of cause and effect, and the law of effort vs. Wyckoff, this pattern provides insights into the accumulation phase of an asset, where institutional investors quietly accumulate positions before a significant. Implementing stop loss and take profit levels. Trend identification, reversal patterns, price projections and trend position. Is the market consolidating or trending? The wyckoff method is a technical analysis approach that can help investors decide what stocks to buy and when to buy them. Confirming markup and markdown phases. What is the wyckoff trading method? Web there are four key areas of the wyckoff market method: There are several market cycle theories. Web considered one of the “titans of technical analysis,” richard d. Determine the present position and probable future trend of the market. Who is the composite operator / the composite man?: The wyckoff market cycle reflects wyckoff’s theory. The wyckoff method is one of the more famous. Web what are wyckoff patterns?

WyckoffMethode, Akkumulation, Pattern erklärt (2024)

The Ultimate Guide to Understanding Wyckoff Method

![How To Trade The Wyckoff Pattern [Forex Chart Patterns] YouTube](https://i.ytimg.com/vi/2FYfXESXsmg/maxresdefault.jpg)

How To Trade The Wyckoff Pattern [Forex Chart Patterns] YouTube

Wyckoff Chart Patterns Explained What You Need To Know About Wyckoff

Wyckoff Chart Patterns Explained What You Need To Know About Wyckoff

Chart Patterns Wyckoff Distribution TrendSpider Learning Center

Wyckoff pattern

Wyckoff Accumulation and Distribution Phases Explained

Wyckoff Theory Accumulation And Distribution Schematics

WyckoffMethode, Akkumulation, Pattern erklärt (2023)

Determine The Present Position And Probable Future Trend Of The Market.

Web The Wyckoff Distribution Pattern Is A Widely Recognized Chart Pattern In Technical Analysis That Helps Traders Identify Potential Market Reversals And Breakdowns.

Wyckoff’s Theory Helps Trader Understand Major Market Swings (Accumulation, Distribution Phases).

Wyckoff Introduced Key Rules For Assessing Market Behavior And Price Movements.

Related Post: