Wedge Triangle Pattern

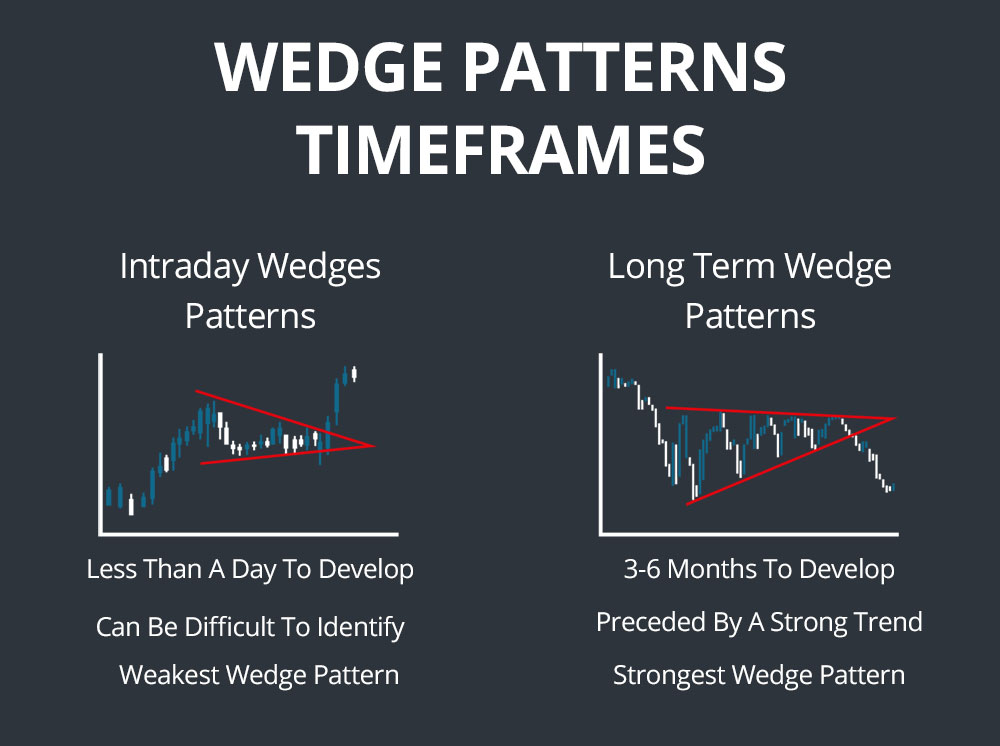

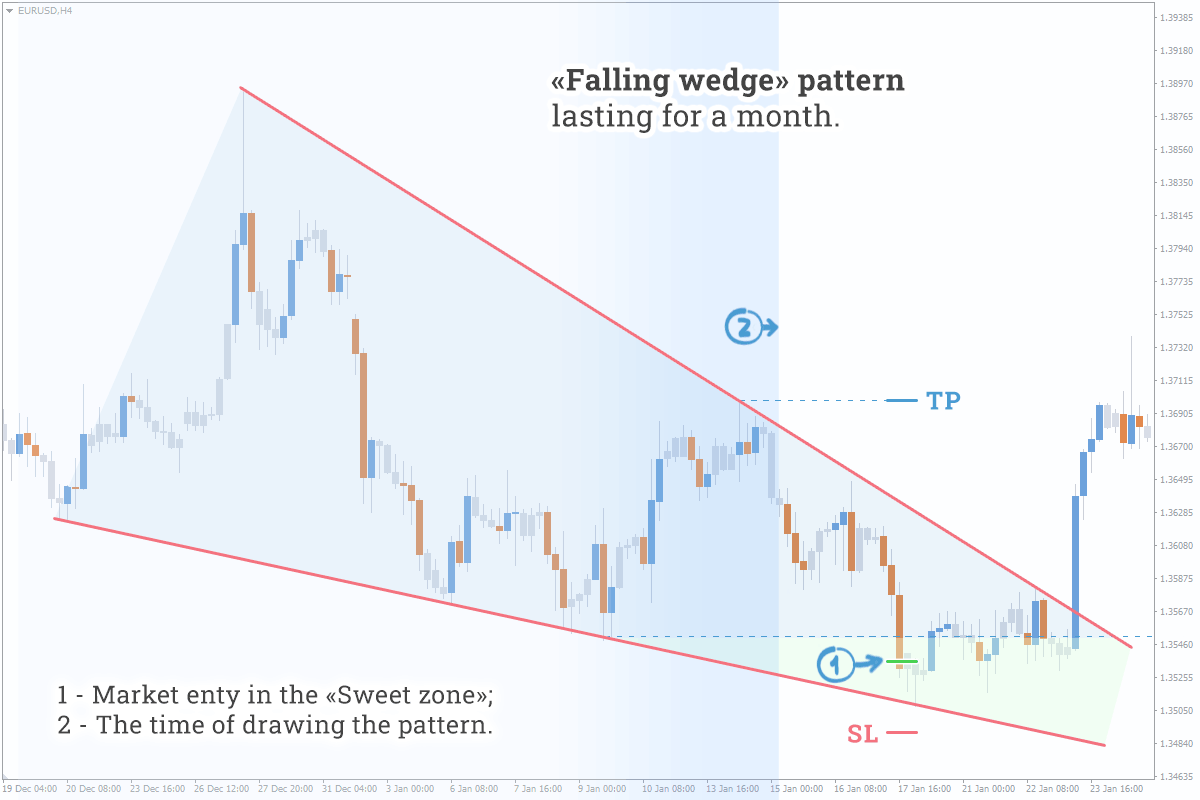

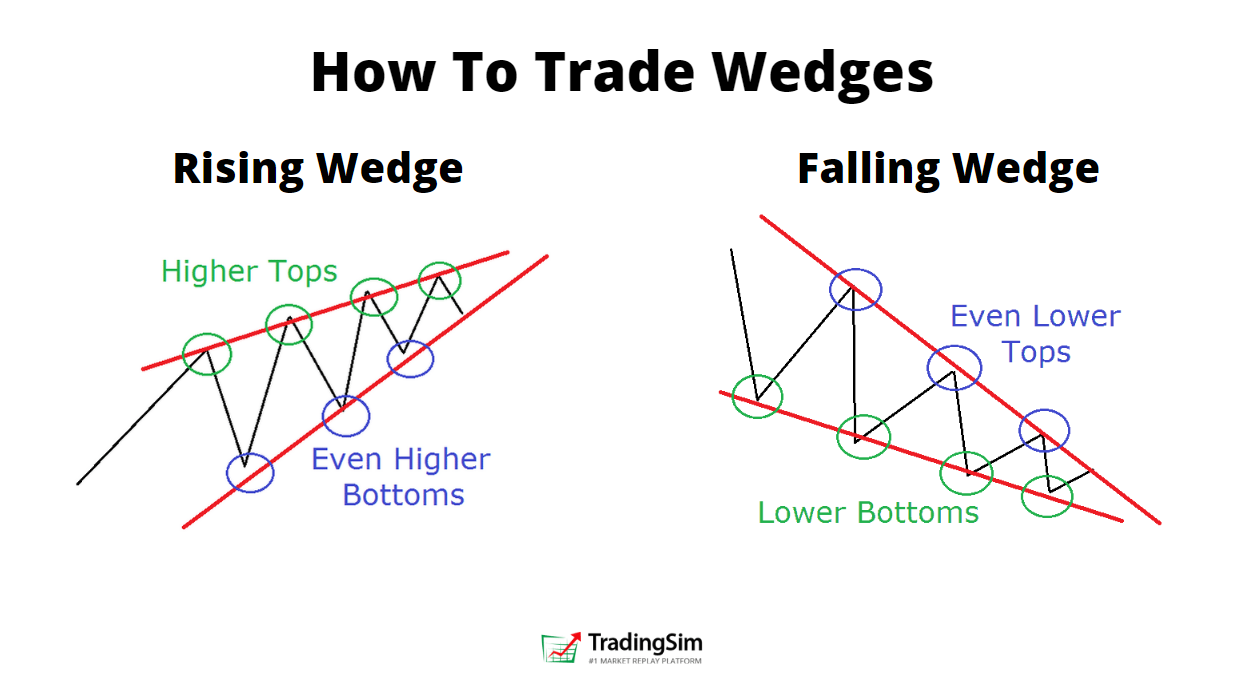

Wedge Triangle Pattern - Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend. Web a wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. Web how to trade the pennant, triangle, wedge, and flag chart patterns. It’s formed by drawing trend lines that connect a series of. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. These trend lines link the asset’s price’s higher highs and lower lows throughout. Web the wedge pattern is a popular technical analysis tool used by traders to identify potential price reversals and trend continuations. These are some of the most powerful and reliable chart. Web the rising wedge and ascending triangle patterns help the price action traders to predict further movement of price of any financial asset. Web rising wedge pattern vs ascending triangle pattern. They can be powerful continuation or reversal patterns, depending on their shape and whether. Web as a reversal chart pattern, the wedging pattern provides valuable trading clues: Web description and execution of the wedge pattern. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and. Web in a wedge chart pattern, two trend lines converge. The two trend lines are drawn to connect the respective highs and lows of a price. Wedges signal a pause in the current. Triangles are similar to wedges and pennants and can be. Web rising wedge pattern vs ascending triangle pattern. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend. The two trend lines are drawn to connect the respective highs and lows of a price. They can be powerful continuation or reversal patterns, depending on their shape and whether. Its. These trend lines link the asset’s price’s higher highs and lower lows throughout. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. Web a triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display. It’s formed by drawing trend lines that connect a series of. Web a triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears. Web how to trade the pennant, triangle, wedge, and flag chart patterns. Web the rising wedge and ascending triangle. Web a wedge is a price pattern marked by converging trend lines on a price chart. Web in summary, wedges and triangles are popular chart patterns that can indicate potential trend reversals or continuation. These are some of the most powerful and reliable chart. Web description and execution of the wedge pattern. Frequently asked questions (faqs) recommended articles. Normally, the wedge is considered a reversal pattern, forming on maximums and minimums of a price chart in. Web the descending wedge is a pattern that forms up when price action has pulled back from a high and consolidates in a declining move. They can be powerful continuation or reversal patterns, depending on their shape and whether. Web a symmetrical. Hints that an eventual breakout or breakdown is coming as price movements. Wedges signal a pause in the current. The rate of printing lower. Web in summary, wedges and triangles are popular chart patterns that can indicate potential trend reversals or continuation. Web a wedge is a price pattern marked by converging trend lines on a price chart. Web in summary, wedges and triangles are popular chart patterns that can indicate potential trend reversals or continuation. These are some of the most powerful and reliable chart. It’s formed by drawing trend lines that connect a series of. Web rising wedge pattern vs ascending triangle pattern. Web description and execution of the wedge pattern. Web as a reversal chart pattern, the wedging pattern provides valuable trading clues: Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend. Web rising wedge pattern vs ascending triangle pattern. Web through this article, we are going to understand how. These are some of the most powerful and reliable chart. These trend lines link the asset’s price’s higher highs and lower lows throughout. Web through this article, we are going to understand how to trade wedge and triangle chart patterns. Web how to trade the pennant, triangle, wedge, and flag chart patterns. Web rising wedge pattern vs ascending triangle pattern. Web a wedge is a price pattern marked by converging trend lines on a price chart. Web in summary, wedges and triangles are popular chart patterns that can indicate potential trend reversals or continuation. Web in a wedge chart pattern, two trend lines converge. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Frequently asked questions (faqs) recommended articles. It means that the magnitude of price movement within the wedge pattern is decreasing. The two trend lines are drawn to connect the respective highs and lows of a price. The rate of printing lower. Web a wedge pattern is created when 2 trend lines converge to form a triangle or wedge shape. Web the descending wedge is a pattern that forms up when price action has pulled back from a high and consolidates in a declining move. Triangles are similar to wedges and pennants and can be.

How to trade Wedges Broadening Wedges and Broadening Patterns

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What Is A Wedge Pattern? How To Use The Wedge Pattern Effectively How

How to Trade the Rising Wedge Pattern Warrior Trading

The “Wedge” Pattern is a Classical Forex Pattern All Types on Chart

Rising and Falling Wedge Patterns How to Trade Them TradingSim

Simple Wedge Trading Strategy For Big Profits

Wedge Patterns How Stock Traders Can Find and Trade These Setups

5 Chart Patterns Every Beginner Trader Should Know Brooksy

How To Trade Wedge And Triangle Chart Patterns Beginner’s Guide To

Web A Descending Triangle Is A Chart Pattern Used In Technical Analysis Created By Drawing One Trend Line Connecting A Series Of Lower Highs And A Second Horizontal Trend.

Hints That An Eventual Breakout Or Breakdown Is Coming As Price Movements.

Whilst Using One And Two Candlestick Patterns Such As The Pin Bar Reversal Are Extremely.

Normally, The Wedge Is Considered A Reversal Pattern, Forming On Maximums And Minimums Of A Price Chart In.

Related Post: