What Is A Bullish Flag Pattern

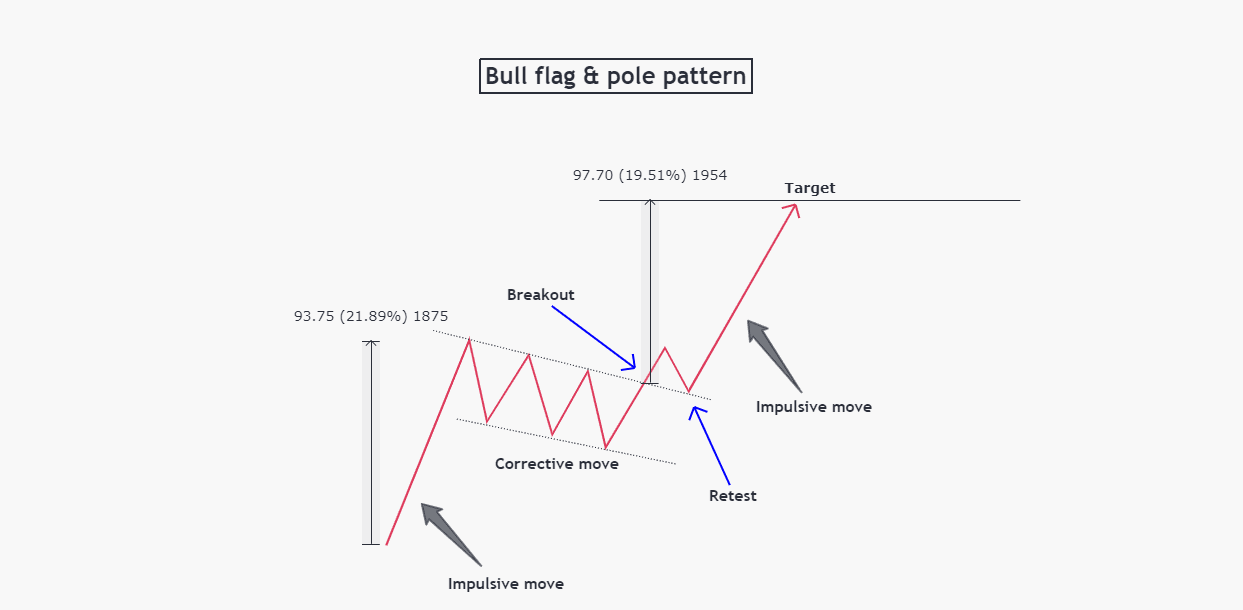

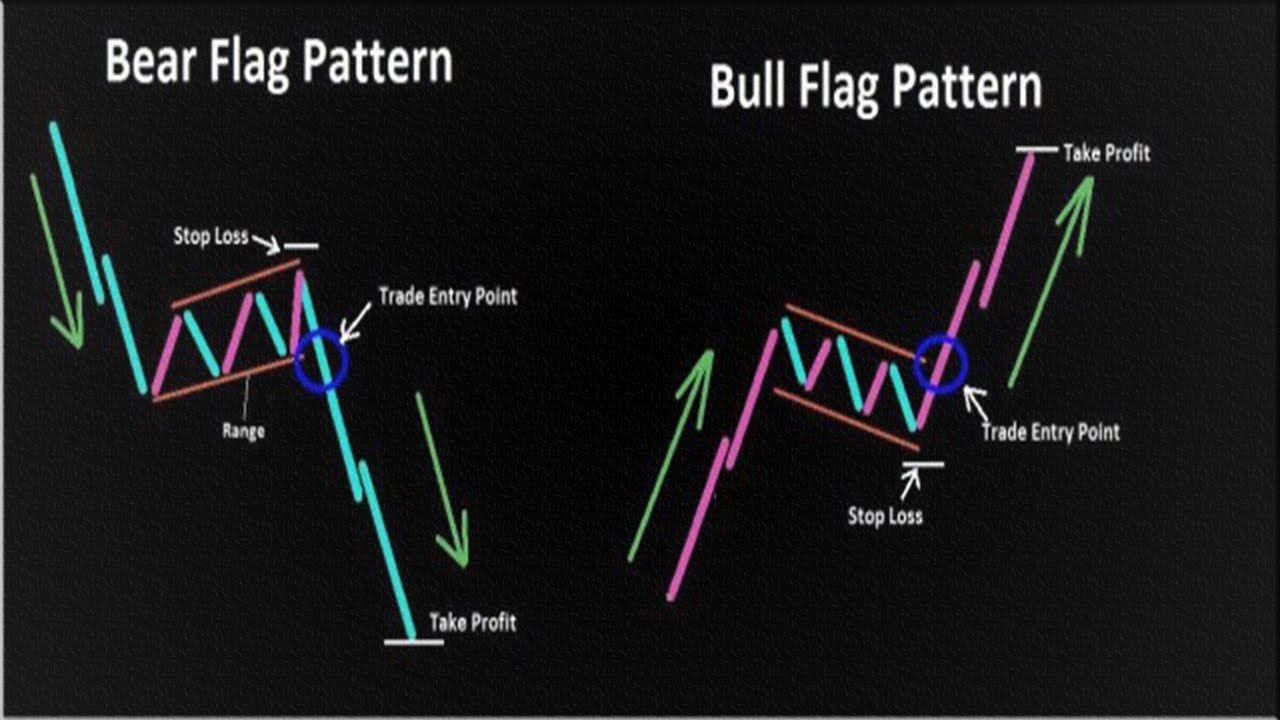

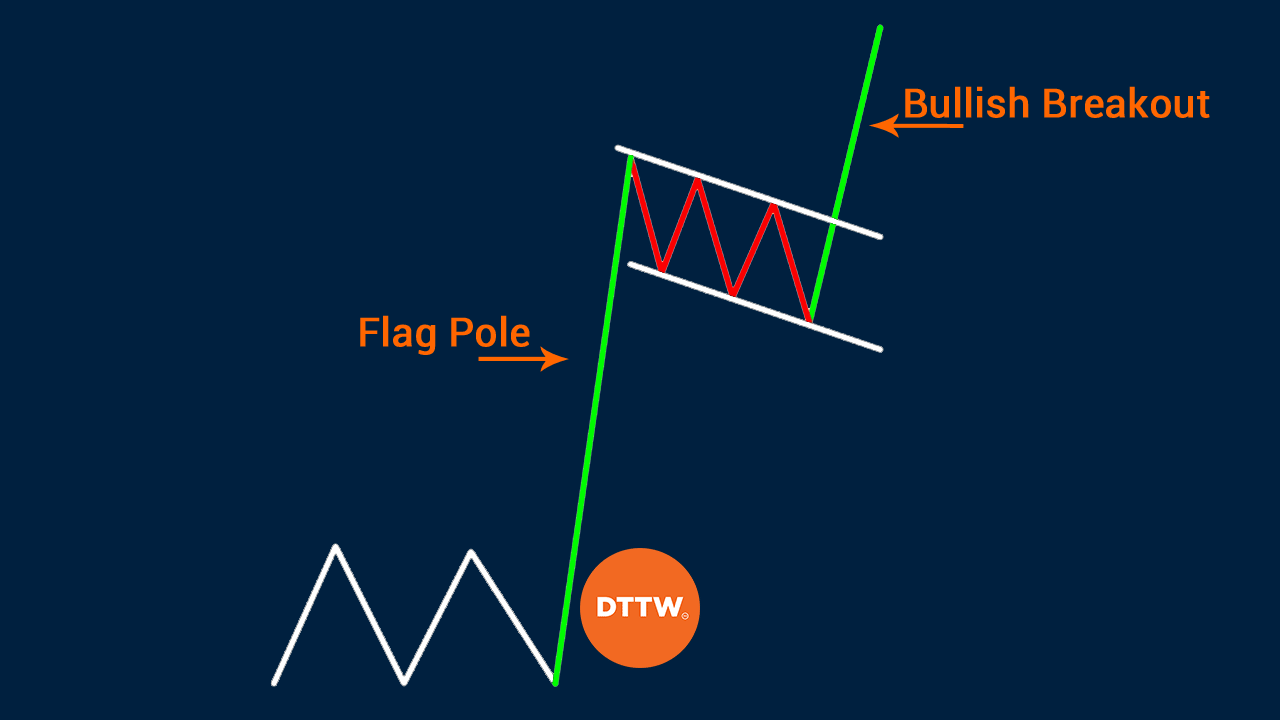

What Is A Bullish Flag Pattern - Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. The flagpole forms on an almost vertical price spike as sellers get blindsided from the buyers, then a pullback that has parallel upper and lower trendlines, which form the flag. The pattern occurs in an uptrend wherein a stock pauses for a time, pulls back to some degree, and then resumes the uptrend. Pole is the preceding uptrend where the flag represents the consolidation of the uptrend. Web he observed a technical pattern known as “sideways overlapping flag type consolidation,” suggesting that bitcoin’s consolidation phase is nearing its end and preparing for a significant price breakout. Web the aud/usd pair retreated to the crucial support level at 0.6600 on monday. As a general trading rule, it is never advised to buy at a random price hoping for an extension to the upside, but wait for either a. Web what is a bullish flag pattern? Web a bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price move higher. Web the bullish flag is a continuation pattern. It looks like a downward sloping rectangle, often represented by two parallel trend lines against the ongoing trend lines. Web a flag pattern is highlighted from a strong directional move, followed by a slow counter trend move. A flag pattern emerges as a brief consolidation after a strong price move, presenting a. Tapiero also remarked on the unpredictability of market catalysts, stressing that the exact trigger for the anticipated surge is unclear. How does bullish flag pattern? Bull flags are the opposite of bear flags, which form amid a concerted downtrend. It signals that the prevailing vertical trend may be in the process of extending its range. Bullish flag formations are found. Tapiero also remarked on the unpredictability of market catalysts, stressing that the exact trigger for the anticipated surge is unclear. Bitcoin’s (btc) price is currently stuck within a flag pattern after failing to breach the flag’s upper trend line. It signals that the prevailing vertical trend may be in the process of extending its range. Web a bull flag is. Web a bull flag is a technical pattern that provides an accurate entry to participate in a strong uptrend. By contrast, a bearish volume pattern increases first and then tends to hold. Web the aud/usd pair retreated to the crucial support level at 0.6600 on monday. The flagpole forms on an almost vertical price spike as sellers get blindsided from. Web simply stated, bullish patterns are among the highest probability signals that an asset’s price will start ticking upward. Many professional traders use this continuation pattern to find the optimal place to trade with the trend. It signals that the prevailing vertical trend may be in the process of extending its range. Web the flag pattern is a continuation formation. Web he observed a technical pattern known as “sideways overlapping flag type consolidation,” suggesting that bitcoin’s consolidation phase is nearing its end and preparing for a significant price breakout. Web gold bull flag formation. The pattern consists of between five to twenty candlesticks. The chart example above shows a bullish flag pattern that formed in the usd/cad currency pair. What's. Web without a doubt, the bull flag is a bullish pattern. What is a bullish flag? They are called bull flags. The flagpole and the flag. Why most bull flag patterns fail. Web the aud/usd pair retreated to the crucial support level at 0.6600 on monday. The pattern has completed when price breaks out of the containing trend lines in the direction of the prevailing trend, at which point it will likely continue its course. The pattern consists of between five to twenty candlesticks. Web a bull flag chart pattern happens when. Web a flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web the bullish flag is a continuation pattern. Bull flags are the opposite of bear flags,. Day 7 of 50k funded account! The stock history shows a sharp rise which is the flag pole followed by an up and. What is the bull flag pattern? Web a bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price move higher. Many professional traders use this continuation pattern to. It forms when the price retraces by going sideways to lower price action on weaker volume followed by a sharp rally to new highs on strong volume. How does bullish flag pattern? Web bullish on disgruntled. It signals that the market’s bullish momentum is strong enough to take a breather (consolidation phase) before prices move even higher. Day 7 of 50k funded account! They are called bull flags. Web simply stated, bullish patterns are among the highest probability signals that an asset’s price will start ticking upward. Most bull flags should be avoided as they have a low probability of success. The strong directional move up is known as the ‘flagpole’, while the slow counter trend move lower is what is referred to as the ‘flag’. Web a bull flag pattern is a sharp, strong volume rally of an asset or stock that portrays a positive development. Web what is a bullish flag pattern? Web bullish flags can form after an uptrend, bearish flags can form after a downtrend. Web the bullish volume pattern increases in the preceding trend and declines in the consolidation. The pattern has completed when price breaks out of the containing trend lines in the direction of the prevailing trend, at which point it will likely continue its course. Web a bull flag pattern means the market price of a financial market is in a bullish trend and the market chart is indicating further price increases after a price breakout from the flag's resistance line. Web bull flag patterns are one of the most popular bullish patterns.What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

How can you tell a bullish flag? อ่านที่นี่ What is bullish flag pattern

How to Trade Bullish Flag Patterns

Bullish flag chart pattern Basic characteristics & 3 examples

Bullish Pennant Patterns A Complete Guide

What Is A Bull Flag Pattern (Bullish) & How to Trade With It Bybit Learn

What is Bull flag pattern? Everything on InoSocial

What is Bull Flag Pattern & How to Identify Points to Enter Trade DTTW™

Bull Flag Pattern New Trader U

Learn about Bull Flag Candlestick Pattern ThinkMarkets EN

Xauusd Took This Trade Based On A Bullish Flag Pattern Break And Retest.

Conservative Traders May Look For Additional Confirmation Of The Trend Continuing.

Web A Bull Flag Is A Technical Pattern That Provides An Accurate Entry To Participate In A Strong Uptrend.

The Bull Flag Formation Is A Technical Analysis Pattern That Resembles A Flag.

Related Post: