What Is An Existing Draw Draft Payment

What Is An Existing Draw Draft Payment - How much you want to pay in words and numbers. Make sure you have enough money in your account to cover the value of the. Customers can customize their billing and payment options to accommodate their individual needs. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. Web a draft is a widely accepted method of payment that allows one party to send funds to another party, typically for goods or services rendered. It assures the recipient that the funds are available and will be paid. Web the draw schedule is a detailed payment plan for a construction. Bank drafts are a secure form of payment guaranteed by the issuing bank, offering a higher level of security compared to personal checks. Bank drafts are commonly used for large transactions, international payments, or when a seller requires a more secure. A draft that is payable through a specific bank. Web ach fees are usually lower than credit card processing fees. How much you want to pay in words and numbers. A bank draft is a payment instrument issued by a bank, guaranteeing the payment of a specific amount to the recipient. Web a bank draft is a method of payment. The drawee honors a sight draft, identified with a. Web a bank draft is a method of payment. But unlike personal checks, a draft is guaranteed by the issuing bank, with no chance that the check could bounce. A draft that is payable through a specific bank. Special consideration is given to these. Web a draw against commission system is a professional payroll offering where you give commissioned employees. Web a demand draft is a safe and dependable payment system because the issuing bank guarantees it, indicating that the money is already in the bank’s control. Web you must use the autopay system to terminate your autopay program. Web the draw schedule is a detailed payment plan for a construction. Submit the dd request and make the payment. Web. With this method of payment, the bank becomes responsible for ensuring that the funds are available and will be paid to the. To get a banker’s draft, a bank customer must have funds (or cash) available. Bank drafts provide merchants and business owners with a secure form of payment since. A demand draft is a method used by an individual. A draft that is payable through a specific bank. Web a bank draft is issued for the equivalent amount. The drawee honors a sight draft, identified with a tenor “at sight,” by paying it when sighted. Demand drafts differ from normal checks in that they do not require. But unlike personal checks, a draft is guaranteed by the issuing bank,. Corporations use these instruments to pay bills. Bank drafts are commonly used for large transactions, international payments, or when a seller requires a more secure. Perhaps most important, your cash flow will improve. Often, to begin the process, the bank account holder must. A certified check confirms that there are enough funds in the account to pay the check’s value. Corporations use these instruments to pay bills. It is less likely to bounce or become fraudulent as a result. Bank drafts provide merchants and business owners with a secure form of payment since. The tenor of the draft determines a sight or a time payment. Web sight draft versus time draft. Web options include draw draft, prepayment and forwarding bills to another address. Web sight draft versus time draft. It is like asking a bank to write a cheque for you. Special consideration is given to these. Demand drafts differ from normal checks in that they do not require. Web the term bank draft (also called a banker's draft, bank check, or teller's check) is a paper document that resembles a traditional paper check. Meanwhile, the bank puts the payer’s funds into a reserve account. Bank drafts are essentially a check that is guaranteed by the issuing bank. Corporations use these instruments to pay bills. Web sight draft versus. Choose the account for making the payment. Web options include draw draft, prepayment and forwarding bills to another address. Bank draft transfers & payments. Meanwhile, the bank puts the payer’s funds into a reserve account. Web a bank draft is a method of payment. Web when used synonymously with automatic payment plans, automatic bank drafts are a convenient and paperless means of paying bills whereby funds are debited from one. Web options include draw draft, prepayment and forwarding bills to another address. It is like asking a bank to write a cheque for you. Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer. Web sight draft versus time draft. A draft ensures the payee a secure form of payment. Web a bank draft is a method of payment. The payer delivers the draft cheque to the third party they are paying. Special consideration is given to these. Bank drafts provide merchants and business owners with a secure form of payment since. Web when a bank account holder signs the authorization, the drawee is given permission to pay the draft to a third party. A demand draft is a method used by an individual for making a transfer payment from one bank account to another. Bank drafts are commonly used for large transactions, international payments, or when a seller requires a more secure. Web a draw against commission system is a professional payroll offering where you give commissioned employees a routine paycheck as an advance against future commissions. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. The funds required to cover.

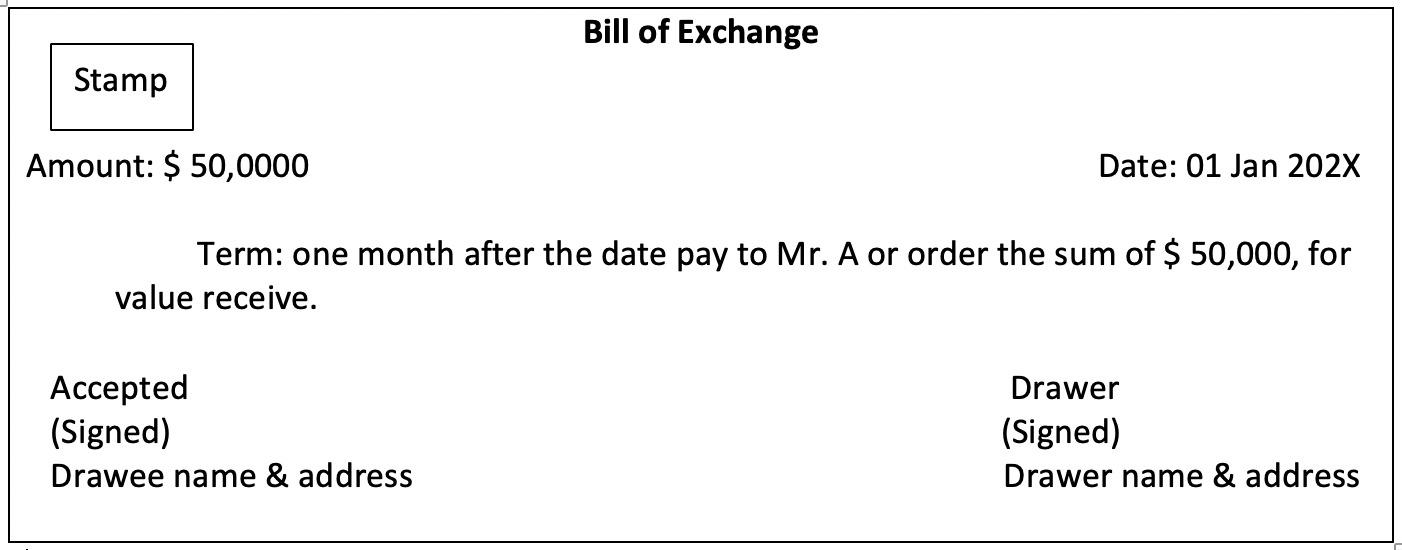

What is a bill of exchange? Features of a bill of exchange?

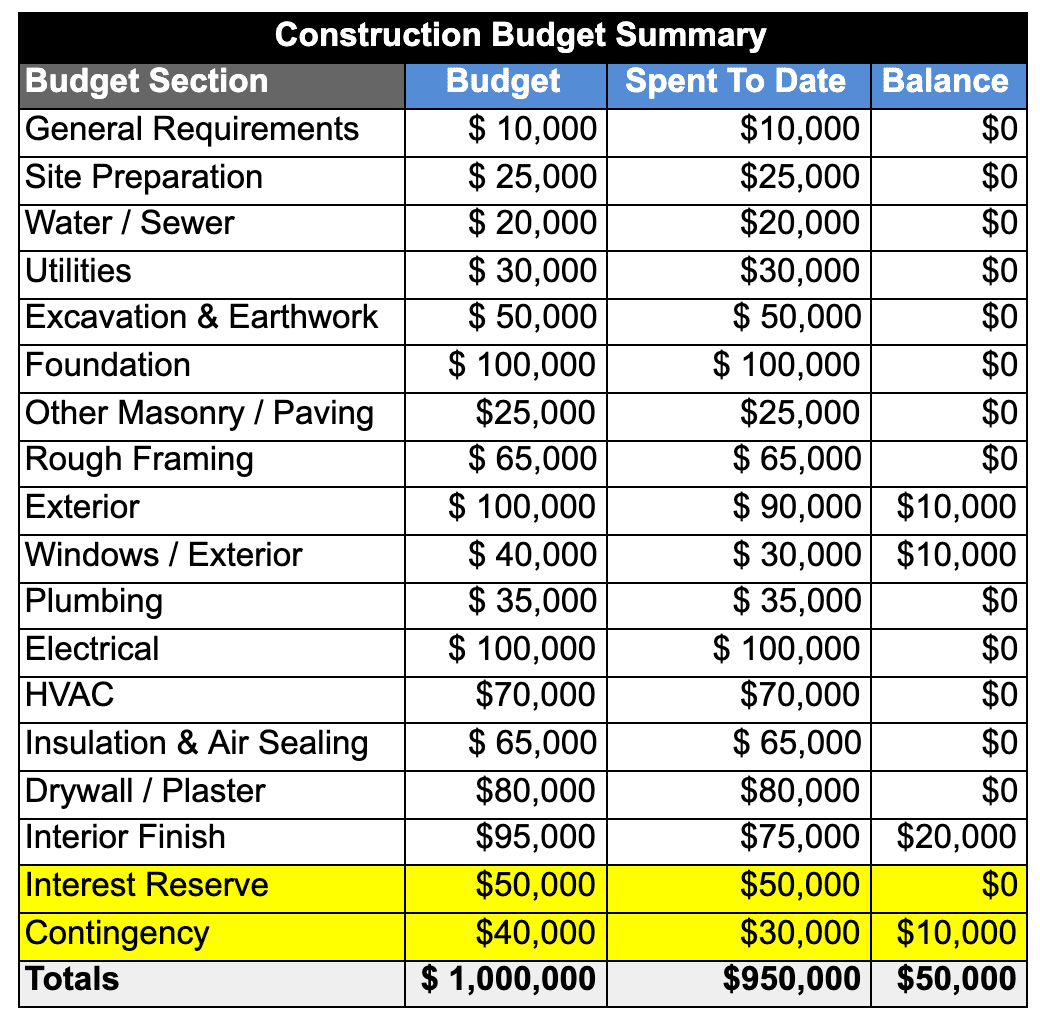

Draw Loan Invest Detroit

Understanding the Construction Draw Schedule PropertyMetrics

Direct Draw Draft System Examples

Direct Draw Draft System Examples

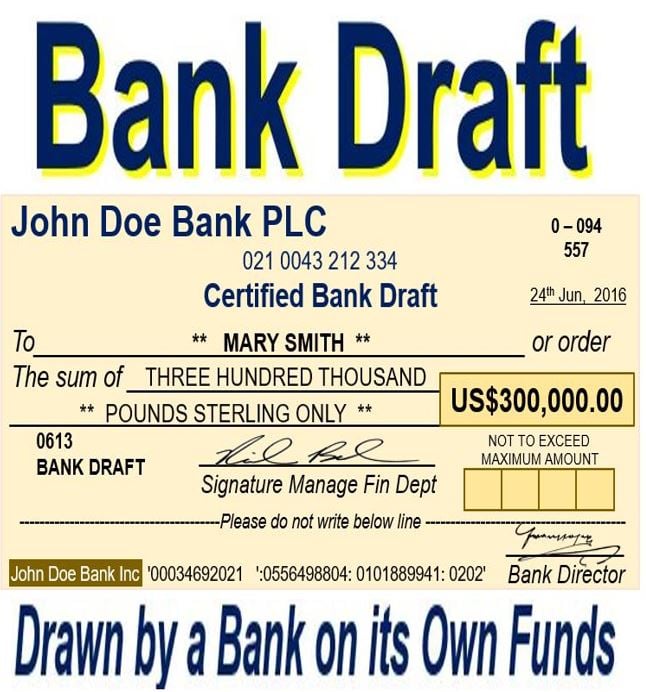

52 BANK DRAFT EXPLANATION BankDraft

What is drafting, who does it and how is it done? Yellow

Direct Draw Draft System Examples

Drawings Accounting Double Entry Bookkeeping

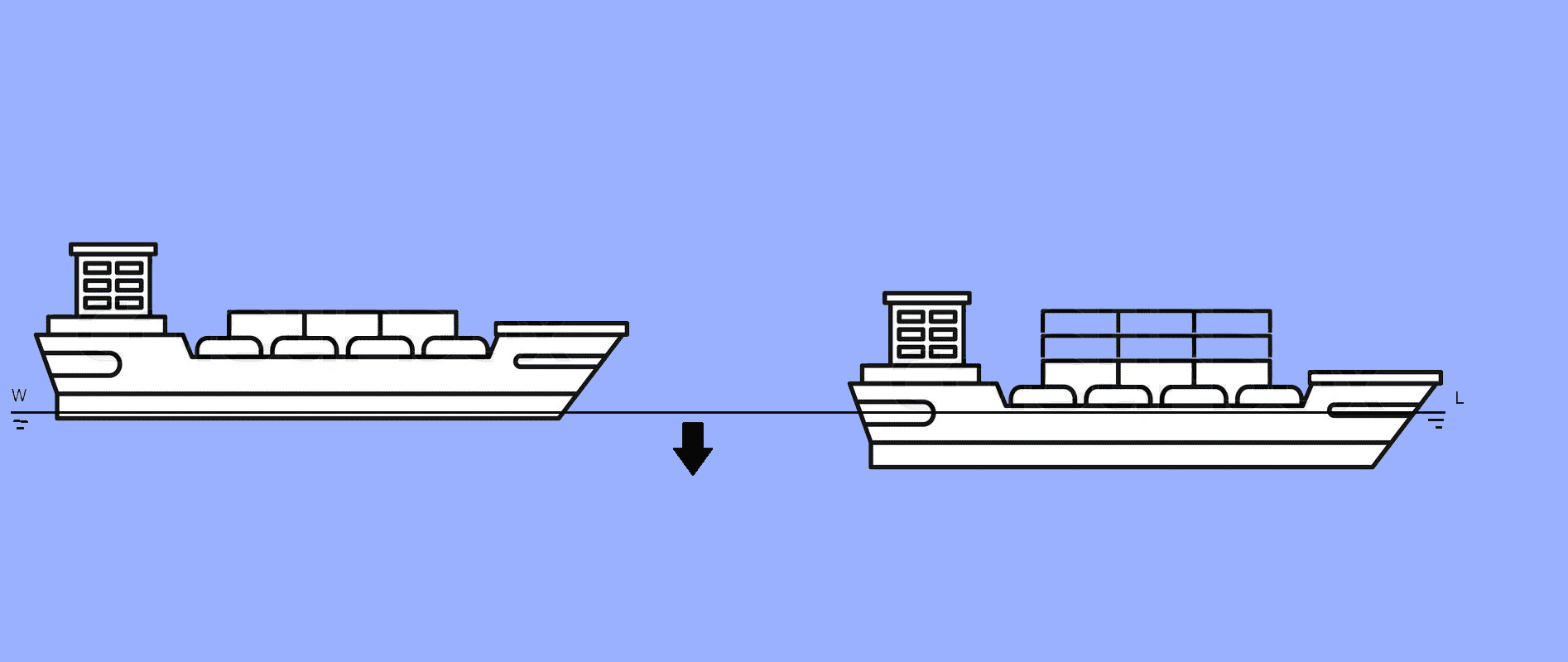

What Is Draft or Draught Of A Ship?

Some Organisations Prefer Bank Drafts To Cheques As They Are Paid For Upfront And So The Payment Is Guaranteed.

A Certified Check Confirms That There Are Enough Funds In The Account To Pay The Check’s Value.

Corporations Use These Instruments To Pay Bills.

A Bank Will Guarantee A Draft On Behalf Of A Business For Immediate.

Related Post: