Wedging Pattern

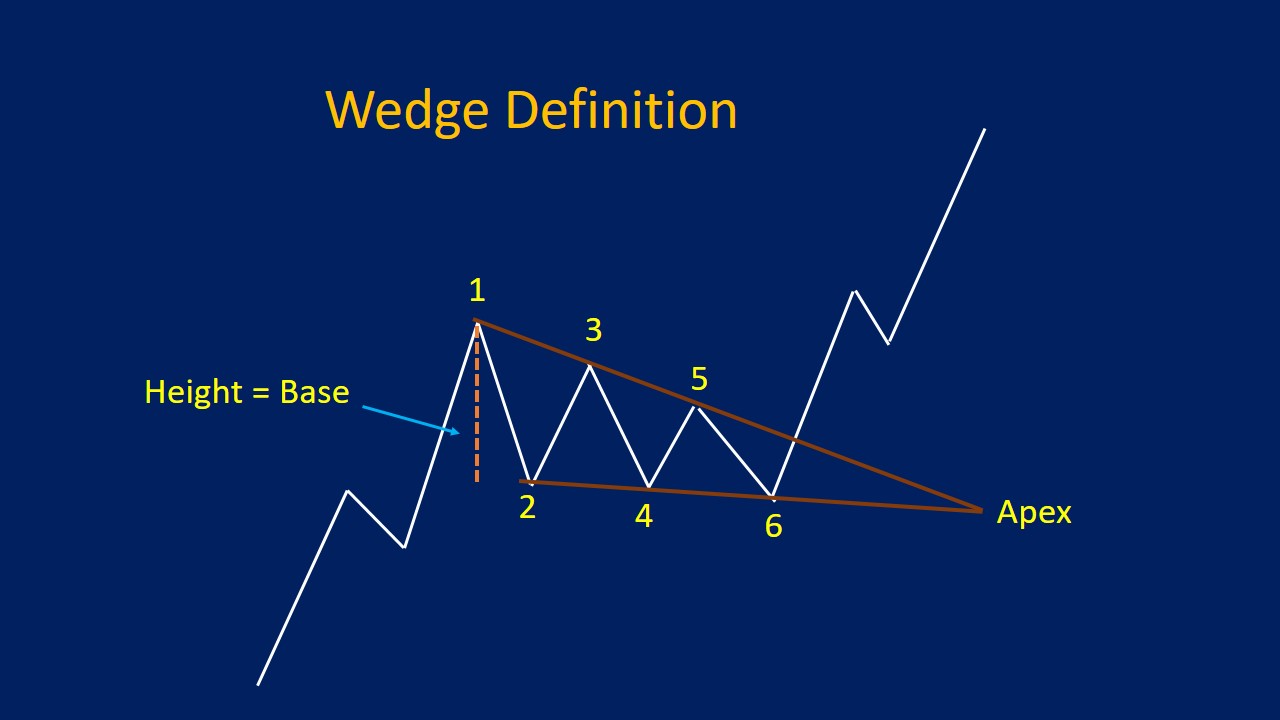

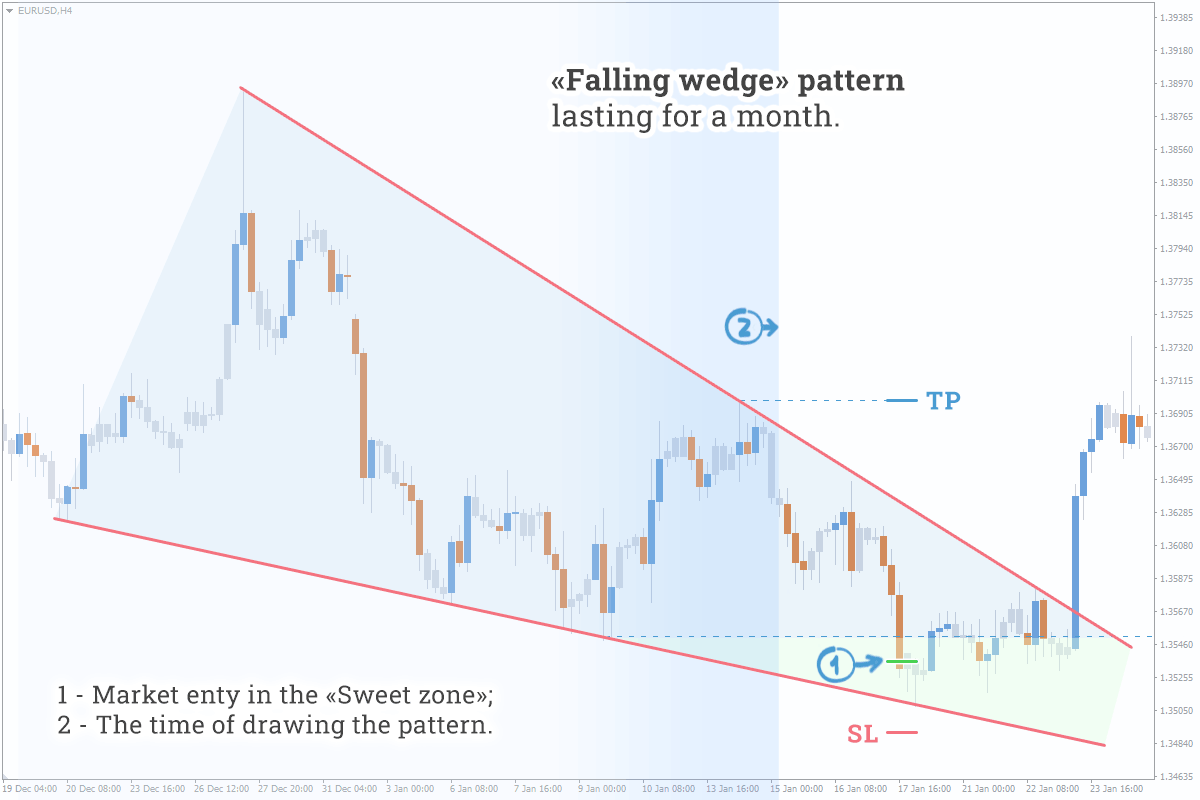

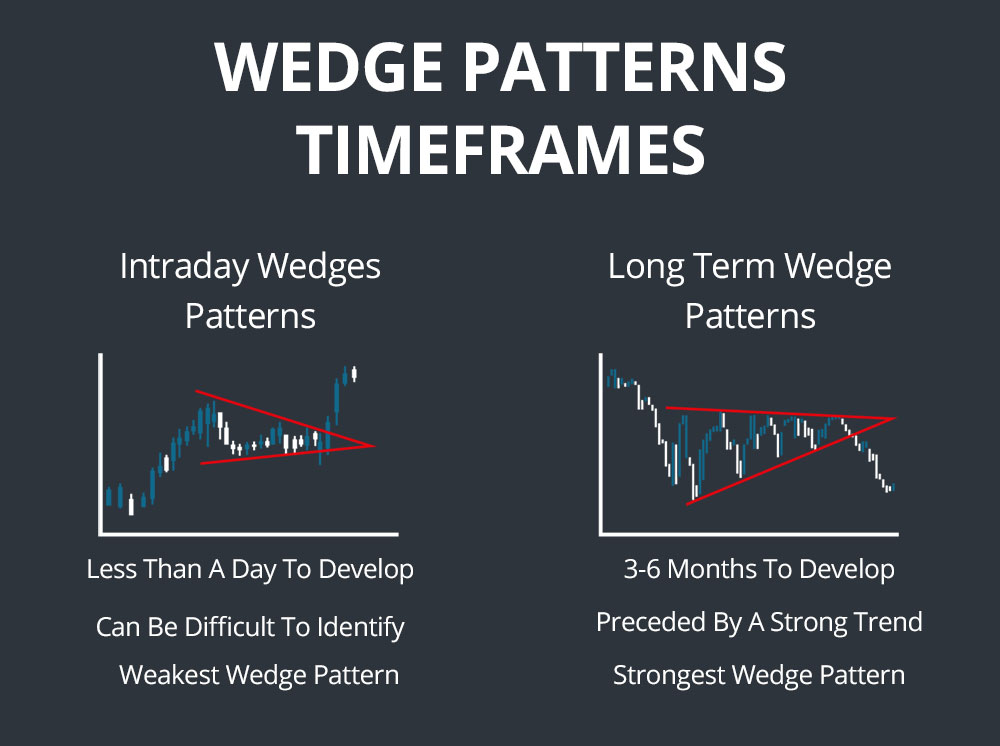

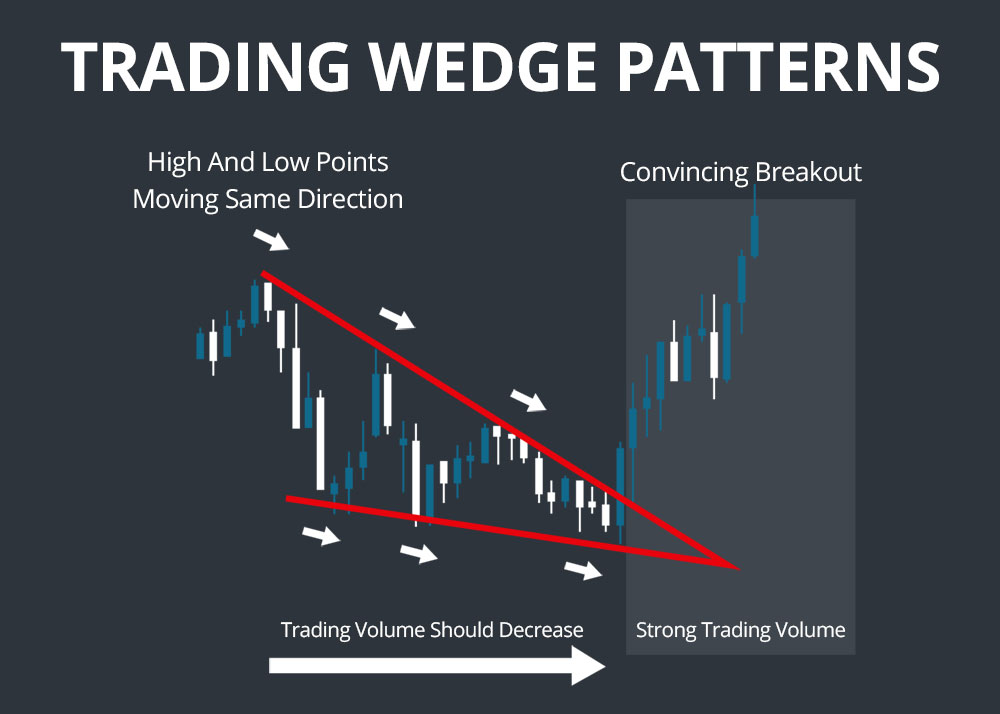

Wedging Pattern - Web the wedge pattern is a popular technical analysis tool used by traders to identify potential price reversals and trend continuations. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for a potential breakout. Rising wedges typically signal a bearish reversal, while falling wedges suggest a bullish continuation. Web a wedge pattern is considered to be a pattern which is forming at the top or bottom of the trend. As outlined earlier, falling wedges can be both a reversal and continuation pattern. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Bitcoin has been pulling back this week following a test of. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. Are you looking to skyrocket your trading profits? It should take about 3 to 4 weeks to complete the wedge. This wedge could be either a rising wedge pattern or falling wedge pattern. Web bitcoin's recent price action shows consolidation within a. Web 1 what is the wedge pattern? It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Rising wedges. These trading wedge patterns emerge on charts when trend direction conflicts with volatility contraction. It is a type of formation in which trading activities are confined within converging straight lines which form a pattern. The falling wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. Web what is a falling wedge pattern?. Are you looking to skyrocket your trading profits? Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Web 🚀 learn technical analysis with our free course! It suggests a potential reversal in the trend. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much. 2 types of wedge patterns. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. Web bitcoin's recent price action shows consolidation within a bull wedge pattern, with two trend lines to watch for a potential breakout. Web a wedge pattern is considered to be. Identifying and understanding wedge patterns is essential for effective technical analysis and successful trading strategies. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It. There are 2 types of wedges indicating price is in consolidation. Wedges signal a pause in the current trend. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. It’s formed by drawing trend lines that connect a series of sequentially higher peaks. In many cases, when the market is trending, a wedge pattern will develop on the chart. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. As outlined earlier, falling wedges can be both a reversal and continuation pattern. 3 characteristics of the wedge pattern. It means that the magnitude of price. 4 how to trade forex and binary options with the wedge pattern. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. Mesmerizing as modern art yet orderly as geometry—wedge patterns capture a trader’s imagination. Web a wedge pattern is a popular trading. Web the falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Its unique shape resembles a triangle, with converging trend lines that slope either upward or downward. It is a type of formation in which trading activities are confined within converging straight lines which form a. This wedge could be either a rising wedge pattern or falling wedge pattern. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. 4.1.1 for the rising wedge. It should take about 3 to 4 weeks to complete the wedge. In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. It is a type of formation in which trading activities are confined within converging straight lines which form a pattern. A wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. The first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. 2 types of wedge patterns. Web 📌 what is the rising wedge pattern? To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support. Web in a wedge chart pattern, two trend lines converge. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. Web the wedge pattern is a popular technical analysis tool used by traders to identify potential price reversals and trend continuations.

Wedge Pattern Rising & Falling Wedges, Plus Examples

The “Wedge” Pattern is a Classical Forex Pattern All Types on Chart

How to Trade the Rising Wedge Pattern Warrior Trading

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

5 Chart Patterns Every Beginner Trader Should Know Brooksy

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

Simple Wedge Trading Strategy For Big Profits

It Means That The Magnitude Of Price Movement Within The Wedge Pattern Is Decreasing.

Are You Looking To Skyrocket Your Trading Profits?

By Stelian Olar, Updated On:

Web Bitcoin's Recent Price Action Shows Consolidation Within A Bull Wedge Pattern, With Two Trend Lines To Watch For A Potential Breakout.

Related Post: