What Is A Bear Flag Pattern

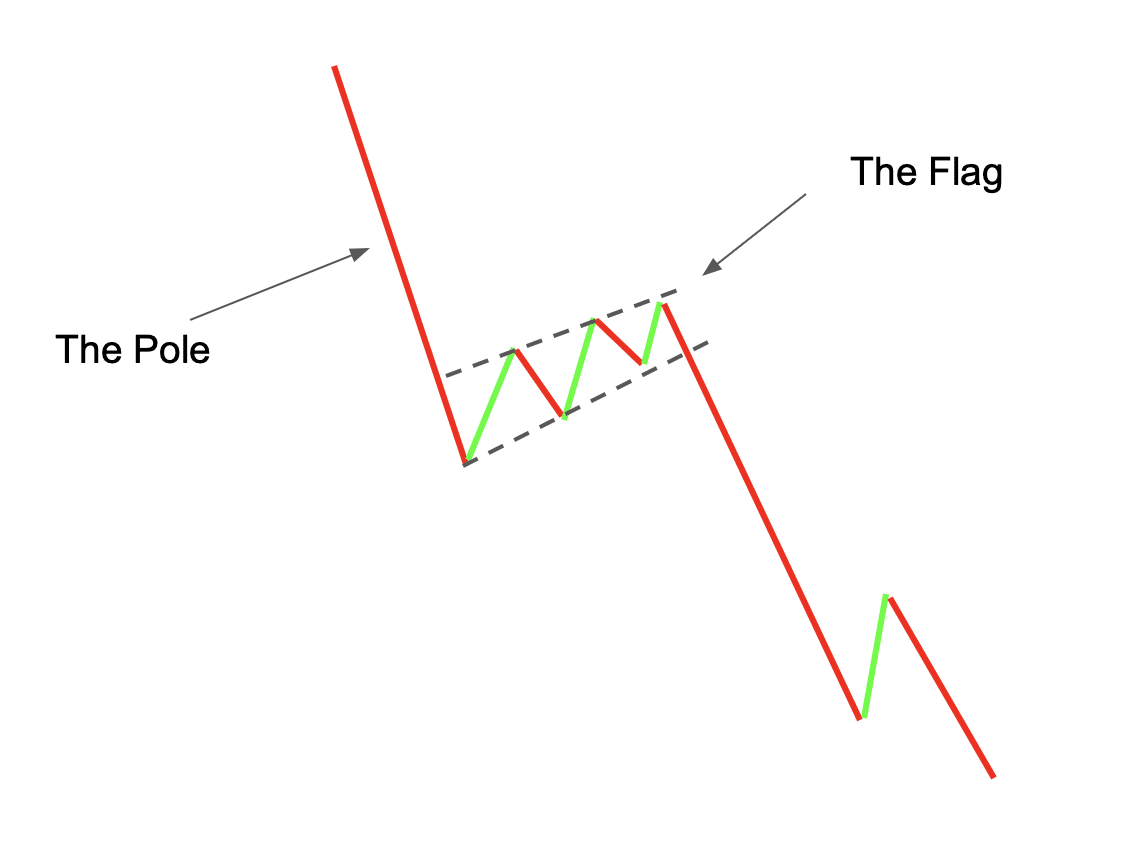

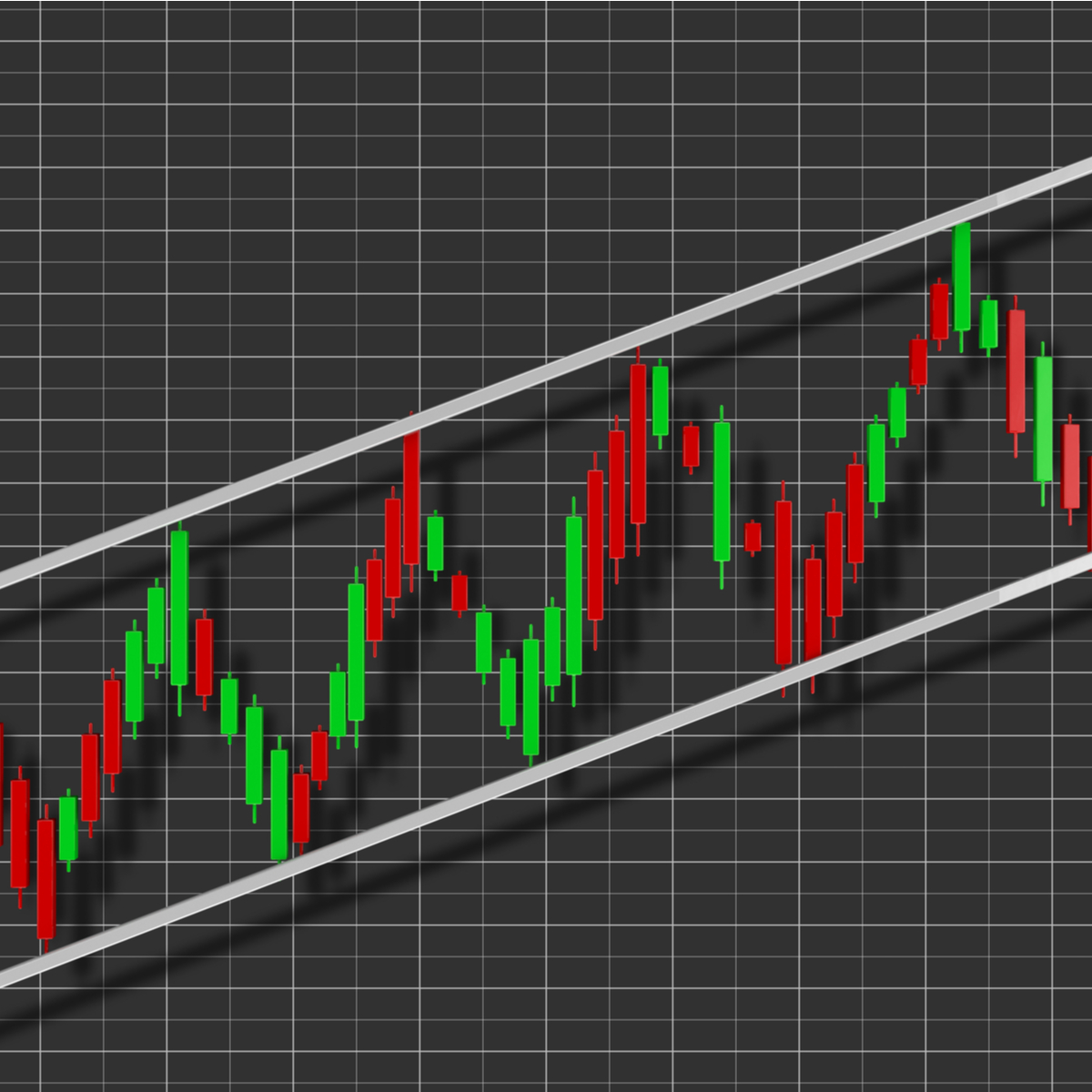

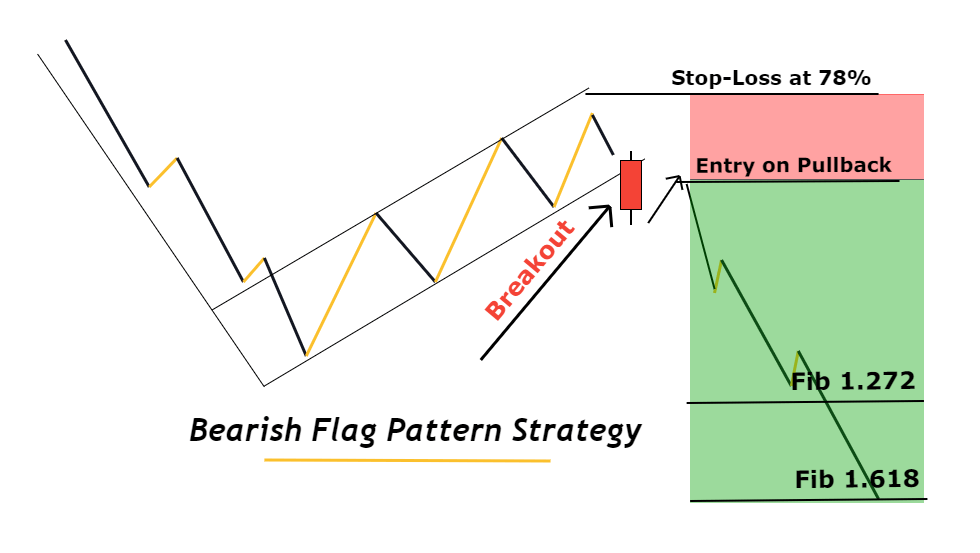

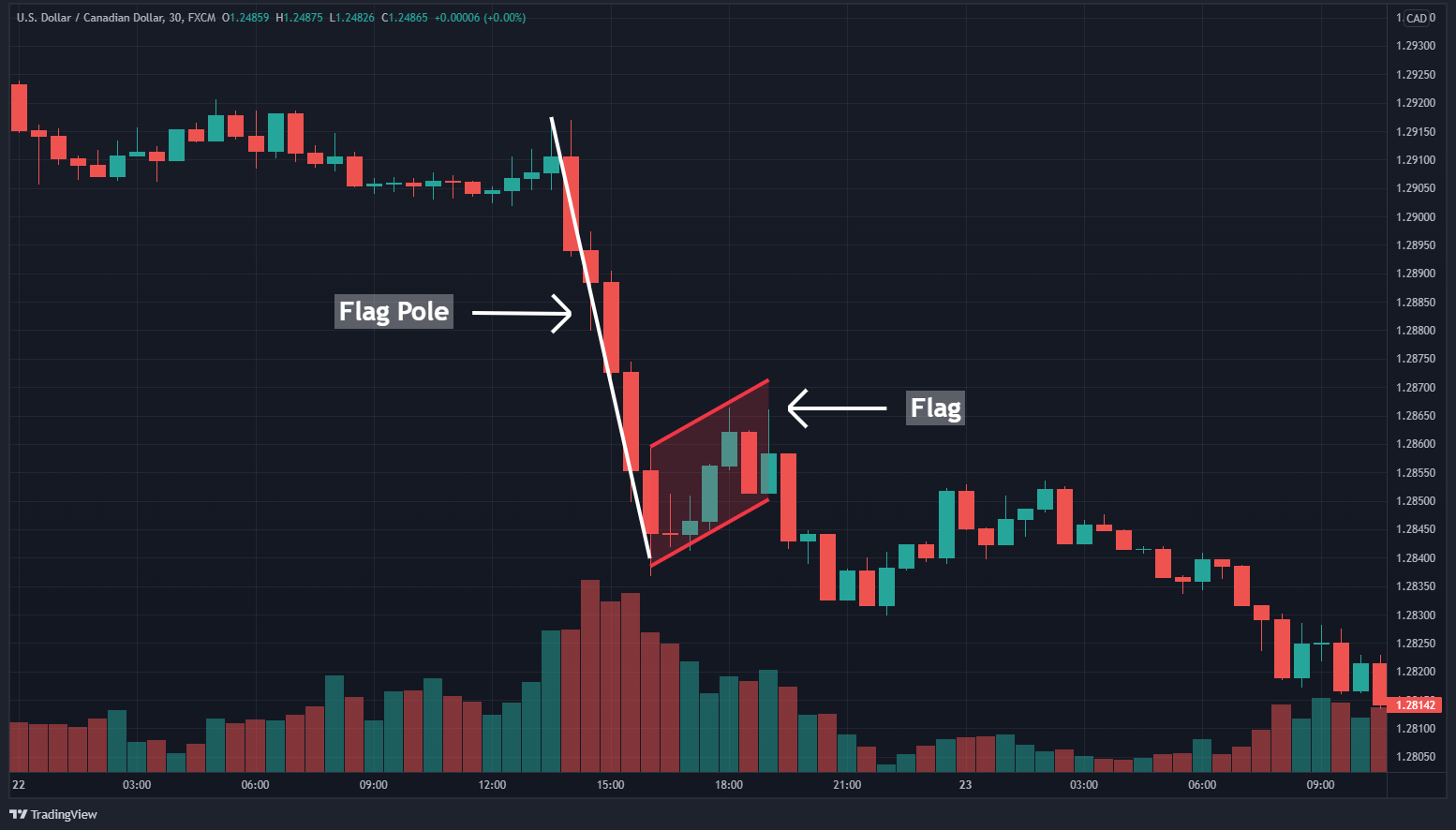

What Is A Bear Flag Pattern - Followed by at least three or more smaller consolidation candles, forming the flag. A bear flag embodies a downtrend continuation pattern. What is a bear flag pattern? Risk management in trading bearish flag pattern. Web the bear flag pattern is a popular price pattern used by technical traders within the financial markets to determine trend continuations. A weak pullback with small range candles. Web the bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. These patterns are considered continuation patterns in technical analysis terms, as they have a habit of occurring before the trend which preceded their formation is continued. What is a bear flag pattern? The bear flag pattern is the opposite of the bullish one. In this edition of stockcharts tv's the final bar, dave focuses in on price pattern analysis for the s&p 500, then reflects on the emergence of defensive sectors like consumer staples. Bear and bull flags are particularly telling, reflecting continuation patterns that may predict price extensions in either direction. He also recaps earnings movers, including dis, shop, and more. Grasping. The flag pole is a pronounced downward price movement, while the flag is a period of sideways price action. Ii what is a bearish flag pattern? Bear flags consist of two parts: Web the bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. Overview. A confirmation where price moves in the same direction as the. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers, then a bounce that has parallel upper and lower trendlines, which form the flag. Web a bear flag is a bearish continuation chart pattern that forms after a rapid price drop. Web. Web every bull flag and bear flag pattern is characterized by six primary traits: Web parts of the country saw the aurora borealis on friday night, and the dazzling show was expected to continue on saturday night, according to experts. Ii what is a bearish flag pattern? This video originally premiered on may 7, 2024. Bear flags consist of two. As a continuation pattern, the bear flag helps sellers to push the price action further lower. The definition of a bearish flag pattern. It has the same structure as the bull flag but inverted. Ii what is a bearish flag pattern? Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. Bear and bull flags are particularly telling, reflecting continuation patterns that may predict price extensions in either direction. This article will explore bear. He also recaps earnings movers, including dis, shop, and more.. Web the definition of a bearish flag pattern. In the technical analysis of financial markets, a flag is a classic pattern appearing on a chart that shows a tight consolidation. The bear flag pattern is the opposite of the bullish one. Web every bull flag and bear flag pattern is characterized by six primary traits: The flag and the flag. In the technical analysis of financial markets, a flag is a classic pattern appearing on a chart that shows a tight consolidation. The retracement of the flag should not be higher than 50% compared to the flag pole. What are bear and bull flags? As a continuation pattern, the bear flag helps sellers to push the price action further lower.. Web a bear flag trend continuation pattern triggered on tuesday and gold closed weak, near the low of the day and below the prior april 23 (b) swing low. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. Web what is the. It is formed when the price of an asset experiences a sharp decline, called the pole, followed by a period of consolidation, which is commonly referred to as the flag. The bear flag pattern is the opposite of the bullish one. Web bull and bear flag formations are price patterns which occur frequently across varying time frames in financial markets.. Bear flags consist of two parts: It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. What does a bearish flag tell traders? Ii what is a bearish flag pattern? This article will explore bear. The flag pole is a pronounced downward price movement, while the flag is a period of sideways price action. The flag pole and the flag. Iii.i bullish flag pattern vs bearish flag. It has the same structure as the bull flag but inverted. Web bull and bear flag formations are price patterns which occur frequently across varying time frames in financial markets. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. Web by patrick stockdale | december 7, 2023. This video originally premiered on may 7, 2024. Iv when should you trade the bear flag pattern? Web table of contents show. Web flag patterns have five main characteristics:

How to Trade a Bearish Flag Pattern

Bear Flag Chart Pattern Meaning, Benefits & Reliability Finschool

Bearish Flag Strategy Quick Profits In 5 Simple Steps

Bear Flag Pattern Explained New Trader U

What Is A Bear Flag Pattern?

What is a Bear Flag? Learn How To Trade This Pattern.

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Learn About Bear Flag Candlestick Pattern ThinkMarkets EN

Explained What Is a Bear Flag Pattern & How to Trade It? Bybit Learn

How To Trade The Bear Flag Pattern

A Weak Pullback With Small Range Candles.

Followed By At Least Three Or More Smaller Consolidation Candles, Forming The Flag.

Web A Bear Flag Is A Bearish Chart Pattern That Signals The Market Is Likely To Head Lower (And The Opposite Is Called A Bull Flag ).

Usually, These Candles Are Moving Up Or Down, Just A Little Bit In A Tight Range After The “Flag Pole.”

Related Post: