Wolfe Wave Pattern

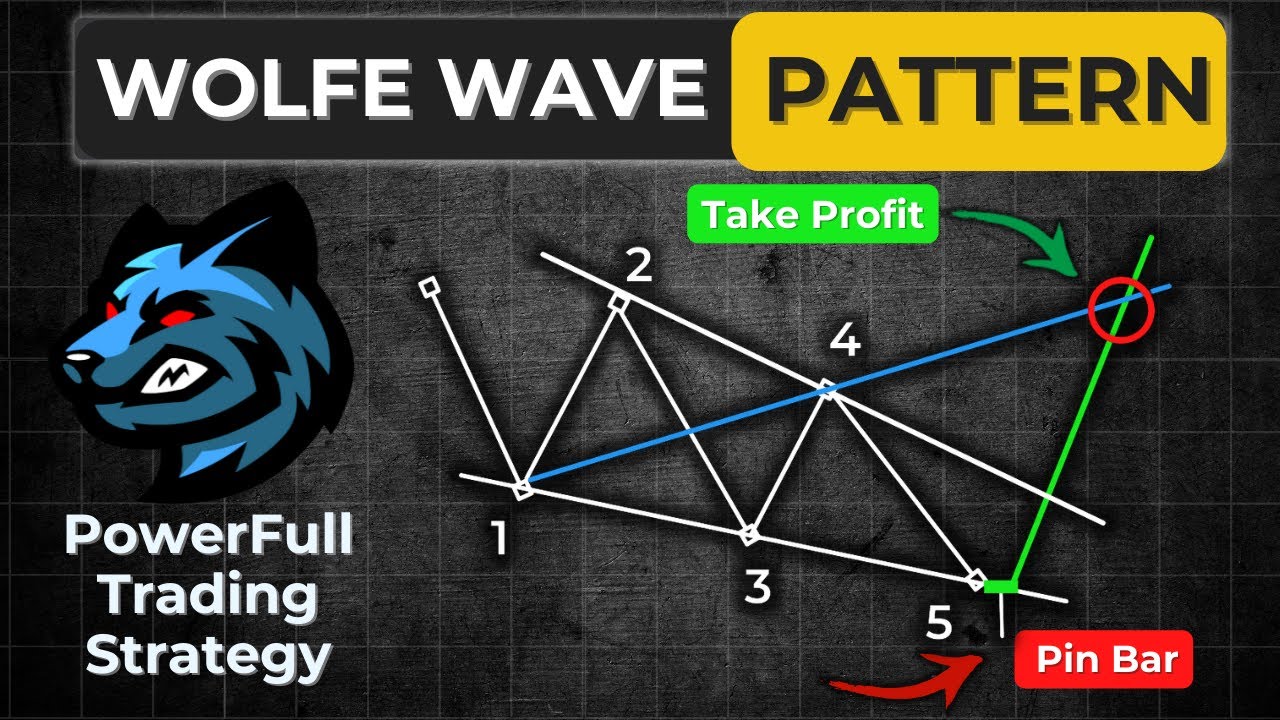

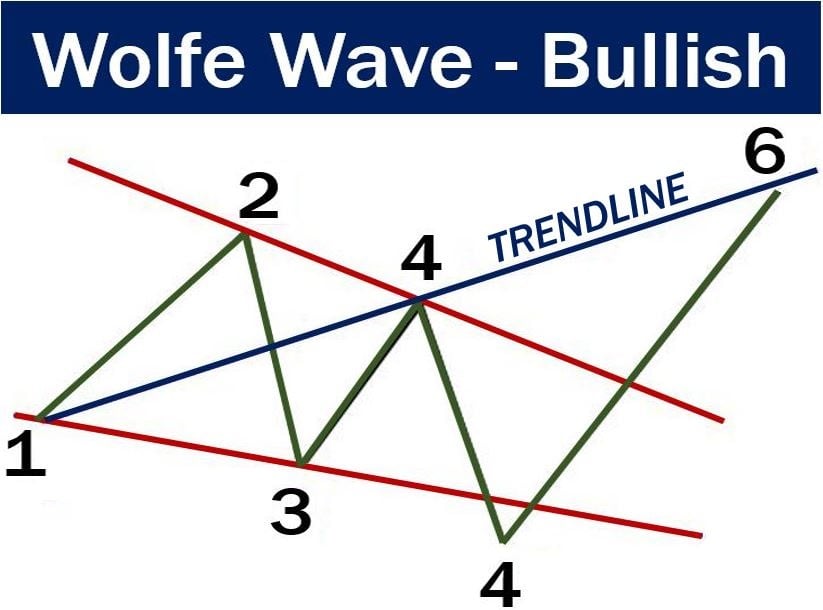

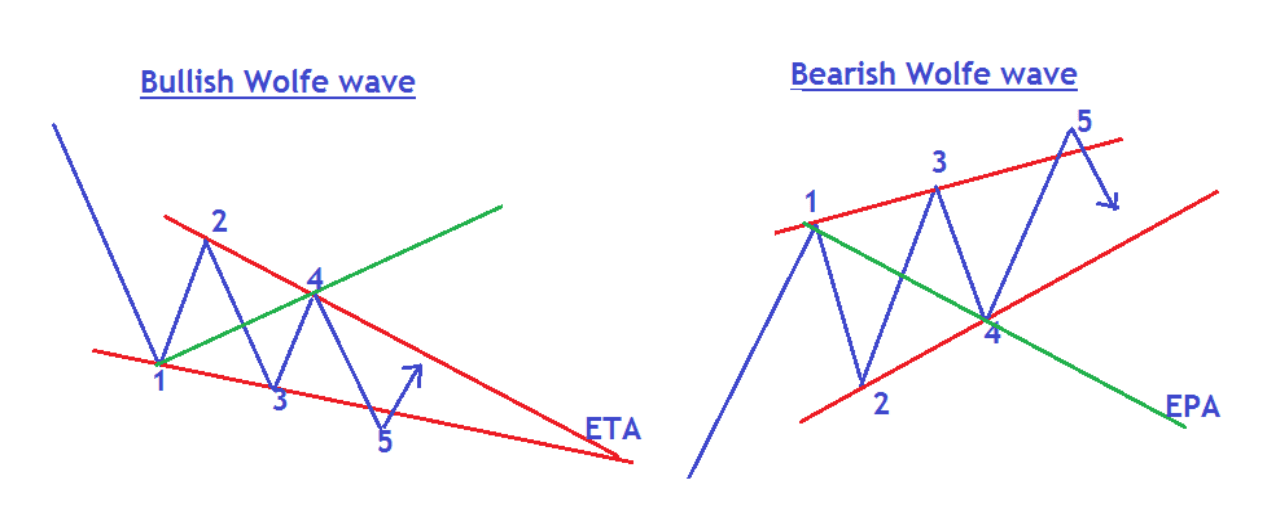

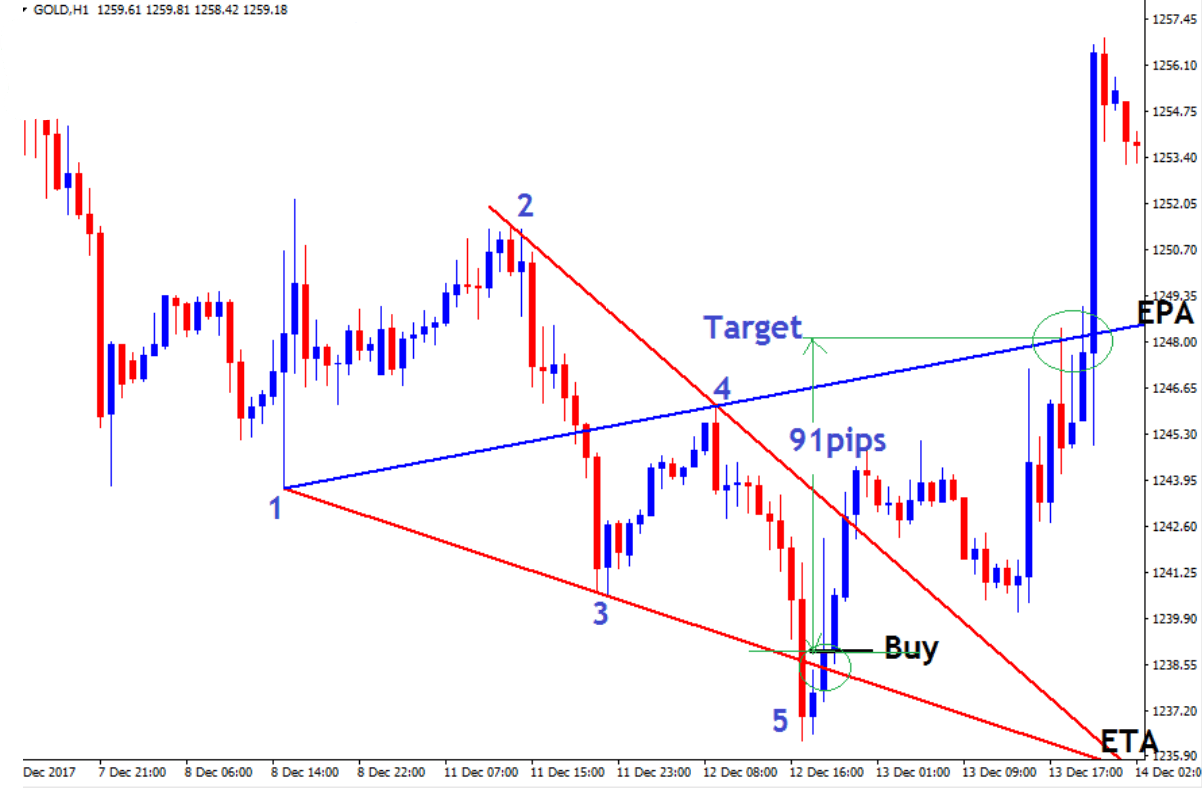

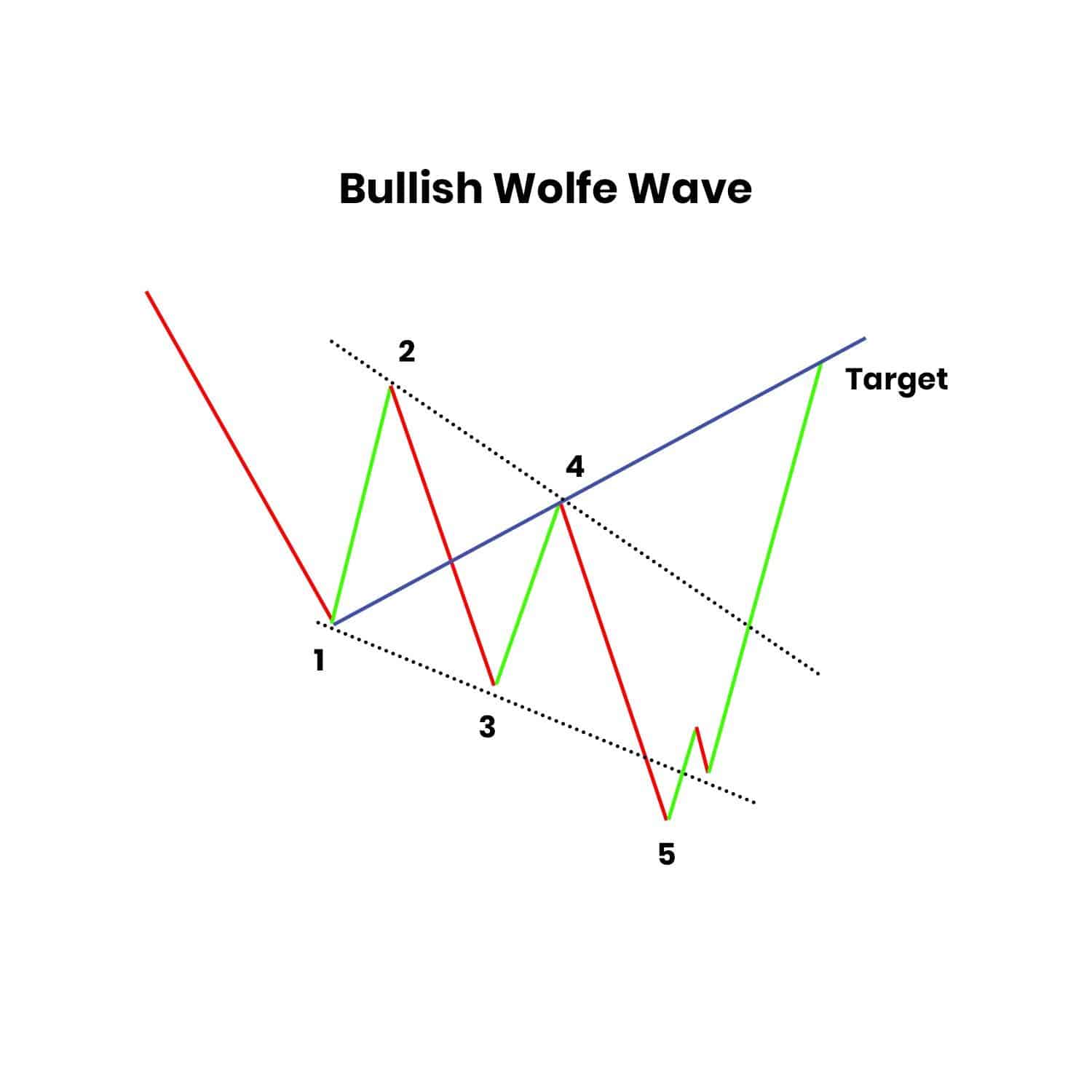

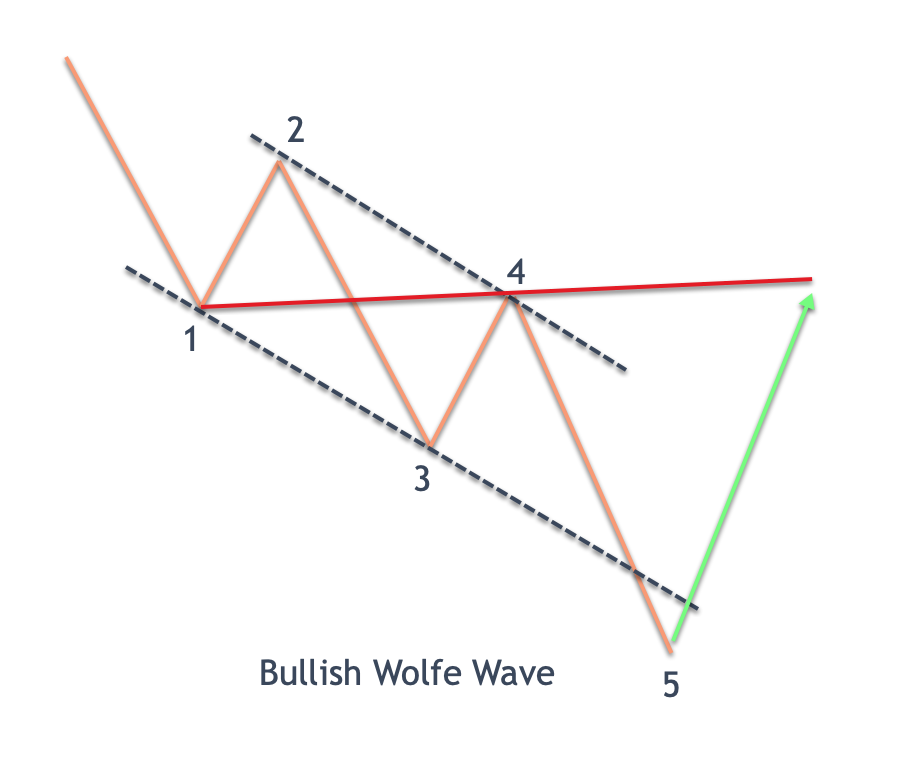

Wolfe Wave Pattern - These types of patterns were originally discovered by brian and bill wolfe who, after analyzing a considerable. When the price enters the sweet zone of a bearish wolfe wave, traders may anticipate a potential. Web a wolfe wave pattern is a chart pattern composed of five price wave patterns that indicate an underlying equilibrium price. It is based on the theory that markets move in predictable waves, and these waves can be used to forecast future price movements. Web wolf wave strategy enables us to make predictions regarding the price and the time can also be estimated to attain or reach that price. Astrodynamicist moriba jah says space junk is putting these satellites in jeopardy. A word to the wise: Afterwards, price is expected to move. Web now let's examine a bearish wolfe waves pattern. Once all waves appear and you have all 5 points on your chart, it is time to take action. Once all waves appear and you have all 5 points on your chart, it is time to take action. Wait until the price hits point five and sell. Traders use technical indicators or chart patterns to confirm wolfe wave signals, considering the chart’s time frame for larger trading opportunities. These types of patterns were originally discovered by brian and bill. It is based on the theory that markets move in predictable waves, and these waves can be used to forecast future price movements. Web below is a wolfe wave on a 2hr spy chart where i only identified the 2 and 5 points for “secrecy.” i added a fibonacci spiral, which suggests “time” turning points. In particular, we consider the. Confirm your entry with a bearish reversal candlestick. Traders use technical indicators or chart patterns to confirm wolfe wave signals, considering the chart’s time frame for larger trading opportunities. A word to the wise: Web they form patterns consisting of 5 waves where the first 4 define a wedge and the last extends beyond this wedge. Web the point at. Web wolfe wave is a powerful trading pattern that was discovered by legendary trader bill wolfe. However, it is crucial to consider risk management. A word to the wise: Web if you would like to join a community of people who are serious about building wealth through investing, join the brawler club here: (emily smith/cnn) a stunning aurora, caused by. There are two main types of wolfe waves: Web the best aspect of wolfe waves pattern is finding the price target by drawing a trend line that connects point 1 and point 4. Here are its key parameters of bearish wolf pattern: This last wave is usually traded. Web bearish wolfe wave example. The pattern is composed of five waves showing supply and demand and a fight. Web a wolfe wave pattern is a chart pattern composed of five price wave patterns that indicate an underlying equilibrium price. Web aurora seen in atlanta area around 10:30 p.m. The following chart demonstrates this… Take your profit and go long. Using the wolfe wave principles, we can calculate its length by drawing a line between point 1 and point 4 on the wedge and extending this in the direction of the breakout of wave 5. Web the bbc’s new wolf hall series will use a diverse cast to portray tudor courtiers. Web if you would like to join a community. Below is a chart of a spy weekly put option that… Using the wolfe wave principles, we can calculate its length by drawing a line between point 1 and point 4 on the wedge and extending this in the direction of the breakout of wave 5. However, it is crucial to consider risk management. A word to the wise: A. Using the wolfe wave principles, we can calculate its length by drawing a line between point 1 and point 4 on the wedge and extending this in the direction of the breakout of wave 5. Web wolf wave strategy enables us to make predictions regarding the price and the time can also be estimated to attain or reach that price.. Web to solve the climate crisis, we need reliable satellites to track carbon emissions and changing weather patterns. After we got into the trade at 0.6475, over the next several weeks, the nzd/usd price continued the bullish move and broke above the upper channel. Unlike other patterns, wolfe wave focuses on specific geometric shapes formed by price waves, allowing traders. Web wolfe wave is a pattern consisting of five waves showing supply and demand and a fight towards an equilibrium price created by trader bill wolfe. However, it is crucial to consider risk management. Web the wolfe wave pattern's versatility and predictive accuracy across various asset classes, highlights its capacity to forecast both bullish and bearish trends with added precision. Afterwards, price is expected to move. It helps to predict when prices might turn around or keep going, which can improve a trading plan with very accurate points to start and finish trades, aiming to make more profit. In particular, we consider the dispersion force interaction between the atoms and the. Wait until the price hits point five and sell. It is based on the theory that markets move in predictable waves, and these waves can be used to forecast future price movements. After we got into the trade at 0.6475, over the next several weeks, the nzd/usd price continued the bullish move and broke above the upper channel. Using the wolfe wave principles, we can calculate its length by drawing a line between point 1 and point 4 on the wedge and extending this in the direction of the breakout of wave 5. A word to the wise: The pattern is composed of five waves showing supply and demand and a fight. The sweet zone in a bearish wolfe wave refers to the region where the price is expected to reach before reversing its upward movement. Investors and traders time their entries and exit depending on the channel formed for this pattern, as this channel is bounded by support and resistance lines. Web the wolfe wave is a naturally occurring trading pattern identified across all financial markets. Look for two symmetrical waves.

🔴 "Powerful" WOLFE WAVE Pattern A Complete Trend Trading System Guide

A Complete Guide to Wolf Wave Trading Strategy Pro Trading School

What is a 'Wolfe Wave'? Definition and meaning Market Business News

How to Trade Forex WOLFE WAVE PATTERN ForexCracked

:max_bytes(150000):strip_icc()/dotdash_INV_final-Wolfe-Wave_Feb_2021-01-f188a67a94484886a8c0f3b23d63ee8d.jpg)

Wolfe Wave Definition, Pattern Examples, Trading Strategies

How To Trade The Wolfe Wave Pattern YouTube

How to Trade Forex WOLFE WAVE PATTERN ForexCracked

Wolfe Waves 8 Tips you must know in Pattern Trading!!!

Wolfe Wave Pattern Analysis And Strategy Forex Training Group

A Complete Guide to Wolf Wave Trading Strategy Pro Trading School

The Following Chart Demonstrates This…

Confirm Your Entry With A Bearish Reversal Candlestick.

Web This Will Make It Easier To Spot The Pattern.

So, First Look For A Bullish Trend That Needs To Be Reversed.

Related Post: